Summary:

- Intel is adapting to market changes by separating Intel Products and Intel Foundry, positioning both businesses to compete better in their segments.

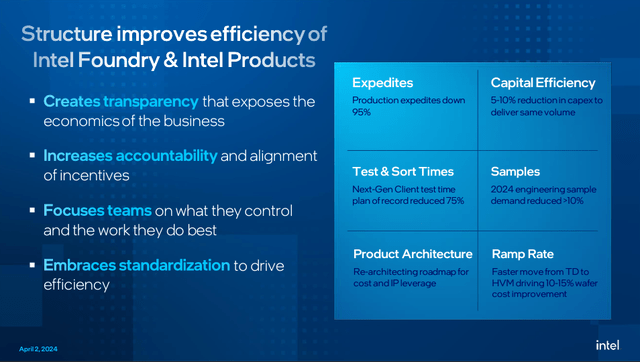

- Intel’s transparency on the economics of their business can result in both firms pursuing efficiency and growth better than being consolidated into one.

- Intel is positioning Lunar Lake and Sierra Forest to address the potential disruption ARM poses to its core business.

- Even if you become more conservative than Intel’s assumptions on their financial target model for their foundry to breakeven, Intel at $30 per share is almost 50% undervalued.

JHVEPhoto/iStock Editorial via Getty Images

Introduction

In my first article about Intel (NASDAQ:INTC), I discuss Intel’s upcoming product and its role in Intel’s strategy moving forward. Influenced by Clayton Christensen’s book The Innovator’s Dilemma and Solution, I will explain the industry shifts and disruption that forced Intel to adopt the IDM 2.0 Strategy, how Intel is positioning the company to face these problems, and how it will influence Intel’s future.

Separation Of Intel Products And Intel Foundry

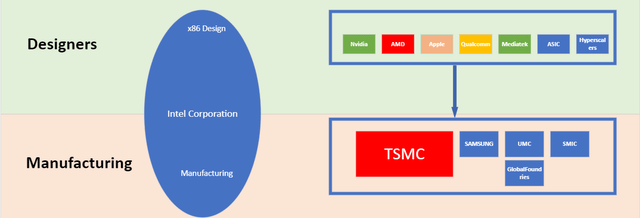

Clayton Christensen, in his book The Innovator’s Solution, highlights that industries tend to start with an integrated value chain and, over time, into a modular value chain as products “become good enough.”

The rising demand for specialized chips tailored to specific workloads or applications and the semiconductor industry value chain becoming more modular has significantly affected Intel’s core business and competitive positioning. For example, there is a growing need for GPUs designed for machine learning (ML) and artificial intelligence (AI), as well as application-specific integrated circuits (ASICs) for tasks such as crypto mining, networking, and security, resulting in the industry transitioning away from depending solely on Intel’s chips for a wide range of computing workloads.

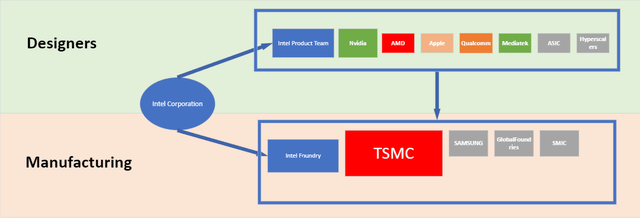

Author’s Graphical Representation of Intel IDM 1.0 Market Positioning vs The Industry

Along with the rising costs of advancing Moore’s Law, building new leading-edge fabs, TSMC’s increasing scale, and pressure from specialized chips on Intel’s core business. Intel’s integrated value chain, or IDM 1.0 structure, is becoming unsustainable.

To solve this dilemma, Intel announced IDM 2.0, which eventually evolved into the separation of Intel Products and Intel Foundry. This separation will encourage transparency for both businesses, making them more conscious of their costs and operations. Additionally, the benefits of competing in the open market will drive both firms to innovate to attract customers rather than relying on each other.

