Summary:

- Intel’s only consistent area is disappointing investor expectations, indicating continued struggles for the company.

- Liquidity-preserving events such as dividend suspensions and headcount reductions suggest that the company’s liquidity profile may deteriorate further and affect a successful turnaround.

- Geopolitical tensions between the United States and China are likely to continue affecting company sales, adding further headwinds to an already dire situation.

- Foundry ambition sounds lucrative but merely masks the company’s real problems. Moreover, Intel’s foundry will likely fail to offset any potential sales losses in recent years.

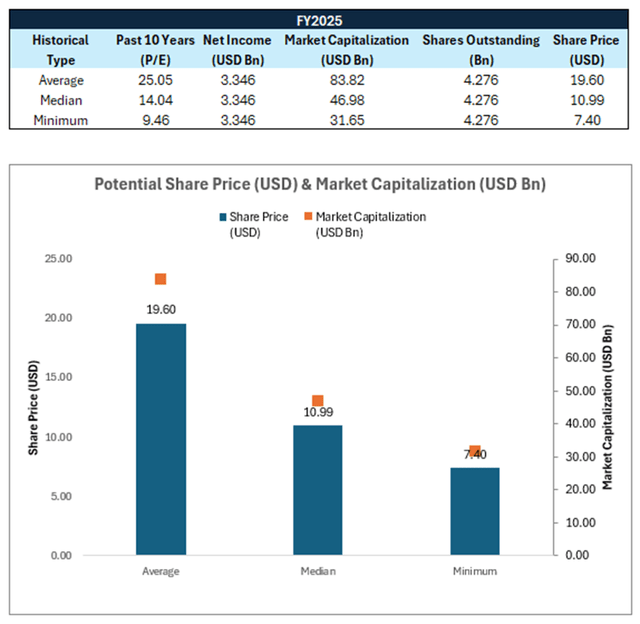

- Do not fall for the illusion of value. Share prices may seem attractive, but further investigation yields that Intel should trade between USD 10.99 and USD 19.60.

sankai

Introduction

As someone who loves turnaround situations, I have been monitoring Intel Corporation (NASDAQ:INTC) ever since Pat Gelsinger took over in 2021. Unfortunately, even with Pat’s technical experience, Intel has yet to show any concrete signs of recovery. The recent developments of the company suggest that persistent headwinds will continue to challenge Intel, and it is unlikely that we will see any near-term positive catalyst. In this initiation report, I will demonstrate why investors should continue to exercise patience and avoid being tempted by the recent decline in the company’s share price.

