Summary:

- I correctly had issued a ‘Sell’ view for Intel last time, but prematurely changed this, leading to a foregone chance to capture 40.05% of alpha.

- Now I am reinstating my bearish stance on the stock as I notice that Intel continues to see falling revenues due to loss of share to competition.

- The company’s margins are also likely to be depressed for the rest of FY24 and beyond as their catchup plans on Foundry Technology incurs high costs.

- I am skeptical of management’s optimism and bullish commentary given their track record of disappointments on revenue guidance. Intel also seems overvalued given an unwarranted premium to its historical valuations.

- Even if one believes in the turnaround, I think the best time to invest is after significant investments are done and before much of the return is realized. Till then, I continue to follow the bearish trend vs. the S&P500.

williv/iStock via Getty Images

Performance Assessment

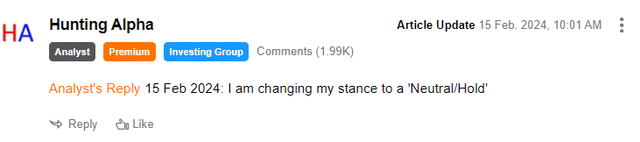

I’m kicking myself when I review the performance of my prior stance on Intel Corporation (NASDAQ:INTC). I had a ‘Sell’ view of the stock. However, I prematurely communicated a change to this view to a ‘Neutral/Hold’ based purely on the technicals:

Pinned Comment on Author’s Last Article on Intel (Author’s Last Article on Intel, Seeking Alpha)

This was a grave error that I will try not to repeat again. The impact of this error was that instead of 40.05% alpha capture, only 1.1% alpha was realized.

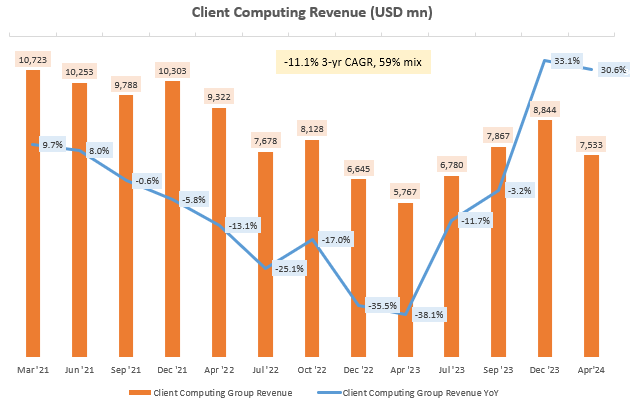

Performance since Author’s Last Update on Intel (Author’s Last Article on Intel, Seeking Alpha)

Thesis

Now, I am reinstating my bearish view on Intel due to:

- Revenue growth is pressured due to Intel losing out to competition.

- Margins are expected to remain depressed for the rest of FY24 and potentially beyond.

- Track record of disappointments makes me skeptical of management’s optimism.

- Intel seems overvalued vs. historical multiples.

- Intel’s alpha erosion trend is very much intact.

Revenue growth is pressured due to Intel losing out to competition

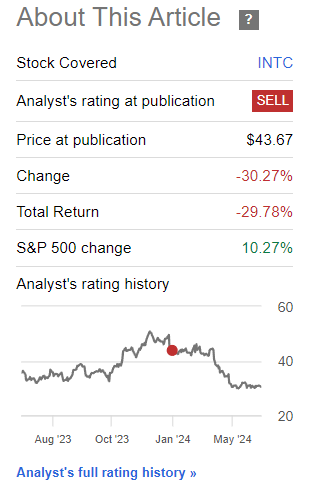

Intel’s overall revenue growth has been on a consistent and material decline as it has lagged its semiconductor peers. Over the last 3 years, revenues have shrunk 13.5%:

Total Revenues (USD mn) (Company Filings, Author’s Analysis)