Intel Products, now mandated to win business at all costs, can use external foundries to access the latest wafer technology, overcoming the potential downside of using Intel Foundry alone. Like any fabless designer, they must be aware of their costs, as they are now charged for activities like hot lots, steppings, and testing. In the old Intel integrated model, they could perform these activities as much as they wanted, resulting in inefficiency. Additionally, Intel design teams can’t now rely on Intel’s manufacturing prowess, which covered their underperformance in the past.

Intel’s New Segment Reporting Presentation

Intel Foundries, now pursuing to be an external foundry, has adopted industry-standard designing tools such as EDA, provided by Cadence and Synopsis, and IP libraries, such as ARM and RISC-V. With Intel Products no longer a guaranteed business for Intel Foundry, they are now forced to drive efficiency and innovation to attract not just its Intel Products, which recently started using TSMC for their upcoming Lunar Lake and Arrow Lake, back into their foundry but also attract external customers. Additionally, Intel’s foundry now has the opportunity to enter markets it previously couldn’t compete in due to its obligation to be a dedicated foundry for Intel products; this allows it to spread the cost of building new fabs and advancing Moore’s law to not just Intel products but also external customers.

Author’s Graphical Representation of Intel IDM 2.0 Market Positioning vs The Industry

Intel is betting that free market forces will bring out the best in its two businesses. By separating them, Intel believes each company can focus on doing what is best for their business. Intel has reinforced this by being transparent and revealing its economics to investors.

Lunar Lake

The story of ARM (ARM) is a classic scenario outlined in Clayton Christensen’s book, The Innovator’s Dilemma. The x86 architecture used to be the uncontested leader in high-performance CPUs, with an architecture focused on high performance. ARM’s focus on efficiency meant that, at that time, it couldn’t compete in x86’s markets—desktops and laptops.

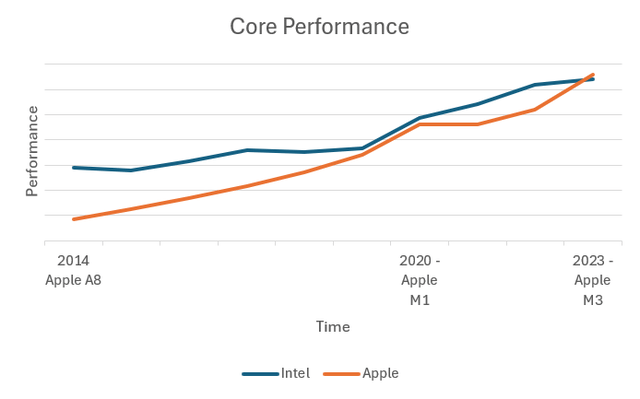

The rise of smartphones, combined with Microsoft (MSFT) and Intel’s missteps in this market, allowed ARM chip designers such as Qualcomm (QCOM), MediaTek, and Apple (AAPL), among others, to open up a new market with efficient and “good enough” CPUs that can handle optimized mobile applications, and slowly move up-market into the high-performance PC market by slowly catching up to Intel in performance while maintaining its advantage in efficiency. This is evident in the graph below.

Author’s Graphical Representation of Intel vs Apple Performance

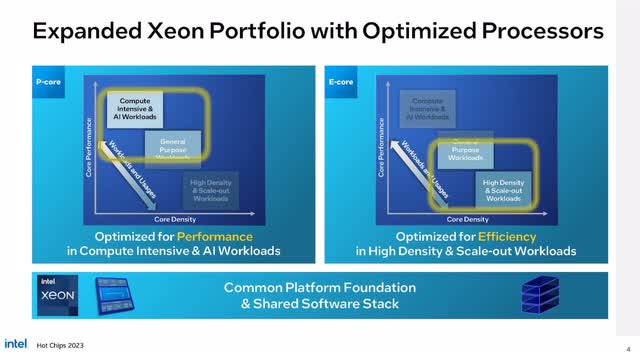

As a solution to ARM’s threat to their client business, Intel introduced E-cores into their CPU design. This design improves efficiency by offloading light workloads to E-cores while the P-cores handle more intensive tasks. For example, Chrome runs YouTube on E-cores and Adobe rendering on P-cores. Additionally, Intel designed two CPU variants dedicated to addressing the needs of these two segments: low-power mobile and high-performance processors, resulting in the birth of Lunar Lake and Arrow Lake.

