Summary:

- Intel Corporation’s Q1 revenue was down 36% year-over-year.

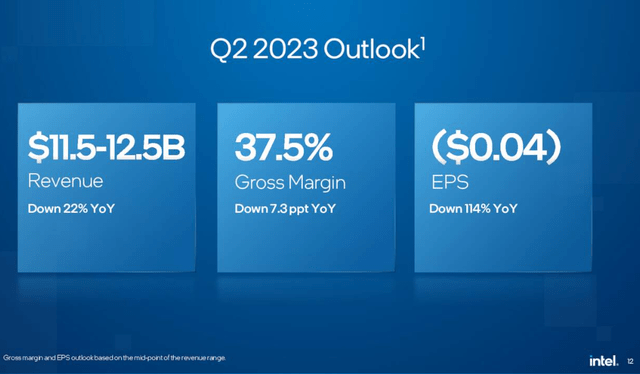

- Intel’s projection for Q2 shows another 22% revenue loss YoY.

- Intel’s financial metrics are terrible.

- Intel’s new fab projects will take years to generate substantial free cash flow.

JHVEPhoto

Overview

Intel Corporation (NASDAQ:INTC) released its second-quarter earnings for FY 2023 on April 27, 2023. Those results were not pretty, as Intel reported a loss of $.04 non-GAAP on revenue that was down a huge 36%. But the bad news didn’t stop there, it also projected losses for the next quarter of $.04 and revenue down 22% YoY.

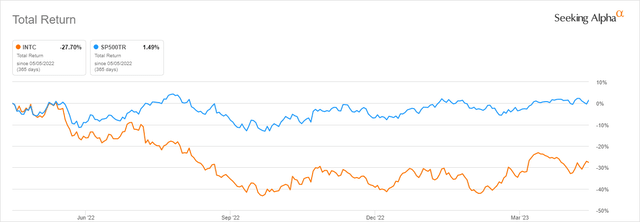

Intel’s share price looks about as ugly as its revenue and earnings would suggest. INTC’s total return (including dividends) for the last 12 months is at a negative 28% compared to the S&P 500 (SP500) loss of 1.5%.

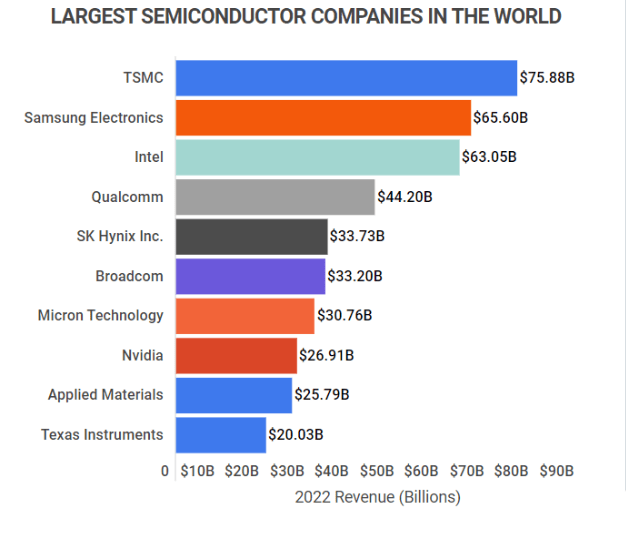

Intel is the 3rd largest semiconductor company in the world by revenue, behind only Taiwan Semiconductor Manufacturing Company Limited (TSM) and Samsung (OTCPK:SSNLF).

zippia.com

The question for investors at this point in time is whether Intel is a reasonable investment, or whether investors should be looking at other tech stocks.

In this article, we will look at 6 significant headwinds Intel faces which combined lead to a Sell recommendation.

1. Intel’s Key Stock Metrics Are Terrible.

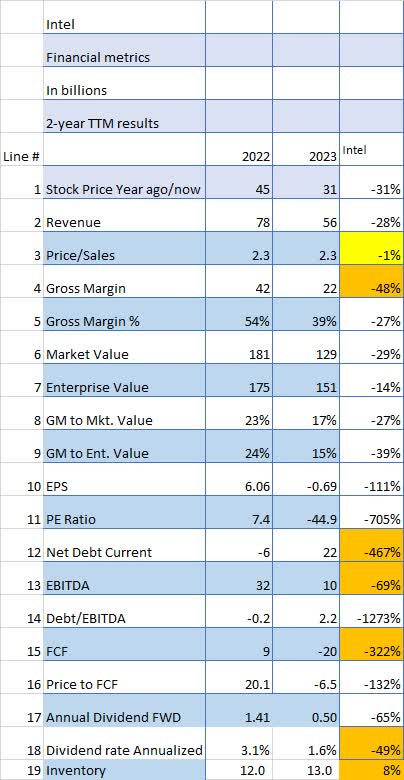

Let’s look at Intel’s financial metrics, comparing the latest TTM (Trailing Twelve Months) with the previous year. As might be guessed, there are some pretty bad comparisons.

