Summary:

- Intel’s restructuring, though painful, is necessary due to efficiency and productivity concerns.

- The Intel client group continued to perform well despite concerns about its competitiveness against ARM and AMD; I believe this is a bit overstated.

- Intel Foundry losses, while a short-term pain for investors, are a long-term value creation opportunity for patient investors.

- With Intel selling at a decade-low valuation, a split makes sense since the most expensive phase of the strategy is reaching its end.

wellesenterprises

2024 Q2 Earnings Takeaway: Another Restructuring

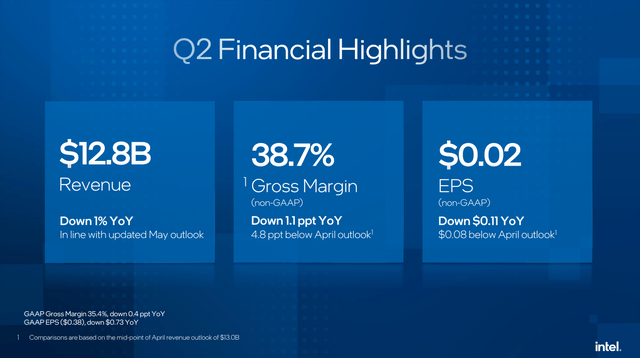

Intel Corporation (NASDAQ:INTC) reported disappointing FY2024 Q2 results. While revenue is within their guidance, the gross margin and the disappointing Q3 outlook led to a nearly 26% plunge in the stock price.

Intel Investor Presentation – 2024 Q2 Intel Investor Presentation – 2024 Q3 Guidance

While I expected them to have a bad financial performance since this is the most expensive year, as they start scaling their EUV nodes and outsource some of their wafers to TSMC (TSM), I didn’t expect them to be this severe. Regardless, I believe this is a good opportunity to buy more because, despite the bad near-term result, the long-term fundamentals of the business haven’t changed.

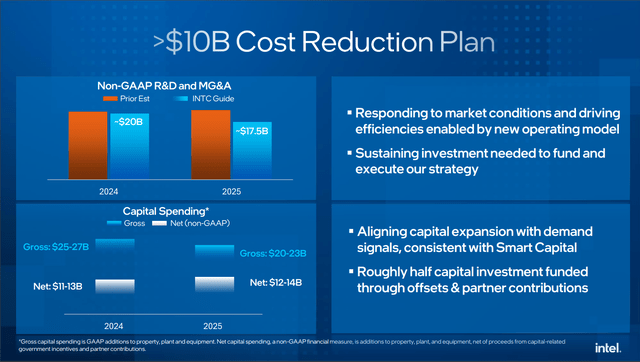

Before the earnings call, they announced a 15% workforce layoff to achieve a ‘clean sheet’ view of their business, which will eliminate complexity and maximize the impact of their resources.

Intel Investor Presentation – Reduction Plan

They should’ve taken this step when they announced the separation of Intel Product and Intel Foundry; management might have been too optimistic and overestimated the market recovery. Regardless, this is a necessary step since Intel’s productivity at its current state isn’t competitive with the rest of the industry.

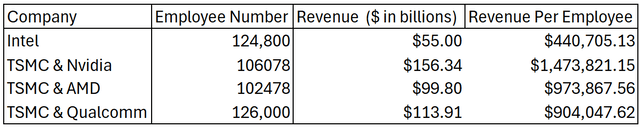

Author’s Compilation – Revenue Per Employee

The table above clearly shows that Intel needs to be more efficient and productive, as the industry generates significantly more revenue per employee than they are.

However, this is also risky, as the falling stock price and layoffs might further affect the company’s morale and productivity. The layoff being targeted instead of company-wide indicates that people crucial for the strategy to succeed won’t be affected. Despite these challenges, Intel needs to take these drastic steps to be competitive against TSMC and other fabless chip designers in terms of cost structure, efficiency, and productivity.

Bright Spot: Client Computing Group

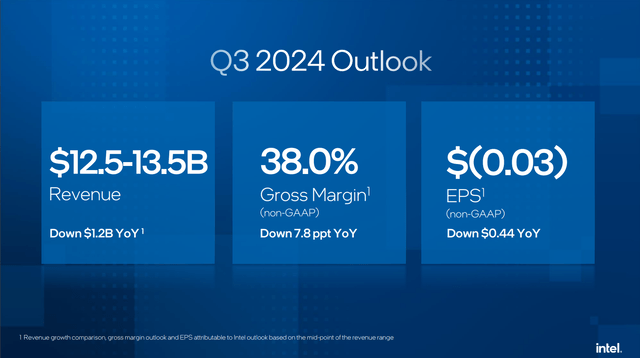

After expecting strong second-half growth due to above-seasonality in their Q1 2024 earnings, Intel now expects the market recovery to be softer than originally anticipated.

