Summary:

- Intel’s fundamental problems are highlighted by stagnant revenue growth, inability to compete in GPUs, and weak balance sheet.

- Recent developments reveal missed revenue estimates, weak guidance, and Intel’s GPU market share diminishing to zero.

- Three different valuation approaches signal that the stock is substantially overvalued.

JHVEPhoto/iStock Editorial via Getty Images

Investment thesis

My previous bearish thesis about Intel (NASDAQ:INTC) aged well as the stock returned -8%, compared to a 24% increase in the S&P500. Today I want to update my thesis because a lot of developments happened over the last year.

Intel’s competition struggles persist and AMD (AMD) together with Nvidia (NVDA) appear to be a dream away in the AI revolution. Intel’s financial performance stagnates as the company is impossible to absorb AI tailwinds. The balance sheet is highly leveraged, which also limits the company’s ability to develop or acquire innovations.

Moreover, three different valuation approaches suggest that INTC is significantly overvalued, which makes me downgrade the stock to “Strong Sell”.

Recent developments

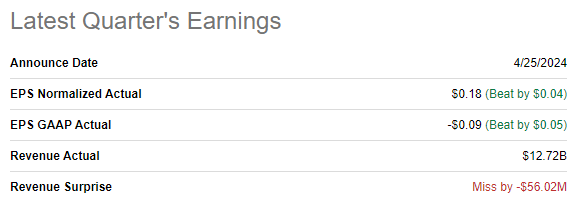

INTC released its latest quarterly earnings on April 25, when the company missed revenue consensus estimates, but delivered a positive EPS surprise. Revenue grew by 8.6% YoY and the adjusted EPS improved from -$0.04 to $0.18.

Seeking Alpha

Despite revenue growth and adjusted EPS improvement, the stock slid after earnings. I believe there are two big reasons for the market’s negative reaction. First, INTC is still in net loss on a GAAP basis. Second and more important, the management’s guidance for Q2 was weaker than expected by Wall Street.

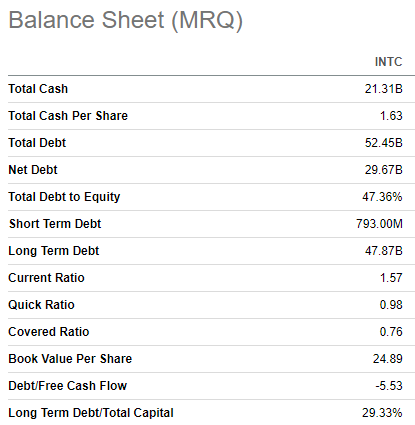

Intel’s balance sheet is still highly indebted with $52 million total debt. An $8.4 billion negative free cash flow [FCF] in Q1 does not add optimism around INTC’s financial position. Having highly leveraged balance sheet looks like Intel’s strategic weakness, especially compared to clean balance sheets of Nvidia and AMD.

Seeking Alpha

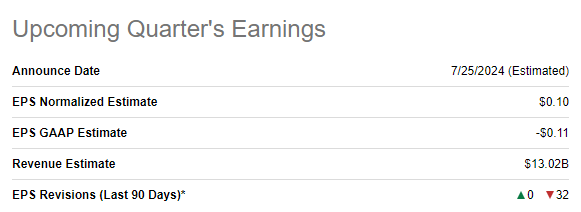

The upcoming earnings release is scheduled for July 25. Consensus estimates expect Q2 revenue to be $13.02 billion, almost flat on a YoY basis. The adjusted EPS is expected to shrink from $0.13 to $0.10 YoY. Overall, there were 32 downward EPS revisions over the last 90 days, a massive bearish indicator.

Seeking Alpha

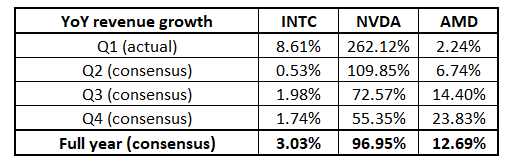

The last quarter’s decent 8.6% revenue growth should not mislead investors. As we see, Q2 revenue is expected to be almost flat. In the below table I summarize 2024 revenue dynamic by quarters for INTC, NVDA and AMD. There is nothing to say about NVDA because this company’s revenue growth is a dream away from both INTC and AMD. A big red flag is that for the full year, INTC is expected to deliver a mere 3% revenue growth, in line with the current inflation level. It means that INTC will not deliver any real revenue growth if inflation is deducted. Intel’s expected revenue growth is expected to be way behind AMD.

