Summary:

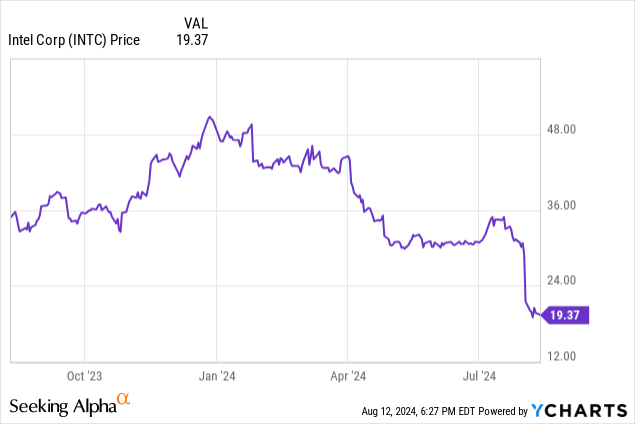

- Intel stock is plummeting as the company announces layoffs, dividend cuts, and a difficult turnaround plan.

- AMD continues to gain market share and revenue, benefiting from Intel’s missteps.

- Intel’s turnaround looks promising and could be poised for success.

- I think both companies are well-positioned for the future.

JHVEPhoto

Intel (NASDAQ:INTC) (NEOE:INTC:CA) stock is plumbing new depths as the company announces a turnaround plan complete with layoffs, dividend cuts, and the promise of an expensive, difficult, and lengthy journey to get back on track. Meanwhile, AMD (AMD) continues to snap up market share, grow revenues, and benefit from Intel’s compounding missteps. In this article, I’ll explore a few of the events that got us here and what the future of this duopoly might look like.

The Collapse

Well folks, it finally happened. Years of mismanagement, technological setbacks, and failure to innovate have come to a head, and Intel’s slow-motion collapse appears to have finally arrived. I haven’t written an article on this topic in almost 3 years, but for those of you who have been following AMD or INTC on Seeking Alpha for a while, you might remember that I have been predicting this inflection point for quite some time. While AMD has been innovating and clawing back from irrelevance, Intel was content to sit on its laurels, pumping out chips with minor improvements in efficiency and clock speeds and dragging out chip cycles to squeeze every last bit of profit from a competition-less market. The results are as we now see: the stock is down 42% over the last 12 months and nearly 60% YTD during what has been a fairly hot market for tech.

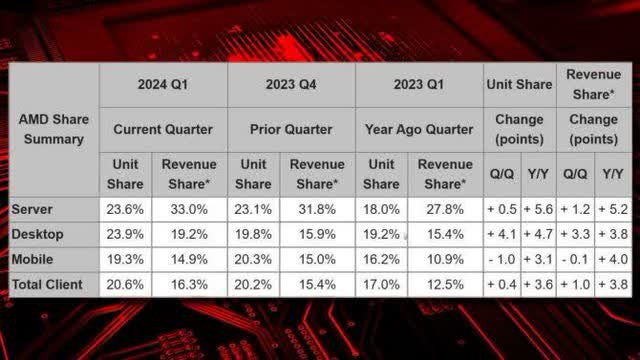

Intel’s complacency led to a self-imposed technological myopia: why innovate if your chips set the market price and any improvements will just widen a performance moat with your competition that’s impossible to cross? It’s this thinking that has led Intel into the quagmire it now finds itself in. In just a few short years, AMD went from near-zero market share in the server CPU market to almost 25% unit share and 33% revenue share and, on the foundry side, TSMC (TSM) went from being on par or slightly behind Intel to leaving them in the dust.

The image above shows the ongoing culmination of Intel’s collapse and AMD’s triumph. AMD used to be the budget option most people dismissed and now, not only is the company increasing its unit share against Intel, but it’s also increasing its revenue share as well. And perhaps most impressive, is that AMD’s revenue share premium over its unit share indicates that Intel is offering significant discounts on its products to stay competitive while AMD reaps a higher profit share. Not the budget option anymore!

