Summary:

- Intel shares have dropped to around $30 per share, presenting a buying opportunity as expectations for the company are low.

- Tensions between China and Taiwan could disrupt the chip supply chain, making INTC a more attractive option for customers looking to diversify their sources.

- The Company’s competitive pricing and advanced chip offerings, such as the Gaudi 3, could give it an edge over competitors like Nvidia.

tupungato

My last article about Intel (NASDAQ:INTC) was back in October 2022, and at that time it was trading for about $25 per share. I was bullish on Intel when I wrote that article and in about 13 months, the stock had just about doubled in value, trading for around $50 in December 2023. However, things have changed, and the stock is back down to around $30 per share. Once again, I believe it is a good time to be buying Intel shares, and that is what I have been doing recently. I know many investors are bearish on Intel and can point to a number of reasons why, including massive relative underperformance when compared to NVIDIA (NVDA). However, that is looking in the rearview mirror, and I am mostly interested in how Intel shares can perform going forward. One thing is for sure, and that is that expectations for Intel seem very low, and expectations for NVIDIA seem extremely high. That is often a great set up for shares of a low expectation company to actually outperform. With this in mind, let’s take a closer look at Intel:

The Elephant In The Room

There is a potentially big problem for Taiwan and that of course is China, which has made it clear it wants to reunify in one way or another. A recent Newsweek article sums up the situation and it states:

The People’s Republic of China claims Taiwan as its territory, despite never having governed there. Xi has said unification is inevitable, through force if necessary. U.S. officials believe he has directed his forces to be capable of an invasion by 2027. However, this does not necessarily mean this or any other year has been chosen for the undertaking.”

We saw some supply chain issues when Ukraine was invaded, but this type of disruption in Taiwan would be far more impactful. Taiwan produces an estimated 60% of the world’s chips and about 90% of the world’s advanced chips, so a disruption in these supplies would impact the global economy. As tensions between China and Taiwan have been rising, that seems to be causing significant unease for some customers of Taiwan Semiconductor (TSM). In one recent article, this unease was confirmed as some customers wanted TSM to move its factories out of Taiwan; it states:

Taiwan Semiconductor Manufacturing noted that it had held discussions with some customers about moving its chip facilities from the island nation amid rising tensions with China, however, such a measure would be impossible, Reuters reported.

Instability across the Taiwan Straits is indeed a consideration for supply chain, but I want to say that we certainly do not want wars to happen,” said TSM’s Chairman and CEO C.C. Wei to reporters following the company’s annual general meeting wherein they were unanimously elected.”

Intel Is The “Home Team”

With Intel being a U.S. company and not just a chip designer but also a manufacturer, and a company that makes chips for other companies, it has so much to offer. When you see companies that are so concerned with potential supply chain disruptions, to the point that they are asking if Taiwan Semiconductor can move out of Taiwan, it would seem to suggest they might want a plan B, which could be to give Intel some of their business as well.

It is a major business risk when you are supplied from just one source. If anything happens to that supplier, your company could be significantly impacted. That is why it makes sense that even if you prefer one product supplier over another, you would want to hedge and have at least some products sourced from a second supplier. For this reason alone, it makes sense for a company to not be too dependent on just one chipmaker, such as Taiwan Semiconductor, but to hedge and get supplied by Intel as well.

Intel Could Have The Edge In Terms Of Pricing And Onshoring And Catch Up With New AI Chips

Whether you are a chip designer like Nvidia, or an end-user that needs to buy chips to make certain products, it makes sense to do at least some business with Intel. Taiwan is a major potential geopolitical and supply chain risk, and this means doing business with Intel is a smart hedge against this risk.

Another reason Intel could win is through the very competitive pricing and advanced chip offerings such as Gaudi 3. One recent article points out the performance and pricing advantages that Gaudi 2 and Gaudi 3 has over Nvidia’s H100, and it states:

Second, Intel announced attractive pricing for system providers, an unusual move meant to highlight the value proposition of its Gaudi chips. An AI kit featuring eight last-gen Gaudi 2 AI chips and a universal baseboard will cost system providers $65,000, while a version with eight Gaudi 3 AI chips will go for $125,000. Intel estimates that these kits are priced at one-third and two-thirds the cost, respectively, of comparable competitive platforms.

While Intel is undercutting Nvidia on price, the company expects its chips to put up impressive performance numbers. The company estimates that a cluster of 8,192 Gaudi 3 chips can train an AI model up to 40% faster than a cluster with the same number of Nvidia H100 chips.”

Intel recently introduced the “Xeon 6” chip, which is an advanced processor that is ideal for AI applications. I believe this is another sign that Intel is serious about catching up in the AI market.

Humanoid Robots

There is a lot of interest in AI these days, but I am thinking out 2 to 4 years from now, which is when I believe we could see AI converge with hardware, creating the starting point for mainstream adoption of humanoid robots. This looks like a truly massive opportunity, especially because many tech leaders and tech billionaires that are leading the way in terms of AI, now appear to be seeing a big opportunity in humanoid robots. Humanoid robots are going to require lots of chips and a variety of them, from basic to advanced. Intel could benefit significantly from the potential growth of this up-and-coming industry.

