Summary:

- Intel Corporation’s performance has shown slight improvements, but it is still behind its best years and the turnaround will take time.

- The company’s growth in AI and data centers is slower than expected, with competition from Nvidia and AMD.

- Intel’s valuation has not changed much, with an intrinsic value of around $20 per share.

hapabapa

Introduction

It’s been around 10 months since I first covered Intel Corporation (NASDAQ:INTC), where I argued the company is nowhere near a turnaround, so I wanted to see how the company has performed over the last year. Since the first article, the company’s stock saw an increase to around $50 a share, but is back to where it was almost a year ago. INTC has been progressing well, and while my price target (“PT”) hasn’t changed dramatically, my perception of the company has, which warranted an upgrade from a Sell to a Hold.

However, that still does not change the fact that it is still not the time to invest given how slowly the company’s plans are progressing and my feeling that the company is slightly behind the main competition in the hype innovations like AI and the foundry game. I could see potentially adding the company to my portfolio, but I don’t think it will be in the next year unless the company manages to surprise me.

Briefly on Performance

As of Q1 ’24, which was published on April 25th, INTC had around $21.3B in cash, equivalents, and short-term investments, against almost $48B in long-term debt. That is a decent amount of debt, however, the company’s interest income from short-term investments covers the interest expense; therefore, I don’t think it is that much of a problem right now. However, many investors dislike such a leveraged balance sheet, so it would be a good idea for the company to deleverage quicker.

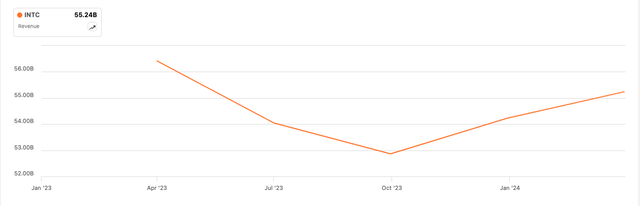

INTC’s revenues have seen a slight recovery in the last quarter of the year, and the most recent quarter. However, it is still too early to tell what the future holds in terms of top-line performance going forward. In my opinion, the growth will continue, however, it will not be impressive growth, just like we saw in the latest quarter, which saw around 9% growth y/y.

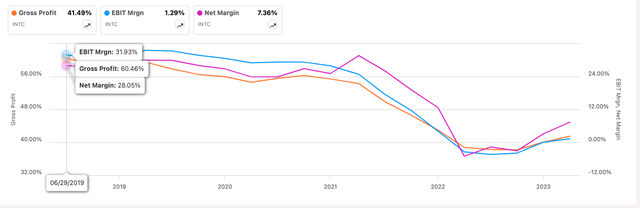

In terms of GAAP margins TTM, the company has seen quite an improvement across the board. However, I believe these are still subpar, and I would like to see further progress going forward, considering the company managed to get much better margins in the past. I am expanding the range of the below graph to show how well it did in the past. So, it seems the company still has a long way to go before getting back to those juicy margins, if it manages that at all.

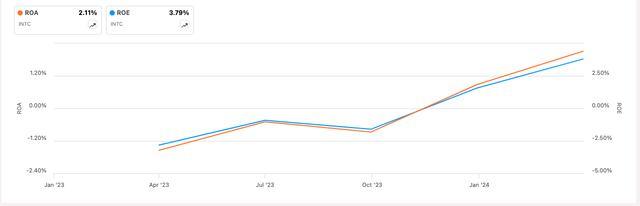

Continuing with efficiency and profitability, the company’s ROA and ROE have seen slight improvements due to the overall improvements in the TTM bottom line. However, these are still well below what I would consider efficient use of assets and shareholder capital.

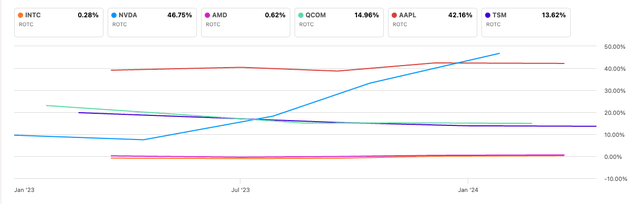

Looking at the competition, I wanted to compare INTC’s return on total capital to some of the most prominent players in the different sectors in which the company operates. These may not be the perfect competitors, but they should give us a good idea of how the company fares in terms of efficiently allocating capital, and it is not looking good for INTC.

