Summary:

- Intel Corporation held an investor webinar last week to update customers on IDM 2.0, but the market was disappointed with the prime focus solely on cost savings.

- The company didn’t announce any major customers with IFS while potentially creating a model confusing for internal business units.

- The stock remains expensive, with Intel required to produce a massive EPS rebound to justify $30+ a share.

Justin Sullivan/Getty Images News

The new Intel Corporation (NASDAQ:INTC) foundry model called IDM 2.0 still appears more of an illusion than a great business concept. The chip company still ignores that most top foundry customers are direct competitors with Intel and are highly unlikely to utilize their foundry services. My investment thesis remains Bearish, as the chip giant continues pursuing a failed business plan with external foundry services while promoting internal foundry flexibility.

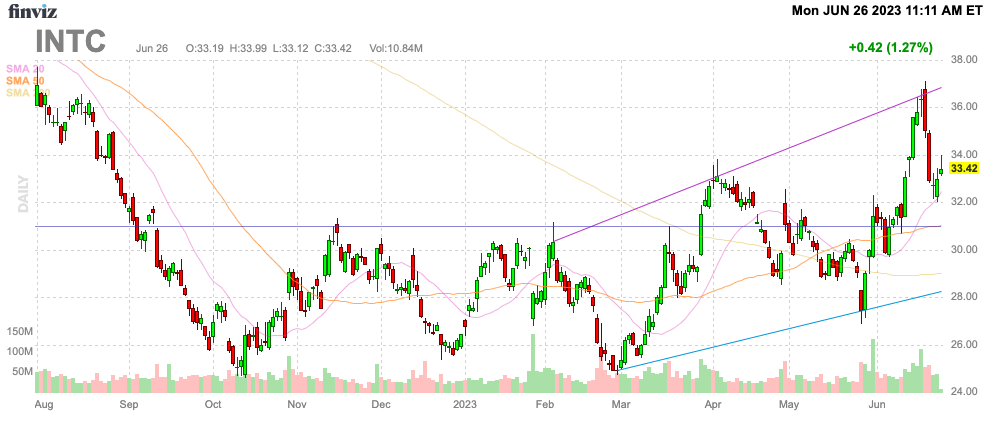

Source: Finviz

Lots Of Illusions

At the Internal Foundry Model Investor webinar last week, Intel failed to announce any major customers for IFS (Intel Foundry Services) and focused almost entirely on cost savings programs. The chip giant continues to pursue the IFS business to limited success despite announcing plans to relaunch the business back in early 202 and invest $1 billion in a fund to drive an innovation ecosystem.

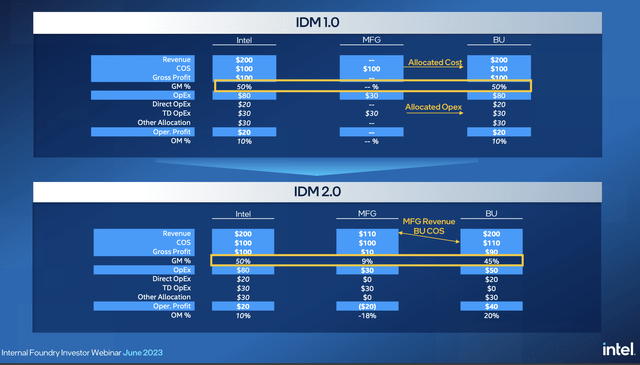

The company updated Wall Street on the plans of the contract chip making business, but management spent most of the time discussing the cost allocation of the updated business model. Intel thinks having a standalone P&L for the manufacturing group will change the dynamics of the group.

Source: Intel Foundry Model presentation

The issue is the dynamic of having a manufacturing unit competing with internal and external customers for the business. What is most important to the manufacturing unit might not be the most important to the chip design units leaving a huge internal struggle.

Ultimately, the problem with the business is the desire of an external customer to utilize the foundry services business. A big aspect of chip design is keeping competitors from being able to copy new chip designs and your competition manufacturing new chips doesn’t appear very ideal or logical.