I believe Intel will be able to fend off the threat posed by ARM, led by Qualcomm and potentially MediaTek, in this market. Efficiency, which has been ARM’s main value proposition, has shifted from a disruptive innovation to a sustainable innovation due to Intel and AMD (AMD) increasingly focusing their designs on efficiency, partly thanks to Apple’s innovation with the Apple M1 in 2020.

In the context of the Jobs-to-be-done theory highlighted in Innovator’s Solution, unless a company can introduce a disruptive innovation that incentivizes customers to switch, it is unlikely that they will change products based solely on sustainable innovations, which in this case are performance and efficiency.

If Qualcomm had introduced these products four years ago, it would have been a different story. Consumers and enterprises were beginning to value efficiency then and would have benefited from this Qualcomm chip. I also believe Qualcomm is pursuing the wrong strategy by diversifying into a slow-growth market, using the same distribution channel, and competing against a mature x86 software ecosystem where decades of software development efforts have been put into this ecosystem.

In the enterprise market, IT decision-makers (ITDMs) are unlikely to risk their jobs by buying laptops and desktops with an unproven chip when they can buy AMD or Intel-powered ones at a similar price, performance, and efficiency without the risk of various applications not working and subpar performance due to emulation.

In the consumer market, without the ecosystem that made Apple successful, by having full integration from hardware to software, to differentiate itself. Qualcomm’s product is just another chip in the market that offers the same value proposition and no new significant features that can entice customers to switch.

Based on recent benchmarks, Qualcomm’s offerings offer little performance and efficiency advantage over AMD and Intel chips. They are their only value proposition because they don’t have the software advantage against x86 in the PC market.

Sierra Forest

ARM successfully entered the lucrative CPU server business. They’ve done this by licensing their architecture to hyperscalers like Google (GOOGL), Amazon (AMZN), and Microsoft, further stepping away from the Intel x86 server ecosystem.

However, not every company has the immense resources these technology giants have, which they can invest in developing their chips in-house to make their products even better. Other software companies and cloud service providers, such as SAP (SAP), Oracle (ORCL), GoDaddy (GDDY), and Bluehost, opt to put all their resources into improving product software and outsourcing the hardware or chip design from outside vendors such as Intel and AMD. Along with private enterprises, Intel and AMD want to protect this market against ARM.

This market is divided into two segments: high-performance computing and high-density computing.

While the HPC segment benefits from Intel and AMD’s ever-growing performance gains with each product iteration, especially with the rise of AI, high-density computing is experiencing a performance oversupply, which is a perfect setup for disruptive innovation like ARM to enter. Highlighted in the Innovator’s Dilemma, performance oversupply often creates an opening for entrants to offer a “Good enough” product at a lower price to the over-served customers. Ampere Computing LLC, a firm licensing ARM architecture to design chips for servers, is trying to enter the server CPU market by focusing on this market segment.

In this segment, customers, typically cloud providers, receive more performance and usually with higher TCO, which they do not need due to the nature of their computing workloads.

This is a remark made by David Zinsner, CFO of Intel, about Sierra Forest at the Morgan Stanley Technology, Media & Telecom Conference on March 06, 2024.

Sierra comes out, like I said, before the first half of this year is over. That’s an important one because it’s our first kind of efficient core product and addresses a place in the market that we were more challenged in terms of what customers are looking for.

Intel has traditionally designed next-gen Xeon Server CPUs with higher performance in mind. Unfortunately, a wide array of workloads don’t need fast cores. Workloads such as hundreds of virtual machines that host applications or websites need a “good enough” core that can reliably run 24/7 and at a lower total cost of ownership. An excellent example of the workloads these products target is marketing websites designed to introduce a company’s product line, which only sometimes has a high volume of visitors; Intel humorously uses Taylor Swift fans overloading ticket masters system as an additional example of use cases of Sierra Forest. Another example is sub-modules of applications with intermittent workloads, where data input varies from time to time, such as SAP HANA. In these cases, SAP plans to implement a system where high-performance workloads run on Granite Rapids, the P-Core variant, and high-density workloads on Sierra Forest, benefitting from Intel’s shared software stack, further differentiating their products against the competition.

