Summary:

- The fall in consumer demand for electronics due to the macroeconomic situation will continue to put pressure on the financial results of Intel.

- The technological gap between Intel and AMD is still wide.

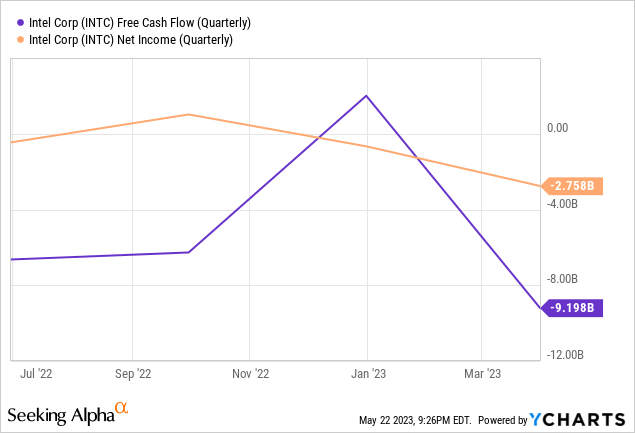

- Intel’s FCF and net income are in a deep negative zone.

- You shouldn’t be greedy when others are fearful this time.

JHVEPhoto

Main thesis

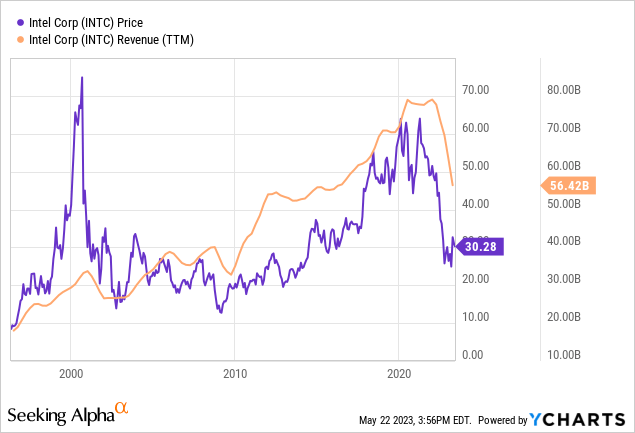

Intel’s (NASDAQ:INTC) value has been decreasing for over 2 years now and there are no signs of improvement. In fact, it’s only getting worse: the technological gap is widening and the health of the balance sheet is deteriorating. The corporation’s problems are escalating from quarter to quarter. And although the financial bottom is most likely already passed, I think investors’ fears quite rightly reflect the problems of Intel.

Macro turmoil

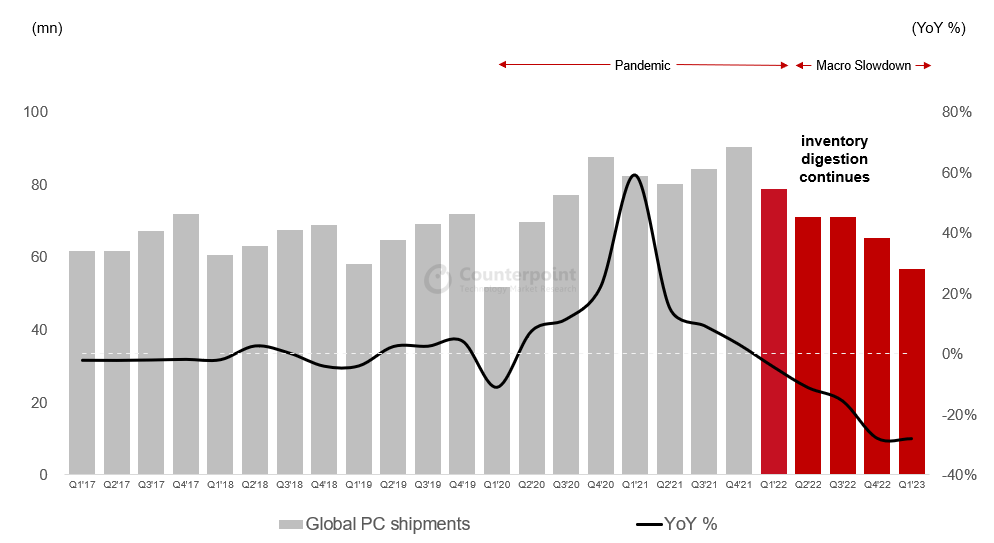

The global PC market is in a deep recession, mainly due to inventory digestion that ballooned back in 2021. Shipments continue to fall sharply as they shrunk 28% YoY in Q1. Intel’s key market has been in recession for a year now. The end of the inventory digestion suggests that the market may start to slowly recover in H2 of 2023.

