Intel: Half A Billion Of Gaudi 3’s Revenue In 2H FY24 Is Not Amazing

Summary:

- Intel’s Q1 FY24 results show weak growth in Mobileye and FPGA businesses, with a disappointing 5% growth in Data Center and AI business.

- Intel’s GPU technology lags behind competitors like Nvidia and AMD.

- Intel’s forecast for Gaudi 3’s revenue is mediocre compared to Nvidia’s data center business revenue.

JHVEPhoto

I presented my bearish view on Intel (NASDAQ:INTC) in my previous article published in January 2024. I pointed out inventory correction issues in Mobileye (MBLY) and FPGA businesses, which could cause a weak growth in the first half of FY24. Intel released their Q1 FY24 result on April 25th with a weak Q2 forecast. I think their GPU technology lags at least one process node behind Nvidia (NVDA) and the guidance of $500 million of Gaudi 3’s revenue is quite mediocre. I reiterate a ‘Sell’ rating with the fair value of $26 per share.

Inventory Destocking and Moderate Data Center/AI Growth

During Q1 FY24, they delivered 8.6% growth in revenue with 5.7% of adjusted operating margin. As mentioned in my previous report, Intel is experiencing strong inventory corrections in its Mobileye and FPGA businesses. Please note that Intel rebranded their FPGA business to Altera, with plans to bring in private equity investors and IPO later.

As a result of the end-market destocking, Mobileye dropped by 48% in revenue year-over-year, and Altera declined by 58% year-over-year. My biggest disappointment in their Q1 earning is not the destocking activities, instead, it is the fact that their Data Center and AI business only grew by 5% in the quarter. Considering the rapid growth in AI and data center capex, I couldn’t imagine Intel can only deliver 5% growth. Apparently, Intel continues to lose market share to their competitors like Nvidia and AMD (AMD).

As a reference, Nvidia’s data center business grew by 409% year-over-year in Q4 FY23, and AMD delivered 38% of growth in their data centre business in Q4 FY23.

Intel expects their Gaudi 3 to achieve around half a billion in revenue in the second half of FY24, and I find the growth expectation to be quite mediocre. Gaudi 3 uses the same process node ((5-namometer)) as Nvidia’s H100 and H200. According to IEEE Spectrum, Gaudi 3 has more HBM than H100, but less than H200, B200, or AMD’s MI300, as depicted in the chart below.

In addition, Nvidia has already announced their Blackwell platform with 4-nanometer process technology, and many large enterprises, including Amazon (AMZN), Google (GOOGL), Dell (DELL), Meta (META), Microsoft (MSFT), Open AI, Oracle (ORCL), Tesla (TSLA) and xAI, are expected to adopt Blackwell platform. It appears that Intel’s GPU technology is at least one process node lagging behind Nvidia. Nvidia generated $18.4 billion of revenue in their data center business in the last quarter; therefore, Intel’s $500 million full-year revenue expectation for Gaudi 3 is just a drop in the bucket.

FY24 Forecast

Intel guides for $12.5-$13.5 billion in revenue and 10 cents of EPS for Q2 FY24, both below the market expectations.

During the earnings call, their management indicated that the weakness in end-market demands and inventory destocking is more severe than they initially expected. They think Q1 would be the bottom of their business growth for the full year, with much of growth expected to be back loaded in the second half.

I am considering the following factors for their FY24 growth:

-Altera and Mobileye: the two businesses combined account for above 4.5% of group revenue. Assuming the inventory destocking activities continue for seveal quarters, their revenues are more likely to drop by 30%-40% for the full year, based on my estimates. As such, it would drag down the total revenue growth by 1.5%-1.8% in FY24, in my view.

– Data Center/AI business: I remain pessimistic about Intel’s ability to gain share in the GPU market, as Nvidia and AMD are firing on all the cylinders. Intel is apparently lagging behind the competition. Semiconductor industry is a highly competitive industry regarding R&D roadmap. At any point, chip designing companies need to make strategic bets on the next generation of designs. Once the company’s technology falls behind their peers, it would take a long time to get the game back, considering the extensive cycle of chip designing, packing, foundry process and final delivery, in my view.

For instance, Intel scrapped their initial plan for their GPU codenamed Rialto Bridge in 2023, which was supposed to be the successor to their Max Series GPU codenamed Ponte Vecchio. Instead, they expect their next generation of GPU to be released in 2025, with hybrid chips codenamed Falcon Shores. The new product release was delayed by one year from their initial plan.

In comparison, Nvidia launched their H100 GPU in 2022, and H200 in the 2024. Apparently, Intel has been struggling to effectively execute their GPU roadmap. Most likely, when Intel starts to mass production of Gaudi 3, Nvidia has already started their production of their next-generation GPU on Blackwell platform, in my view.

As such, I assume Intel will deliver 5%-10% type of growth from data center and AI markets.

