Summary:

- Intel slashed employee pay in a desperate sign the company has cash flow problems.

- Management appears committed to the dividend, yet the $6 billion in annual pay-outs are problematic for a business under pressure.

- The stock faces more downside pressure on a cut or even elimination of the dividend.

mohd izzuan

Any company paying a dividend while not being free cash flow positive is paying a dividend at risk. Intel (NASDAQ:INTC) is the latest company at risk of needing to cut the dividend due to huge capital spending while earnings are quickly disappearing. My investment thesis remains ultra Bearish on the chip giant with a major dividend cut a real possibility due to the high costs of capital spending to build out new fabs.

Shocking Pay Cuts

After reporting a bad quarter and guiding to a very weak Q1, Intel surprisingly cut pay for employees. The company apparently made the following cuts in order to preserve cash:

- CEO: -25%

- Executives: -15%

- Sr. Managers: -10%

- Mid-level Managers: -5%

- Hourly employees: 0%

The move is intended to reduce pay to the highest paid employees by the most due to the financial struggles. While other tech companies have slashed employee counts, Intel is slashing pay to existing employees and likely pushing out high performers in the process. In addition, the company has announced plans to lay off a small portion of the workforce.

The company has announced plans to cut spending by $3 billion with a goal of increasing the cost reduction program to $10 billion by 2025. The problem facing Intel is that the chip business use to produce gross margins in excess of 60% and a far more competitive Advanced Micro Devices (AMD) has the chip giant only targeting a return to 50% margins.

For 2022, Intel saw operating cash flows dip to $15.4 billion while the company spent an estimated net $21 billion on capex for the year. The problem is that the chip giant now spends $6.0 billion annually on dividend payments.

The 2022 cash flow scenario is unsustainable and Intel just guided to Q1’23 sales collapsing to only $11.0 billion. The chip giant generated $18.4 billion worth of Q1’22 revenues leading to the subpar cash flow numbers of 2022. The cash flow situation gets much worse in 2023.

The large pay cuts are a sign of how much the dividend is at risk. The company had $24.5 billion worth of operating expenses in 2022. A 5% average pay cut would reduce expenses by ~$1.25 billion, but this estimate is probably too high. Either way, the pay cuts don’t come close to covering the high dividend pay-outs.

Dividend Cuts

Intel was adamant the company would pay a “competitive dividend”, yet the statement on the Q4’22 earnings call was left to interpretation considering the comments on prudently allocating capital:

Well, obviously, we announced a $0.365 dividend for the first quarter. That was consistent with the last quarter’s dividend. I’d just say the Board, management, we take a very disciplined approach to the capital allocation strategy, and we’re going to remain committed to being very prudent around how we allocate capital for the owners. And we are committed to maintaining a competitive dividend.

If Intel intended to raise the dividend on a yearly basis, the statement would’ve said as much. The company currently pays a far above market 4.8% dividend yield. One could argue a competitive dividend yield would involve cutting the dividend in half and a prudent capital allocation strategy involves not paying large dividends when burning lots of cash.

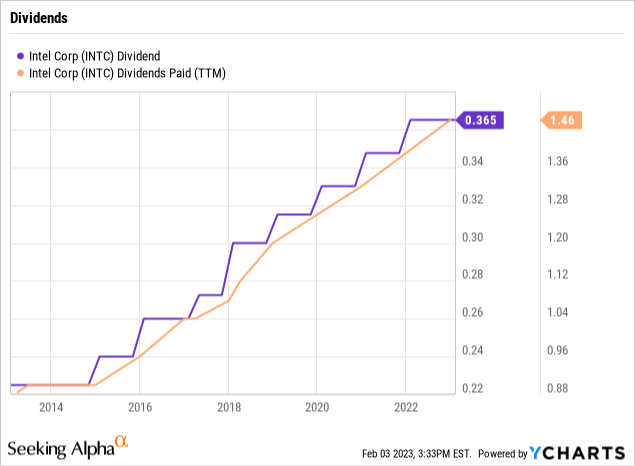

The chip giant has aggressively hiked the dividend over the last decade going from a $0.225 quarterly payout in 2014 to $0.365 now. The company has nearly doubled the quarterly payout to nearly $1.5 billion leading to $6.0 billion in annual pay-outs now.