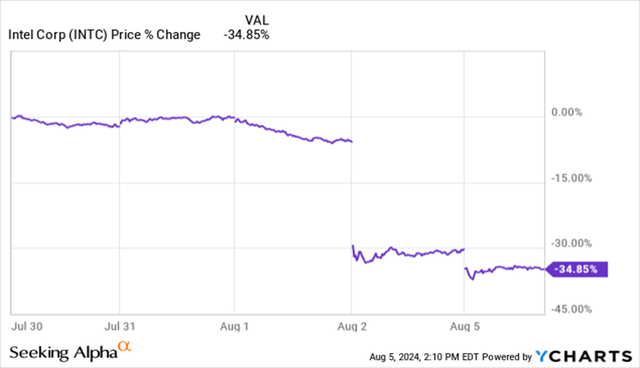

Consistently Disappointing Investor’s Expectations

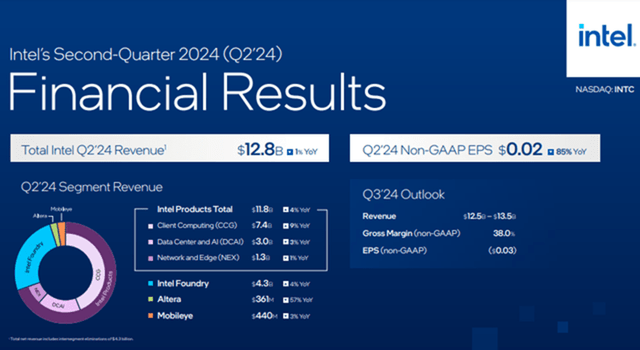

On 1st August 2024, Intel’s share price fell more than 25% after reporting disappointing financial performance. Intel reported revenue and EPS of $12.93 billion and $0.10, missing consensus estimates once again. In addition, gross margins have deteriorated by 0.40% to 35.40% as compared to 2Q23 while operating expenses have substantially weakened to -15.30% from 7.8% in 2Q23. Not surprisingly, this was the third consecutive time where revenue missed street expectations.

Besides the company’s underwhelming performance, Intel also posted soft guidance. For 3Q24, Intel expects revenue of between $12.5 billion and $13.5 billion, representing a sales decline of between 4.6% and 11.72% year-on-year. The gross profit margin will continue to decline as the company continues to be reliant on external wafers for its AI PC products; investors should expect the gross profit margin for 3Q24 to be approximately 38%, deteriorating by at least 70 basis points as compared to this quarter.

2Q24 Earnings Infographic (Intel)

Unfortunately, there were no indications that this phase of missing estimates and poor guidance would end any time soon. After all, even Intel’s CFO, David Zinsner has stated in the latest earnings call, “We expect customers to reduce inventory over the second half of the year, along with the continued modest negative impact from export controls.” Although Intel has indicated that 4Q24 results will be slightly better due to improved inventory levels in 3Q24, we should not be surprised if the company misses street estimates again.

Liquidity-Preserving Initiatives a Cause for Concern

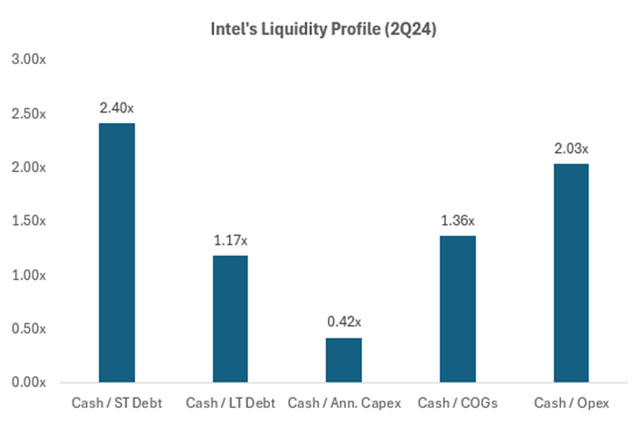

Apart from the poor financial results and soft guidance, the company’s management has stated that Intel will embark on various initiatives to preserve liquidity. For a company that is relying on a capital-intensive foundry ambition to maintain investors’ confidence, this sudden need to preserve capital is alarming and often suggests the emergence of a liquidity crisis.

2Q24 Liquidity Profile (Intel’s 10-Q)

As an initial but significant measure, Intel will reduce headcounts by more than 15% by the end of 2025. This headcount reduction represents more than 18,000 employees and will reduce the company’s operating expenses to approximately $20 billion and $17.5 billion for FY2024 and FY2025 respectively. Unfortunately, it is not immediately clear what types of positions will be affected; at this stage, I can only hope that this wave of layoffs will not be a net drag on the company’s financial position over time.

In addition, Intel will reduce gross capital expenditures by more than 20% to between $25 billion to $27 billion for FY2024. However, it is important to note that overall capital expenditures are expected to remain high as Intel is still in the formative stage of its foundry vision; gross capital expenditures for FY2025 are likely to remain between $20 billion and $23 billion. Although Intel is receiving billions of dollars from the Biden Administration, the company neither could generate sufficient cash flow to sustain its high burn nor have enough cash to consistently fund its foundry ambitions; current cash to capex is estimated to be 0.42x. Rating agencies have already downgraded Intel’s credit ratings due to high capital expenditures, elevated leverage, and poorer operating performance.

