Summary:

- Intel Corporation is fulfilling its roadmap with the production of Intel 7, Intel 4, and Intel 3, gaining credibility for its ambitious goal of “5 nodes in 4 years.”

- CEO Pat Gelsinger’s leadership has been crucial in achieving these milestones and driving a successful turnaround.

- Intel’s capital allocation strategy and funding methods, such as partnerships and IPOs, are supporting its growth and innovation plans.

- I rate Intel Corporation stock as a Buy.

4kodiak

I rate Intel Corporation (NASDAQ: INTC) as a buy as the company is fulfilling its roadmap as expected. Intel’s ambitious goals of “5 nodes in 4 years” are gaining more and more credibility as the Intel 7 (which is an enhanced version of the 10-nm SuperFin), the Intel 4 (which is the 7-nm), and the Intel 3 (which is an enhanced version of the Intel 4) are already in production. This is a very important scenario for Intel, as some analysts thought that with the use of the EUV for the first time to produce Intel 4 and Intel 3, Intel might face some delays, a similar situation when Intel suffered the delays of the 10-nm some years ago.

In my view, the leadership of Intel CEO Pat Gelsinger was crucial to achieving these milestones. His leadership was one of the main factors that would increase the chances for a successful turnaround, which was mentioned in my previous article written in June 2023 to develop a bullish case for Intel when the stock price was trading at around $35 per share. In that article, I explored Gelsinger’s performance as CEO of VMware from 2012 to 2020 to get some insights about what to expect about his future performance at Intel; apparently, my prediction was on the right track. In addition, in that article, I explored Intel’s capital allocation in the last decade to compare it with that of Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM) aka TSMC, where I showed why TSMC performed way better than Intel in all that period.

In this article, I will review Intel’s current situation briefly to support my positive view about Intel’s prospects in the long term. Though the current stock price is not necessarily cheap, I rate the stock as a “moderate buy” at the current levels, which is a strategy that would suit well if the long-term investor is committed to adding more shares when the stock price drops below its current levels.

Context

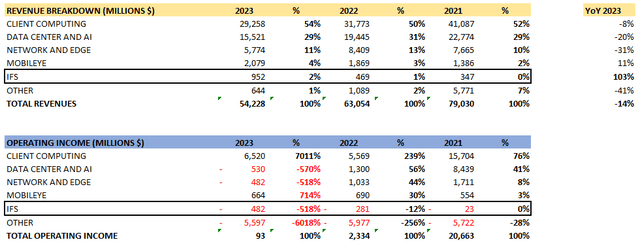

In 2023, revenue growth was -14% YoY, given the decline of its different business segments. This is because in the first half of 2023, customers had higher inventory levels, which recovered to more normal levels in the second half.

Even when revenues dropped in FY 2023, that revenue growth was better than in FY 2022 YoY, which was around -20%; net income also had a bad performance, -72% in FY 2023 YoY. Looking at the table above, we should notice that the foundry services (IFS) are increasing their participation gradually over the total sales, and that is part of Gelsinger’s strategy called IDM 2.0, in which Intel wants to reinforce its foundry services through more innovation with the 5 nodes in 4 years.

Qualitative factors that are giving confidence to the market: capital allocation and management

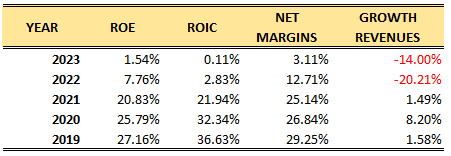

I collected some data and constructed some ratios that will help us understand Intel’s current situation:

Author

Probably, an investor who is unaware of Intel’s current situation while looking at these ratios would be afraid to put some money in the stock, as clearly those metrics above indicate that the company has not done well in the last few years, particularly since 2022.

However, we know that Pat Gelsinger took over as CEO in 2021, establishing important changes in the culture and vision of the company for the long term to recover the market position it lost in the past. The lower margins, ROE, and ROIC in the last 2 years are associated with a problem of customer inventory at a global level, which is more related to a shift in spending on AI data servers rather than more traditional server chips.