While we expect to deliver sequential revenue growth through the rest of the year, the pace of the recovery will be slower than expected, which is reflected in our Q3 outlook. Specifically, Q3 will be impacted by a modest inventory digestion in CCG with DCAI and our more cyclical businesses of NEX, Altera, and Mobileye trending below our original forecast.

Meanwhile, AMD (AMD) told analysts in its Q2 2024 earnings call that it expects an above-typical seasonality.

Our view of this is the AI PC is an important add to the overall PC category. As we go into the second half of the year, I think we have better seasonality in general, and we think we can do, let us call it above-typical seasonality, given the strength of our product launches and when we are launching. And then into 2025, you’re going to see AI PCs across sort of a larger set of price points which will also open up more opportunities.

This is a conflicting outlook; one side is optimistic, while the other is not. However, due to its scale in the PC business, Intel’s outlook is a better barometer for the PC market outlook in the near term than AMD’s, which is smaller. We have to remember during their call in Q2 2022, Intel was the first company to warn the market about weaker PC demand in the second half of 2022, while AMD, at that time, had more of an optimistic outlook. They eventually followed suit and issued the same warning to the market. Ultimately, the OEM’s outlook in their upcoming earnings call will confirm who is right and wrong, but my bet is on Intel due to their size.

There are also concerns about market share and the competitiveness of their products. AMD still has the advantage in efficiency due to its use of a much better node, TSMC 4nm, compared to Intel. However, Intel has managed to close the gap with its Meteor Lake product in the form of the Core Ultra 1xx series. Yet, most of its client products are still on the Intel 7 node, which requires a higher power draw to remain competitive.

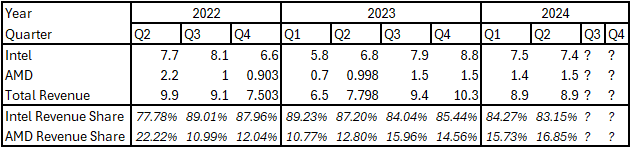

Author’s Compilation – x86 Revenue Share

Since 2022, Intel and AMD’s revenue share has hovered around 80% and 20%, respectively; I believe this is a healthy market share since OEMs want an alternative supplier to offset the supplier’s bargaining power.

Another point of concern is Intel’s competitiveness against AMD and Qualcomm (QCOM), which, I believe, is a bit overstated since, nowadays, the performance of these CPUs is very close to each other. Thus, the competing factor will be on the CPUs’ other offerings, such as security or software. In PC, there are two types of customers: consumer and business. Both customer types value PCs differently: consumers tend to irrationally value things like experience, aesthetics, and ease of use, while businesses value security, availability, and price.

On the consumer side, Intel is trying to influence OEMs through programs such as Intel Evo certification to match the experience of Apple’s MacBook. However, they could only do so much since the OEMs and Microsoft do most of the integrations.

On the business side, the decision-makers are usually the CIO, CISO, or IT heads. Unlike on the consumer side, where they value other things besides the price, enterprise customers prioritize security, availability, and cost, where Intel is strong with its Intel vPro offerings and scale.

Even with the entry of more chipmakers that use ARM architecture, I believe Intel will be fine in this area since future innovations will sustain ones like improved performance and efficiency, which incumbents usually do very well. They have prioritized efficiency in their recent chip designs, since the market demands more efficiency than performance.

However, the further commoditization of the PC CPU industry is an increasing concern. While differentiating itself on other aspects of its CPU, Intel needs to keep up with the competition. Otherwise, the performance gap will be so big that their advantage in security and software won’t be enough to entice customers to stick to their offering.

Not So Bright Side: Data Center And AI Group

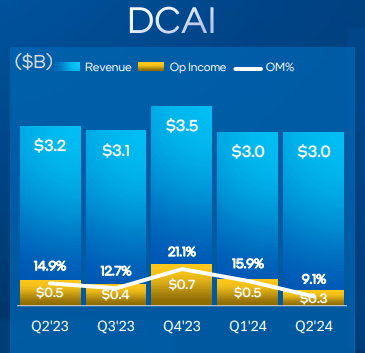

Out of all the businesses under Intel, this is the weakest. They are losing market share to AMD, with their EPYC offering more performance and cores, especially in the cloud segment. Additionally, their minimal AI presence in the high-performance accelerators, where Nvidia currently dominates, is really showing in their revenue performance, which has stagnated since 2023.

Investor Presentation – DCAI 2024 Q2

However, market share is a lagging indicator; it reflects the previous management’s past missteps on Sapphire Rapids and Larrabee. Now, it is getting back to Intel under new management that is taking all the heat. Nevertheless, let’s focus on what Intel is doing to improve its position.

