Summary:

- Intel Corporation had tremendous losses in a “kitchen-sinked” quarter, with big write-downs.

- We move to a buy on a robust pipeline of activity and positive views of the business lines.

- The Bears are no longer in control.

Riou

Intel Corporation (NASDAQ:INTC) has been a tempting buy of late, following absolute carnage in the stock, but also with news of contracts and deals benefitting the company. However, it comes down to performance, and the incredibly anticipated Q3 results were just released. Let us discuss the major key metric results.

Intel posted mixed results relative to many of our expectations. We were anticipating seeing a some recovery in PCs. We saw progress on Foundry. Things are turning the corner, but there is a long way to go. The losses were tremendous, though may not be comparable to consensus due to restructuring charges and a reset of the business. David Zinsner, Intel CFO, stated in the press release:

Restructuring charges meaningfully impacted Q3 profitability as we took important steps toward our cost reduction goal. The actions we took this quarter position us for improved profitability and enhanced liquidity as we continue to execute our strategy. We are encouraged by improved underlying trends, reflected in our Q4 guidance.”

Pat Gelsinger, Intel CEO, added:

Our Q3 results underscore the solid progress we are making against the plan we outlined last quarter to reduce costs, simplify our portfolio and improve organizational efficiency. We delivered revenue above the midpoint of our guidance, and are acting with urgency to position the business for sustainable value creation moving forward. The momentum we are building across our product portfolio to maximize the value of our x86 franchise, combined with the strong interest Intel 18A is attracting from foundry customers, reflects the impact of our actions and the opportunities ahead.”

So what happened with the earnings miss. They had 10nm that were never deployed. The restructuring led them to believing they no longer needing them, this led to a massive write-down. So do not focus on the big earnings miss here, with losses of $3.86 per share GAAP wise and $0.46 loss per share adjusted. Here is the deal. There was real hope that the second half of 2024 would have been a real turnaround, and we are starting to see green shoots. Sure, there are margin headwinds, high expenses and charges, despite spending reductions, but “investments” are being made, and have been ongoing, and should bear fruit moving forward.

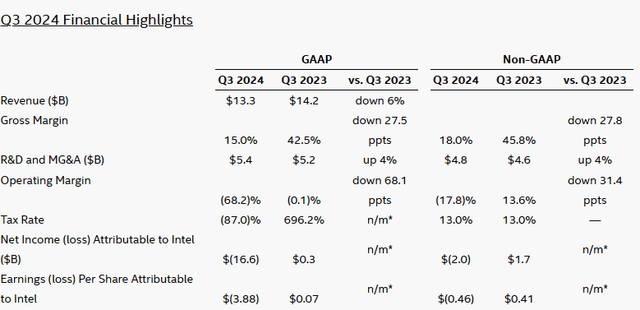

This is a tough print on its own though, but the stock is up after hours on the forward look. Comps for Q3 2023 show across-the-board pain. Intel’s revenue was down 6% from a year ago. This came as adjusted gross margins whiffed on our expectations of 19% hitting 18.0%, down from 45.8% a year ago, and well below historical averages. Still ugly. Operating margins were a pathetic negative 17.8%, swinging from 13.6% last year. Again, charges weighed. Net loss was $16.6 billion on these charges, or $2.0 billion adjusted. That is pain. But again, there were big charges.

Here is a brief summary of them. $3.1 billion of charges were recognized in cost of sales, related to non-cash impairments and the acceleration of depreciation for certain manufacturing assets (10 nm), related to the Intel 7 process node, based upon an evaluation of current process technology node capacities relative to projected market demand. So they were written off. Another $2.9 billion of non-cash charges were associated with the impairment of goodwill for the Mobileye reporting unit – as well as certain acquired intangible assets. And then there was a huge $9.9 billion of non-cash charges related to the establishment of a valuation allowance against U.S. deferred tax assets.

You really can’t argue that there are improving valuation metrics with the dividend history of cuts, and the valuation metrics swinging to negative because of losses. What about segment performance? Here is the segment performance. This is where we see some improvement for the future.

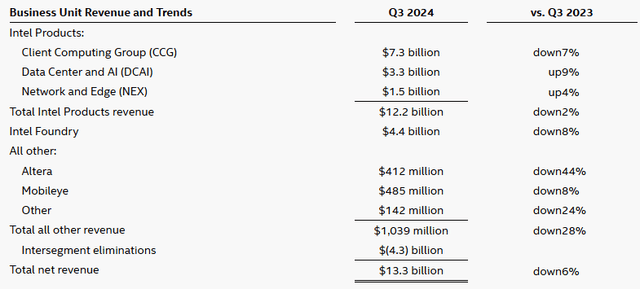

Client computing was actually decent, with revenue dipping 7% to $7.3 billion, but slightly off what many were expecting. We had projected 10% declines to 5% increases, so this print is not that terrible. Otherwise, data center and AI were up 9% to $3.3 billion, while most chip companies are seeing strong data center growth. We anticipated 8% revenue gains here, so Intel did better there, and the growth was still positive.

Network and edge were up 4% as well, in line with expectations. But Foundry was decent, down 8% to $4.4 billion, but we thought it would be worse. Other revenue sources were down 28% to $1.04 billion. Altera dropped off 44%, with Mobileye down 8%. It was a tough print. We are seeing the stock up sharply though, why?

Looking ahead

Here is the deal. It is over now, the complete mess is over. Stocks bottom on bad news, and this quarter was mixed to bad on its own. We think the Street likes the major restructuring and writing off the equipment. They simply had too much of it. All the charges, this was a kitchen sink, really.

And the Street likes it. The Foundry is positive. The forward look there is positive, as a ramp in 2025 is expected. The AI PC will be coming and Intel has its piece of the pie with key partnerships as well. The Q4 outlook is decent here, with a major margin rebound in store. Revenue is seen at $13.3-$14.3 billion, while gross margin is seen at 36.5%, or 39.5% adjusted. This is very bullish and a big margin rebound. Very positive. Adjusted EPS will swing positive from Q3 (though the charges notwithstanding) to $0.12.

As we see it, the inventory position is much better. The CEO and CFO sound upbeat in commentary and in live interviews taking place at the time of this writing. We think the stock is now a buy once again on this news.

While there is work to be done, the bears being in control has ended with this report in our opinion. It’s over.

Take home

We have upgraded Intel stock to buy, the company having “kitchen-sinked” write-downs to right size inventory. Client computing is rebounding, data center is strong, and foundry should ramp. 2025 looks to be a year of rebirth for the company. We move to bullish.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

LAST CHANCE. Join now for outsized returns

Significantly grow your wealth by embracing a blended trading and investing approach at our one-stop shop. Start winning now!

Our prices go up November 5th, but right now we have a big sale on the current price. Join NOW and you can lock in 75% of savings versus the $1,668 some members pay, this sale will end when 3 more members sign up.

We invite you to try us out, with a money back guarantee if you are not satisfied (you will be). Let’s win together. Come take the next step. START WINNING!