Counterpoint Research

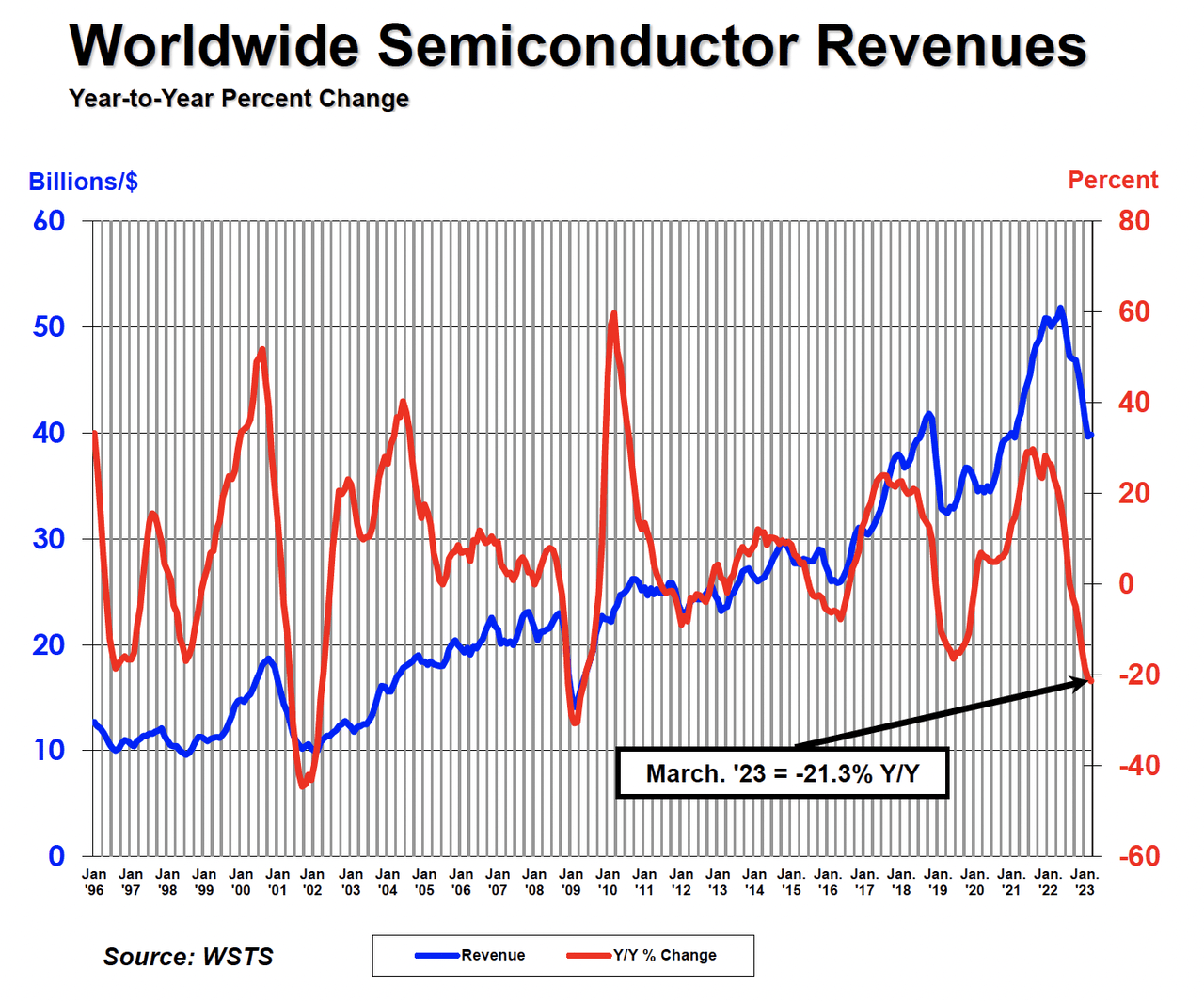

So, due to the failure of consumer demand for electronics, semiconductor sales are declining at a record pace.

