Summary:

- Intel’s share price has plummeted, but I believe it has bottomed and presents a value opportunity for patient long-term investors.

- The Amazon deal solidifies Intel’s standing in the AI chip market, signaling its competitiveness and potential to attract other major clients.

- Intel’s upcoming catalysts include the Windows 10 upgrade cycle, AI computing advancements, and the buildout of AI infrastructure, all of which could drive profitability.

- Despite past failures and competition, Intel’s cost reduction plans and strategic investments could restore its profitability to over $10 billion annually.

hapabapa

Intel Corporation (NASDAQ:INTC) has brought nothing but pain and frustration to its shareholders over the past several years. While their valuation has been chopped in half, Advanced Micro Devices (AMD) has closed the gap on desktop chips and gained ground in the laptop market. INTC also missed the boat on GPUs, and even if they felt the bitcoin mining boom was just a fad, it was followed up by an AI Boom that has taken Nvidia Corporation’s (NVDA) to $2.85 trillion. INTC’s dividend is gone, shares have lost more than half their value over the past 5-years, they are losing market share, and missed several big opportunities. On September 20th news broke that Qualcomm (QCOM) was looking to take over INTC, which made INTC shares jump off their multi-year lows. I sold my position in INTC when they announced their dividend reduction in the first half of 2023 and have been getting very interested in INTC as shares fell into the $20 range. I recently started building a position in INTC before the QCOM news, and I don’t believe that INTC needs QCOM to survive. While shareholders would probably benefit in the short term by a boost to the share price on a buyout, I think that INTC may have bottomed and is trading at a valuation that could be beneficial to long-term investors. Between the Amazon (AMZN) partnership, Windows 10 coming to the end of its support cycle in October 2025, the foundry business, and AI computing, INTC has several catalysts over the next several years that can turn the share price around.

Seeking Alpha

Following up on my previous article about INTC

It’s been a long time since I wrote an article about INTC. The last article I wrote was in October of 2022, when shares were trading at $25.74 (can be read here). For a while, I was correct as INTC was paying a large dividend, and shares broke the $50 level in December 2023, but ultimately INTC crashed and burned. Since writing that article, shares of INTC have declined by -15.14%, and when the dividends are included before being suspended, the total return is -10.8%. Investors could have just invested in the S&P 500, and they would have recognized a gain of 54.01%. I am following up with a new article because I think that INTC has fallen too much, and I don’t see a technological landscape without INTC. I think that shares have bottomed and that there is a lot of value for investors who are patient.

Seeking Alpha

Risks to my investment thesis

I could be incorrect, and shares of INTC could decline further after establishing a new floor. AMD has taken substantial market share from INTC, and we could see INTC’s dominance erode further. We could also see increased competition from companies such as Arm Holdings (ARM), as some of their chips are found in Microsoft (MSFT) products. INTC missed the boat on tablets, phones, and graphic cards. Not diversifying from the computer and server segment could be INTC’s downfall as AMD is now a prime competitor, and INTC didn’t branch out into other markets. The focus on foundries could also not play out how I think it will, and this could end up being one of the worst investments a company has made. It’s also going to take a lot to change the markets sentiment regarding INTC, and they may never get back to the days of generating over $10 billion in annualized profits. A lot has to go right for the investment to work, and INTC’s management team hasn’t proven that it can provide value to shareholders over the past several years.

The Qualcomm takeover probably won’t get past regulators, and the Amazon deal is much more important

The most interesting aspect about the QCOM and INTC deal to me is that Raymond James analyst Srini Pajjuri speculated that to reduce the regulatory burden, if QCOM Was only to acquire INTC products business, it could be valued between $130 – $140 billion. INTC is currently trading at a sub-$100 billion market cap, so it is interesting that Srini Pajjuri feels that the product segment could fetch more than the entire company’s market cap. I doubt that this deal would get approved, considering it would need to pass through the regulation process in China, the European Union, and the United States. QCOM is one of the largest chipmakers in the smartphone market, and I have a hard time believing that in the current political climate, regulators would also allow QCOM to control most of the PC chip market. I don’t think investors should get their hopes up for a buyout from QCOM as I think it would be a tremendous uphill battle to get approved.