Compiled by the author

This revenue dynamic is screaming about Intel’s fundamental problems. The company does not drive revenue growth even in the current extremely favorable environment when hyper scalers pour tens of billions of dollars into data centers.

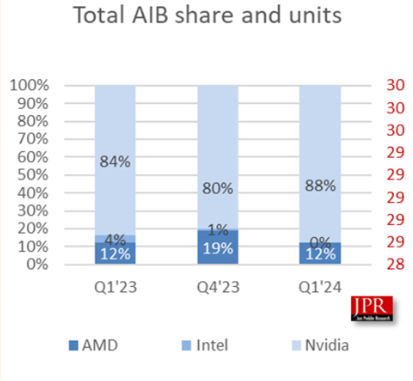

The fact that INTC is unable to absorb massive AI tailwinds is also underscored by the recent information that Nvidia erased Intel’s market share in GPUs to zero after Q1 2024 earnings were released by all three companies. This is remarkable, especially considering that in Q1 2023 INTC held a 4% market share, which decreased to 1% by the end of the last year. This market share dynamic indicates that INTC is unable to compete in the GPUs industry.

JPR

To conclude, I am extremely bearish about INTC. The company’s revenue stagnates in the booming industry backed by massive AI momentum. The balance sheet is weak compared to AMD and Nvidia, which makes INTC much less equipped to compete in terms of innovation. The company had a tiny market share in the GPU industry but was not able to maintain even its small piece of the rapidly expanding pie.

Valuation update

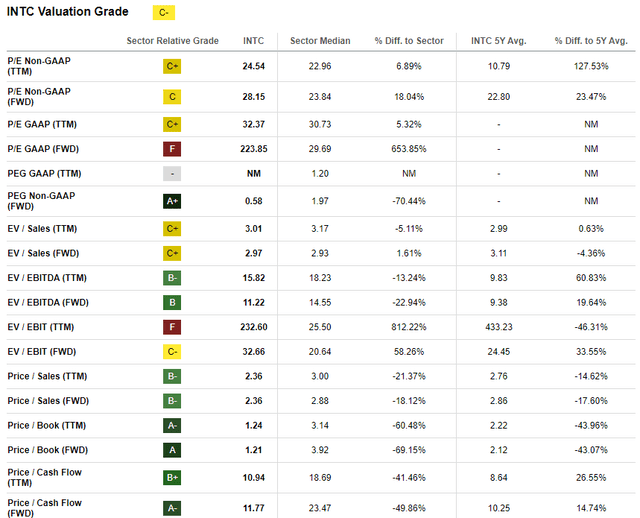

Intel declined by around 40% YTD, substantially lagging behind the broader U.S. market as well as the iShares Semiconductor ETF (SOXX), which gained 30% since the beginning of 2024. Intel has a “C-” valuation grade from Seeking Alpha Quant, meaning that the stock is approximately fairly valued. However, a 28 forward non-GAAP P/E ratio is sky-high for a company with stagnating financials and weak strategic positioning in AI.

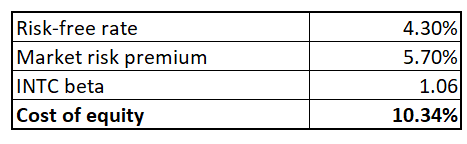

To figure out Intel’s fair share price, I want to calculate the dividend discount model [DDM]. I need to figure out the cost of equity using the CAPM approach. All assumptions for the cost of equity calculation are publicly available. The risk-free rate is the current 10-year Treasury bonds’ yield.

Author’s calculations

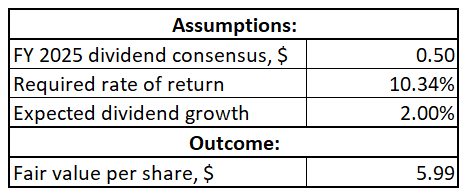

To calculate target price for the next twelve months, I take FY 2025 consensus dividend estimate of $0.50. INTC’s dividend growth track record is poor with negative last decade’s CAGR. Therefore, I incorporate a 2% dividend growth in line with long-term inflation rates.

Author’s calculations

Based on the DDM, fair share price is $6. It is five times lower than the current market price. While I am extremely bearish about INTC, it is difficult to believe that a fair share price can be that low.