With manufacturing no longer a hindrance to its server CPUs, Intel recently launched its E-core server, offering Sierra Forest for high-density workloads. In addition, Intel is expected to launch its P-core brother, Granite Rapids, for high-performance workloads in Q3. These two products will match the competition in core count and performance: Granite Rapids with 128 P-Cores and Sierra Forest with 288 E-Cores.

Additionally, as investors slowly start scrutinizing and demanding tangible results from AI investments made by businesses and cloud players, CAPEX prioritization for GPU might normalize and start to favor CPU. Since 2022, the CAPEX allocation has heavily favored GPU over CPU, so there are a lot of server CPUs that need to be refreshed; this could benefit Intel since it will enter this refresh cycle at its strongest position in terms of product competitiveness.

However, this assumption is still uncertain since companies, desperate to improve or retain their competitive position, are still heavily prioritizing their CAPEX on AI. Whichever scenario plays out, Intel needs to strengthen its position in AI accelerators with its Gaudi 3 and upcoming Falcon Shores.

Intel Foundry: Short-Term Pain Due To Long Lead Times

Intel has not only failed to benefit from the AI boom through its accelerators but also in its foundry, at least for now. While TSMC is running short of capacity to cater to the huge demand from AI chipmakers, Intel fabs are currently underutilized mainly due to Intel product’s low revenue, resulting in a run rate of around $2.5B operating loss per quarter due to its high fixed cost and start-up cost on their EUV nodes that will start to ramp this year.

Intel Investor Presentation – 2024 Q2 Intel Foundry

So why is Intel Foundry not benefiting from the AI boom despite being one of the only three manufacturing companies-TSMC, Intel, and Samsung-that can only produce leading-edge wafers required to produce AI chips?

It is crucial to know that chip design wins for a foundry don’t happen overnight, in days, months, or even a year. Some upcoming chips from designers are already planned to use that specific wafer node years before they’re even released. Intel CEO Pat Gelsinger perfectly sums up this in his interview with Stratechery.

In no way do I think that just because we’ve now demonstrated 18A, we’ve given the first PDKs (Process Design Kit) for it, the world is going to say, “Oh, let’s stop doing all that 3 nanometer stuff and let’s move over here”, that’s not going to happen. But I am pretty dead set that we are going to capture major designs because everybody, when they finish their 3 nanometer designs, they’re going to say, “What’s next?”, and the combination of RibbonFET and PowerVia is proving to be very compelling. Compelling on area, compelling on performance, compelling on power capabilities.

Furthermore, even though their leading-edge node is already manufacturing-ready, reaching a meaningful volume ramp takes 6 months to a year.

Intel Presentation – Wafer Mix Forecast

If we look at Intel’s forecast of their wafer mix in the upcoming years, it is clear that it will take years before their EUV node mix makes up most of their wafer outputs. EUV nodes achieving scale is crucial for Intel Foundry achieving break-even because having the majority of their wafer outputs on Intel 7 puts significant pressure on the foundry’s margin.

However, as their mix of EUV nodes starts to take up most of their wafer mix, their operating margin should also improve as these EUV nodes constitute a higher margin.

While Intel’s expensive venture might be a short-term pain for Intel investors, it is important to emphasize that there cannot be a sole supplier of leading-edge wafers in this important industry. This industry will fuel all future technological innovation, including AI, and only three companies can do this. Furthermore, Intel doesn’t even have to be the leader in this space, at least for now, for this endeavor to succeed.

However, Intel must offer a compelling value proposition to entice customers to switch from TSMC. Otherwise, I see them as merely an alternative supplier for fabless companies looking to diversify their supply chains. But given Intel Foundry’s current state, where they are losing billions of dollars, any win-regardless of whether it’s just for supply chain diversification-is a major victory for Intel.

Valuation: A Split Makes Sense

While Intel’s valuation is at an all-time low, its problems are fixable; just split the company into two independent ones to unleash its value to the market. I believe Intel is an excellent target for an activist investor at this current valuation. Especially at this point, when the most expensive phase of the company’s strategy is peaking this year and expected to normalize moving forward as their post-EUV nodes start ramping, and they return to the normal cadence of wafer node technology development.

In their recent earnings call, Intel CEO Pat Gelsinger prepared remarks on what’s beyond Intel 18a.

Beyond Intel 18A, we are well underway on Intel 14A and Intel 10A development. Even as we continue to extend leadership and innovation on our process roadmap, we are transitioning to a more normal cadence of node development. The normalized cadence will have positive implications for both pace and magnitude of on-going R&D and capital spending requirements.

After achieving the ‘5 nodes in 4 years’ strategy by 2025, Intel plans to return to a normal process of technological development cadence, which will ease their capital intensity in R&D moving forward.