Cementing the bleak liquidity outlook, Intel will cease all dividend payments from 4Q24. Although the company pays merely 2.33% in annualized dividends, there are many ETF issuers and investors that include Intel as an income-generating asset in their portfolios. It is likely that the capitulation of Intel’s share price is just the beginning, and we should expect further deterioration in the company’s share price as investors rebalance their portfolios to exclude Intel.

Revenue Contribution from China Often Overlooked as a Significant Risk

The effects of the “technological war” between the United States and China are often overlooked and under-discussed. Besides a deteriorating business outlook and a poor liquidity profile, the effects of geopolitical tensions are likely to continue weighing on Intel.

Lately, in favour of domestic chip producers, China has banned the use of foreign chips in Chinese government computers and servers; there are only 18 approved processors and renowned brands such as Intel or Advanced Micro Devices, Inc. (AMD) has failed to make the list. This is likely the tip of the spear as China has a history of prohibiting adversarial technologies for the government, which often leads to further capitulation of market share to their domestic counterparts even in the consumer market.

Unfortunately for Intel, the United States is also acting in a similar fashion. Recently, Intel was banned from exporting CPU processors to China’s Huawei, leading the company to issue a revenue warning for its latest quarter. The United States will continue to impose export controls on chips, eventually hindering Intel’s efforts to sell in China. It is important to highlight that China is Intel’s largest market by geography, representing more than 25% of the company’s total revenue. For context, revenue from China has already declined by more than 35% from $23 billion in FY2021 to $14.85 billion in FY2023. Further revenue deterioration from China is disastrous for a company that is already struggling with a potential liquidity crisis.

We are still in the beginning phases of a protracted technological and economic war. The geopolitical tensions between the United States and China are unlikely to ease anytime soon. In fact, China is expecting more export controls from the United States and is already stockpiling chips; it is a shame that these chips are not intel chips. As we continue to monitor Intel’s path to turnaround, we must also factor in the potential revenue decay that the company will inevitably see from this region.

Reviving Other Business Segments Seem More Crucial than Intel’s Foundry Ambition

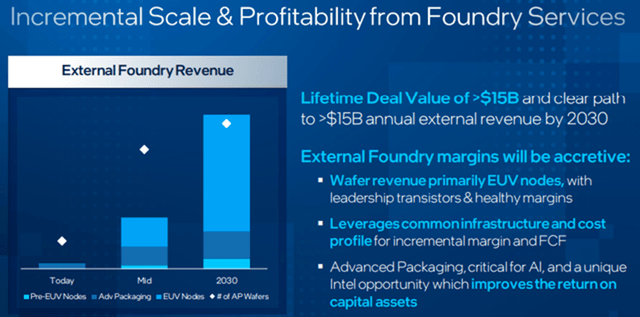

External Foundry Revenue (Intel’s New Segment Reporting Webinar)

In recent years, Intel has been hyping up the prospects of its foundry ambition to appeal to more investors and bolster the confidence of existing shareholders. According to an interview with Pat Gelsinger, Intel’s Foundry is expected to breakeven by FY2027 and achieve a double-digit return on invested capital by FY2030.

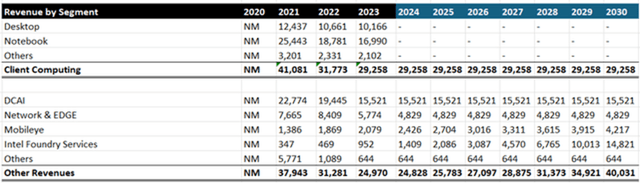

Revenue By Segment (Author’s Projection)

Although these figures sound extremely lucrative and suggest that a successful foundry is the key to reclaiming Intel’s former glory, the foundry is expected to only generate $15 billion in annual revenue by FY2030. $15 billion is hardly enough to offset the previously lost sales in all its business units in recent years. For context, Intel’s revenue has deteriorated from $79 billion in FY2021 to $54.22 billion in FY2023, representing a decline of more than 30% over the past two years.