The news that I think shareholders and anyone considering an investment in INTC should focus on is the latest AMZN and INTC partnership. AMZN and INTC’s relationship just expanded as AMZN tapped INTC in a multi-year partnership to produce custom AI fabric chips for AWS. INTC will produce the AI chips on the Intel 18A platform and the custom Xeon 6 chips on Intel 3. In my opinion, the deal solidifies INTC’s standing in the AI chip market and could signal that INTC is ahead of the competition in this market. AMZN is also giving INTC a nod of confidence in its foundry business. This should signal to other large companies, including Apple (AAPL), Broadcom (AVGO), AMD, and QCOM, that INTC is able to compete with Taiwan Semiconductor (TSMC) regarding manufacturing. Looking past today and out several years, the Foundry business, which has generated $18.6 billion in revenue over the trailing twelve months (TTM) and lost -$8 billion, is in a position to increase its revenue while turning this into a profitable venture. Even if the margins get to just 10%, it would eliminate roughly -$8 billion in losses and could drive billions to the bottom line.

The AMZN deal is more important than QCOM wanting to expand its product footprint because it gives INTC additional validation in the next revolution of computing. The multi-billion dollar deal indicates that INTC is committed to making strategic investments to advance its products and help design what the AI chip market will become. INTC was also just awarded $3 billion under the Chips Act as INTC builds foundries in 4 states. Many companies depend on TSMC, and INTC is positioning itself as a viable alternative. AMZN can work with any company they want, and if they didn’t feel INTC could deliver these products, they could have tapped AMD for the next generation of chips to power AWS. In addition, the United States Government has a vested interest in INTC’s success from a national defense standpoint, which is why INTC was awarded nearly $20 billion in awards from the Biden Administration to subsidize its production and manufacturing capabilities. From a strategic standpoint, the United States and its allies need an alternative to TSMC in case China engages in an attempt to take over Taiwan and to decrease our dependence on chips from foreign countries. INTC is in a position to take market share away from TSMC and provide quicker lead times to many domestic chipmakers, as shipping from Ohio will be much quicker than from overseas.

Intel

Intel has 3 catalysts outside of the Foundry business that aren’t being discussed enough

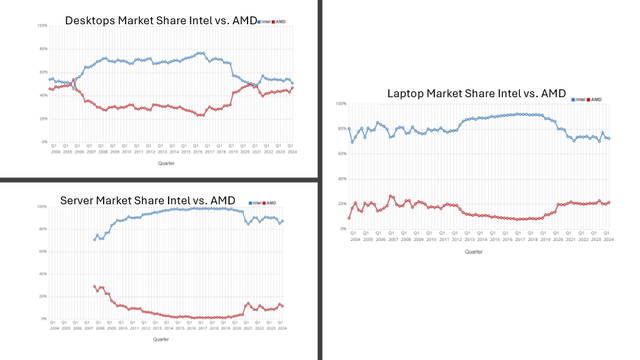

The main competitor to Intel is AMD in the X86 space. While ARM has started making some chips, it’s still a duopoly in the X86 sector. In the early 2000s, AMD overtook INTC for a short period of time on the desktop side for a single quarter in Q1 2006, but that was short-lived as INTC eventually got back to over 75% of the market. Recently, AMD has done a tremendous job as it once again overtook INTC for a single quarter in Q1 2021 as they grabbed 50.5% of the desktop market and is now neck and neck with INTC as AMD represents 46.8% of the market in Q3 2023. When I look at the laptop and server market, it’s not even close, as INTC has 72.6% of the laptop CPU market and 87.6% of the server market.

