Summary:

- Intel secures a major, multi-billion dollar design win with Amazon.

- Intel’s foundry division will become an independent subsidiary, allowing it to raise capital independently and reduce conflicts of interest.

- With a clear foundry turnaround plan and positive momentum on its 18A node, Intel is a Buy.

JHVEPhoto

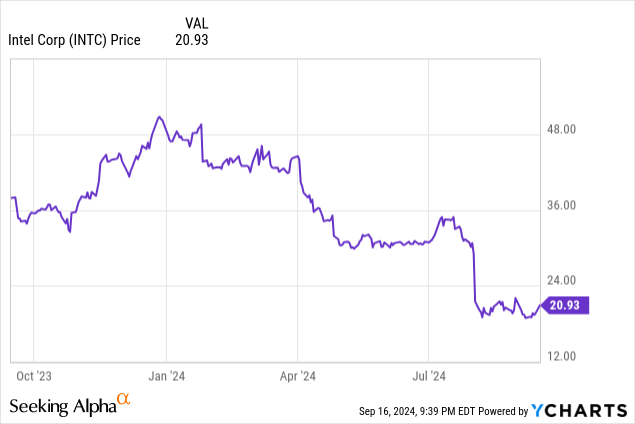

Intel (NASDAQ:INTC) finally delivered some good news to investors after the close Monday, as it announced that it had secured a long-term partnership with Amazon to manufacture chips on its 18A and Intel 3 processors and that it would be making the foundry division an “independent subsidiary” inside Intel. The market evidently liked the move, as the stock jumped nearly 8% after hours to $22.50 per share, and for good reason, as, in my opinion, there is a lot to like.

A Vote of Confidence for 18A

Another Intel article from Kumquat Research?! I know I know, but Intel is making headlines left and right and each of these events are material enough to deserve some discussion. But for the first time in weeks, INTC is actually in the news for a positive reason, so shareholders rejoice! Specifically, the company announced a “multi-year, multi-billion dollar” deal to manufacture a custom AI chip for Amazon using its upcoming 18A manufacturing node AND announced that, instead of a spin-off, Intel’s foundry division would become an independent subsidiary within the company. Both of these are substantial bullish developments, but let’s start with the Amazon deal.

In my article last week detailing the showdown between Intel’s 18A and TSMC’s (TSM) upcoming node, I noted that Intel’s skipping its 20A node to focus resources and investment in 18A was essentially an all-in move: with the foundry’s losses mounting, a failure for 18A could mean dire straits for the company. That piece can be read here.

I also covered the recent report by Reuters that Broadcom (AVGO) was disappointed in their preliminary assessment of 18A, and the negative implications this could have on Intel’s future should the rumor hold weight. Enter Amazon, and sentiment has done a complete 180. This deal provides a huge vote of confidence for the 18A process, as Amazon is committing to billions of dollars in business over multiple years to manufacture chips at Intel fabs. This is exactly the kind of sign INTC investors have been waiting for, indicating that the company’s manufacturing woes might be mostly in the rearview.

In another piece of positive news, Intel and Amazon have also committed to a partnership to manufacture Xeon processors on the Intel 3 node for AWS. As one of the foremost consumers of processors in the world, Amazon tapping Intel for these upcoming products is a massive win for the company’s beaten down manufacturing business.

But that’s not all! Intel also announced it would make its foundry an independent subsidiary within the company itself. Let’s discuss that next.

Foundry Spin-in?

In another article from a couple of weeks ago, I discussed the rumors of a spin-off that were circulating and made the argument that such a move would be a mistake and a negative impact on shareholder value. That article can read here.

Intel management seems to have agreed and, instead of a spin-off, it appears they have opted for more of a “spin-in”, though the current plan certainly seems to open the door for a spin-off down the road. It’s not quite clear yet as to how this will work, but the basics appear to be that the foundry will be independent, have its own board, have separate accounting and financials (much of the work for this part specifically has been well underway), and be able to potentially raise its own capital.

This move also has many major benefits, mainly that it separates out the conflict of interest that some chipmakers might have seen with using Intel’s nodes to make their processors, thereby providing Intel additional resources to their chip design division. Additionally, being able to independently raise funding could help the division cope with some of the more capital-intensive moves required to turn the foundry around without burdening the rest of the company with debt.

In my article, I was skeptical of a spin-off because of concerns over how the foundry would survive on its own, that it would handcuff the design division for years with locked-in contracts with the foundry anyway, and that it would endanger $3 billion in CHIPS funding. However, this staged approach to turning the foundry around internally and setting up a future spin-off when the time is right, is much more agreeable.

While I am bullish on these developments, it remains to be seen exactly how external customers will react. How will Intel enforce the separation between divisions? Will that be convincing enough for potential competitors to buy in? In the event of an eventual spin-off, which looks much more likely now, how will ownership be divvied up for shareholders?

These are all questions Intel will hopefully provide more detail on in the coming weeks and months, but while uncertainty remains, Amazon’s huge vote of confidence for 18A and Intel’s commitment to turning the foundry around in the near-term and setting it up for success long-term both indicate that the overall turnaround is intact and that the stock has room to run.

Investor Takeaway

Intel has finally provided investors with hope for a successful turnaround. Amazon has bought in on 18A and management seems to have a plan for fixing the foundry’s issues and then setting it free, like a bird from a nest. After growing concerns that perhaps the manufacturing node that Intel has pinned all its hopes on was facing problems, this announcement has put those fears to rest for the time being.

After initially downgrading INTC to Hold on the uncertainty surrounding the foundry spin-off and the possibility of a direct carve-out, on the back of a big design win and a clear path forward for the foundry division’s success, I am re-rating INTC a Buy and see the company continuing to execute. Investors should keep an eye on customer announcements going forward, as typically all it takes is one big domino to fall, leading others to potentially follow the lead, especially when the first domino is a customer of Amazon’s caliber.

Thanks for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.