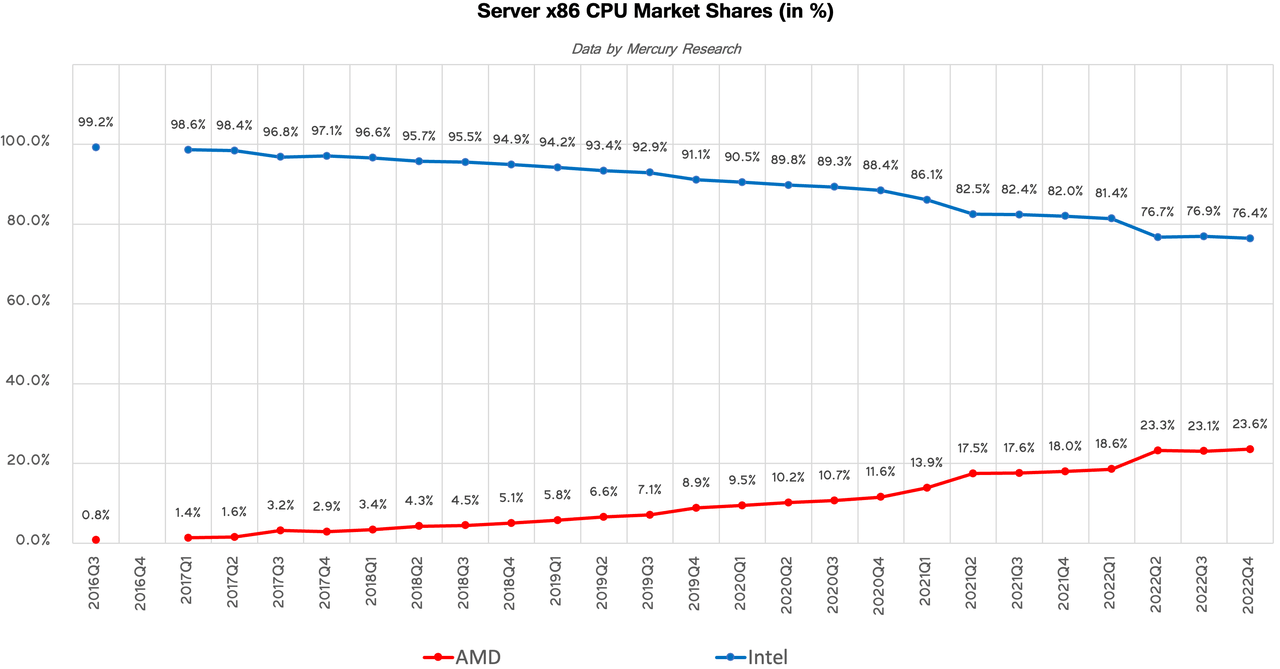

I have been beating the drum on EPYC since it was unveiled (here’s an article I wrote on the topic back in 2017 for a fun little time capsule), claiming AMD’s approach of a more modular design with higher core counts would put Intel under pressure from both a cost perspective and a manufacturing perspective. AMD could achieve higher yields and lower manufacturing costs with EPYC’s chiplet design, which it dubbed a multi-chip module (“MCM”), while Intel was left still utilizing a monolithic die, one of the main reasons Intel had trouble scaling its 10nm node (rebranded to Intel 7). This is, in my opinion, one of the most emblematic dichotomies that defines the last decade of this war: AMD tried something novel and risky to gain an advantage while Intel simply did the same thing it had always done, assuming it would be enough. Spoiler alert, it was not:

The results speak for themselves.

Part of the reason AMD has been so successful with its turnaround has been the struggles of Intel’s fab business, which I touched on earlier. In the last few years, TSMC has become the clear leader in chip manufacturing worldwide, as Intel has struggled to match pace with its manufacturing processes. Because AMD made the decision to go fabless in 2012, which in hindsight was arguably the most substantial contributor to the company’s successful turnaround, it has been able to simply go to the best chip manufacturer around and place an order (a bit more complicated than that, but you get the gist). Meanwhile, Intel has been locked into its own foundry because going to someone else to make your chips when you have an extremely capital-intensive in-house foundry would be financial and competitive suicide. So while AMD was able to focus on designing good chips, Intel had to worry about designing good chips, achieving scalable yields, designing new manufacturing processes, and had to hope that all those things worked in tandem. Theoretically, being vertically integrated can be an immense advantage, but only if executed properly, something Intel has failed to do.

Which brings us to where we are now. How will this race look going forward now that Intel has committed to a full-scale turnaround?

A New Era

While Intel has certainly lost the battle, and a critical one at that, the war rages on. I’ll quickly mention some of the details of the company’s proposed turnaround strategy before discussing what the future might hold. Full details in Intel’s quarterly report, but here’s the most relevant points:

- Cutting research, marketing, and administrative expenses from an expected $20 billion in 2024 to $17.5 billion in 2025 (a 12.5% reduction) and even further in 2026, including a 15%+ reduction in headcount.

- Reducing gross capital expenditures by 20% in 2024 relative to projections and saving $1 billion in cost of sales in 2025.

- The suspension of the company’s dividend.

At a glance, this all sounds pretty dire. And it is. But this is exactly the sort of difficult choice the company needed to make in response to the situation it now finds itself in. The current restructuring was, in my opinion, an inevitable consequence of the 10nm debacle, so the fact they are finally tackling these issues in a direct way is perhaps the best possible outcome. There will be short-term pain (the stock is proof of that) but ultimately, I think Intel will come away from this as a leaner and better positioned entity. So what will the post-turnaround future look like for Intel and for AMD?