As a result, the first quarter was one of the worst quarters in Intel’s history in terms of sales decrease and the depth of net loss. In Q2, management expects revenue in the range of $11.5-12.5 billion (vs $11.7 billion in Q1), despite the fact that the macroeconomic situation and the level of stocks of finished goods remain highly uncertain. In addition, the gross margin forecast also assumes an improvement from 34.2% to 37.5%. We can say that Intel has likely found the financial bottom in the previous quarter. However, it does not mean that a steady recovery to 2021 or even pre-COVID levels is on the way.

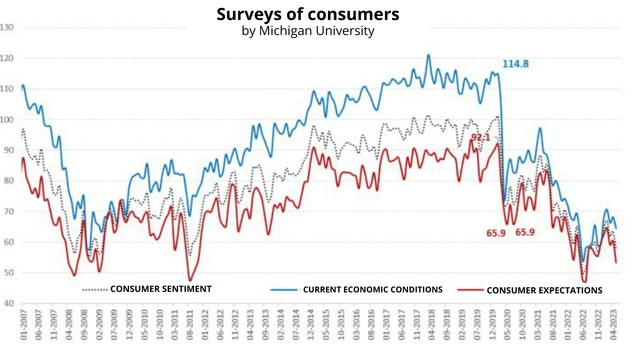

Looking forward, there is no evidence of rising demand for electronics in the next 12 months due to the recession which looks inevitable. In early May, the US consumer sentiment index, according to the University of Michigan, fell to a semi-annual low of 57.7 and this time expectations were falling rapidly. Moreover, long-term economic expectations are also declining, Americans don’t believe in a soft landing.

Technological gap

The technological gap between Intel and its competitors is still wide. One of the reasons is the slowdown in innovation: every 5 years or so, Intel introduces radically new products and then it monitors competitors and modificates the ones that hit the market. Correlating, revenues rose sharply and then went into a long sideways cycle, there have been 4 such cycles since the late 1990s.

The company was damaged by the imperfection in production: a number of wrong decisions led to delays in the development of new products in recent years. AMD (AMD) completely outsourced the creation of chips to TSMC (TSM) and got the release of capital from the need to build their own facilities, as well as efficient and much more technological production, since Taiwan Semiconductor is a recognized leader in this field with huge resources. On the other hand, Intel was increasing costs, trying to establish its own production and at the same time cooperating with contract manufacturers.

Intel’s latest innovations, apart from Xeon Sapphire Rapids, are Core processors of Raptor Lake series. This is a development of the Alder Lake line in terms of layout (high-performance and energy-efficient cores on one chip), but the new processors have received a serious performance boost. Nevertheless, it is still 10-nm, Intel itself can’t switch to more modern production standards. The company is too late: AMD is fully mastering the 5 nm and preparing for the transition to 3 nm, Intel is stomping on 10 nm, the 11th generation processors are inferior to AMD on the technical side, especially on energy efficiency.