Steven Fiorillo, Passmark

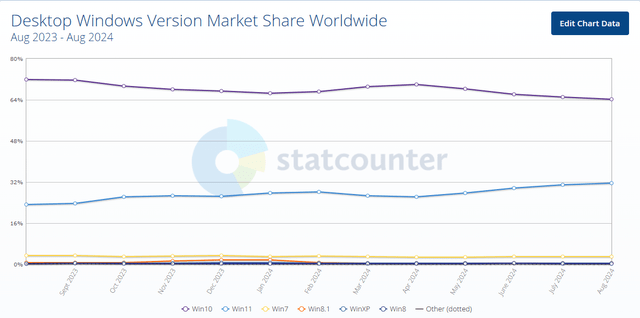

According to MSFT, support for Windows 10 will end on October 14th, 2025. This means that software updates, technical assistance, and security fixes will no longer occur. This puts every individual and business at risk, and with cyberattacks on the rise, it’s in everyone’s best interest to upgrade to Windows 11. Everyone wants to talk about the iPhone super cycle from AAPL because Apple Intelligence is only able to run on the latest chips, but people aren’t talking about the PC super cycle we’re about to witness. Unlike AAPL, where customers can delay upgrading, customers have 13 months to upgrade to Windows 11, and Windows 11 can’t run on many Windows 10 machines due to the chip requirements. This will cause an immense PC upgrade cycle that will benefit both INTC and AMD as users rip and replace the CPU or opt to purchase a new computer.

As of August 2024, Windows 10 machines accounted for 64.17% of the Windows market share. On the latest HP Inc. (HPQ) conference call they discussed that they have seen the impact from MSFT sunsetting Windows 10 in their sales and believe it will continue to grow as we head into the last year of its lifecycle. Dell Technologies (DELL) also discussed on its latest conference call that they are also optimistic about future sales as the PC refresh cycle will be fueled by Windows 10 reaching its end of life. Both HP and DELL, which are 2 of the largest computer manufacturers, are signaling that they will see increased sales due to MSFT sunsetting Windows 10, and I think this will be a huge beneficiary to INTC going forward.

Statcounter

The next catalyst is AI computing, which was indicated by both HP and DELL during their conference calls. This upgrade cycle will last well beyond the Windows 10 upgrade cycle as advancements in AI-enabled architectures and applications continue. Some machines don’t need to be upgraded because they either have Windows 11 on them or are powerful enough to install Windows 11 on them. As new chips are made specific to AI, users will need to upgrade their hardware to unlock AI capabilities. DELL believes that there is a total addressable market of $174 billion supported by AI hardware and services. The reality is that computing could drastically change over the next 5-years. To utilize the latest software and services, customers will need new computers, which should cause an upgrade cycle that is larger than the Windows 10 upgrade cycle.

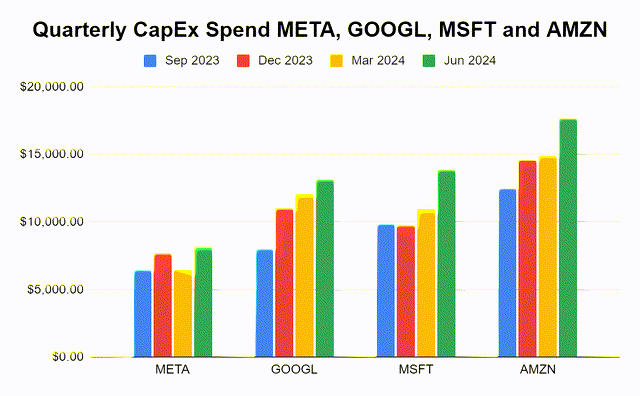

The third catalyst I believe that INTC will benefit from is the overall buildout of AI infrastructure. Meta Platforms (META), Alphabet (GOOGL) (GOOG), MSFT, and AMZN spent $177.14 billion in CapEx over the TTM. The allocation to CapEx has only increased, and these companies are not slowing down. Southern Company (SO) discussed on their latest conference call, that there are close to 200 projects in their project pipeline over the next decade, and 40% are data centers. One of the largest utility companies is telling us that more than 40% of their future projects revolve around expanding IT infrastructure, and they went as far as to say that 80% of the electricity they will bring online will be allocated toward new data center infrastructure. This is bullish for INTC because you can’t just run a data center on Nvidia Corporation (NVDA) GPUs. You need CPU server chips and networking equipment as well. INTC has 87.6% of the server market, so as new IT infrastructure is built, INTC should be a direct beneficiary.

