Summary:

- I see Intel’s leadership change to co-CEOs Zinsner and Holthaus as net-neutral and thus maintain my Hold rating on the stock.

- I expect the new CEOs to take a fresh look at many facets of Intel’s turnaround plan (for example, the spin-off of its foundry unit).

- I also expect the new CEOs to keep receiving government support.

- However, I’m not certain about the company’s underlying profitability and its financial resources.

- These are also important ingredients for successful turnarounds besides effective leadership.

tupungato

INTC stock: Previous thesis and new development

I last wrote on Intel stock (NASDAQ:INTC) back in mid October 2024. To be more explicit, that article was titled “Intel: Inventory Does Not Lie.” That article rated the stock as a Hold after weighing the positive catalysts (mostly the potential of a Qualcomm acquisition) and negatives at that moment. Quote:

The potential Qualcomm acquisition of Intel has emerged as a key upside catalyst for the stock. This development has prompted me to upgrade my rating from Sell to Hold. However, investors need to be prepared to hold the stock as a standalone company in the case of no deal. My view is that Intel is in a very weakened competitive position, judging by its latest inventory data.

Since then, there have been a few important developments surrounding the firm. In the remainder of this article, I will concentrate on the top development: New CEOs. The specifics are quoted below to prime the subsequent discussion:

Seeking Alpha News: Intel (INTC) made the surprising announcement on Monday that Chief Executive Officer Pat Gelsinger is retiring and will be replaced by co-CEOs David Zinsner and Michelle Johnston Holthaus. Gelsinger is also stepping down from the company’s board of directors. Both departures are effective Dec. 1.

Next, I will explain why I view this development as largely net-neutral and thus maintain my hold thesis on the stock. I certainly see positives in this change of leadership. New leadership can bring fresh perspectives and innovative ideas to the table. This could lead to new strategies and approaches to address Intel’s challenges and capitalize on emerging opportunities. In particular, both Zinsner and Holthaus are seasoned executives with deep knowledge of Intel’s business. For instance, Holthaus’s experience in the Client Computing Group could lead to a stronger focus on developing innovative and competitive products. And Zinsner’s background as CFO could lead to a focus on cost-cutting measures and improving financial performance.

Last but not least, these new co-CEOs could also take a fresh look at Intel’s foundry unit and might decide to accelerate its spin-off timetable. As argued in an earlier article, I have a pretty negative view on INTC’s progress on the foundry front and consider a spinoff as a (if not the) approach to stop its losses on this front.

But in the meantime, I also see some fundamental challenges facing the new co-CEOs as detailed next.

INTC stock: Margin pressure

Through experiences, I’ve learned that a successful turnaround requires at least three elements: Effective leadership, sound economics of the business itself, and also plenty of financial resources.

The change in leadership, hopefully, provides the first element. However, I’m not optimistic about the other two. INTC’s latest financial results and consensus guidance have led me to question the fundamental economics of its business.

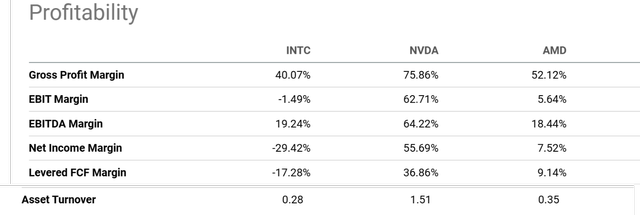

As an example, the next table compares the profitability metrics of Intel (INTC) against its major (and fabless) rivals: Nvidia (NVDA) and AMD. Intel’s profitability lags significantly behind its competitors across the board. It has a negative EBIT margin of -1.49% and a negative net income margin of -29.42%. In contrast, Nvidia boasts strong profitability with a 62.71% EBIT margin and a 55.69% net income margin. AMD also demonstrates solid profitability with an 18.44% EBITDA margin and a 7.52% net income margin. Also note that Intel’s asset turnover of 0.28 is significantly lower than Nvidia’s 1.51 and also noticeably lower than AMD’s 035, indicating a less efficient use of its assets for sales generation.