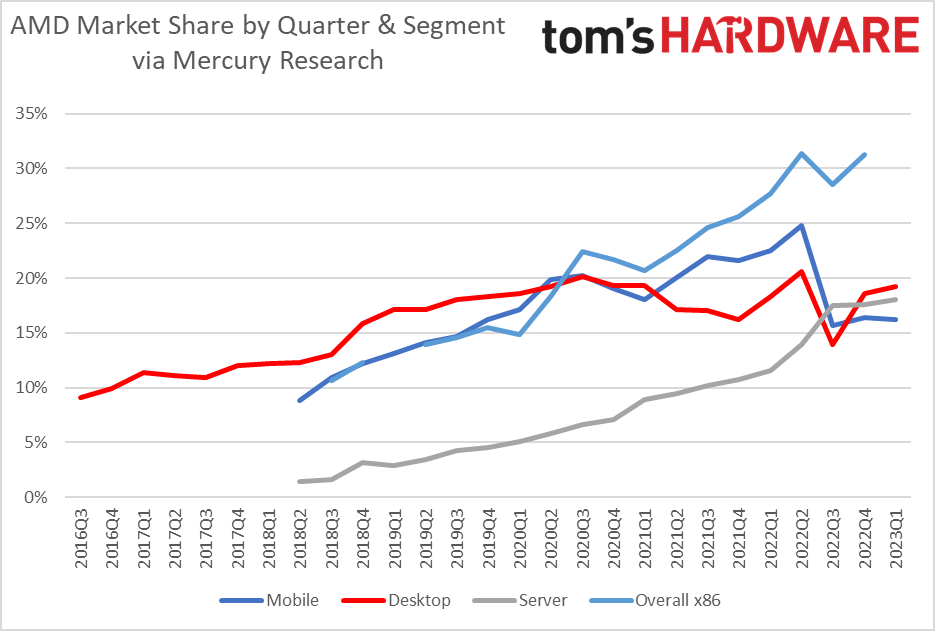

AMD has almost tripled its share of the x86 processor segment over the past four years. Its share already exceeds 31%, up from 12.4% at the end of 2018. The key to AMD’s success has been its EPYC server processors, which have displaced Intel Xeon from the server market. The new Ryzen desktop and mobile CPUs are also contributing. The results AMD has achieved in the last four years are still very far from their peak. 2023 will likely be the year of even stronger strengthening of the company’s position in the server segment, both through Epyc and Instinct line growth.

Tom’s Hardware

Balance sheet is deteriorating

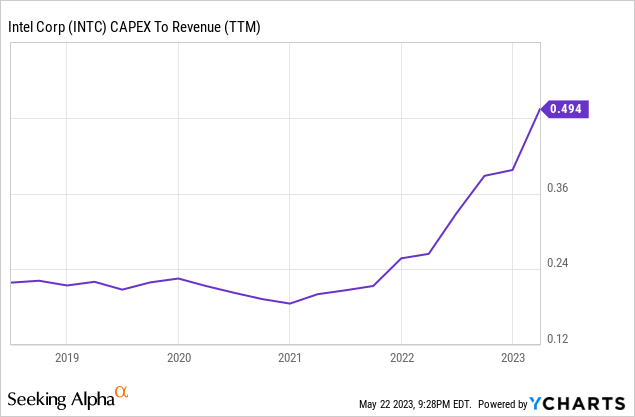

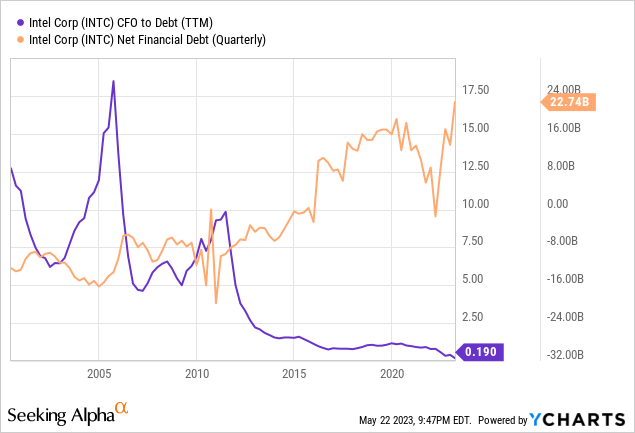

All in all, Intel continues to lose ground at record pace. To stop the growth of a competitor, the company needs serious investments. The “5 nodes in 4 Years” plan is extremely expensive: Intel’s net profit and free cash flow went deep into the negative due to weak financial results and rapid growth capital costs.

Therefore, it is reasonable to expect FCF for 2023-2024 to remain negative with CAPEX/Revenue in the 35-50% range.

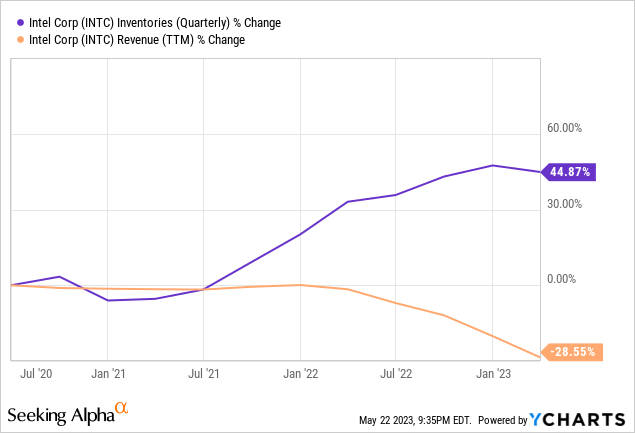

At the same time, the corporation is facing ballooning inventories that are not in line with the demand for its products.

