Summary:

- Intel is expected to report a weak third quarter with a 64% drop in earnings and a 12% drop in revenue.

- The stock has rallied in hopes of a turnaround in the fourth quarter, but recent pressure from Nvidia’s plans to make ARM-based PC CPUs has caused declines.

- Options traders are betting on further declines in Intel’s stock, with technical analysis suggesting a potential 8% drop.

Leon Neal

Intel (NASDAQ:INTC) is expected to report third quarter results after the close of trading on Thursday, Oct. 26. Analysts forecast it to be a horrible quarter for the company, with earnings expected to drop by 64% while revenue drops by almost 12%.

Still, the stock has had a big move higher since February in hopes that the business will turn around in the fourth quarter. However, more recently, shares have come under pressure as Nvidia (NVDA) announced its plans to make ARM-based PC CPUs.

The recent move lower in the stock has an options trader betting the declines aren’t over, and the stock has more to fall. Based on technical analysis, it could be as much as 8% from its current price of around $33.50.

Weak Result Expected

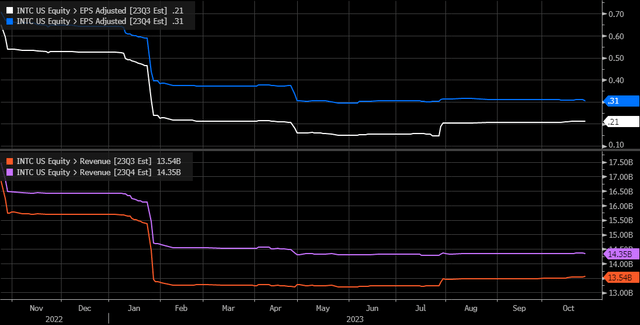

Earnings in the third quarter are expected to be pretty bad, at just $0.21 per share, down from $0.59 last year, while revenue is expected to fall to $13.5 billion, down from $15.3 billion. Additionally, adjusted gross margins are forecast to fall to 43.1% from 45.9%.

Growth is expected to improve next quarter, and that’s why the stock has rallied as investors hope that the worst is the company. Analysts forecast that Intel will earn $0.31 per share, up from $0.10 in the fourth quarter of 2022, while revenue jumps to $14.3 billion from $14.0 billion, as adjusted gross margin expands to 44.2%.

Meanwhile, the data center and AI are expected to see revenue slip 7.4% to $3.941 billion, while client computing is forecast to drop by 9.2% to $7.39 billion. Given all the hype around AI and data center growth, a miss in that one line item could send share lower by itself.

Hopes For Better Times To Come

The hope of stronger growth has seen the stock rise mainly due to P/E multiple expansion, with the ratio rising to almost 21. That’s well above the historical range since 2010 of between 10 to 14. If the stock were traded back to 14 times 2024 earnings estimates, it would be worth just $23.80.

This P/E expansion is due to the very large earnings growth that’s expected, going from $0.55 this year to $1.70 in 2024, then $2.15 in 2025. The growth in earnings is expected to be fueled by revenue, which is forecast to rise to $58.7 billion in 2024 from $52.52 billion in 2023 and to $63.5 billion in 2025. But there’s also expected to be a lot of gross margin expansion, rising to 46.2% in 2024 from 41.6% in 2023 and then 51.1% in 2025. Even with all the margin expansion, off the lows, margins will remain well below the levels witnessed between 2010 and 2019 when it was at 60% or higher.

Options Traders Not Optimistic

Still, options traders do not appear to be believers, betting that Intel’s stock is likely to see lower prices in the weeks ahead. Whether it’s because they are betting that other companies will start taking market share from Intel or analysts’ forecasts for future earnings growth and margin expansion are too rosy, given the broader equity market infatuation with AI and data center growth, options traders could simply be betting on a line item miss.

Whatever the case, the options bets on Intel are turning bearish. On October 24, the open interest for the November 17 $35 puts rose by almost 11,700 contracts. The data from Trade Alert shows that 9,000 put contracts traded on the ASK for $1.75 per contract. This would imply that the trader thinks the value of the stock will be $33.25 or less if holding the options until the expiration date.

But there’s more because on October 24, the open interest for January 19, 2024, $40 calls increased by almost 20,000 contracts. The data here shows that these calls were traded on the BID for $0.93 per contract, suggesting that these calls were sold. This is a bet that Intel stays below $40 by the middle of January.

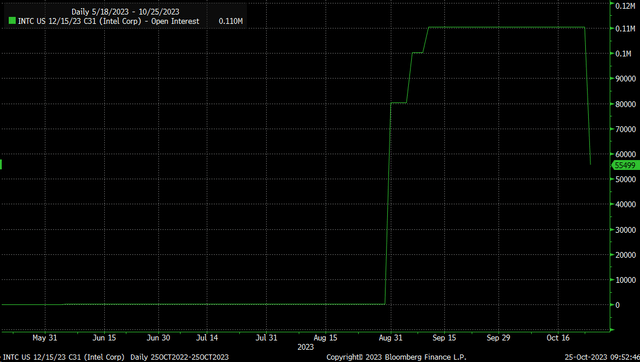

Also, worth noting is that on October 25, the open interest for December 15, 2023, $31 calls fell by almost 55,000 contracts. The data shows the calls were sold on the bid for $4.45 per contract. There had been a large buyer of these calls on August 31, 2023, with a block of 80,000 contracts trading for $5.45 per contract. This would suggest that the trade sees no upside in Intel at current levels and is selling his calls at a loss.

Momentum Turns Bearish

The technical chart for Intel does not look strong and shows that momentum has turned bearish on the relative strength index. Additionally, the stock is trading at the lower bound of a triangle pattern, and a break of the lower bound around $33.50 could result in the stock falling all the way back to $30.90, a drop of around 8%. Meanwhile, a move higher in the stock is likely limited to the upper bound of the triangle around $35.75.

Intel’s shares have certainly seen a big move higher, and if the company can deliver better-than-expected growth and provide guidance better than expected, then shares could see a decent rebound. However, a miss on cloud and AI revenue could mean the shares fall sharply, especially given how much the PE ratio has expanded in recent months because this stock is not cheap, even when factoring in all future growth estimates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

TRY READING THE MARKETS AND GET THE FIRST 2-WEEK FREE *

- Reading the Markets identifies macro trends likely to influence the stock market.

- I utilize economic data and macroeconomic forces to forecast the potential directions of interest rates, the value of the dollar, and commodity markets, along with their possible impacts on stocks.

- These relationships are more crucial than ever when making short- and long-term trading or investment decisions.

- I offer daily videos or podcasts complemented by a written commentary.

*2-week trial not available on Mobile App