Summary:

- Intel stock has found a consolidation zone above the $20 level as its selling intensity normalized.

- CEO Pat Gelsinger attempts to assure investors of Intel’s roadmap, bolstered by its foundry partnership with AWS.

- Intel could benefit from a cyclical recovery in its client business through 2026, but execution risks remain high.

- INTC is also not valued at a discount, suggesting plenty of room for disappointment.

- I explain why investors should consider staying away from Intel’s sinking ship, as the risk/reward upside isn’t attractive enough. Read on to find out more.

hapabapa

Intel’s Struggles Not Expected To Be Over

Intel Corporation (NASDAQ:INTC) (NEOE:INTC:CA) investors have endured a challenging two months, although its bearish momentum has normalized since falling to its early August lows. As a result, INTC remains well-supported above its $20 level, as dip-buyers sought an opportunity to buy into its recent battering.

The former King of semis has attempted to calm investors’ nerves, as CEO Pat Gelsinger clarified its roadmap in a recent pivotal release. Gelsinger sensed the market needs help in assessing INTC’s directional bias, as he underscored, “there has been no shortage of rumors and speculation” since its Q2 earnings release in early August 2024.

In my previous INTC update, I urged caution on the stock, as its execution missteps have disappointed massively. Hence, it has led to significant doubts about its ability to turn around as the company flounders.

As a reminder, Wall Street estimates on Intel have been downgraded as the market worries about its ability to execute a sustained turnaround across its ecosystem. Intel has struggled on most fronts, as it failed to keep pace with AMD (AMD) and NVIDIA (NVDA) in the data center space. Nvidia’s AI clusters are expected to gain even more traction with the hyperscalers and big tech. Therefore, Intel’s inability to follow closely and participate in the AI growth inflection could leave it vulnerable to potentially more significant market share losses.

Intel Foundry Faces A Monumental Task Against TSMC

Nvidia CEO Jensen Huang recently underscored his belief in TSMC’s (TSM) foundry leadership and the gap the Taiwanese foundry has created with its peers. Accordingly, Huang highlighted Nvidia is “fabbing at TSMC because it’s the world’s best, and it’s the world’s best not by a small margin; it’s the world’s best by an incredible margin.” He went further, articulating that Nvidia’s “hockey stick” inflection is predicated on the remarkable ability and responsiveness of its supply chain partners, including TSMC. Therefore, Intel’s ability to close the gap against TSMC has likely taken a significant hit, as it failed to convince the market of its ability to be a reliable foundry partner at TSMC’s level.

In its recent pivotal update, Gelsinger shared critical and timely information that Intel has won the nod of Amazon Web Services (AMZN) on a “multi-year, multi-billion-dollar framework covering product and wafers from Intel.” Winning the approval of AWS to fab its AI fabric chip and a custom Xeon 6 chip are assessed to be crucial developments in Intel Foundry’s roadmap. Hence, it could validate the transformational potential and ambitions of Intel Foundry’s five nodes in four years project.

Notwithstanding Intel’s optimism, I assess that the market will likely be cautious about reading too much into the partnership with AWS. It was reported earlier this year that AWS struggled to convince its customers to use its current custom AI chips (based on TSMC’s process nodes). Hence, Nvidia’s market-leading AI chips are expected to maintain their dominance, bolstered by its proprietary CUDA software stack and networking technologies. Moreover, I assess that there aren’t sufficient details on how the Amazon partnership could pan out, which could have helped investors better evaluate the volume growth and yields. While winning AWS as a customer is a significant milestone worth celebrating, I believe the market will likely need more solid proof points to move further ahead.

Intel’s Worst Could Be Over, But Execution Risks Are High

Wall Street is likely confident in management’s decision to turn Intel Foundry into an independent subsidiary. As a result, it could lend credence and assurances to its semiconductor rivals about leveraging Intel to fab their designs. In addition, it is expected to create a more level playing field for its business divisions and external customers, potentially helping to close the gap with TSMC.

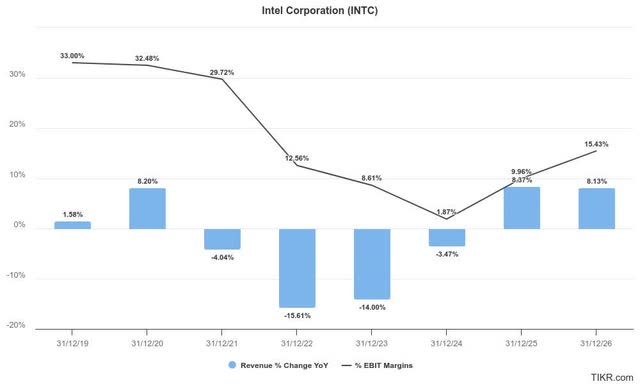

Notwithstanding the downgrades, Wall Street expects Intel’s cost-cutting efforts to pan out, coupled with the cyclical recovery of its client business segment. As a result, a revenue and profitability growth inflection could follow through FY2026 as Intel scales back on its aggressive CapEx expansion.

In addition, the US government seems committed to bolstering Intel’s ability to succeed in its foundry business, given the recent grants provided to the company. While still early, winning AWS’s business should be considered a crucial milestone in Intel Foundry’s ability to compete effectively against TSMC. Hence, the market has likely priced in significant pessimism against INTC.

Is INTC Stock A Buy, Sell, Or Hold?

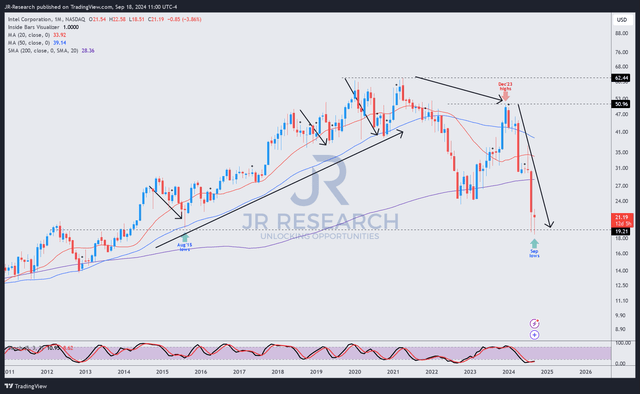

INTC price chart (weekly, medium-term) (TradingView)

INTC’s “D” valuation grade suggests it isn’t assessed to be undervalued. Its forward-adjusted PEG ratio of 2.07 is more than 10% above its sector median. Hence, the market has likely lost confidence in its ability to execute immaculately across its ecosystem.

Notwithstanding my caution, INTC’s consolidation over the past two months suggests further potential downside seems increasingly unlikely, given the possible growth inflection opportunity through 2026.

Despite that, I assess that INTC has decisively lost its uptrend bias, behooving caution about its bullish thesis. While being bearish seems too aggressive at the current juncture, I have not determined sufficient reasons for investors to buy INTC’s battered thesis at the current levels.

Intel’s turnaround plan has yet to pan out. Its inability to capitalize on the AI surge could be telling, as Nvidia pulls further ahead. Huang’s candid commentary about TSMC’s leadership suggests that winning more businesses beyond AWS could be increasingly challenging.

In a cutthroat AI business, the leading AI chips companies likely have little margin for error. Nvidia’s Blackwell delay underscores the increased complexity of fabricating cutting-edge AI chips. Therefore, it seems unlikely these companies would risk their current supply chain reliability (with TSMC as the leading foundry partner) to support Intel’s domestic manufacturing ambitions.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!