Summary:

- Intel’s recent poor performance led to a downgrade from a strong buy to hold, with missed expectations and dividend suspension surprising investors, including myself.

- Layoffs and struggles to keep pace in the semiconductor market may be indicating deeper issues within Intel’s management and execution capabilities.

- Despite potential government funding and opportunities in the AI market, Intel’s ability to execute on their turnaround strategy remains uncertain, leading to a cautious hold on shares.

- AI PC chip margins were damaging to their AI story.

FinkAvenue

Investment Thesis

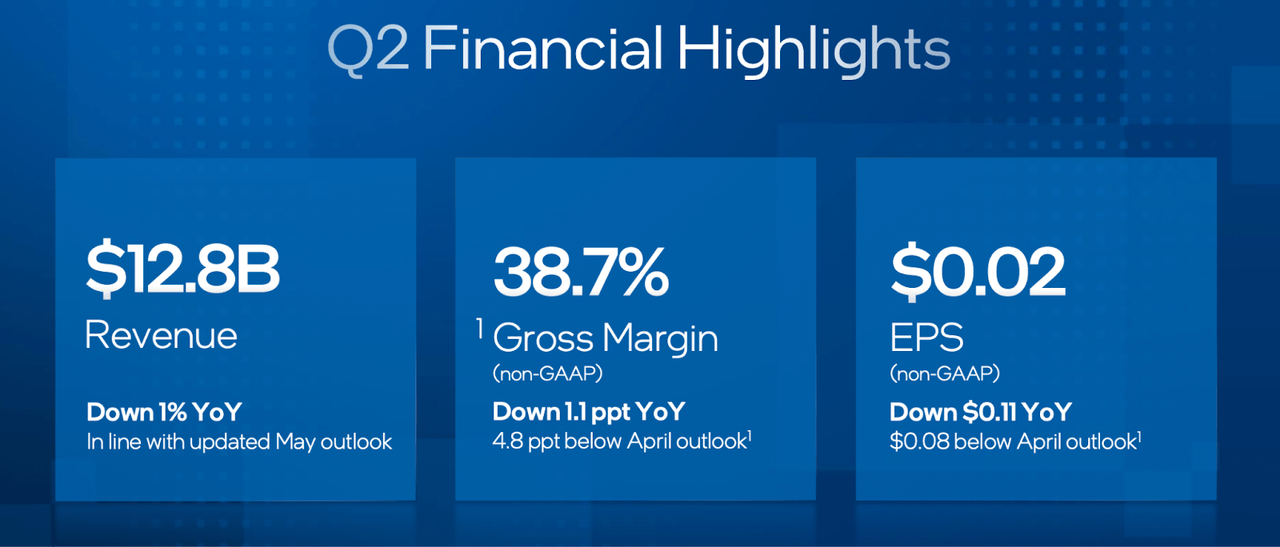

I wanted to take some time to digest the most recent Intel (NASDAQ:INTC) quarter. To put it plainly, it was a poor performance that frankly took me by surprise. I’ve unfortunately now soured on the stock, down from a strong buy to a hold. Q2 results showed the chipmaker’s revenue falling short of expectations by $147.82 million, coming in at $12.83 billion. Adjusted EPS of $0.02 missed by $0.08. With this, Intel suspended its dividend to help preserve liquidity. The dividend suspension took the investor base by surprise, including myself. Dividends have historically been a key selling point for Intel shareholders.

Intel Results Snapshot (Intel)

With the earnings miss, the company also announced plans to lay off 15% of their 110,000 employees, in order to help the once industry-leader work in smaller teams more efficiently. While these layoffs may help streamline operations and reduce costs, it means the company is going to have to dig much deeper than I originally thought to pull off a turnaround. I thought the company was already in the midst of a turnaround (see my last piece). In hindsight, this was clearly not the case.

The overall semiconductor market’s strong growth should favor Intel, but the company’s recent quarter shows that the company is struggling to keep pace.