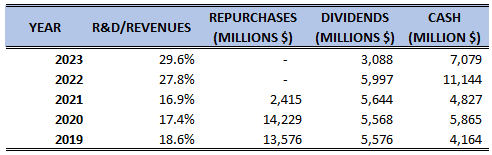

The next table is what gives me more confidence about Intel’s future:

Author

Intel is giving more confidence to the market as it is fulfilling its roadmap with Intel 7, Intel 4, and Intel 3, and it was necessary to increase the R&D expenses, which is something we are looking at in the table above. On the other hand, in my previous article about Intel, I pointed out that it was important for Intel to stop the buybacks program in order to use all that liquidity in reinvesting in the business given the huge capital requirements for the strategy IDM 2.0, and the company is taking that reasonable path.

In addition, in that previous article, I assumed a similar amount paid in dividends for 2023 compared to 2022; even when I was wrong in the exact amount, I was right that the amount allocated to dividends is still significant, which indicates that the CEO does not want to disappoint its dividend investors. In regard to the total debt, since the arrival of Gelsinger, Intel’s total debt increased from $38 billion in 2021 to $49 billion in 2023, which appears to be a low increase in debt given Intel’s huge capital requirements to make a successful turnaround.

The reason behind this relatively lower than expected increase in debt is a strategy for capital allocation implemented by Gelsinger, named “Smart Capital Approach,” which enables Intel to use a new and more sustainable funding model. For instance, in 2022, Intel signed an agreement with Brookfield (NYSE: BIP) to invest up to $30 billion through a partnership with Intel’s 51% stake and Brookfield’s 49% stake in the manufacturing expansion in Arizona.

Also, Intel is taking advantage of the CHIPS Act, which is another source of funding for Intel; for instance, in the last call for Q4 2023 results, the management said that Intel received $845 million of advanced manufacturing investment credits as part of the CHIPS Act. Thus, it’s clear that Pat Gelsinger has changed the capital allocation strategy of Intel very clearly.

Intel is using other methods for funding, such as IPOs; indeed, Mobileye’s IPO was released in 2022, where Intel retained 88% of the total stake and raised around $861 million. Now, Intel announced in October 2023 that it is planning to launch another IPO from its subsidiary Programmable Solutions Group (PSG) in the next 2 or 3 years with the goal of enhancing shareholder value while retaining a majority stake.

In my view, I think that all these moves in capital allocation and funding strategy come from very good management, which is a factor frequently overlooked by many analysts; the quality of the management is critical when a company is in the middle of a turnaround, and that’s why I focused on Gelsinger’s past performance in VMware in my previous article. Apparently, we are on the right track with our bet on Intel’s management as a potential catalyst for long-term shareholder value.

First achievements give more support to future achievements: 5N4Y and beyond

In 2021, Pat Gelsinger announced his ambitious goal for Intel for the next few years, specifically the goal of launching 5 nodes in 4 years (5N4Y), which, at first, was not taken seriously by the market. To achieve this very ambitious goal, it’s imperative to have a sound and sustainable capital allocation, and as we’ve seen previously, Intel is on the right path to provide strong support for those ambitious goals.

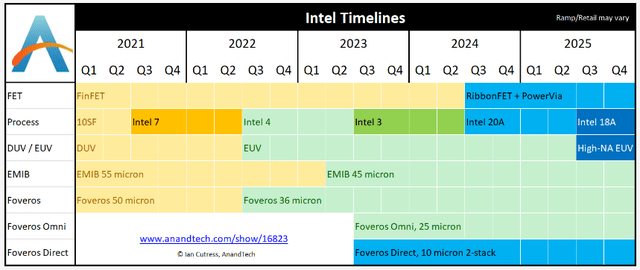

As you can see in the table above, Intel has already fulfilled 3 out of the 5 nodes, which is something that gives more credibility to Gelsinger’s 5N4Y plan. Also, we can see that Intel was already using the EUV lithography tools for the manufacturing of the Intel 4 and Intel 3. Now, as we are approaching lower process nodes, a new architecture will be required, so Intel will start using the RibbonFET, or Gate-All-Around Field-Effect Transistor (GAAFET), for the Intel 20A and 18A, which are 2-nm and 1.8-nm processes nodes, respectively.