We can clearly see INTC sharing the bottom places with AMD regarding efficient capital allocation. I usually look for at least 10% to consider a company worthy of investment, and seeing that INTC is not a new company, I would have expected it to at least achieve my minimum requirement.

Overall, there isn’t much to like here. The company is showing signs of improvement, but it looks like it is still well behind its best years and that a turnaround is going to take a long time. Another question is if the current management succeeds in turning the company around.

Comments on the Outlook

As I mentioned earlier, the company managed to grow at around 9% y/y this quarter, which, I think, is not good enough. The Client Computing Group or the CCG growth, which was rather impressive at around 30%, was dragged down by the company’s other segments, mainly by the lackluster growth of Data Center and AI, which grew only 5%, network and edge decreased by 8%, Foundry decreased by 9.5%, and all others decreased by 46%.

The promising growth of AI and Data centers is taking much longer than anyone expected. Other players in the space like Nvidia (NVDA), Advanced Micro Devices (AMD), and even Dell (DELL) have seen considerable growth recently in this space, and yet INTC not so much. It seems to me that there is a bit too much competition from the mentioned juggernauts in this space and I expect INTC to struggle to capture any meaningful market share in the future, without some innovation that would beat out the competition.

The company’s best-performing segment, the CCG, I believe will continue to see decent growth going forward. This segment has seen rather bad performance in the last two or so years, due to an oversupply of inventory, and higher inflation, which forced customers to delay purchases and reduce inventory. Now that these levels have normalized, I expect healthy growth going forward, as the negative sentiment has shifted. AI-powered PCs will be a big sell in the upcoming years, and given the company’s new Core Ultra has shipped 5 million AI PCs in the last 3 or 4 months, Intel’s CEO Pat Gelsinger is very confident in achieving 40m units shipped in 2024, which implies quite a ramp up going forward.

With the release of Gaudi 3, the company aims to compete more closely with NVDA’s Hopper H100 chip, which is nearing its end and will be replaced by an updated version, the H200, and eventually by the B100 model, I am wondering how well Gaudi 3 stacks up against these models in the future. NVDA controls about 80% of the AI accelerator market, because of its expertise, so it would be very hard for INTC to outperform the juggernaut in the space, but it doesn’t necessarily mean that INTC is doomed.

If some customers don’t demand purely raw power that NVDA’s chips provide, which are quite expensive, and if INTC’s chips are on the lower power and are cheaper, there will be customers who would be willing to purchase these instead of NVDA’s. That doesn’t seem to be the case, however, as Intel is saying that the new chip will be

“1.7 times faster than H100 at training LLMs and up to 1.3 times faster for inferencing than the upcoming H200, and is 2.3 times more power efficient than the H100.”

Although these are still just claims by INTC, I am surprised that the company is comparing itself mostly against the H100, which is a generation behind, so I wouldn’t be surprised if INTC is aiming to make gen AI available to a much wider audience with its better pricing and supposedly better performance. I am eager to see how this chip will truly stack up against the upcoming NVDA chips.

We received an update on how the company’s IDM 2.0 is coming along. The company’s internal foundry is operational now, which should lead to future efficiencies and higher profitability. However, I don’t see this contributing to many improvements for the next year or two, as it is still quite at the early stages of implementation, and these stages come with higher costs.

Speaking of foundries, some people think that IFS is going to challenge Taiwan Semiconductor (TSM) aka TSMC on their turf, given that it is a U.S. company that is benefiting from the CHIPS Act and puts it further away from the geopolitical tensions that surround Taiwan and China. A good way to geographically diversify. In my view, it will take quite a few years to even catch up to what TSMC is doing currently, and it may be a big challenge because I don’t expect TSMC to stand around and let someone else like Intel take its market share. Furthermore, TSMC also has been diversifying its geographical footprint, with the Arizona plant to be opened in 2026, if there aren’t any more obstacles.

In summary, I’m sensing a theme of Intel being slightly behind. NVDA already has the dominance in the AI market, which will be difficult to compete with, while TSMC is the dominant player in the foundry space. That doesn’t mean that the company won’t be able to capture some of that total addressable market, or TAM, but it does mean that it will not be an easy road. There are positives for INTC, but I do think it is going to take much longer to get where it wants to be and investors are not jumping in just yet, since they seem to agree with this view as well.