I use the financial metrics to discover what I consider to be positive investment numbers (Yellow boxes) and compare them with any negative investment numbers (Orange). One quick look at the financial metrics table above comparing 2022 to 2023 shows what I consider to be serious problems in results for Intel over that time period. In fact, it is the worst year-over-year financial metrics comparison I have done yet.

Seeking Alpha and author

Gross Margin (Line 4) is significantly lower, down 48% since last year. This would imply serious revenue concerns and/or operational inefficiencies over that one-year time period.

Enterprise Value (Line 7) decreased by only 14%, although revenue was down 28%. That may imply a higher market price than deserved.

EBITDA (Line 13) has dropped almost 70% or $22 billion.

Net Debt (Line 12) is down $28 billion, a huge amount for a one-year period.

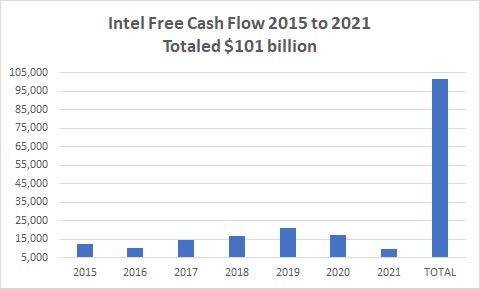

Also, free cash flow (“FCF”) (Line 15) went from $9 billion to a negative $20 billion, a breathtaking $29 billion drop. To see how bad that is, here’s a 6-year history of Intel’s huge previous FCF, totaling $101 billion over 6 years.

Seeking Alpha and author

Due to the extreme nature of Intel’s performance, the dividend (line 17) was cut by 65%.

Perhaps the most worrisome indicator of all is outstanding Inventory (Line 19), which sits 8% higher than last year even after a decrease in revenue of 31%. That would imply some serious management issues, to say the least. If the business doesn’t pick up significantly in the coming quarter or two, will there be some sort of significant inventory write-down?

2. Fabs Take A Long Time To Build And Even Longer To Generate FCF.

One of the big arguments for Intel’s investment is its new focus on becoming a viable competitor to Taiwan Semiconductor Co. In order to accomplish that, Intel must invest somewhere on the order of $88 billion over the next 5 years in new fabs just in Europe. Of course, there will be significant offsets to that $88 billion depending on how much Intel can cajole governments to cough up as credits/cash subsidies, but that is still unknown at this time.

And those numbers do not include a $30 billion Arizona fab investment and a $20 billion Ohio fab investment.

An investment of $138 billion in fabs sounds like a monumental job with myriad chances of delay and cost overruns. Where are you going to find the engineers and workers to build them all in a reasonable amount of time?

But regardless of how much government funding is received by Intel, the time frame is expected to be at least 3 years to build, per Intel’s own estimates. And after the 3 years, it will take another year or two to generate enough revenue to generate positive FCF.

Why invest now if you won’t know for sure how much revenue and profits will be for 4 or 5 years?

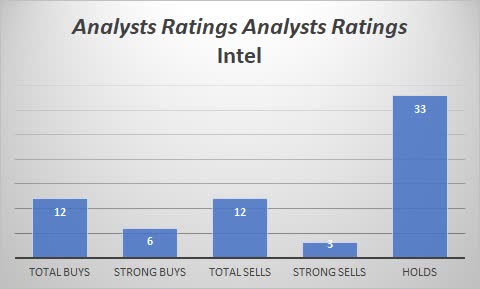

3. Analysts Are Less Than Excited About Intel’s Investment Potential.

Wall Street and Seeking Alpha analysts have mixed messages on Intel ratings, with 12 Buys and 12 Sells. And interestingly, the number of Hold ratings exceeds the total of Buys and Sells, 33 to 24. There appears to be no consensus on Intel.

Seeking Alpha and author

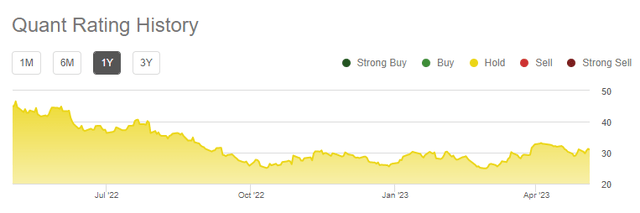

The quant rating is in the same direction as the analysts – a Hold rating for the entire year.

If there is very little enthusiasm for Intel from analysts or quants, why should you invest?