Target Model, Not A Forecast

John Pitzer, Intel VP for Investor Relations, clarified at the BofA Global Technology Conference about the financial remarks made during their new financial segment reporting involving Intel Products and Intel Foundry on April 2, 2024.

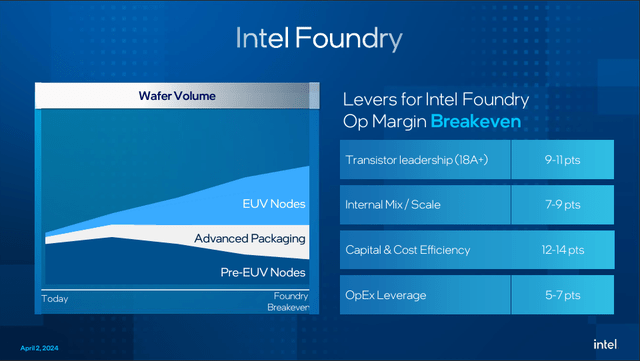

Yeah. I’m glad you asked the question because it’s a really important point of clarification. When we presented the webinar in early April, what we tried to present to the investment community was a target model, not a forecast, but really a target model that was based on what we thought was reasonable to conservative revenue expectations.

Pitzer clarified that their expectation of the Intel Foundry breakeven in 2027 is based on a conservative target model. That model assumes that Intel’s Product will grow at a conservative 8% to 10% CAGR to $85B and that Intel Foundry will generate $15B by 2030, for a total revenue model of $100B by 2030. He further stated that they presented not a financial forecast but a target model; this means that Intel Foundry can break even earlier if Intel Products grows beyond that model, assuming most of their wafers are made by Intel Foundry instead of TSMC and the Foundry wins more external customers.

I believe Intel’s assumptions from their presentation are reasonable and very attainable. Currently, Intel Foundry is losing significant money as it transitions from being a dedicated foundry for Intel Products to an external foundry competing in the open market. Their P&L being exposed to investors and the market will force them to pursue efficiency, competitive pricing, and innovation to provide a better alternative to TSMC. Investors must be patient with them as they go through the usual learning curve of being an external foundry.

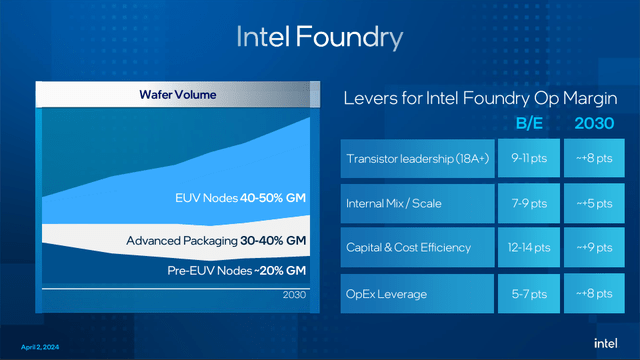

Intel’s New Segment Reporting Presentation

Additionally, most of their wafers are still on Intel 7 and in high volume since most of their current products in the market, Sapphire Rapids, Emerald Rapids, and Raptor Lake, use it. With Intel Foundry now using market-based pricing, Intel 7 pricing will be matched to TSMC 6/7nm, which constitutes a lower margin since there is an abundant supply on this node after being in the market since 2019, as reflected on their slides, where its Gross margin is only 20%.

Intel’s New Segment Reporting Presentation

But as they release and ramp up their EUV products, Intel 3, Intel 20a, and Intel 18, which are used by Granite Rapids, Sierra Forest, and Arrow Lake, along with external customers such as Mediatek and Microsoft, we can expect their higher ASP to help the foundry improve its margin. And, of course, higher revenue is always a good tailwind for a high fixed-cost business like Intel, so if they can further expand that $15B foundry lifetime value, it will be a significant tailwind for its bottom line.

