Summary:

- The thesis of this article is simply that the benefits from the CHIPS Act are not properly factored into Intel’s current market valuation.

- Consensus estimate project an EPS recovery around 2025.

- However, market sentiment could trigger a stock price rebound ahead of EPS improvement once the benefits of the act begin to kick in.

- Contrasting Intel’s fab business with AMD, a fabless chip designer, further illustrates Intel’s mispricing.

David Ramos

Thesis

Intel (NASDAQ:INTC) spent the last 1 or 2 years struggling with various headwinds, some of its own making and some beyond its control. Take its third quarter as an example: EPS declined to $0.59, only about 1/3 of the previous year’s results ($1.71). And sales fell sharply by more than 20% as well. Such horrific results are due to the technological lag of its chips (e.g., when compared to peers like Advanced Micro Devices (AMD) and also Apple’s (AAPL) own chip lines such as M1 and M2) and macroscopic conditions (such as the COVID-related restrictions, especially in China). Unfortunately, both types of issues are likely to persist well into 2023 and even beyond.

Against this gloomy background, in this article, I will argue that these issues have been more than priced in at this point. My view is that the market has focused too much on the negatives and has ignored the positive catalysts. And I do see a few strong catalysts unfolding. Management has enacted cost-cutting measures that are expected to result in $10 billion in savings by 2025. Its fab initiatives are progressing well and more importantly, the CHIPS Act passed in 2022 will help tremendously to defray the cost. In my view, the current market valuation has not properly factored in these potential impacts and created an investment opportunity with a large margin of safety.

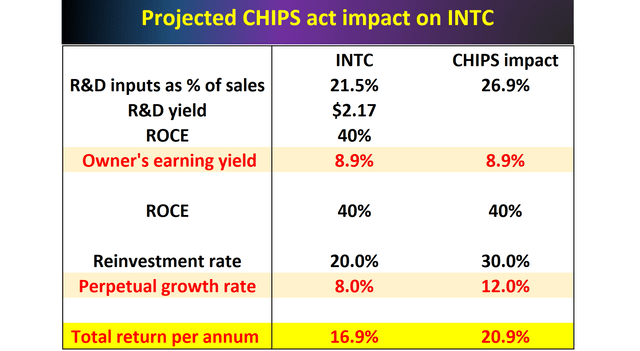

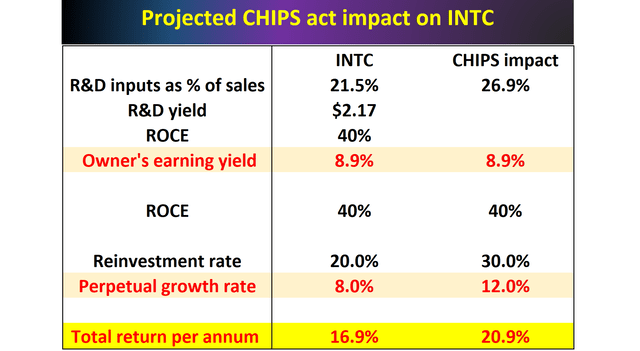

In the remainder of this article, I will focus more on the CHIPS Act impact, as summarized in the table below. I see the impacts can come in multiple ways. First, I expect the CHIPS Act to effectively boost its R&D yield by about 25% due to tax benefits and also sponsored research at government labs and universities. Second, by direct subsidies into its fab plants, I also expect the act to effectively boost its reinvestment rate (“RR”) to about 30% from its historical average of 20%. All told, these benefits are projected to boost its annual return potential from the mid-teens to about 20%. I will run through these numbers in more detail immediately next. In particular, I will contrast Intel’s fab business with AMD, a fabless chip designer, to further illustrate these impacts.

Source: Author based on Seeking Alpha data

INTC: CHIPS Act impact on its R&D expenses

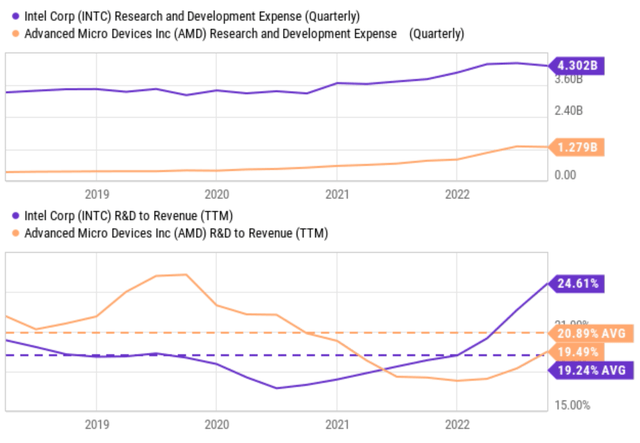

The chart below shows the R&D expenses of INTC over the year, also those from AMD to provide a better context. As seen, both AMD and INTC have been investing heavily in R&D consistently. INTC on average spent 20.89% of its total sales on R&D efforts in the past 5 years, on par with AMD’s 19.49% average. And since 2021, INTC has ramped up its R&D efforts substantially and currently spends 24.6% of its sales on R&D, both higher than its historical average and also AMD by about 500 basis points.

In absolute dollars, INTC’s R&D expenses were more than $4B per quarter and are projected to be almost $18B in 2022. The CHIPS Act includes $200 billion for research grants, more than 10x of INTC’s current annual R&D budget.

At this point, it is not entirely certain how much support INTC (or other chip makers) can receive from the act. As INTC’s CFO commented during its recent Earnings Report (slightly edited with emphases added by me):

Dave Zinsner (INTC CFO): … we have not assumed any CHIPS Act money in 2022. Our expectation is there’ll be a process and that process will take us into 2023 before we start receiving money from CHIPS. So not assumed in 2022, although, we’re assuming that we will see some in 2023. As you point out, the CHIPS Act or the bill that was passed is a combination of grant money and in tax credits, I think it’s a little early to determine exactly how all that is administered and makes its way into our P&L.

