Summary:

- Intel Corporation’s shares have risen 28% since my Buy recommendation, yet they remain undervalued, trading at par to book value amidst market pessimism.

- Q3 revenues beat expectations at ~$13.3 billion, with promising growth in Data Center & AI, despite sluggish PC sales impacting Client Computing revenue.

- Intel’s $10 billion cost-saving plan is on track, with potential operating margin improvements, but CHIPS Act grant delays and new administration pose risks.

- Despite headwinds, I remain cautiously optimistic about Intel’s future growth and reiterate my Buy rating for INTC stock, expecting significant progress by 2025.

Pla2na/iStock via Getty Images

Investment Thesis

A few months ago, American chip giant Intel Corporation’s (NASDAQ:INTC) chief decision maker, Pat Gelsinger, explained his company’s precarious position to a group of investors at Deutsche Bank’s 2024 Technology Conference. He then went on to detail how his management team was throwing everything it had to salvage the situation for itself and its investors and deliver $10 billion in cost savings.

That conference was enough for me to go back to review my analysis on Intel and see just how underappreciated the company’s shares had become, as it traded at 70% of its net book value.

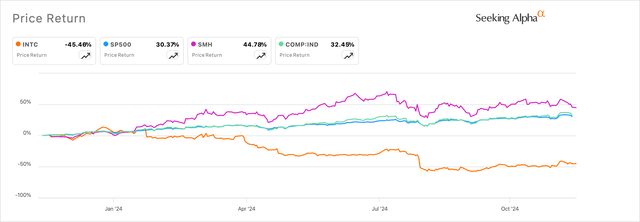

Since my last research note, Intel’s shares have shot up 28% after I published my Buy recommendation, while the company’s shares are still down 51% for the year. Intel’s Q3 report showed it had covered some ground in a few of its business segments.

Exhibit A: Intel’s shares have covered some ground after falling. (Seeking Alpha)

But we are at a juncture where the US welcomes a new administration that is not exactly fond of the CHIPS Act, of which Intel has become a beneficiary. Then, there is also the sluggish PC sales that are going to put more brakes on Intel’s Client Computing revenue.

As Intel’s shares rose in the past two months, the company trades at par with its book value. In light of the uncertainty that some of these headwinds add, I am cautiously optimistic about Intel, continuing to recommend a Buy on the company.

Great Q3 Quarter, Cool Update On Cost Savings

Intel’s Q3 quarterly earnings report must have come as a huge sigh of relief to not only its management team but also all its investors who have invested in the company, as well as folks in Washington, D.C.

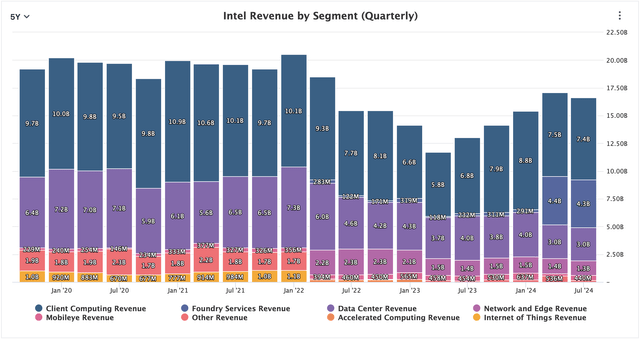

Q3 Revenues came in at ~$13.3 billion, surprising the market by beating median consensus estimates by almost a quarter of a billion dollars. Ignoring the persistent slowdown seen in Intel’s Client Computing division, which I will discuss later, Intel’s revenues in DCAI (Data Center & AI) were encouraging. Intel’s Foundry sequentially weakened, but I’ll swallow the 2-3% sequential contraction in the Foundry business after seeing months of no movement at all.

Exhibit B: Intel’s Q3 revenues, while still strong, paused the sequential momentum that started from July last year. (stockAnalysis)

With Intel now firmly on track to separate its Foundry business away from its Products business, management will be expected to shore up the Foundry business for which updates were provided. In an earnings call, management explained how they’re close to forming a fiduciary board that will stay separate from Intel’s board. This is as the company moves to create an optimized capital structure for both the separate entities that results in additional shareholder value while upholding overall business credibility.

