Summary:

- Intel Corporation stock has rallied a bit, perhaps on the news that we may be near the bottom of the cycle.

- This was the biggest loss in company history, and there is growing concern that this company is dying relative to competitors, fears that are overblown in our view.

- Intel stock is likely to be a bit of a zombie the next few months until there is clarity that a turnaround is clearly going well.

- But the one thing that drew investors to Intel for years, the dividend, is a long way from being restored, and as such as a no-growth stock, Intel should continue to be a zombie.

RugliG/iStock Editorial via Getty Images

Intel Corporation (NASDAQ:INTC) has been characterized in many ways and most recently as a dying company by some of our members, and we think this is overblown. Without a doubt, the company is facing its darkest hour, having just reported its largest loss in history. While the company is not dead, we think Intel going to be a zombie-like stock.

While shares are rallying on hopes that the cycle is at or very near the bottom, the one draw that brought investors here for years, the dividend, is a shadow of its former self. Since this stock is offering no earnings growth, and the value is poor due to losses, we suspect the stock trades sideways, or zombie-like, for the next few months. The gains today could easily be wiped out if we have a recession that takes broader markets back. We recommend remaining net long stocks but having some hedges, and raising some cash the higher we go. So, this quarter was certainly eye-popping, but there were plusses on top of the minuses. Let us discuss.

We want to repeat. Intel Corporation is a massive company. And frankly, a blue chip that has fallen onto hard times. But the company is not going out of business, folks, although the stock will move like a zombie. A cursory glance at the six-month chart shows it is already exhibiting such behavior. That was fine with the dividend when it was at its old rate, but that cut has made the dividend far less attractive.

It is hard to call the earnings poor, despite being the worst in history, as that was expected. Intel actually surpassed many expectations in its results. The market had priced in a lot of pain, so the release of earnings that were not absolutely horrific is helping to fuel the rally, as well as some commentary from management.

Intel is working to address costs. David Zinsner, Intel CFO, stated:

“We exceeded our first-quarter expectations on the top and bottom line, and continued to be disciplined on expense management as part of our commitment to drive efficiencies and cost savings. At the same time, we are prioritizing the investments needed to advance our strategy and establish an internal foundry model, one of the most consequential steps we are taking to deliver on IDM 2.0.

Pat Gelsinger, Intel CEO, added:

We hit key execution milestones in our data center roadmap and demonstrated the health of the process technology underpinning it. While we remain cautious on the macroeconomic outlook, we are focused on what we can control as we deliver on IDM 2.0: driving consistent execution across process and product roadmaps and advancing our foundry business to best position us to capitalize on the $1 trillion market opportunity ahead.

This is pretty clear: the company is controlling what it can control. It is slashing costs where it can, while investing to establish its internal foundry model while working toward IDM 2.0. With that said, the results were better than we had expected:

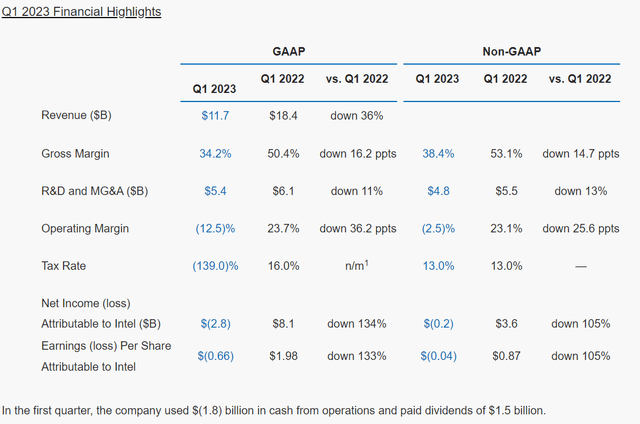

The company beat estimates on the top and bottom lines. While better than expected, the comps with Q1 2022 are simply mind-blowing. So, as you can see, Intel Corporation’s revenue was down 36% from a year ago. Margins narrowed again and were below our 39% expectations. Revenue beat by $570 million. Operating margins were down, and of course negative. Net income is down 134% from last year’s earnings. The company lost $0.04 adjusted, a sizable beat versus the consensus for losses of $0.14.