The EUV tools will still be used for the production of the Intel 20A, but for the 18A, more advanced tools will be required from ASML Holding N.V. (NASDAQ: ASML). In this sense, Intel has already acquired 6 high-NA EUV tools out of the 10 units that will be produced by ASML in 2024, proving here the excellent management execution to buy them before any rival given the limited number of units to be produced by ASML due to their high complexity.

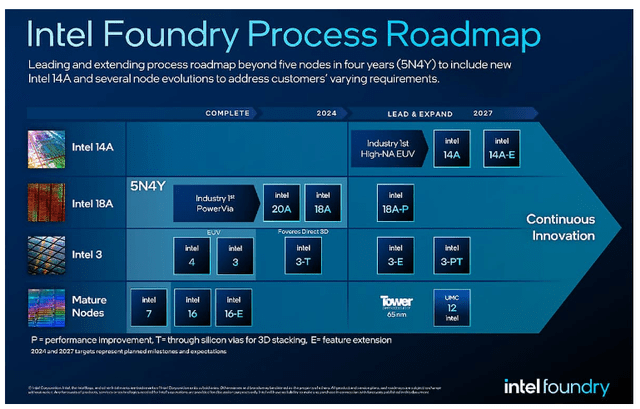

With these machines, Intel could follow its ambitious roadmap for the next few years, as these high NA-EUVs would enable it to produce process nodes lower than 2-nm; furthermore, Pat Gelsinger is showing very strong signs that Intel will not stop with the 18A, as the CEO will push the company to keep innovating beyond 2025, going farther than its 5N4Y plan:

Indeed, in the table above, we see that Intel will keep using the most advanced ASML tools for the production of the 14A or 1.4-nm, which might make it the global leader in foundry services. Of course, the path will not be easy for the company since many things could happen in the meantime in that dream scenario, but it’s clear that Gelsinger is gaining more and more credibility with his transparency, leadership, and solid execution, as his achievements with Intel 7, 4, and 3 are proving.

Geopolitical risks might favor Intel’s long-term prospects

In my article about TSMC written in January 2024, I pointed out the risks associated with TSMC’s location, which could not be mitigated with its geopolitical expansion in other countries as its most advanced factories will always be located in Taiwan. Even in a scenario where China does not invade Taiwan, customers might seek to diversify their foundry requirements, knowing the great advances Intel is achieving.

Of course, Samsung is another foundry source, but Intel could be seen as the second source because of its tremendous advances in innovation. For instance, companies like Nvidia (NASDAQ: NVDA) might see Intel as a very feasible second source for foundry services in the next few years. There was some news in January 2024 that Nvidia’s AI supply faced restrictions as the advanced production capacity at TSMC was not enough to cover its demand, so Nvidia was diverting orders to Intel.

Intel is offering advanced packaging in a very unique way using glass substrates that can tolerate higher temperatures, have 50% less pattern distortion, have ultra-low flatness, have an have an improved depth of focus for lithography, etc. Intel’s advanced packaging management has become one of the factors contributing to its solid competitive advantage for its Foundry services. As such, companies like Nvidia might start developing more businesses with Intel in the future, considering Intel’s technological advances and the TSMC’s geopolitical risks.