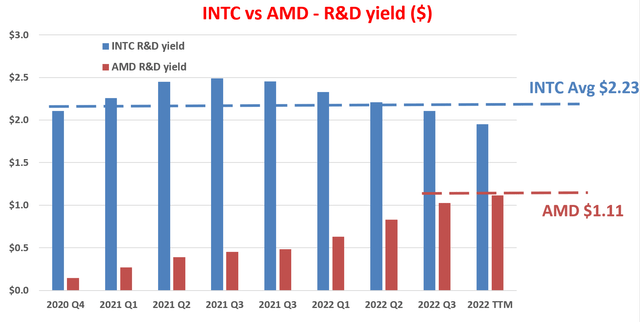

With this backdrop, let me emphasize that my following results represent a scenario analysis, aggregating the grant money and tax credit as the CFO mentioned. My results are based on a variation of Buffett’s $1 test on R&D expenses as detailed in our earlier articles. As seen, the R&D yield for INTC has been both quite healthy and stable over the years. INTC boasts an R&D yield of $2.23 in recent years. That is, for every $1 it puts into its R&D efforts, it generated on average $2.23 of earnings. It is only healthy in absolute terms, but also far exceeds that from AMD (on average $1.11, which is healthy in its own right too).

Now looking forward, with the tax credit and research grants as aforementioned, my projection is that these benefits would boost INTC’s R&D yield by at least 25%.

The benefits are expected to come in two directions the way I see things. First, the tax credit will effectively lower INTC’s actual R&D costs (lower tax rates). Second, as just mentioned, a sizable portion of its future R&D would now be carried out by government labs and universities.

Source: Author based on Seeking Alpha data

INTC: impact on fab and profitability

Besides boosting its R&D, the CHIPS Act is also expected to boost INTC’s profitability. And here again, I see the boost to come from at least two fronts. First, INTC is expected to receive substantial amounts of subsidies to pay for its future CAPEX. Again, it is a bit too premature to quote an exact number on the subsidies at this point and analysts’ opinions varied by quite a bit as you can tell from the following report (the quote texts were slightly edited by me).

Intel has said previously it hopes to receive as much as $3 billion for each new fab it builds in the U.S. and has noted the $3 billion per fab is a cap in the legislation… Reuters quoted one unnamed person saying Intel that might get $20 billion with CHIPS Act plus $5 billion or $10 billion under the FABS Act…

But given INTC’s fab initiative and the US government’s strategy to move chip manufacturing back to the US, I expect the subsidies to be sizable and be above $10B. Under this assumption, the CHIPS Act would effectively boost INTC’s RR (reinvestment rates) to about 30% from its current level of 20%.

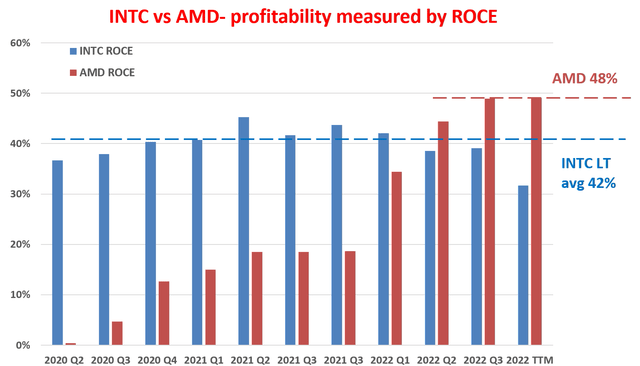

In the long term, as detailed in our earlier articles, Growth Rate simply is governed by the product of RR and ROCE (return on capital employed). Therefore, the next chart shows the ROCE of INTC (again, plotted against AMD to provide a better context). As you can see from these results, INTC was able to maintain a ROCE consistently at the 42% level.

Source: Author based on Seeking Alpha data

CHIPS Act – final results

Now, let me put all the pieces together by revisiting the chart that I used to open the article. First, given INTC’s compressed valuation, its owners’ earning yield (“OEY”) is estimated to be about 8.9 percent. Note that the OEY is different from the commonly quoted earning yield because owners’ earnings are different from accounting EPS (the differences are detailed in our other articles if you’re interested).

Then as detailed above, the CHIPS Act is projected to boost its R&D yield and also RR, which both in turn help to boost its long-term growth rates. With the effective RR of 30% projected above and INTC’s ~40% ROCE, its long-term growth rates would be about 12% (40% ROCE * 30% RR = 12% growth rates). Combining the OEY and the growth rates, the CHIPS Act could push INTC’s potential return to 20% per annum in the next few years.

Source: Author based on Seeking Alpha data

Risks and final words

First and foremost, as articulated earlier, my results here represent a scenario analysis. It is too premature to know the exact allocation of the CHIPS Act funds. Then as mentioned earlier, the company definitely faces strong headwinds, both due to issues with its own products and also due to macroscopic conditions. Management’s efforts for cost-cutting and productivity enhancement will take time to generate meaningful results.

To conclude, the main thesis is that these issues have been more than priced in at this point given how compressed its valuation has become (about 10x TTM P/E, compared to AMD’s 18x and NVDA’s 44x). The market only focuses on its negatives now and ignores the positives the way I see things. Especially, I view potential impacts from the CHIPS Act as not factored in.

A final word about AMD. I do not want to leave readers with the impression that AMD is a bad choice. I am actually bullish on AMD too as you can see from my other writings. The point I want to make here is that I expect Intel to benefit more from the CHIPS Act as a fab business than AMD as a fables business.

Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.