Summary:

- Intel Corporation has unfortunately seen its massive capital spending years coincide with a downturn in the PC market.

- The company was forced to cut its dividend, however, it remains mostly on track for its capacity ramp-up. Capital spending will be tens of billions of dollars.

- Intel has massive homegrown support for its business, with tax incentives etc., which should enable strong support for its future business.

JHVEPhoto

Intel Corporation (NASDAQ:INTC) is one of the largest semiconductor companies in the world, with a market capitalization of roughly $125 billion. The company is growing through an industry downturn, but as we’ll see throughout this article, it continues to have a strong portfolio of assets and exciting growth prospects that make it a valuable investment.

Intel Overview

Intel had a reasonable quarter in relation to its goals. However, it couldn’t escape a broad industry downturn.

The company is expecting a modest 2H ’23 recovery, with an expected long-term PC total addressable market (“TAM”) of 300 million units / year. The company also sees substantial demand for both server CPU cores and AI computing technology over the long-term. The company has managed to drastically reduce its costs, and is committed to continuing to do so.

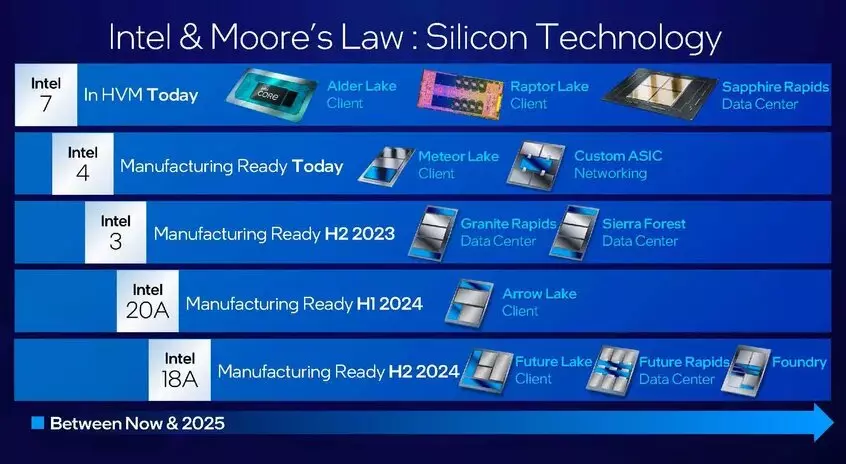

The company remains committed to its goal of 5 nodes in 4 years, something that would symbolize its return, but remains to be seen. The company’s Clearwater Forest processor and its 2025 target, on an 18A node, would be the symbol of its recovery.

Intel Q1 Financial Performance

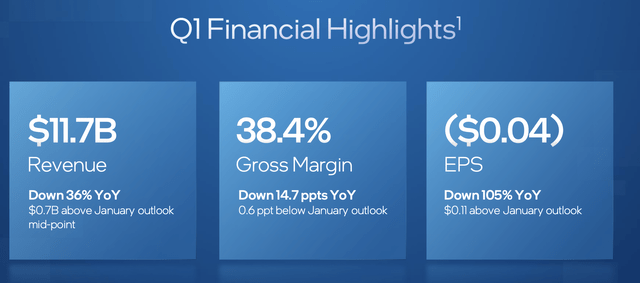

Intel had a tough Q1 as the PC market took a dramatic hit. That’s been seen across various companies as a COVID-19 induced boom has slowed down.

The company earned just under $12 billion in revenue, down 36% YoY. However, even tougher for the company, not only did revenue drop, but margins declined substantially by almost 15% YoY as well. The company’s margins dipped below 40% from highs of more than 50%. That pushed the company to negative EPS.

That’s incredibly tough financial performance.

Intel Outlook

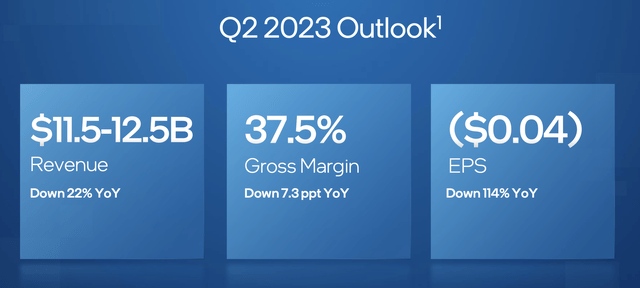

The company’s outlook shows that the declines have stagnated, but the markets remain weak.

The company is guiding for $12 billion in revenue with 37.5% in gross margins. Revenue is expected to increase slightly QoQ while margins have decreased QoQ resulting in -$0.04 in EPS. That’s constant negative EPS QoQ for the company. We expect that 2023 will remain a tough year for the company, but it’s noteworthy that it’s not losing significant cash.

We expect that it’ll recover from this point.

Intel Fab Opportunity

At the same time, outside of the company’s core silicon, there’s a massive long-term opportunity within its FAB business.

Intel Investor Presentation

Intel has adjusted its node names to be much closer to TSMC nodes, which makes comparisons easier. The company is spending more than $100 billion across the world on new fab plants, and the next major target is whether it can ramp up Intel 4 production by year-end. That would put it close to parity with Taiwan Semiconductor Manufacturing Company Limited (TSM, or “TSMC”), which is ramping up 3nm production now.

The late-2023 performance for the company with 4 nm ramp is much more of a smoke test. The real determination will be for the company’s goal to produce and ramp 20A next year. TSMC’s 2 nm ramp isn’t expected to come until 2026, meaning this would put Intel ahead of TSMC. TSMC’s volume production means it has much more of a difficulty with ramp than Intel.

At the end of the day, scale production of a lower node means faster chips fundamentally. Intel could quickly win over large amounts of business if it proves it’s competitive again, especially with its strong enterprise relationships.

Thesis Risk

The largest risk with our thesis is the company’s historic trouble. Can Intel make high volume low nm nodes, for example its target for a 20A node. The company’s struggles with 10 nm are what let TSMC move ahead dramatically, arguably symbolized to Apple’s (AAPL) move away to TSMC. Beating TSMC with a 20A node would help future returns dramatically.

Conclusion

Intel Corporation has previously been one of our top recommended investments. The company operates an integral position in the global silicon chain and despite setbacks in recent year, still remains essential. At the same time as the main U.S. silicon company, the company has massive homegrown government support.

Intel Corporation’s goal for 5 nodes in 4 years is coming to fruition. The largest test will be whether the company can ramp up 4 nm by YE, and then remain on track for 20A before year-end 2024 with ramp up. That would put Intel Corporation 1-2 years ahead of TSMC and give a massive potential kickstart to its future fab business.

We remain optimistic for Intel Corporation’s future, but it needs to prove it can execute.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.