Valuation

It is quite possible to know that a woman is old enough to vote without knowing her age or that a man is fat without knowing his exact weight.

A famous simile by Benjamin Graham can be used to assess Intel’s current valuation. At its current price, Intel is undervalued, regardless of the valuation method you use. In my previous article, I used industry multiple to valuate Intel Products and argue that Intel is priced where you only buy the potential of Intel products and everything else for free.

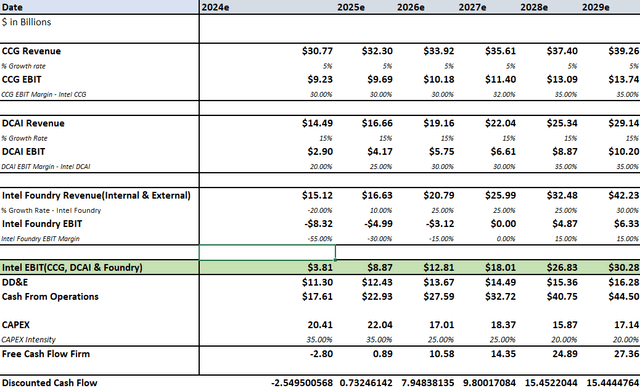

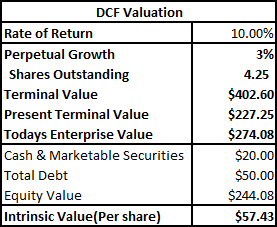

Based on Intel’s new segment reporting presentation, we can use Intel’s financial target models and assumptions on our DCF model. To emphasize how undervalued Intel is right now, we will only include the revenue of Intel CCG, DCAI, and Intel Foundry in the model, excluding its other businesses like Altera, NEX, and Mobileye (MBLY). Moreover, We will be more conservative than Intel in our assumptions.

We will assume that Intel CCG will grow in the mid-single digits and DCAI at 15%. Considering the potential of Intel Gaudi and future DCAI products to regain market share, I believe 15% is a very conservative growth assumption.

For Intel Foundry, Intel expected the foundry losses to peak this year due to less volume due to Intel client outsourcing a significant amount of its wafers from TSMC and the startup cost of their EUV nodes Intel 3, Intel 20a, and Intel 18a. But as their Intel 3 & 18a starts to ramp up, we can expect Intel Products to return to using Intel Foundry; along with its higher ASP and increased volume from Intel products and external customers, we can expect their foundry losses to lessen until it hits breakeven by 2027.

Author’s Intrinsic Value

With an intrinsic value of $57.43 per share, you can buy Intel at almost a 50% discount and get Altera, NEX, and Mobileye for free.

Risk

Execution Issue

Intel’s assumptions on their segment reporting rely heavily on their execution. Intel has a history of problems regarding its ability to execute. However, I believe Pat Gelsinger, whom Andrew Groove heavily influenced, can bring back the culture that made Intel successful. Ultimately, the proof of whether they can execute will be if they deliver the 5 nodes in 4 years and their products on time.

Competition

ARM architecture proved that it can match x86 performance while maintaining its efficiency. Future ARM products may outperform Intel products due to the nature of x86 or Intel’s ability to execute. Qualcomm and Mediatek’s entry into the PC market risk further commoditizing the market, so the competition moving forward will be on how companies such as Intel integrate their software into their chips. Apple and Nvidia have shown us that providing the hardware isn’t enough in today’s competitive environment. To differentiate itself among potential server and PC market entrants, Intel must also work on its software to differentiate its products.

Conclusion

Intel faces a significant challenge in establishing its foundry and fending off ARM’s entry into its core business. Additionally, Intel will be in a period of investment to correct past mistakes made by previous management, which allowed TSMC to take advantage of the industry’s modularization and ARM to dominate the smartphone market and gradually move up-market into the PC market. Intel can correct these past mistakes by adapting to industry changes and separating its Intel Products and Intel Foundry divisions. This separation allows both businesses to benefit from competing in the market and pursue their best interests.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.