While Intel’s latest chips are an attempt to regain their industry leadership (including the launch of a new series of AI chips targeting both PC and server markets to tap into the strong industry demand), the market’s reception to date has been minimal, which really surprised me. Even with the company’s AI accelerator chips being priced competitively, the combination of performance improvements and low costs have not been compelling enough for enterprises to bite.

While Intel’s challenges are evident, I believe there are a few scenarios that could turn this into a bullish story again. For now, these scenarios are unfortunately far more speculative than they appeared just a few months ago. Intel’s current trajectory no longer inspires confidence in my opinion. Until there is clear evidence of a significant breakthrough in their tech, I am no longer seeing the immediate potential of a bullish story. The market is looking for tangible results, and Intel’s ability to execute on their strategy and translate government incentives into real market gains remains to be seen in their performance. For now, I am a hold.

Why I’m Doing Follow-Up Coverage

With Intel’s new series of AI chips, alongside government incentives, including a $3.5 billion investment in New Mexico for advanced semiconductor manufacturing, my expectations in my last piece were high for a resurgence. However, I must call a spade a spade—this optimism was misplaced.

Intel showed a lot more promise at the start of this year and even a few months ago with strong AI CPU offerings and AI servicer chips. But we didn’t see this show up in a significantly stronger order book for Intel. The most disappointing aspect, for me, has been the inability to meet even revised guidance which I placed a lot of trust in. In my view, this has been a critical factor in the company’s current struggles. Management has to say what they’re going to do and then do it. I think they’re not doing this. I feel misled personally.

This follow-up coverage is to identify where I (and likely others) misjudged Intel’s potential and what the implications are moving forward. I believe the missed expectations show execution issues within Intel’s management team. We’re witnessing a company struggling to keep pace with industry changes. As we move forward, the focus will be on how Intel can realign their strategy to address these challenges.

Background: Earnings Deep Dive

I waited a few days to write this follow-up piece because I wanted to dig deeper into what went wrong. Intel’s recent performance has been disappointing for me. The company’s forward EPS GAAP growth now stands at (negative) 46.32% YoY, a stark contrast to the sector median of (positive) 7.04% YoY growth. Intel’s forward revenue growth of -3.18% is also a red flag, especially when we compare it to the sector median of +6.69%.

In terms of guidance, Intel missed Q3 expectations. Revenue guidance came in at a range of $12.5 billion to $13.5 billion, well below the analyst’s midpoint estimates of $14.35 billion.

The chipmaker’s decision to suspend their dividend was another significant blow to investor confidence. Their plan to cut 15% of their workforce shows their financial strain. Had Intel communicated a clear plan to reinvest profits, embrace leaner operations, and transparently articulate a longer turnaround timeline (part of which included cutting guidance further), I would have remained patient. Unfortunately, this was not the case.

My main concern driving my new bearish sentiment comes from the disappointing performance of their AI PC chips. Intel’s AI PC chip margins have been compressing, a significant issue for a company that has heavily invested in their Meteor Lake series. Intel’s AI PC chips were supposed to help accelerate PC upgrades at a higher average selling price (ASP), but this strategy is backfiring. The higher average selling prices are not offsetting increasing production costs, leaving Intel with shrinking margins that are unable to support their ambitious investments. It’s a really bad spot to be in.

CFO David Zinsner discussed this during the Q2 earnings call:

Weaker than expected gross margin was due to three main drivers. The largest impact was caused by an accelerated ramp of our AI PC product. In addition to exceeding expectations on Q2 Core Ultra shipments, we made the decision to accelerate [the] transition of Intel 4 and Intel 3 wafers from our development fab in Oregon to our high-volume facility in Ireland, where wafer costs are higher in the near term. However, this change resulted in approximately $1 billion of capital savings and will improve Intel 4 and Intel 3 gross margin long-term as we scale up the Ireland fab. Margins were also impacted by higher than typical period charges related to non-core businesses and charges associated with unused capacity -Q2 Call.

The company’s adjusted gross margin dropped to 38.7%, far below their long-term target of 60%.

Adding on to all of this, their decision to move wafer production from Oregon to Ireland has increased costs. While this might improve efficiency in the long run, it currently exacerbates Intel’s margin concerns. For a company attempting a turnaround, the inability to leverage new technologies into profitable growth is concerning.