Intel would also struggle with getting external financing as it doesn’t generate enough operational cash flow to cover its total debt. This is a huge liquidity problem.

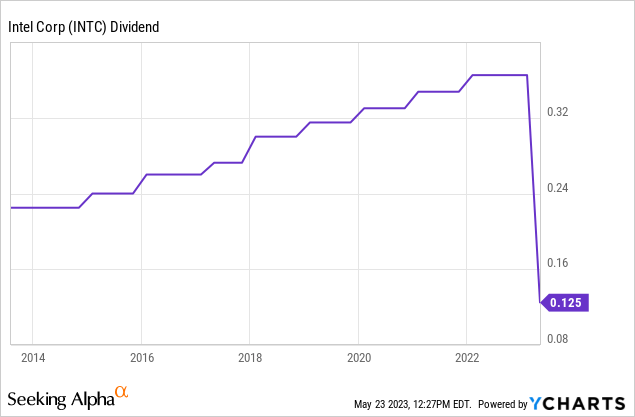

Dividend cuts

At the beginning of 2023, Intel management announced a sharp reduction in dividends by 66% from the 2022 levels. Payments to shareholders are now at their lowest since 2007.

Thus, forward dividend yield (NTM) is only estimated at 1.69%, which highlights the unattractiveness of Intel as a value stock.

Valuation

|

Company |

P/E 2024(E) |

EV/EBITDA 2024(E) |

|---|---|---|

|

Intel |

17.3 |

8 |

|

GlobalFoundries |

19.3 |

8.5 |

|

AMD |

26.1 |

15.5 |

|

Semiconductor Manufacturing International |

23 |

8 |

|

Broadcom |

15 |

10.5 |

|

Taiwan Semiconductor Manufacturing |

14.4 |

7.1 |

|

Samsung Electronics |

15.1 |

4.3 |

|

Average (of Intel’s peers) |

18.8 (+8%) |

9 (+12.5%) |

As we can see, Intel appears to be slightly undervalued to its peers, although the earnings and EBITDA estimates for 2024 are quite optimistic.

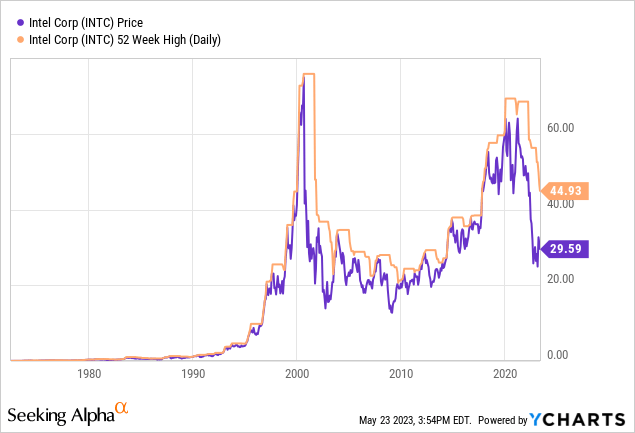

Extreme fear prevails

Intel hasn’t seen a downward cycle like this since the dot-com bubble burst. It is currently down 55% from 2021 high and 33% from 52 week high.

Conclusion: Should you be greedy when others are fearful?

Warren Buffett’s lifelong rule has always been ‘Be greedy when others are fearful’. However, he has another lifelong rule to stick to successful companies that have wide moats and bright future ahead of them. That’s not the case for Intel. Intel is just at the beginning of a big transitional phase. The company in the next few years will not even try to regain the status of the undisputed leader, but simply stop the loss of positions. This process will be fueled by a giant CAPEX, low liquidity cushion, low revenue growth and low dividends. While the corporation still has moats surrounding its business, like great scale and brand value, they shrink every year. The Intel’s case is full of uncertainty given macroeconomic downturn, positions loss and dividend cuts.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.