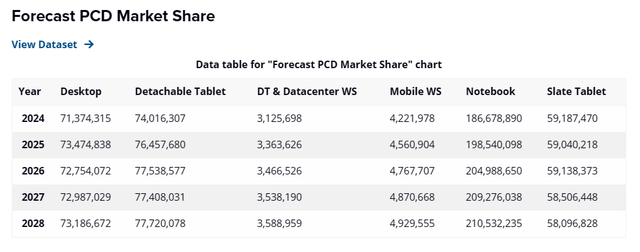

-Personal computing device: IDC predicts that AI PCs will drive the growth of overall personal computing devices, and the PC market will grow at a CAGR of 2.4% from 2024 to 2028.

For normalized growth, I expect Intel delivering low-to-mid single digit revenue growth from their PC/tablet CPU business.

-Foundry: Intel presented a big picture on the global foundry market during the earnings call, projecting the whole market to grow from $100 billion today to $240 billion by 2030. They anticipate capturing 15% of market share over the long-term. In my view, Intel will potentially grow their foundry business considering they are investing heavily in manufacturing capacities. However, foundry business is an asset-heavy business, requiring constantly heavy spending on CAPEX, as evident from TSMC’s (TSM) financials. In my view, Intel needs to attain a certain scale before achieving a decent profit margin. If Intel achieves similar growth to the market, their foundry revenue could potentially grow by 15% annually. Assuming Intel can achieve $15 billion in foundry revenue as they planned, the business would account for 25% of total revenue. Thus, the foundry business could potentially contribute 3%-4% of growth to the topline.

Adding all these parts together, I expect Intel will deliver around 6% of normalised revenue growth.

Valuation Revision

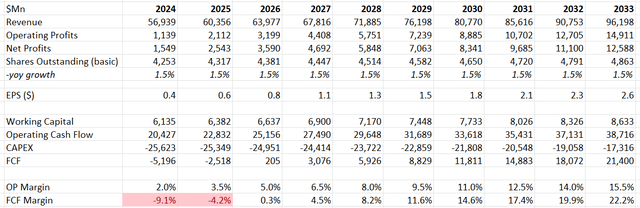

Intel spent $25.7 billion on CAPEX in FY23 to expand their chip manufacturing capacities. In Q1 FY24, they generated -$1.2 billion of cash from operations with $5 billion on CAPEX. Due to their ambition to grow their foundry business, I don’t expect their capital expenditure to slow down anytime soon. As such, I assume Intel will allocate more than $25 billion towards annual CAPEX in the near future.

I expect that Intel’s margin expansion will primarily come from revenue growth and operating leverage. As they are in a heavy investment stage, they face tremendous start-up cost pressures. In addition, due to the heavy CAPEX spending, Intel is going to incur high depreciation costs in the near future. Assuming Intel can deliver 6% of normalized revenue, I estimate that the operating expenses will grow at around 5%, leading to some operating leverage for margin expansion.

As Intel doesn’t repurchase their own shares, I assume the total number of shares outstanding will grow by 1.5% annually, reflecting the dilution from stock options.

Intel DCF – Author’s Calculations

The WACC is calculated to be 11.6% assuming:

-risk free rate: 4.6% ((US 10-Y treasury yield))

-beta: 1.38 ((SA DATA))

-equity risk premium 7%; cost of debt 7%

-debt balance $49.2 billion; equity $105.5 billion.

-tax rate: 13%

Discounting all the future FCF and adjusting with debt and cash balances, the fair value is calculated to be $26 per share, based on my calculations.

Key Risks

Other than the weak topline growth and market share loss, I think the biggest risk for Intel lies in their balance sheet. The ended the quarter with approximately $21 billion in cash and cash equivalents, and $52 billion in total debts. Their gross debt leverage was 3.8x in FY23, and I would not argue Intel has a robust balance sheet, considering many semiconductor companies have net cash positions.

In March 2024 , the Biden-Harris Administration announced that the U.S. Department of Commerce will provide up to $8.5 billion in direct funding under the CHIPS and Science Act to support Intel’s chips manufacturing expansion on U.S. soil. In FY23, Intel had -$14 billion of free cash flow as a result of heavy CAPEX spendings. As per my calculations, Intel’s current cash and potential government funding could sustain the company for another 2-3 years assuming no additional funding from equity or debts insurance.

Intel’s stock price has poorly performed compared to Nvidia YTD. What’s the potential upside for their stock price? In my view, the near-term catalyst for Intel’s stock price is their Altera IPO. As discussed earlier, Intel plans to bring in a private equity shareholder for Altera, before conducting an IPO, following a same path as they did with Mobileye. Altera is a quite solid business, a leading position in FPGA market. As communicated over the earnings call, Altera is expected to achieve a revenue run rate of $2 billion in FY24. The potential IPO of Altera could unlock some of Intel’s valuation, resulting in potential upsides for their stock price.

Conclusion

In the near-term, Intel’s growth is still dependent on their traditional CPUs business in PCs and laptops. Their GPU business is lagging behind their competitors, and I don’t anticipate the data center business will become a significant growth driver for Intel. I reiterate the ‘Sell’ rating with a fair value of $26 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.