So far, only Amazon.com, Inc. (AMZN) and two other unnamed external clients count as Intel Foundry’s customers. Management understands the importance of scoring more customer wins, as they detailed on the earnings call, and I hope to hear more about customer wins and deal values moving forward.

Moving over to Intel’s Product side, Intel’s 18A, its fifth node technology in five years, looks on track with the company racing to begin high-volume chip production in H2 2025. Apart from the “AI Fabric chip” that Intel will produce for Amazon, two other external customers and Intel’s internal Panther Lake and Clearwater Forest chips. 18A also appears to be healthy with a defect density of 0.4 defects per sq. cm, per Gelsinger’s comments at the 2024 Technology Conference, which is roughly in line with the defects seen in other leading-edge technologies at peers such as Taiwan Semiconductor Manufacturing Company Limited (TSM).

Taking management’s projections into account, Intel’s 2024 sales would most likely have contracted by 2.8% to ~$52.7 billion. The company is looking at sales growing in the mid-single digits in 2025. Management is currently investing about 45% of their revenues into capex currently into future expansion plans.

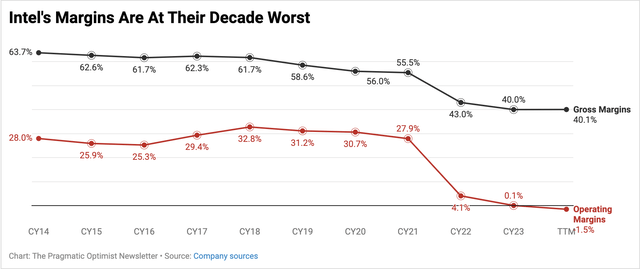

On cost savings, Intel appears to be on track to deliver its $10 billion budget reduction plan by saying it has already reduced its workforce, with another billion dollars coming from sales efficiencies at Intel’s Foundry among other initiatives. Gross margins might be range-bound at the 40% mark, but operating margins could see some improvement through next year.

Exhibit C: Intel’s margin profile looks under pressure for now. (Company filings)

But When Will CHIPS Act Pay Up & What Trump 2.0 means for Intel?

A large part of the concern for now remains on when exactly Intel will start to see payments coming in from the grants it was supposed to receive from the CHIPS & Sciences Act.

In a recent Bloomberg TV interview, Intel’s Gelsinger aired some of his frustration at the lack of seeing those grants:

We are disappointed by how long and how slow the dispensing of funds has been. $30 billion has been invested, and the company has seen no release of grants from the Chips Act.

It’s well over 2 years at this point. I’ve invested $30 billion in capital, and we’ve seen zero dollars of the chips grants at this point. So we do believe that that has been too slow. We’re somewhat frustrated by that, and we’ve taken it out of our financials for this year.

Apart from the $8.5 billion grants it’s supposed to receive, the company should also get future tax rebates of up to 25% on more than $100 billion in qualified investments. However, the race is tight for Intel to get the $8.5 billion in grants, especially as we usher in the new administration that has not looked kindly upon the CHIPS Act.

While it’s still unknown how Trump 2.0 can act on the CHIPS Act, the new administration does heavily favor domestic US manufacturing, which could be a boon for Intel that is already invested billions.