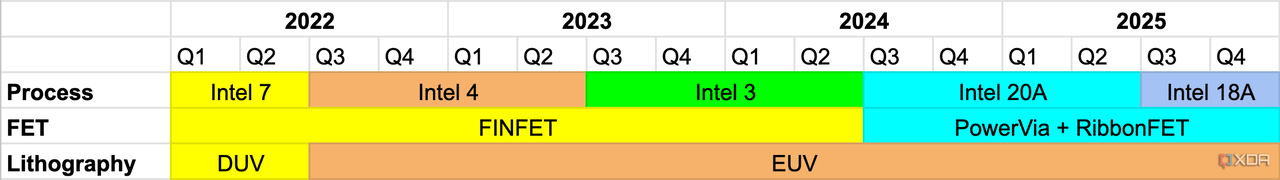

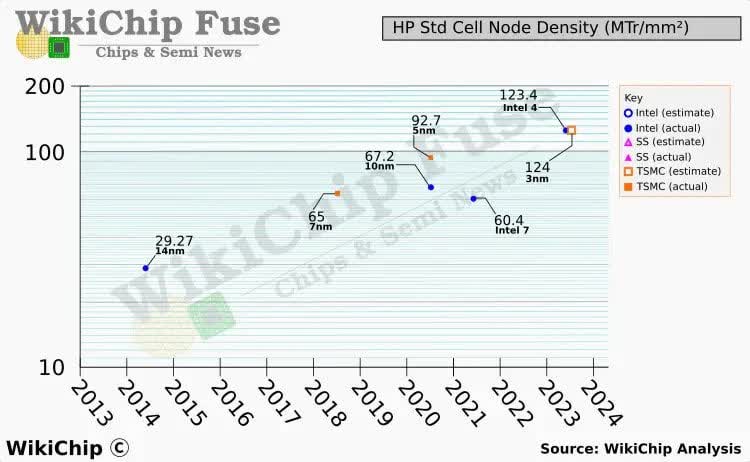

I’m gonna say something I haven’t said in quite some time, maybe ever: I think Intel is well-positioned for a recovery and investors are overreacting. The company has made a concerted effort and committed significant capital to ironing out its manufacturing process, and it has been paying dividends (too soon?). The “four nodes in five years” strategy has been a painfully expensive but necessary initiative to close the gap to TSMC, and it appears to have been moderately successful. In 2023, the company released Intel 4 on an almost even schedule to TSMC’s equivalent node:

WikiChip

The numbers here are node density, which is a better indicator of efficiency and performance than any of the nanometer stuff, which has become mostly marketing jargon. Now, density is not the be-all and end-all of chip performance, but it’s usually a good approximation. As for the next generation, Intel has claimed that their datacenter-focused Intel 3 process is already in volume production, though we’ll have to wait and see what kind of volume they can actually produce.

Beyond that, Intel’s roadmap is roughly as follows:

Intel 20A will likely match up with TSMC’s N3P node and the Intel 18A node will likely match up with TSMC’s N2 node (yes, these terms are getting very confusing). TSMC is expected to have a lead in performance and efficiency for each of these nodes, but Intel expects to release the Intel 18A before the N2, which in itself is a massive victory compared to where the company was a few years ago. So, at least until 2026, TSMC will likely still have the best chip on the market at any given time, but Intel has put in the blood and the sweat to back into the race, and I’m fairly optimistic it will lead to success.

These process improvements should allow Intel to regain some lost ground in chip performance and stanch some of the market share bleed we’ve seen in recent years. Further, I think Intel’s decision to opens its fabs to outside customers will go a long way towards increasing overall revenues and income, even if contract manufacturing is a lower margin business.

An Aside: Implications for AMD

What does this all mean for AMD? I’m going to focus on the datacenter market as I have done throughout most of this article because it has by far the highest margins, highest growth potential, and is the most significant driver of stock price for these companies.

While AMD has been the primary beneficiary of Intel’s woes, I don’t think it will suffer much, if at all, from an Intel resurgence. AMD gained market share in the datacenter by releasing innovative chips at attractive price points to undercut Intel, but the only surprising part, to me anyway, was the speed at which the companies’ fortunes flipped. Once AMD got its act together and released a halfway-decent, affordable server CPU, they were always going to gain market share, I just thought it would take 10-15 years instead of 5-7 years. Intel’s fumbles with 10nm sped up that timeline significantly. However, with the overall growth of the datacenter market, both companies were and are poised to have a duopoly on an extremely lucrative sector. Yes, they will have to compete and innovate to stay on top and market share will fluctuate, but both companies are still well-positioned for the future of compute, which is why I don’t think an Intel comeback jeopardizes AMD’s fortunes.

Further, AMD is even better positioned than Intel because of its burgeoning GPU accelerator business. Increased sales of EPYC CPUs and Instinct GPU accelerators led to 115% year-over-year growth (“YoY”) and 21% growth in AMD’s most recent quarterly report. Intel’s earnings put a damper on the whole chip sector, forecasting overall weak demand in the short-term, but AMD still forecasted a 50 bps non-GAAP gross margin expansion, 16% revenue growth YoY, and 15% sequential revenue growth. AMD is set for success regardless of Intel’s fate.

Investor Takeaway

Intel has been beaten down, but the restructuring and roadmap have me optimistic that the company, and the stock, can rebound. There will likely be some further short-term pain and I wouldn’t be surprised if shares remain depressed for a while, but I think long-term investors should treat this as a long-term value play at current levels.

For the first time in my many years at Seeking Alpha, I think INTC makes for a solid buy and by the time of this article’s publication, I will have purchased long-dated call options (think 2026) on the stock.

Thanks for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.