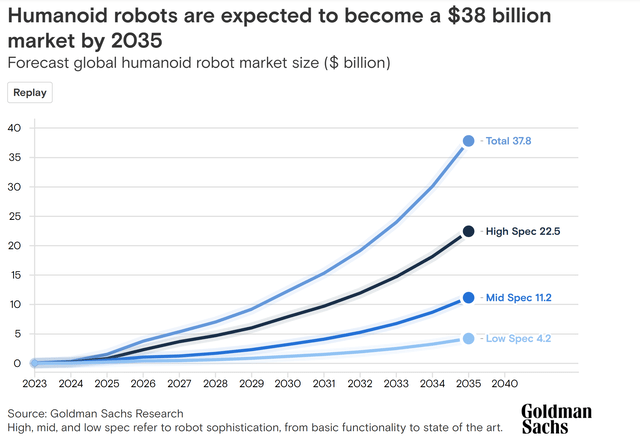

Apple (AAPL) is reportedly looking into developing personal robots. Tesla is developing the “Optimus” humanoid robot, which Elon Musk said could be bigger than any other product that Tesla makes now. Elon Musk has also said Tesla could be prepared to start selling robots in 2025. Another humanoid robot company, “Figure AI”, has received funding from Amazon’s (AMZN) Jeff Bezos, as well as Jensen Huang of Nvidia. Analysts at Goldman Sachs (GS) have forecasted that humanoid robots could be a $38 billion industry by 2035, as shown below:

Sentiment And Market Share Can Change Quickly With Chip And Tech Stocks

Sentiment and market share can flip in a very short time, and of course, we have seen many chip stocks rise and fall. Years ago, I wrote an article about Advanced Micro Devices (AMD) when it was trading for about $3 per share. Back then, many investors thought AMD was going to end badly, but that turned out to be a huge buying opportunity. In 2016, Nvidia shares traded for just about $7, and today it trades for around $1,200 per share. This shows investors have a history of underestimating the potential of chip stocks.

It’s important to keep in mind that almost every major tech stock has had a period whereby investors were very negative and felt that the growth was gone and that these companies would not regain that ground again. This happened with Microsoft (MSFT) under Steve Balmer, it happened to Apple (AAPL) in the past, it happened to Meta Platforms (META), when that stock plunged to less than $100 per share less than 2 years ago over growth concerns, and now it trades for nearly $500.

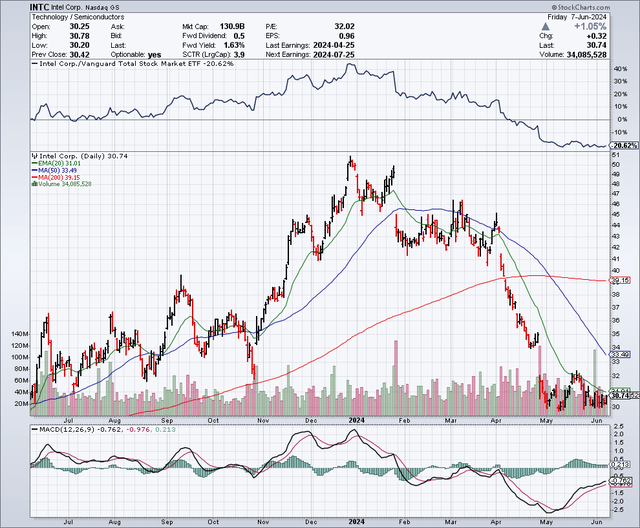

The Chart

As the chart below shows, Intel shares were trading for around $50 in December 2023, but in the past few months this stock has almost been cut in half. Intel shares are now trading well below the 50-day moving average which is $33.98 and the 200-day moving average which is around $39.18.

Earnings Estimates And The Balance Sheet

This year, the bar seems set fairly low for Intel. Analysts expect Intel to earn $1.10 per share in 2024, on revenues of $55.84 billion. However, growth investors should be happy to see earnings estimates nearly doubling to $1.98 per share in 2025, with revenues coming in at $62.63 billion. Earnings are expected to jump once again in 2026, with estimates at $2.57 per share, on revenues of $68.58 billion. Investors seem fixated on the lackluster earnings estimates for 2024, but I see reason for optimism when considering how much earnings are expected to grow in 2025 and beyond.

As for the balance sheet, Intel has about $52.45 billion in debt, and $21.31 billion in cash.

Potential Downside Risks

Intel clearly has dropped the ball in the past by allowing companies that were once much smaller come up from behind and capture huge market share levels in terms of advanced chips. But, it does seem to have acknowledged this and the need to get back on track. I think Intel has a solid plan to not only remain viable, but to reclaim the throne at least to some extent in the future, but this will clearly take time. However, the competition from Nvidia will remain fierce and could pose continued downside risks for Intel. Management execution is clearly a potential downside risk, as are macro issues such as a potential recession. Tariffs and chip bans are another potential downside risk as tensions rise between China and the U.S.

In Summary

The sentiment towards Intel appears to be very negative, and this is not uncommon when a stock is trading at or near 52-week lows. But this is when it gets interesting for value and contrarian investors. I see the reasons to be skeptical about Intel, but I have also seen this same type of negativity and skepticism with other stocks which turned out to be buying opportunities. I don’t have a large position in Intel, but I will add more on further weakness and I will give this company time to take advantage of all the tailwinds it could enjoy in the coming years, from a PC cycle refresh, to AI, to humanoid robots. Intel is also uniquely positioned as the “home team” whereby it can serve as a hedge and a key supply chain partner for many tech companies, especially in the event of disruptions in Taiwan.

Again, sentiment can change rapidly in the tech sector, particularly with chip stocks. As an example, just remember that Intel was a $50 stock in the past 52 weeks, and I do believe that when sentiment turns more positive it will go to $50 and beyond in the coming years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.