Valuation

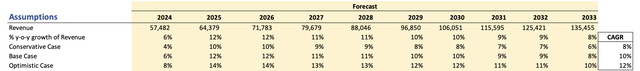

It’s been around 10 months since I did a model of INTC’s valuation. A lot has changed in terms of economics, so let’s look at some assumptions. For revenues, analysts aren’t very optimistic the company will see fantastic growth going forward, with only around 3.3% growth for FY24, and 12% for the next year. I usually like to approach this with a more conservative mindset, however, I think the company may end up doing better in the upcoming year, so I went with around 6% growth for FY24.

Over the next decade, I am modeling a 10% CAGR, which, I think, is rather ambitious. However, we are entering a new era of computing, and I believe the company will see a boost in top-line growth. If we look back over the last decade, the company is at the same levels of revenue as it was back in 2014, so keep that in mind. Below are those estimates, and their respective CAGRs for three scenarios.

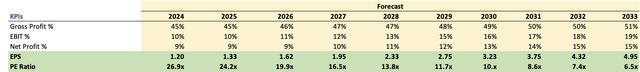

In terms of margins, everyone seems to be using the non-GAAP metrics. Therefore, I will be, too, since that is what the company touts to be the “real value” of the company. Gross margins will see an improvement of around 600bps over the next decade, assuming cost measures are successful, and the company becomes more efficient in the process, while EBIT and net margins will improve by 900bps and 600bps, respectively. Below are those estimates.

Margins and EPS assumptions (Author)

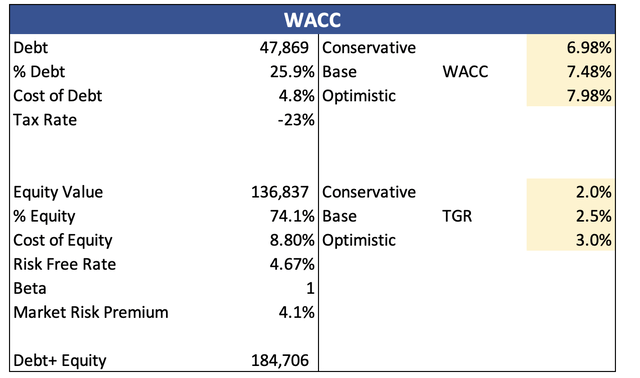

For the discounted cash flow, or DCF, model, I am going to use the company’s WACC of around 7.5% and 2.5% as my terminal growth rate. Below you will find my WACC calculations.

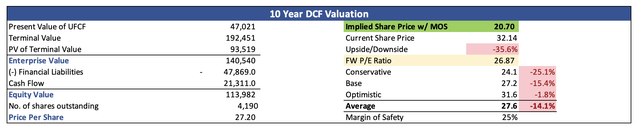

Additionally, since I wasn’t very conservative in my revenue and margin assumptions, and because I like doing it, I will discount the company’s intrinsic value by 25% just so I get a little extra room for error in my calculations. With that said, the company’s intrinsic value hasn’t changed much since my first article 10 months ago, which is around $20 a share, down from around $23.

Closing Comments

Even though my PT hasn’t changed much, my outlook on the company, however, has. I believe INTC does have a good future and may be able to capture some of that hype surrounding AI computing and advancements in tech in the foundry business. However, I don’t see it being the leader in either of those. Not at the rate the company is going at right now.

Nevertheless, there is room for another player in these spaces. Therefore, I am upgrading Intel Corporation stock to a Hold from a Sell. The main reason is the one I just mentioned, but also, I tend not to assign sell ratings any longer due to how I look at the companies from the perspective of a person who doesn’t own any shares of a stock, therefore, a Hold rating, in my opinion, means I’m in no rush to invest currently. Furthermore, the company has declined around 40% since the peak at the end of December. I believe the downside isn’t as pronounced as it was back then, so if you haven’t sold yet, I believe you can stomach any further drops at this point.

I have set a price alert for around $20 a share and will continue to monitor the developments of the new products and further advancements in AI and its applications within these products. However, for now, I will continue to be on the fence, as I believe there will be further pain ahead until the company turns around.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.