Valuation

These are the multiples shown by Seeking Alpha:

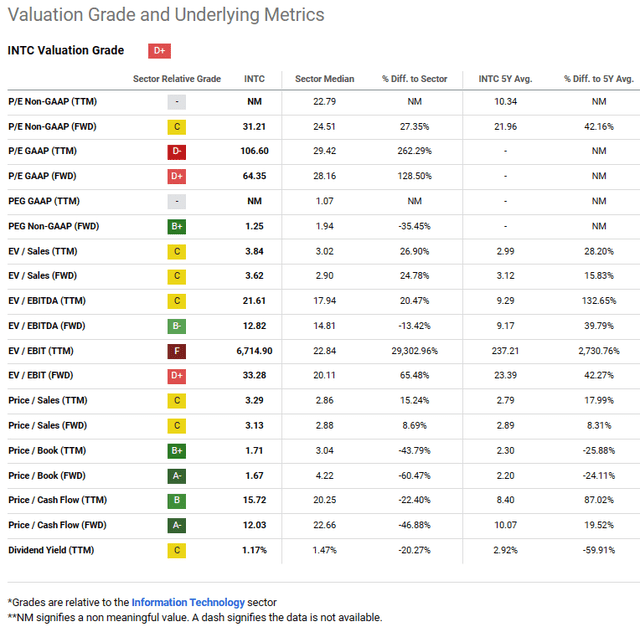

I think it’s hard to determine the validity of any of these multiples when the company is facing a hard turnaround, since if we compare Intel with the other comparables in its sector, we are assuming that those comparables are in a similar situation as Intel. So, I would say that most of them are distorted now. I will try to calculate an intrinsic value using a DCF even when this method has limitations; at least I have more control over the assumptions.

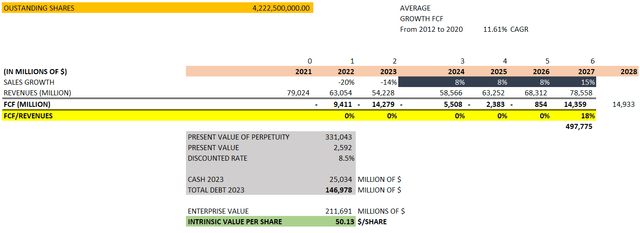

Assumptions

I assume the following:

- Outstanding number of shares in 2023: 4,222,500,000

- Revenue growth forecast: from 2024 to 2026: 8% annual (aligned with consensus)

- FCF margin revenues: 0% until 2026; 15% in 2027 onward (FCF margin of 19% on average from 2012 to 2021)

- Growth of FCF for perpetuity: 5.5% CAGR (from 2012 to 2021: 11.6% CAGR)

- Discount rate of 8.5%

- In 2027, Intel completes its turnaround, returning a positive FCF.

- In 2027, Intel will, at least, generate the revenues it did in 2021 (it might happen earlier as well).

- I added $100 billion of the turnaround investments to the current total debt of the company as of December 2023. Of course, Pat Gelsinger is finding other ways to finance Intel’s huge capital requirements through the “Smart Capital Approach” that I mentioned previously. So, the fact that Intel is not raising its debt levels but finding partners who want to share risks and rewards while investing in new fabs might be a good long-term catalyst by itself.

- FCF in 2024, 2025, 2026, and 2027: negative (according to consensus)

- FCF 2027 is calculated by multiplying our revenue projection for 2027 by the FCF margin of 18%.

To find the perpetuity, we used the formula:

Perpetuity = FCF 2027/(discounted rate – g).

Where g = FCF growth in perpetuity, which was assumed to be 4.5% annual.

With perpetuity, we calculate the present value of all the FCFs beyond 2027. Then, we calculate the enterprise value using the following:

Enterprise Value = Present Value of FCF (from 2024 to 2027) + Perpetuity + Cash – Total Debt.

Finally, the intrinsic value is calculated by taking the enterprise value and dividing it by the outstanding number of shares. In this way, we could get $50.13 per share under the assumptions presented. Compared to the current stock price of around $41 per share, there is not enough margin of safety, which is a very important concept for a long-term investor.

However, as I explained in this article, there are strong signs that the management is doing well, fulfilling a very ambitious roadmap while gaining more credibility to fulfill the next process nodes of 20A and 18A, and even with those amazing achievements, the management is already preparing Intel for the 14A process node. It seems that Pat Gelsinger has changed the entire culture of Intel, which is a very positive factor that might be overlooked by the market.