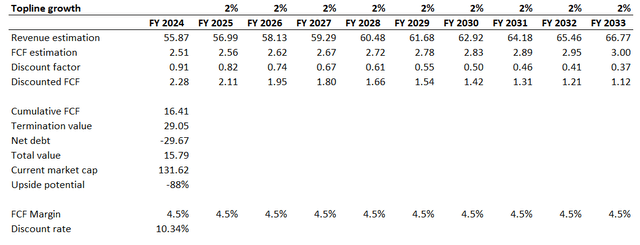

Therefore, I must simulate the discounted cash flow [DCF] model as well. To be able to compare apples to apples, I will use the same discount rate as for the DDM. Since INTC’s revenue stagnates, I cannot give it a revenue grow rate above the 2% inflation rule of thumb. I use a flat 4.5% FCF margin, which is INTC’s last five years’ average.

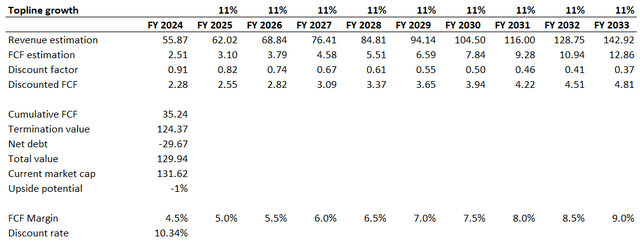

As we see, the business’s fair value is far below its market capitalization. I will not suggest any target price for INTC, I can only conclude that the stock is overvalued. To justify its current valuation, INTC must deliver an 11% revenue CAGR over the next decade and expand its FCF margin by 50 basis points every year.

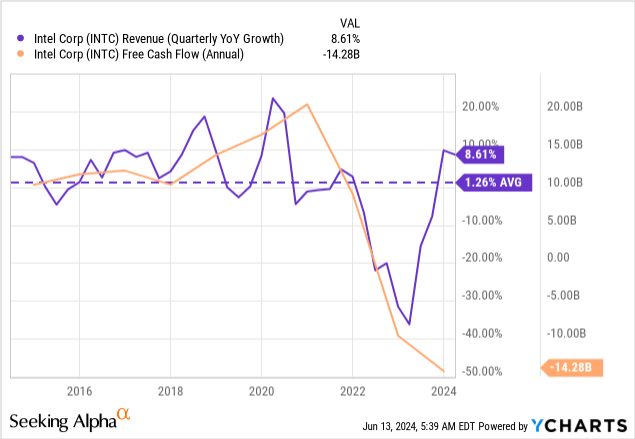

Achieving an 11% revenue CAGR and consistent FCF margin expansion looks unlikely given INTC’s last decade’s decline in revenue and FCF. Over the last decade, INTC delivered a 1.26% revenue CAGR, and I see no reason for the topline growth to suddenly spike to 11% per year.

Risks to my bearish thesis

In 2023 Intel had the same fundamental weaknesses, but nevertheless the stock rallied by 90% in 2023. The AI boom in the stock market fueled lots of semiconductor stocks, while not all of them have strong AI exposure. Intel is a widely known company with a vibrant brand, and this might be misleading for some investors who think that buying INTC will give them strong AI exposure. Therefore, there will always be a risk that rallies in semiconductor superstars like Nvidia and Broadcom (AVGO) can drag INTC up as well.

Intel’s business model differs from AMD and Nvidia because INTC owns and operates its own manufacturing facilities. Amid the strained relationship between China and the U.S., Joe Biden’s administration grant governmental support to companies owning their own foundries to relocate their production capacity to the U.S. Under the CHIPS and Science Act, Intel gets governmental support amounting to billions of dollars. Under this program, INTC might conduct a turnaround which will help the company to reset its struggles of past years and start from the blank sheet to operate more efficiently.

Apart from investing heavily in its capital facilities, INTC also invests billions in R&D. This means that there is always a possibility that the company can present a disruptive product to the market. Given all the fundamental flaws, I think that the probability of such a scenario is extremely low, but the positive magnitude might be significant.

Bottom line

To conclude, INTC is a “Strong Sell”. If the company is not able to absorb current massive tailwinds, imagine what INTC will demonstrate when tailwinds cool down. The company lost even its tiny 1% market share in GPUs, meaning that Intel’s exposure to AI is really low. The balance sheet is much weaker compared to AMD and NVDA, making Intel less prepared to compete in terms of innovation. Valuation does not look attractive as well as three different methods suggest substantial overvaluation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.