Summary:

- Intel stock’s improved outlook has mitigated recent selling intensity, helping INTC bolster its bottom above the $20 level.

- Management’s restructuring and cost-cutting efforts have bolstered market confidence. However, are they enough for a long-term turnaround?

- Intel’s external foundry business and AI chip efforts lag behind those of its key rivals.

- INTC’s forward valuations suggest that much pessimism has been reflected, but this doesn’t automatically make it a buy.

- I argue why betting on the wrong horse (INTC) isn’t wise, as the AI growth inflection takes center stage.

hapabapa

Intel: Near-Term Selling Intensity Likely Dissipated

Intel Corporation (NASDAQ:INTC) investors have escaped further hammering since my previous update in September 2024. I reminded investors that INTC found a consolidation zone over the $20 support level. Hence, some Intel Bulls might even suggest that the worst seems over, affording a lower-risk entry point.

In Intel’s Q3 earnings release, the company helped mitigate further downside volatility, as its performance was better than expected. Intel’s guidance indicated that Wall Street had turned too pessimistic, validating INTC’s current consolidation phase.

Notwithstanding the INTC’s recent outperformance, I must remind investors that the stock has underperformed the S&P 500 (SPX) (SPY) and its semiconductor peers (SMH) (SOXX) over the past year. Accordingly, the stock delivered a total return of nearly -40%. To worsen matters for Intel investors, S&P Dow Jones Indices has decided to replace INTC with NVIDIA Corporation (NVDA) stock soon, ending its 25-year run in the Dow Jones Industrial Average (DJI) (DIA). However, INTC’s buying sentiments haven’t wavered since its recent earnings scorecard, suggesting that near-term selling intensity has likely reached a bottom.

Intel: Are Cost Reduction Efforts Enough?

Intel’s restructuring plans (Intel filings)

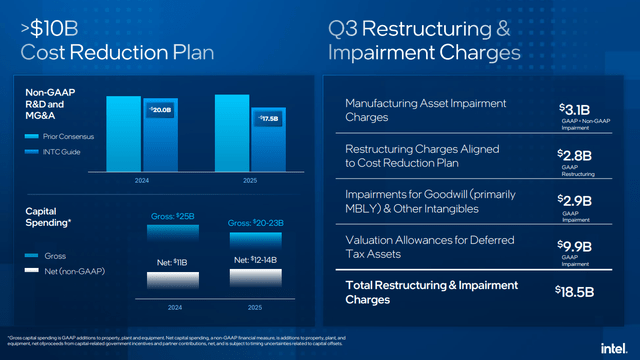

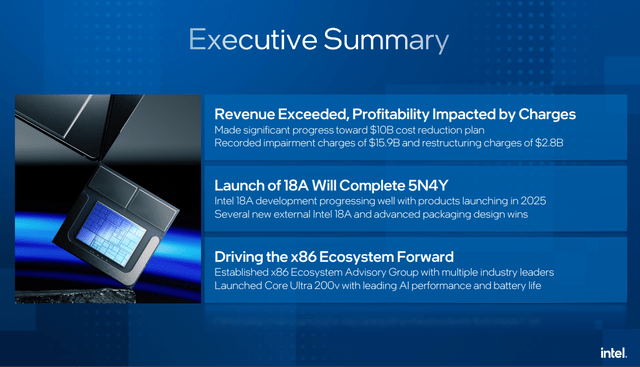

Intel Management prefaced its recent earnings conference by underscoring its commitment to undertaking a significant restructuring and cost-cutting program. While it impacted its GAAP earnings markedly (dropping to -$3.88 in Q3), they are not expected to persist. Hence, the market is justified in its confidence that Intel’s cyclical recovery should carry on, as management maintained the market’s optimism with a better-than-anticipated outlook.

Despite that, investors must question whether these cost improvement and restructuring maneuvers could propel Intel back into the big league with Nvidia, Advanced Micro Devices, Inc. (AMD), and Broadcom Inc. (AVGO). The decision to drop Intel in Nvidia’s favor was to “ensure a more representative exposure to the semiconductors industry.” Therefore, it’s increasingly clear that Pal Gelsinger’s turnaround plans have not gained the required traction and confidence that the market has baked into since his return in early 2021.