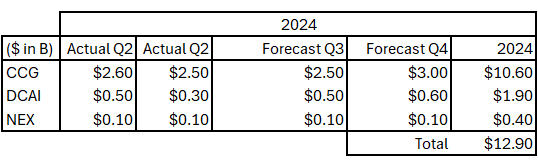

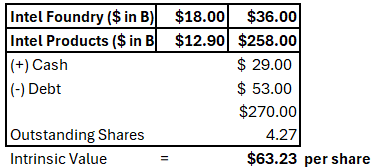

Let’s valuate the fabless Intel or Intel Products to determine its intrinsic value if the split plays out. Note that in my previous Intel article, I used a similar method, but this time, I will include Intel Foundry to estimate the total value investors could get if they are to be separated tomorrow.

Intel Investor Presentation – Q2 2024

Despite all the negativity surrounding this stock, you can’t deny that Intel Products are profitable. If separated, you have a run rate of around $12B operating profit.

Author’s Compilation – Intel Products 2024 EBIT Forecast

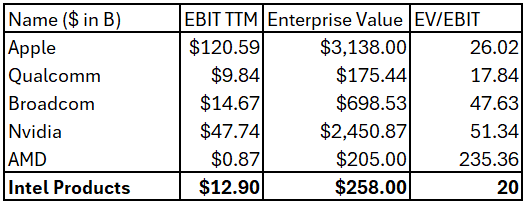

I will relatively valuate the fabless Intel to its fabless peers such as AMD, Nvidia, Qualcomm, Broadcom and Apple using their current EV/EBIT multiple.

Author’s Compilation – Fabless EV/EBIT Multiple

Since there are some outliers in the table above, I will subjectively use a 20x EV/EBIT multiple on Intel, which, I believe, is reasonable considering the potential of Intel AIPC and upcoming server and accelerator chips moving forward.

On Foundry, since there’s not much clearer information about when some of the $15B lifetime value will start to come in for Intel Foundry, we instead use what’s on their current P&L presentation, which is the revenue coming from manufacturing for the Intel Products team.

Intel Investor Presentation – Q2 2024

While I expect them to lose some of the revenue from Intel Products, with Intel Products outsourcing a portion of their wafers from TSMC, I expect most of the Intel Products to return to Intel Foundry as they scale their EUV node in the coming years. Thus, we can settle at around $18B revenue run-rate.

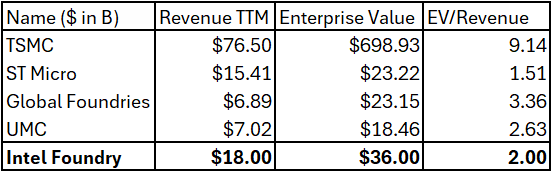

Author’s Compilation – Semiconductor Manufacturer EV/EBIT Multiple

TSMC, being the leader, clearly deserved that EV/Revenue multiple. While Intel is undoubtedly losing money due to the unfavorable wafer mix and start-up cost of EUV nodes, we must acknowledge that only three companies-TSMC, Samsung, and Intel-will have the capability to operate in this space due to how capital-intensive this business is in terms of R&D and CAPEX. Thus, the barriers to entry in this industry are high.

Nonetheless, I will subjectively use a 2 EV/Revenue multiple to valuate Intel Foundry, which, I believe, is reasonable and conservative considering its current state.

Author’s Intrinsic Value

An intrinsic value of $63 per share implies a discount of around 70%. I know this sounds silly, but that’s what Mr. Market thinks Intel’s current value is because of its recent performance. This doesn’t even account for their stake in Mobileye and the upcoming Altera spin-off.

Risk

Intel Foundry Reliability on Intel Products

According to Intel CEO Pat Gelsinger, the economics of the Intel Foundry heavily depend on the success of Intel Products, which poses a significant risk. The foundry’s success is closely tied to the demand for Intel Products, which faces significant competition.

Long Lead Time on Building Leading-Edge Fabs

It takes 5–6 years to build a leading-edge semiconductor fab. This long lead time presents a significant risk, as the assumptions made before the investment could be entirely inaccurate by the time the fab is operational. Additionally, Intel’s competitors, such as TSMC and Samsung, may have the same assumptions for the future, which can lead to overcapacity.

Conclusion

Intel undoubtedly faces significant challenges as it navigates this near-term uncertainty. But Mr. Market’s short-term thinking has given us, long-term investors, an opportunity to buy more at a lower price. But does this mean that, with the price at a decade-low, it will be smooth sailing to the upside from here? No one can say for sure. However, I firmly believe that patient Intel investors who resist the urge to follow Mr. Market’s action will get rewarded in the long run.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.