Intel Still Looks Undervalued

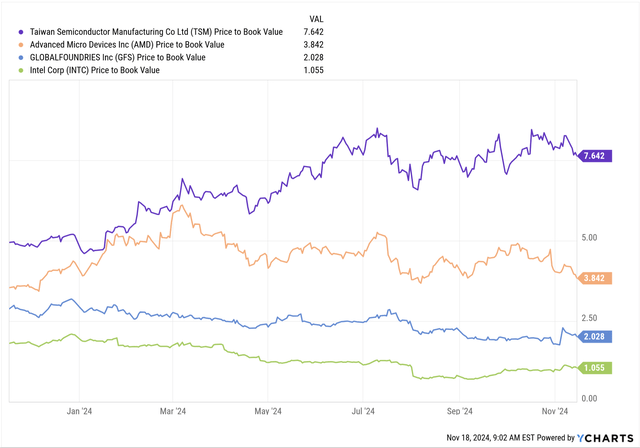

The full extent of Intel’s upbeat revenue guidance is still not appreciated by the market, which continues to trade the company’s stock at par with its book value. Markets have at least seen incrementally more potential than the last time I reviewed the company, when it was trading at a book value of just 0.7x.

Still, markets at-par pricing of Intel’s books put the company at a discount when compared to many of its peers in the foundry business as well as in the fab business.

The company is taking concrete steps to create an appropriate capital structure for both its core divisions, the Products business and the Foundry business, and markets are still discounting the book value of Intel.

The at-par pricing of Intel’s book value still signals Intel’s shares remain underappreciated.

Exhibit D: Intel is still undervalued versus its peers (YCharts)

Risks & Other Factors To Know Of

The grants from the CHIPS Act present some form of a burden for Intel to manage if it does not eventually receive those grants. Reports indicate lawmakers in Washington, part of the outgoing administration, are rushing to approve those grants, with some expressing strong confidence in those grants being released. The release of these grants would be good news for Intel, which could push the stock higher. Conversely, any reversal in these grants may cap momentary upside.

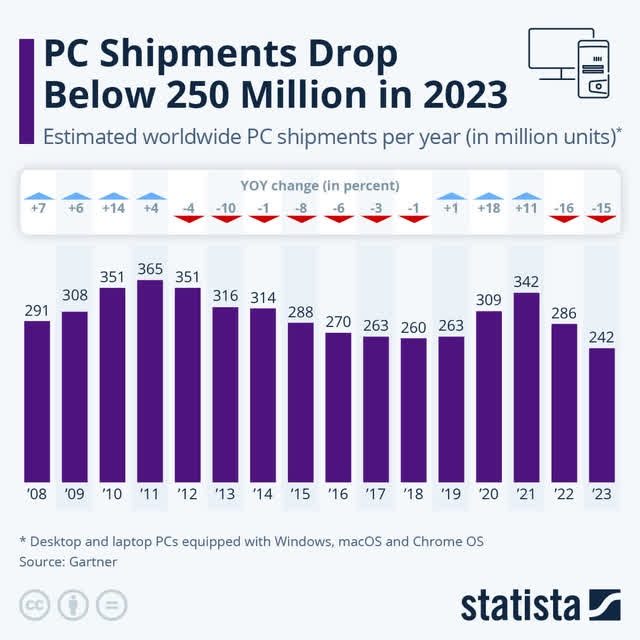

Additionally, Intel’s Client Computing Group, which is responsible for selling chips to OEMs, etc., might face pressures as PC shipments haven’t really taken off this year. This is despite all the rosy outlooks issued last year and the AI PC boost that was expected to lift momentum for PC sales.

Last year, IDC suggested that 2024 PC shipments should rise 3.4%, but so far, its latest report shows 2024 shipments won’t rise as much as its initial expectations. Industry analysts are now expecting 2025 to be the year of the much-awaited PC refresh. Microsoft Corporation’s (MSFT) Windows 10 reaches its end-of-life support next year, which is expected to boost sales. But that boost will only be seen in H2 of 2025.

Exhibit E: PC Shipments are showing sluggish growth in 2024 (Gartner via Statista)

Takeaway

The pessimism is still persistent in Intel’s stock, as it continues to trade at par with its book value. With revenues seen growing higher next year per management’s commentary, I remain optimistic about the company. However, at the same time, I am cognizant of some looming headwinds, such as stalling PC shipments next year and the CHIPS Act grants that can impact Intel should they present themselves.

Despite these headwinds, I remain confident Intel can navigate itself through these challenges and emerge victorious in 2025. I cautiously reiterate my Buy rating on Intel.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.