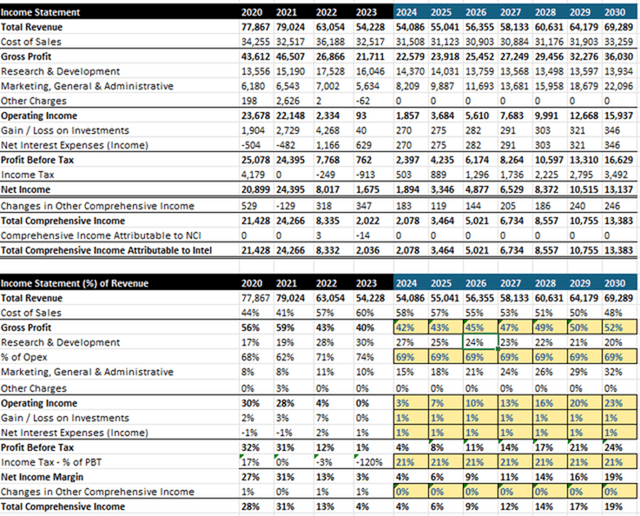

Income Statement Projection (Author’s Projection)

Based on my analysis, if Intel achieves its foundry targets, optimizes its costs gradually, and maintains its revenue in its core business segments, the company will generate a total revenue and net income of merely $69.28 billion and $13.13 billion respectively. Moreover, these figures have yet to factor in any revenue deterioration due to geopolitical tensions and cannibalization by other competitors. This is far from the successful turnaround that I envision for the former king of microchips.

At the end of the day, Intel cannot run away from its actual problem. Although the foundry is an important growth driver, it is more important for us to continue to assess Intel’s ability to maintain its core business units and not be deceived by the smoke and mirrors of the company’s foundry ambition. In recent years, the company has allowed key competitors to continue flourishing, lost important customers, and failed to capitalize on the AI investment cycle; unfortunately, until today, Intel has been unable to address these issues.

Do Not Fall for the Illusion of Value

On a year-to-date basis, the company has fallen more than 50%. Like most investors, I have been tempted to accumulate shares in this company multiple times. However, a careful valuation analysis, even in an optimistic scenario, suggests that the company is overvalued.

FY2025 Valuation Analysis (Author’s Projection)

If Intel maintains its current revenue levels (which is unlikely given that sales have been deteriorating consistently), achieves its foundry targets, and improves operating margins by optimizing expenses, the company should be able to generate $55.04 billion and $3.34 billion in revenue and net income respectively for FY2025. Historically, Intel’s normalized price-earnings ratio trades between 14.04x to 25.05x. Utilizing these multiples on our projected net income, Intel’s share price should range between $10.99 and $19.60.

Given that the current share price at the time of writing is $20.11, there is little to no upside to justify the risks that investors will be exposed to. The risk-to-reward profile is heavily skewed towards the downside, suggesting that it is prudent for investors to continue exercising patience until there are more concrete indications of a successful turnaround.

Closing Remarks

Investors who tend to focus on special situations and turnaround opportunities are likely to have been tempted multiple times by this ostensibly cheap company. However, my analysis suggests that Intel is far from being a worthwhile investment.

Ever since Pat Gelsinger has taken over Intel, the company has not shown any concrete signs of improvement. Despite his enthusiasm and excitement, the company continues to face headwinds; Intel must continue to navigate its capital-intensive ambition amidst the backdrop of geopolitical tensions and a deteriorating liquidity profile. As evident by the financial performance in recent years, Intel typically struggles in times of crisis.

Until there is any clear evidence that the company is effectively sustaining its current core business units and achieving its foundry targets, investors should continue to resist the temptation to load up shares in Intel. As Peter Lynch once said, “The trick is not to learn to trust your gut feelings, but rather to discipline yourself to ignore them.”

Analyst’s Disclosure: I/we have a beneficial short position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.