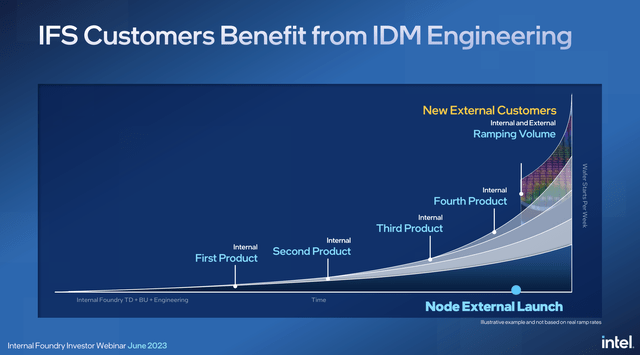

Intel hosted the Intel Foundry Model event on June 21 and the company didn’t announce any new customers. A prime reason could be part of the presentation discussing internal products obtaining first access to new nodes.

Source: Intel Foundry Model presentation

Apparently, external customers would only have access to leading-edge process nodes after Intel has launched up to 4 products with the node. The IFS business won’t sign up any major customer with Taiwan Semiconductor Manufacturing Company Limited (TSM) providing access to leading-edge process nodes immediately due to no internal products.

At the investor webinar, Bank of America analyst Vivek Arya asked Intel management about the prime issue with the new business structure (emphasis added):

Let’s say, one of your product groups wants to go to an external foundry, what flexibility do they really have, because these foundry relationships are done years in advance? And even if that product group leaves, who covers that underutilization charge, right? So, doesn’t in some way this new structure kind of give the illusion of separation and flexibility without actually having the real flexibility that your fabless and foundry competitors are enjoying today?

The answer from the CFO and the VP of Corporate Planning back up the theory of the BofA analyst. The business units of Intel have limited actual flexibility to use outside foundry space and external customers are likely to not trust the separation of the manufacturing business providing nothing more than an illusion.

Cost Structure

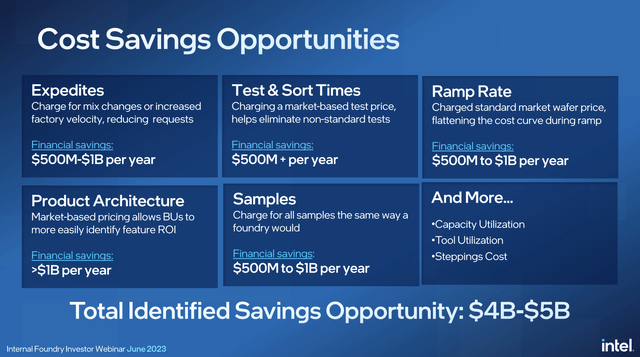

The new business model is nothing more than accounting changes amongst the business units. Intel forecasts another $4 to $5 billion in annual savings from IDM 2.0 due to the business units boring industry costs.

Source: Intel Foundry Model presentation

The company identified areas where the business units were expediting orders and the cost of workflow disruptions while testing was taking longer due to inefficiencies in the business model. What ultimately matters is whether IDM 2.0 delivers 5 nodes in 4 years. Intel can generate all the cost savings in the world, but the chip giant needs a technology process leadership to compete in foundry services.

Intel is busy planning new fabs all around the globe with plans in Germany and Israel progressing in the last few weeks. The company is busy working up government subsidies which again should be the secondary goal with process leadership and new foundry customers the ultimate goal.

Analysts have earnings snapping back over the next couple of years to justify the current stock price. Our view is that Intel won’t achieve meaningful profit growth due to the business spinning their wheels changing the business model and only creating an illusion of progress while potentially creating an internal struggle.

Takeaway

The key investor takeaway is that Intel continues working towards setting up IDM 2.0 only creating an illusion of a flexible business acquiring external customers.

Investors should avoid Intel Corporation stock, with the requirement for a substantial EPS rebound to even justify the current price at $33.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.