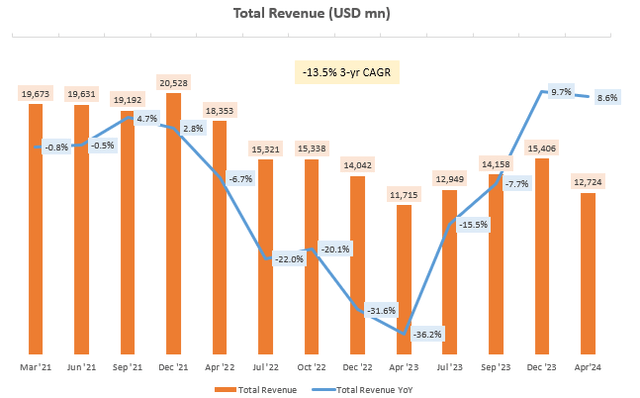

Unfortunately, these negative 3-yr CAGRs are a common characteristic of all segments:

Client Computing Revenue (USD mn) (Company Filings, Author’s Analysis)

In the Client Computing bucket, which mainly involves the sale of desktop PCs and notebooks, the company is losing market share to Advanced Micro Devices, Inc. (AMD), NVIDIA Corporation (NVDA) and QUALCOMM Incorporated (QCOM). I would like to highlight the following exchange between a sell-side analyst and CEO Patrick Gelsinger in the Q1 FY24 earnings call:

So I want to ask about server CPU share… And it sounds — you sound maybe a little bit less optimistic, if I’m sort of reading between the lines, on share into the back half of the year, just given how long it takes these things to sort of impact your share. So your bullish outlook in the second half of the year, it sounds like it’s more market-driven versus share-driven. Can you just clarify that?

– UBS Analyst Timothy Arcuri’s question in the Q1 FY24 earnings call, Author’s bolded highlight

My interpretation of the CEO’s response suggests that the hypothesis about market pressure and even losses in server CPU share may be true:

Well, overall, I like to say it’s hard to predict, right, exactly how these will play out in light of the overall gen AI surge that we’ve seen. That said, products are good, right?…

– CEO Patrick Gelsinger’s initial response

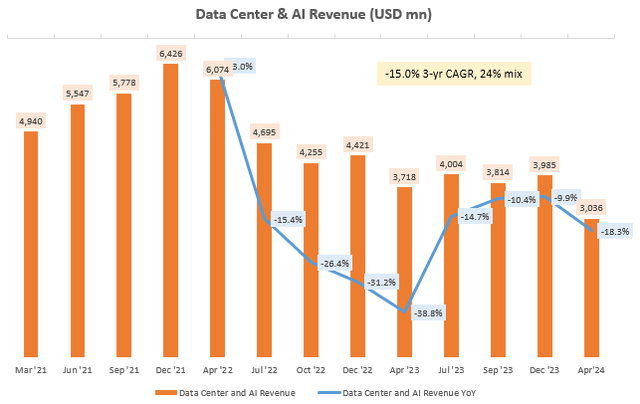

In the Data Center & AI segment, which sells processors to hyperscaler customers, Intel has been shrinking its revenues at a 15% CAGR over the past 3 years:

Data Center & AI Revenue (USD mn) (Company Filings, Author’s Analysis)

The key competitors that Intel is losing to here include AMD, Arm Holdings plc (ARM) and NVIDIA.

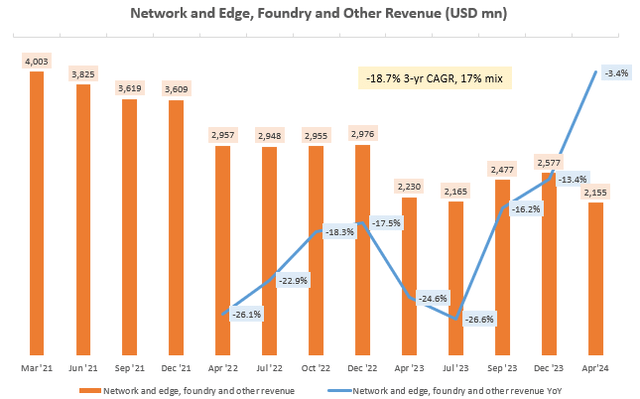

Network and Edge products convert fixed-function hardware to general purpose cloud-native programmable hardware. Ethernet and 5G technology, network processors are involved here. Other revenues mainly include Mobileye, which includes products such as Intel EyeQ for chips used in ADAS computer vision. And of course, Foundry relates to Intel’s design and manufacture of semiconductor chips. Intel recently reclassified its segments to separate out Foundry revenues. But I have clubbed them together for trend comparison purposes:

Network and Edge, Foundry and Other Revenue (USD mn) (Company Filings, Author’s Analysis)

Here too, Intel has been dropping revenues at an 18.7% 3-yr CAGR, losing to its semiconductor competition. On the Foundry side, I outlined my case for why I believe it is losing to TSMC in my last article.