Steven Fiorillo, Seeking Alpha

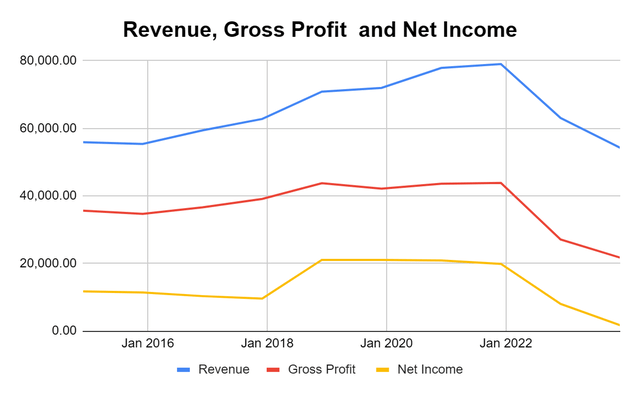

I think Intel can get back to where they were and is undervalued based on forward projections

INTC’s decline over the past several years has been catastrophic, as they strung together 3 consecutive years of exceeding $20 billion in profitability to not even achieving $1 billion in the TTM. INTC’s revenue peaked in 2021 at $79.02 billion and has declined by -30.25% to $55.12 billion in the TTM. INTC’s revenue and profitability weren’t a fluke due to a surge in spending from the rise of work from home during the pandemic, as they generated more than $70 billion in revenue and $20 billion in net income in 2018 and 2019. It’s been a perfect storm for INTC, from AMD taking away market share to the cost of goods and running the business increasing that has led to INTC’s decline. INTC recently indicated that it will cut 15,000 jobs to align with its new cost structure. INTC believes that this initiative will reduce costs by $10 billion in 2025. INTC’s current costs are higher than before, which has negatively impacted its margins, especially in an environment where its revenue has declined. INTC is still a profitable business, and they are making the hard decisions to reduce costs while building for the future. If INTC can pull this off, I think they can get back to generating over $10 billion in profitability annually, as there are several favorable trends on the horizon that can complement reduced expenses.

Steven Fiorillo, Seeking Alpha

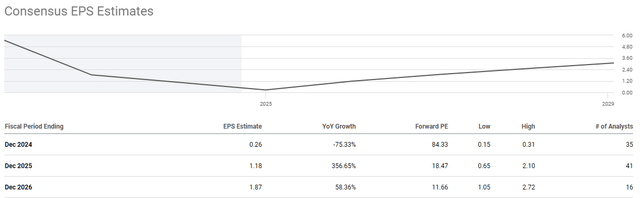

The analyst community indicates that INTC will generate $0.26 in EPS for 2024, making them trade at a 84.33 P/E. INTC is projected to generate $1.18 in EPS in 2025 and $1.87 in 2026. This puts their forward P/E at 18.47 times 2025 earnings and 11.66 times 2026 earnings. 2024 is almost over, and if INTC comes anywhere near these numbers for 2025 and 2026, I think the stock will rally. I think that INTC could actually generate more EPS in 2026 due to AI chips, the Windows 10 upgrade cycle, and the need for more server chips as data centers expand. For investors who have time on their side, I think INTC can pull off a turnaround.

Seeking Alpha

Conclusion

INTC has been a horrible investment over the past several years. Not only has its share price declined by more than 37% over the past year, but it also missed opportunities in the GPU market and had a significant amount of market share taken by AMD. I think that shares of INTC are trading around the bottom, and there is an opportunity for long-term investors. The deal announced by AMZN has far-reaching implications that could set INTC apart from AMD in AI chips and cause the largest chipmakers to tap INTC over the next several years for their foundry services. Between the several catalysts on the horizon and INTC’s cost reduction plans, I think that INTC can get back to generating over $10 billion annually in profits and that the current share price represents a value opportunity. If the forward projections are correct, INTC trading at less than 12 times 2026 earnings could be a steal. I am currently building a position in INTC as the risk-reward entices me.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, NVDA, AMZN, META, SO, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.