In my view, I like to see these signs in the management since they might indicate that the company will push itself to keep innovating even beyond 2025; that’s the type of behavior that Intel had lost years ago that enabled competitors to surpass Intel in several innovative aspects and performance in general.

Of course, the intrinsic value could be higher than $50 per share as Intel keeps expanding through the implementation of new fabs and the fulfillment of its roadmap. As Intel aims to increase its presence in foundry services, attracting more clients, and keeps developing its different segments such as client computing, data center and AI, network and edge, and mobile, it might gradually push up the growth of its FCF over the years to similar levels, like the period between 2012 and 2020, when Intel got a 11.61% CAGR of growth in its FCF, so that could boost the intrinsic value, gradually supporting my rating of “buy.”

For instance, in 2023, Intel’s fabs in Ireland and Israel started production; the Fab28 from Kiryat, Israel, started production, completing an investment of more than $50 billion over the last 50 years in the country. The fab is being focused on the production of the 300-mm, 22-nm, 14-nm, and 10-nm process nodes. Intel will build another fab in 2024, the Fab38, investing $25 billion to produce 300-mm, 22-nm process nodes.

In Ireland, the Fab34 started production for the Intel 4 or 7-nm and the 300-nm process nodes. For 2024, there will be 2 more fabs that will start production in Chandler, Arizona: Fab52 and Fab62, both for the production of the 300-nm and 20A process nodes. In the next decade, Intel is planning to invest around $100 billion in new fabs in Ohio; one of those is the Fab27 that will produce the 300-nm and 18A process nodes. Then, in Malaysia, Intel will finish fabs that will produce the 300-nm process node and advanced packaging for 2024.

In addition, in the next few years, Intel will build factories in Germany and Poland to support its ambitious roadmap related to the most advanced chips.

Risks

An important risk of my thesis is that Intel faces delays in the construction of new fabs for many reasons or delays in the development and manufacturing of new process nodes; in this sense, even when the uncertainty now is less than 2 years ago when Pat Gelsinger took over as the new CEO’s Intel, there is still uncertainty since the turnaround required is very challenging for any CEO in a company like Intel.

Nevertheless, I think that Pat Gelsinger is giving adequate signs that the odds are in favor of Intel’s long-term investors, as he is gradually fulfilling his ambitious goals while proving excellent management execution; from the 5 nodes in 4 years, Gelsinger has already achieved 3, so that helps to build up momentum.

Another risk is that Intel might find difficulties in finding new partnerships to finance new fabs or that a new U.S. government restrains the funds for the semiconductor industry in the U.S. I think that there are mitigations to those risks, as more partners would like to be exposed to investments related to semiconductors and AI, knowing the long-term tailwinds. In addition, the U.S. government has all the incentives to support its semiconductor industry to have better control over advanced technology as a critical pillar to retaining its global power.

Final Thoughts

I think that Intel is a long-term play, as the company is gradually taking important steps that might reinforce its future market position as one of the most advanced foundries, even challenging TSMC. It’s clear that one of the factors that is pushing Intel down the right track is Pat Gelsinger. In my previous article, I emphasized that he was one of the main long-term drivers for Intel’s successful turnaround.

In this article, I assessed some of his achievements while highlighting his leadership, capital allocation, and execution, which are critical factors in fulfilling Intel’s ambitious goals. In this sense, the stock should be seen as a long-term play to let the turnaround construct value for shareholders. When the stock was trading at $30-$35 per share, I saw it as a special situation; that implied that an investor should see a clear catalyst or driver that enhances shareholder value as, in my view, the management.

Now, the stock is gradually confirming the thesis that I’ve made in my previous article in June 2023, and that’s why I rate it as a “moderate buy” now. Even when my intrinsic value is $50 per Intel Corporation share, the company is in a good position to reduce future uncertainty as it fulfills its next nodes, 20A and 18A, while reinforcing its innovative culture to produce the 14A and beyond, which might push up even more its intrinsic value.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.