Management’s recent commentary confirms the ugly truth that Intel continues to face competitive issues with its products portfolio:

We had execution challenges which impacted the competitiveness of our products.

– CFO David Zinsner in Intel’s New Segment Reporting Webinar

As usual, there are promises of better progress in the future:

While first half trends are modestly weaker than we originally anticipated… We continue to see Q1 as the bottom, and we expect sequential revenue growth to strengthen throughout the year and into 2025

– CEO Patrick Gelsinger in the Q1 FY24 earnings call

However, I am skeptical of the positive speak for reasons discussed in a later section below.

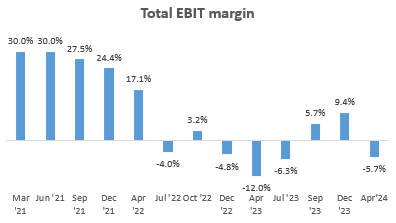

Margins are expected to remain depressed for the rest of FY24 and potentially longer

Intel’s profitability has dipped below zero in Q1 FY24:

Total EBIT Margin (Company Filings, Author’s Analysis)

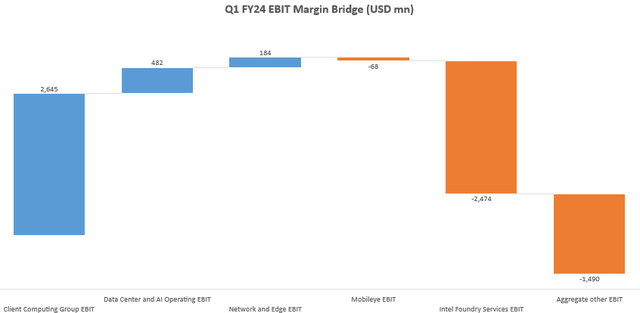

This is mostly due to Intel’s Foundry Services eating away at most of the profitability generated by Client Computing and Data Center & AI:

Q1 FY24 EBIT Margin Bridge (USD mn) (Company Filings, Author’s Analysis)

Intel’s ambitious plan to catch up to TSMC with its 5 nodes in 4 years strategy is leading to high initial costs for Intel Foundry. And the profitability outlook here is expected to be pressured for the rest of the year and also in 2025:

The foundry P&L will remain challenged through the year, and we expect operating margins to trough in 2024 as start-up costs associated with 5 nodes in 4 years peak and the P&L absorbs an expected increase of roughly $2 billion in depreciation… there will be additional start-up costs next year [2025]

– CFO David Zinsner in the Q1 FY24 earnings call, Author’s bolded highlights

I believe the issues with a loss of share and a decline in revenues, coupled with a constricted margin outlook for the next year or two reduces the attractiveness of the stock. I think the best time to invest in turnarounds is after the major investments are done and the yield on those investments are yet to materially accumulate. That is not the stage Intel is in right now, in my opinion, even if one believes in their ability to fix their laggard positioning.

Track record of disappointments makes me skeptical of management’s optimism

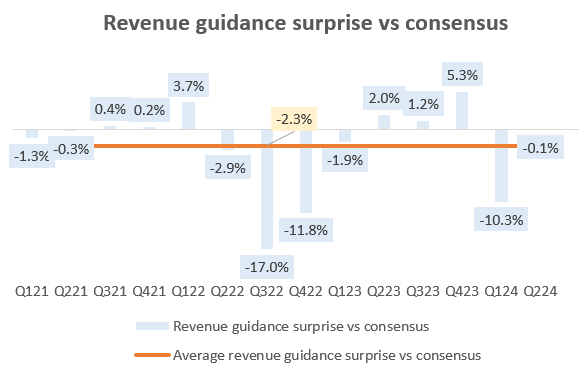

I find more reasons to be skeptical of Intel’s prospects when I consider their track record in revenue guidance surprises:

Revenue guidance surprise vs. consensus (Capital IQ, Author’s Analysis)

Intel has been active in their communications and painting of brighter pastures ahead. However, it is important to balance these narratives with the numbers of empirical performance measures; the company has had an average guidance miss of 2.3% over the past 3 years.