So, what now?

Despite Intel Corporation stock still being just over $30, the valuation metrics are not exactly attractive because of the losses. The market is trying to look forward here to better days ahead. Some may argue it is a trap, while others see opportunity. We think the stock is actually great for trading as a bit of a zombie. Buys in the mid to high 20s and sell in the low and mid $30s.

What could drive the stock higher? If we see no recession at all, and a confirmed turnaround for the entire sector, and more importantly, Intel is regaining its footing for market share, we would grow more bullish. But it’s going to be a tough sell into late spring and the summer. We think this economy is going into recession. The leading economic indicators are screaming recession is coming. We are seeing GDP slow down.

And as we have communicated with our membership, there is a huge negative catalyst that will suck money out of the economy coming, and that is the return of student loan repayments in August. Barring some sort of extension, millions of Americans will see hundreds of dollars taken from their spending power. What do you think the impact will be on PC demand and broader economic spend? So, we think the market goes lower, and you get a chance to buy Intel lower later this year. We love a buy at $25, but here at $32, it’s a sell.

Conditions have worsened for everyone in the chip sector, or almost all of them, but we are looking for more earnings reports from competitors to confirm that a bottom of the cycle is here or within reach. For now, the business is suffering; it is what it is. Intel has over $3 billion in cost reductions on the table, including layoffs and leaning out of segment spend. As we look ahead, more Intel weakness is expected, but it was not as dire as it could have been.

Q2 2023 outlook

After this report, we have to be concerned with how Q2 numbers will look, especially with the margin compression being so bad. For Q2, Intel Corporation has now guided for revenue of $11.5-$12.5 billion, on just 37.5% adjusted margins. Those are still absolutely horrific margins. That needs to be stated plainly. Folks, those margins are even lower than Q1’s 38.4%. They are targeting EPS to now swing to losses of $0.04 per share in the quarter adjusted (the same losses as Q1), and losing $0.62 on a GAAP basis. They are continuing to burn billions of dollars in free cash flow this year. It is not out of question that the Intel dividend could be cut again. It is a cash flow burn. They could always increase it in future quarters. If the company cannot see a turn soon, the dividend is once again in jeopardy.

Take-Home

Intel Corporation is not going out of business, but the quarter was still terrible, even if less terrible than expected. The outlook is poor. The margin compression is really eye-popping. While the company is taking steps to improve its fiscal state, including using a foundry model and cutting staff, and doing even more to rein in R&D spending, we think Intel Corporation stock will be a zombie moving sideways for months. The company is getting serious about its spending and controlling what it can control. We will be monitoring competitor reports to see if we are on the verge of a new cycle, or close to the bottom at least, but do not see it improving until late 2023 or more likely, 2024.

We think Intel Corporation stock can be traded and is a sell the farther along into the $30s (e.g., $32-35) we go, with shares being a buy in the mid-$20s (e.g., $25-$26).

Your voice matters.

What other positives in the quarter do you see? Should Intel eliminate the dividend? Should investors sell here and come back lower? Is trading around a position too much work? Do you think the market is going much lower in the coming months?

Let the community know below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join BAD BEAT Investing before prices go up 40% on May 1st, 2023

This is the last chance. If you want to be a winner, you should immediately join the community of traders at BAD BEAT Investing before prices rise.

Trade with hedge fund analysts. We answer all of your questions, and help you learn and grow. Learn to best position yourself to catch rapid-return trades.

- You get access to a dedicated team, available all day during market hours.

- Rapid-return trade ideas each week

- Target entries, profit-taking, and stops rooted in technical and fundamental analysis

- Start winning today