4. Intel Has Underperformed Virtually Every Other Semi-conductor Stock

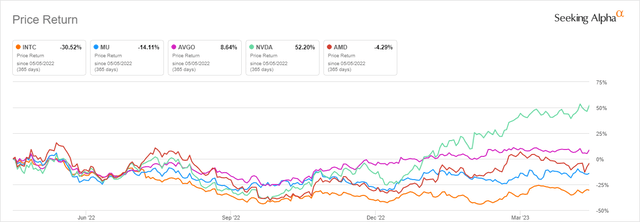

A legitimate question when looking at any stock is to compare its potential with other stocks in the same market sector. If we look at Intel’s performance over the last year and compare it to other large market-value stocks in the semiconductor sector, we can see Intel has performed poorly compared to the others, with a total return (including dividends) of minus 13%.

In the following chart, we compare Intel’s performance with Micron Technology, Inc. (MU), Advanced Micro Devices, Inc. (AMD), Nvidia Corporation (NVDA), and Broadcom Inc. (AVGO). Intel is the worst performer by far.

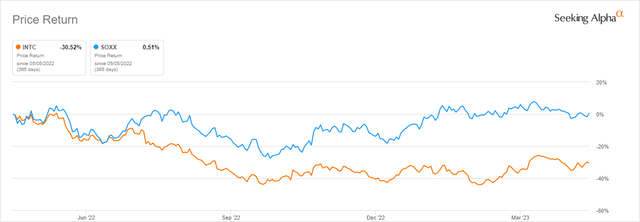

Another good comparison is with the iShares Semiconductor ETF (SOXX), which includes all the major semiconductor stocks in one ETF.

In this case, SOXX has outperformed INTC by 30% over the last year.

It is easy to see once again that Intel has not performed as well as the semiconductor sector in general over the last 12 months.

5. Experts Are Indicating The Slowdown In Chip Revenue Is Not Going Away Anytime Soon

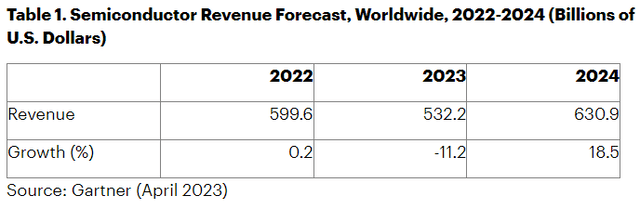

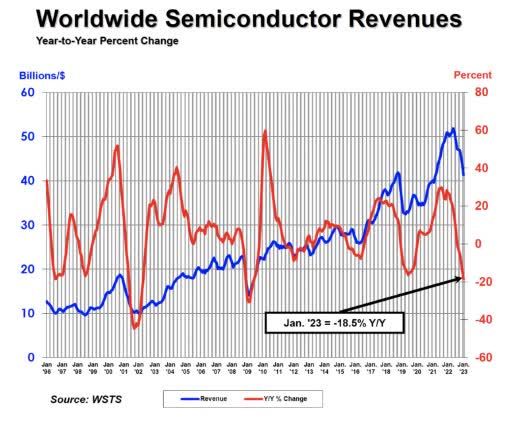

The other looming issue is whether semiconductor revenue, in general, is done falling yet. Gartner says no, there is more downside to come.

The WSTS (World Semiconductor Trade Statistics) also shows a slowdown.

WSTS

Another indicator of a weak semiconductor market is Samsung’s recent announcement that it was cutting back on chip production.

Why invest now when indicators are clear that at least near-term and quite possibly longer, sales and shipments will be sluggish at best?

6. The ARMy Is Coming

ARM chips are becoming ever more competitive with Intel’s. Amazon already uses them in its Graviton server chips, and even Microsoft is looking at ARM for the Surface Laptop and Windows in general starting with Windows 12.

ARM chips are becoming more competitive over time and with ARM’s coming IPO they will undoubtedly become even more competitive.

In total, ARM has shipped over 250 billion chips, or 35 for every man, woman, and child on Earth.

Is Intel Stock A Buy, Sell, Or Hold?

Obviously, there are risks with an Intel investment. For example, if semiconductor sales continue to be muted through the end of 2023, Intel shares will almost certainly go lower. Add to those risks the risk of Intel spending $10s of billions building new fabs that won’t be busy enough to generate the FCF needed for years to come.

In addition, UBS reports weak IT spending may have impacted chips. Why would April or May or the rest of 2023 be any different?

Also, Intel’s big inventory overhang is a concern at least for the next quarter and maybe for the rest of the year. Is there an inventory write-off coming sometime yet this year?

Considering the poor performance relative to competitors, the possibility of a weak sales environment, the terrible financial metrics, and the long lead time for successful fab production, I rate Intel Corporation stock a Sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.