Unsurprisingly, research analysts have found the disconnects between narratives and execution exasperating:

I think everyone has been hearing them say the next quarter will be better for two, three years now

Intel seems overvalued vs. historical multiples

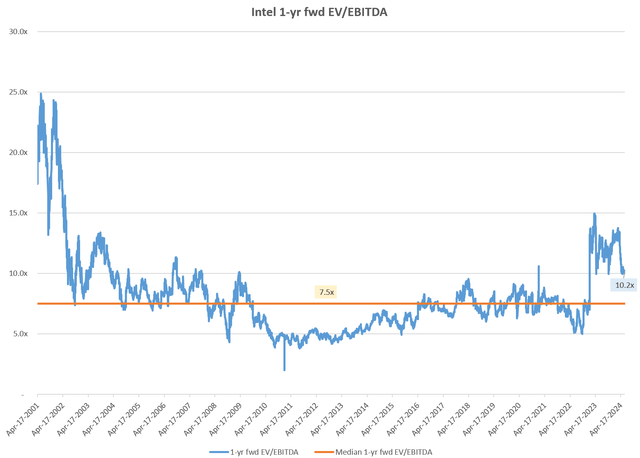

Today, Intel is trading at a 1-yr fwd EV/EBITDA multiple of 10.2x, representing a 34.7% premium to its longer-term median of 7.5x:

Intel 1-yr fwd EV/EBITDA (Capital IQ, Author’s Analysis)

Now some may argue that some premium is justified as Intel is poised to benefit from the semiconductors’ upcycle. However, I disagree with this view since Intel is clearly lagging behind its competitors.

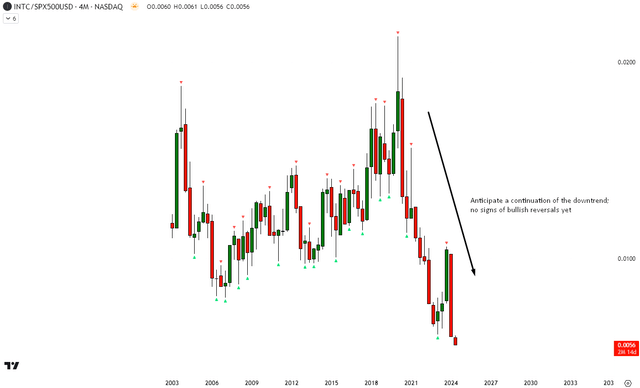

Intel’s alpha erosion trend is very much intact

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder returns as they are adjusted for dividends/distributions.

Relative Read of INTC vs. SPX500

On the 4-monthly chart of INTC vs. the S&P500 (SPY) (SPX), I anticipate a continuation of the strong bearish trend. There are no signs of a bullish reversal yet.

INTC vs. SPX500 Technical Analysis (TradingView, Author’s Analysis)

This time, I will be more mindful of prematurely changing my stance for tactical reasons based on the technicals alone lest I miss out on capturing meaningful alpha.

Key Monitorables

Readers familiar with my work and investing style would know that valuations alone can very rarely influence me to change my mind on a stock in operational decline. Hence for Intel, at the very least, I would like to see a halt to the revenue declines at least and better commentary on market share trends before considering a change in my stance. I do not expect much to change on the margin pressure side of things as management has clearly indicated that it would take some time for the Foundry to turn profitable.

Takeaway & Positioning

My earlier ‘Sell’ view on Intel played out beautifully, but I am kicking myself for a premature change in stance that led to a missed opportunity for 40.05% of alpha capture.

Now, I am reinstating my ‘Sell’ view as I recognize that the fundamental headwinds are still very much intact; Intel is seeing a broader declining trend in revenues across all its segments as it loses share to competition. The margins are under pressure as their ambitious catchup plans in Foundry technology incur significant costs. I am skeptical of the company’s promises and bullish commentary in H2 FY24 as evidence from the track record of misses vs. expectations gives little reason to give them the benefit of the doubt on executing well. Given these drawbacks and a trend of alpha erosion vs. the S&P500, I believe trading at a 34.7% premium to historical valuation multiples signals overvaluation.

Rating: ‘Sell’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time horizon for my view is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.