Intel needs to generate $10.0 billion in annual free cash in order to only have a manageable 60% payout ratio. With $20+ billion in capex spending, the chip giant needs to generate $30+ billion in annual operating cash flows to cover the capex spending and pay the dividend with a 60% payout ratio.

Remember though, Intel only had operating cash flows of $15.4 billion last year and 2023 is starting off far worse than 2022. The company isn’t even going to be profitable in Q1, yet chip giant still have to cover capex and pay dividends.

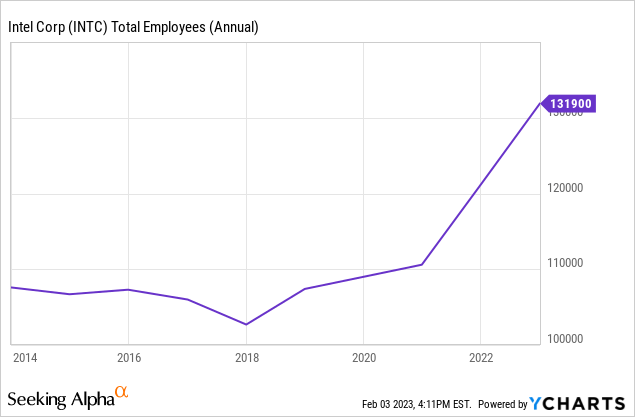

This is exactly why the pay cuts is a desperate move. The move cuts pay to all employees equally when Intel needs to actually slash employees while the whole tech sector is busy slashing workers. Management should use this market climate to slash underperforming employees and streamline operations, but Intel again isn’t making the tough moves despite the big increase in employees since the start of Covid.

Intel ended 2022 with cash and short-term investments of $28.3 billion with total debt of $42.1 billion. The chip company has a ton of assets, including $5.9 billion in equity investments and another $11.3 billion in other assets, so the financial situation isn’t dire yet.

The issue is that the scenario gets dire very quickly with the company trying to feed both capex and shareholder returns via a large dividend payout. Management shows no signs of prudent financial discipline via cutting either capex or the dividend despite originally forecasting cash flow strains in both 2023 and 2024.

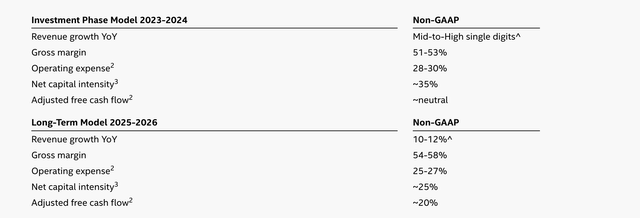

Back at the 2022 Investor Meeting, Intel had guided to adjusted free cash flow at neutral. The company made these forecasts on the basis of at least mid-single digit revenue growth off a $76.0 billion revenue target for 2022.

Source: Intel ’22 Investor Meeting

The best case scenario was already for Intel to be cash flow breakeven over the next 2 years. The company has seen business deteriorate to the point where positive earnings are a major question leaving the only positive operating cash flows from deprecation charges.

With Intel spending $20+ billion annually on capex, the company will have no choice but to slash and probably eliminate the dividend. In fact, investors should want the dividend eliminated until the company is back to free cash positive to where the balance sheet isn’t weakened from dividend pay-outs. Intel doesn’t have excess cash to cover pay-outs anymore.

The chip giant will have a hard time competing with AMD in a scenario where the company has net debt levels topping $20 billion or even $30 billion in a couple of years. The biggest fear is that Intel starts losing top talent after slashing pay by 10% to 15% creating a never ending downward spiral.

Investors trying to own the stock here should know that dividend cuts aren’t handled well by the market. Unfortunately, too many people blindly buy stocks solely for the dividend payment.

A heavily indebted Lumen Technologies (LUMN) eliminated the dividend in order to make nearly equal stock buyback purchases, yet the stock still collapsed 15%. Intel needs to cut the dividend just to preserve cash in what is a worse scenario for shareholders.

In a similar manner, Hanesbrands (HBI) fell over 15% on pulling their dividend pay-outs. Intel appears headed for a similar fate.

Takeaway

The key investor takeaway is that Intel shareholders face more pain ahead with the chip giant in no position to continue paying large dividend pay-outs. The stock has more downside until the cash flow position improves and the most likely outcome is a dividend cut leading to more downside pressure on Intel.

Disclosure: I/we have a beneficial long position in the shares of LUMN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.