Seeking Alpha

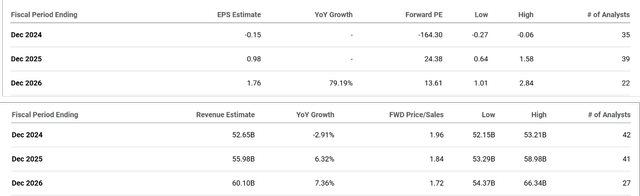

Looking ahead, the picture does not improve too much. The chart next displays the EPS and revenue forecasts for INTC stock in the next few years. Analysts predict a loss of $0.15 per share for the fiscal year of 2024 (and thus negative net profit margins too). Even assuming a substantial recovery for FY 2025, the EPS was projected to be $0.98 per share. Revenue is expected to be $55.98B in FY 2026. Assuming its current share count of about 4.25 billion, these numbers translate into a net profit margin of around 7.4%, still nowhere near that of NVDA and showing no clear advantage compared to AMD.

Seeking Alpha

INTC stock: Financial resources

Moving onto the next requirement in most successful turnaround cases: The availability of financial resources. I’m not confident if INTC has the resources it needs to keep working on its turnaround with its recent financials.

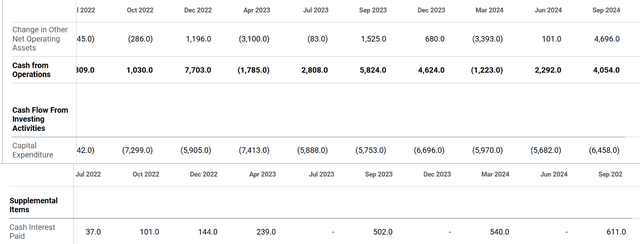

To wit, the cash flow statement below illustrates its latest operating cash flow, capital expenditures, and also cash interest paid. As you can see from these figures, the picture is a quite dire one. Its operating cash flow has been volatile and followed a downward trend in general in recent quarters. For the latest quarter, the cash flow was $4.05 billion, a large improvement from Q2’s $2.29 billion. But the bad news is that the cash flow was nowhere near the capital expenditure commitment ($6.46 billion) and also the interest payments ($611 million).

Seeking Alpha

Other risks and final thoughts

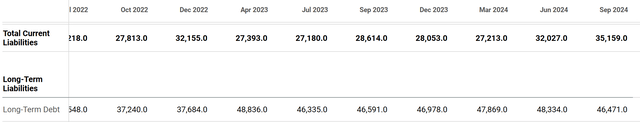

Other challenges include a relatively heavy debt burden. The company’s debt has increased substantially in recent quarters as seen from its balance sheet below. As seen, in the past eight quarters alone, its current liabilities have increased from $27.8 billion in October 2022 to $35.2 billion currently. In the same period, its long-term debt has climbed from $37.2 billion in October 2022 to $46.5 billion as of now.

Seeking Alpha

The combination of choked cash flow and increasing debts have led major rating companies to lower their credit rating. Two examples from Fitch and S&P global are quoted below. A lower credit rating tends to increase future borrowing costs and thus adding another hurdle for its turnaround efforts.

Fitch Downgrades Intel’s Ratings to ‘BBB+’; Affirms Short-Term Ratings at ‘F2’; Outlook Stable on 01 Jul, 2024…. the successful execution on Intel’s strategy to regain process technology leadership and build the leading foundry services business could support a return to the A-category. However, Fitch does not expect this to be apparent in the next few years.

S&P Global lowered Intel Corp’s Rating To ‘A-’ On Weaker-Than-Expected Growth While Capital Intensity Stays High; Outlook Negative. We expect Intel Corp.’s revenue to be weaker than previously forecasted given recent personal computer and data center end market recovery trends for 2024.

In terms of upside risks, besides the fresh leadership, government support is another key positive catalyst. INTC has been a key beneficiary of the CHIPS & Science Act under the Biden administration. As part of the act, the Biden administration has recently approved up to $7.86B of direct funding to help Intel to build its foundry capabilities. It’s likely that the incoming Trump administration would keep the same stance that advanced chip manufacturing is a matter of national security and continue supporting INTC.

To sum up, the changes in INTC’s leadership have motivated this reexamination of the stock. However, this reexamination has led to no change in my rating. I’m still seeing a very uncertain future for the company. I certainly see many positives with the new leadership, and I expect them to take a fresh look at many facets of Intel’s turnaround plan (for example, the spin-off of its foundry unit). However, besides effective leadership, successful turnaround cases also require sound underlying economics and a good amount of resources. I’m not certain if INTC can meet these requirements judging by its recent and forward profitability metrics and also its latest financials.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.