What Happens From Here?

Intel’s recent fallout shows the pivotal moment we are at in the semiconductor industry, with the company’s 35%+ drop in shares so far in August. Intel was once the industry leader.

While Intel securing government funding via the CHIPS Act means their survival seems somewhat given, it doesn’t mean they’ll be a leader again. The infusion of federal grants keeps Intel as a key player from a national security perspective and too critical to fail. Here-in might lie the silver lining. The company has access to really cheap (if not free capital) from the US government. They don’t have to be exceptional capital allocators to get a strong return on this money since it’s so cheap (compared to private sector loans). They just have to be decent capital allocators.

The decision to slash 15% of their workforce and suspend dividend was for sure a hard one. It may cost CEO Pat Gelsinger his job. But it’ll free up cash flow and create an opportunity for the company to finally dig in and reinvest in innovation, shedding the burden of being a traditional cradle-to-grave employer.

Valuation

Given that I’m now a hold on shares, I am cautious about my previous price targets for both median and long-term projections. The current market conditions make a miraculous recovery seem highly unlikely. These price levels are still achievable if the company can pull off a low probability turnaround in the short run. But I am no longer counting on these targets.

The forward PEG non-GAAP ratio stands at 1.85, slightly above the sector median of 1.84, indicating a 0.71% difference. Ironically, this suggests that Intel’s stock is trading at a slightly higher valuation compared to their peers, driven by the market potentially pricing in more EPS growth than Wall Street analysts are modeling. I think this indicates the market is slightly bullish, but it’s too early to tell. I believe the market is more clearly indicating their management slightly sand-bagged guidance (guided too conservatively to help moderate expectations).

Bull Thesis

In the long run, I am still bullish on the company’s capability to revamp their AI PC sales and expand gross margins, amidst the truly accelerating competitive pressures in the semiconductor industry. With Nvidia’s (NVDA) recent delay in the launch of their next-gen Blackwell B200 AI chips due to a design flaw, Intel might even find themselves in an advantageous position in the enterprise server market. At the same time, however, I think it’s more clear now that this situation may favor Advanced Micro Devices (AMD) more, given their strong CPU market positioning and their more holistic AI chip ecosystem (see my analysis from last month). This won’t box Intel out of the AI market. But they really need to execute flawlessly on their AI PC revamp and leverage their manufacturing capabilities for their fab business to pull this off. This is what I expected them to do in June. They disappointed me with this quarter.

On this note of AI PC chips, Intel clearly saw a margin compression here, but this was due to switching where these chips were made. They switched them for a strategic reason. Intel’s joint venture with Apollo, offers opportunities to scale manufacturing operations without straining their balance sheet. This $11 billion co-investment in Fab 34 in Ireland aligns with Intel’s Smart Capital strategy to leverage off-balance sheet capital for scaling operations. It also allows Intel to maintain a controlling interest while sharing financial responsibilities, which may boost their capacity to meet rising AI and semiconductor demands. This may compress margins but reduce their capital requirements. Lower capital requirements means they can invest in other places to help facilitate their turnaround vision.

Takeaway

Intel’s setbacks and resulting performance show the importance of admitting missteps and reassessing your priorities as a company. While the chipmaker has been demoted from the long-standing position as a leader in the CPU & semiconductor market, I still think there remains a possibility for a turnaround, albeit a less likely one than before.

The next quarter is even more critical for Intel. The company must show real, tangible, progress in their AI and semiconductor initiatives to regain investor confidence. Failure to deliver will further cement their position behind competitors like AMD and Nvidia, who have already seized significant market share in the AI and data center segments. Time is of the essence.

Investors are hesitant. For now, a hold on Intel shares seems fair. The company’s pivot towards lean investment strategies, such as partnerships for investments in manufacturing facilities, offer the potential for future growth with less capital requirements. However, it’s really all up to execution in the coming months. A strong performance in the next quarter could be a turning point, but the pressure is on for Intel to prove their mettle and reclaim their standing as an industry leader. After this last quarter, I am now a hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.