Intel Faces Structural Headwinds Against Its Peers

Intel’s Q3 executive summary (Intel filings)

As a result, INTC’s significant underperformance against SMH since then isn’t a coincidence. It exemplifies the structural damage to Intel’s bullish thesis as AMD gained market share in data center CPUs. In addition, Gelsinger and his team focused on regaining process leadership from arch-rival Taiwan Semiconductor Manufacturing Company Limited (TSM). However, Gelsinger’s frustration with the US bureaucracy is evident for all to see, as Intel has not received funding from the CHIPS Act over the past two years.

Furthermore, Intel has struggled to gain traction in its external foundry business, notwithstanding the recent partnership with Amazon.com, Inc.’s (AMZN) Amazon Web Services. Although management underscored its confidence in surpassing $15B in external foundry revenues by 2030, the market will likely increasingly demand proof points. Investors will likely remain cautious Unless INTC can reverse the market’s confidence in TSMC’s technological advantages and production yields.

TSMC has also strengthened its Foundry 2.0 roadmap as advanced packaging becomes critical in the increasingly complex AI chips. The recent production snags that TSMC and Nvidia faced underscore the challenges that Intel must convince its external foundry customers as it seeks to supplant the Taiwan-based foundry’s process leadership (with its 5N4Y roadmap). The annualized launch cadence by Nvidia and its peers is expected to complicate Intel’s endeavors, potentially embedding TSM’s advantage in the AI chips era. Given the “insane” demand dynamics for Nvidia’s Blackwell AI chips and the intensely competitive AI investment CapEx growth outlook by the leading hyperscalers, I don’t think they will contend with seeking the second-best if they can secure sufficient capacity with TSMC. Therefore, Intel’s decision to lower its CapEx guidance by more than 20% to between $20B and $23B for 2025 seems wise.

Furthermore, Intel faced challenges meeting its revenue outlook of $500M for its Gaudi AI chips. AMD’s revision of its AI revenue from $4.5B to $5B underscores the gap between the “AMD dark horse” and Intel’s faltering efforts. Both companies are way behind Nvidia, as the King of AI outperformed its peers, while Jensen Huang and his team aim to penetrate more growth optionalities. Therefore, Intel’s best bet seems to be on the cyclical recovery and upgrade cycle of AI PCs, although the growth cadence is anticipated to be uncertain.

Intel anticipates shipping more than 100M AI PCs through the end of FY2025. However, QUALCOMM Incorporated (QCOM) and AMD are expected to be robust competitors as Intel’s peers seek to gain a foothold in the AI transition for PC users. Despite that, it could help underpin Intel’s cyclical recovery through 2025, although the market’s optimism could be tempered due to inherent challenges in its data center business.

Intel Investors Betting On A Cyclical Recovery

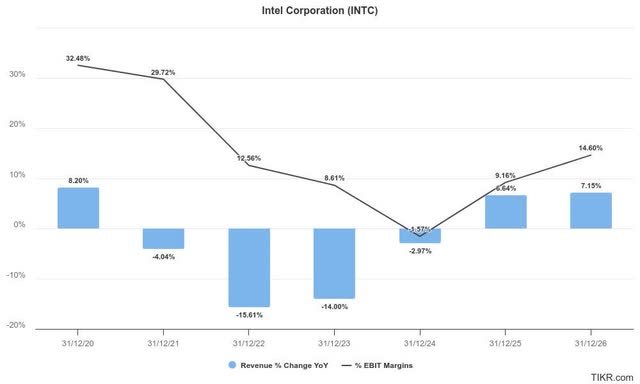

INTC’s recent bottoming and lack of selling intensity aligns with Wall Street’s outlook on its cyclical recovery thesis. Management’s ability to provide an improved forward outlook has also underpinned the market’s confidence, sustaining its recent recovery.

INTC’s FY2026 adjusted EPS multiple of 13x is markedly below its 10Y average of 17.5x. Hence, the market has baked in significant execution risks on its bullish thesis, suggesting its near-term outperformance could continue.

However, investors must question whether they want to trade Intel stock on a short-term mean-reversion opportunity based on its September 2024 lows or anticipate a longer-term, structurally bullish opportunity. I’ve not assessed bullish signals from Intel management on its ability to mitigate share losses in the data center business against AMD and Nvidia. In addition, its external foundry business seems to have struggled against TSMC as the leading-edge foundry upped the ante with its Foundry 2.0 business model.

Therefore, I assess a Hold rating as appropriate as INTC potentially consolidates above its recent lows.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA, AVGO, SMH, AMZN, TSM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!