Summary:

- Intel stock plunged from $30 to $19 after the Q2 earnings miss.

- Management credibility issues and potential downside risks are highlighted.

- Potential positives include a turnaround plan, foundry business, and onshoring trend, but earnings estimates and balance sheet raise concerns.

maybefalse

My last article on Intel (NASDAQ:INTC) was written in June 2024, and I was bullish and wrong. Back then, the stock was trading for $30, but after the company released Q2 earnings for 2024, the stock plunged to about $19 per share. Fortunately, I only have a very small position and I reduced it almost completely before earnings came out because I did not think a recent major job cut announcement was a bullish sign before earnings. So, I am long the stock, but just barely, and I think the question is what is the right strategy now. I think there is an allure to buying this former chipmaking legend, but at the same time it just continues to disappoint. It has not only been a money loser for many investors lately, but it has also been an opportunity cost since so many other chip stocks have been rising. I am very disappointed with the recent results, and yet I still see some reasons to be hopeful, so let’s take a closer look:

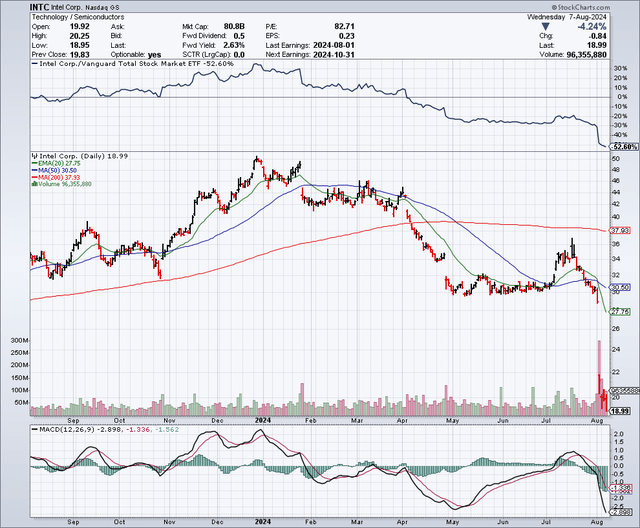

The Chart

As the chart below shows, Intel was trading for about $50 per share in December, and after the Q2 earnings plunge, it now trades for about $19 per share. The 50-day moving average is around $30 and the 200-day moving average is about $38. There is really nothing bullish about this chart, except for the fact that Intel shares are now deeply oversold. This could lead to a rebound in many cases, although any rebound in this stock could be muted because it has been a disappointing investment for many investors, and it continues to report underwhelming results.

I also want to look at a longer-term chart, which shows that Intel shares are now trading at levels not seen since 2013. This major plunge and the fact that it is trading at historically low levels, makes it feel like a capitulation event has potentially taken place, and that could be a very bullish sign. Capitulation often occurs when investors have been extremely disappointed and are willing to sell a stock at just about whatever they can get for it. Capitulation is also usually accompanied by very high trading volumes, which we have clearly seen in recent days.

Q2 Earnings Results

For Q2, Intel reported non-GAAP earnings of $0.02 per share, which was a miss by $0.08. Revenues came in at $12.83 billion, which was another miss by $150 million. In addition to these disappointing earnings results, the company said it would lay off about 15% of its workforce as part of a $10 billion expense reduction plan. It also announced it would suspend the dividend. I am actually pleased to hear about the $10 billion in expense reductions, but the problem is that at this stage of the Pat Gelsinger (the CEO of Intel) turnaround plan, all of this news of expense reductions and the suspension of the dividend came unexpectedly, and I believe it is way too late.

Management Credibility Issues

All of this expense reduction and dividend suspension news suggests that Intel is nowhere close to being a turnaround candidate. It shows me that there are significant potential execution risk issues that lie ahead, and it is not even clear that the turnaround will even succeed at this point. One of the biggest problems I have right now is with the lack of management credibility. It seems clear to me that with such a big miss on earnings, plus a dividend cut and the apparent need to lay off such a big part of its workforce, management does not seem to have a good grasp of the situation at Intel and that greatly reduces my confidence. I know that Pat Gelsinger has been a buyer of Intel shares when it was trading at much higher levels and again, this suggests to me that he was overly optimistic about Intel’s prospects. All of this means that I have to take optimistic statements and forward guidance with a skeptical view because it has repeatedly been a mistake for investors to believe in management’s optimism before now.

Here Are My Concerns About Intel

There are many potential downside risks. As mentioned above, I have very little faith when it comes to management in terms of execution or guidance. Because of this, I am concerned that the big plans to cut costs and jobs present potential downside risks, as this could lower employee morale. I also feel that Intel could be seeing a “brain drain” whereby top employees decide to leave because they are also potentially seeing a lack of credibility with Intel management.

In just a couple of months, we will start getting into the tax-loss selling season, which often gets underway in October and then peaks in November and December. With Intel shares having lost more than half of their value since last December (when it traded at about $50), I expect this stock will be a prime candidate for heavy tax-loss selling. There will also be plenty of fund managers who are not going to want to show ownership in a stock that has performed so poorly, so this could cause “window dressing” whereby fund managers liquidate or greatly reduce their position in Intel.

Intel has many competitors, some of which seem to be continuously outpacing it in terms of new product development and innovation. Unfortunately, this appears to be a trend and I don’t see signs of this ending soon. Intel’s foundry business is not profitable and that is a potential downside risk to consider, as the plans to achieve profitability might not work out on a timely basis or ever.

Intel might look cheap now, even based on recently reduced earnings estimates; however, the problem is that Intel looked cheap earlier this year when the stock was much higher. The issue is that earnings estimates have continued to erode, and they could continue to do so. I am also concerned about the balance sheet, which has a considerable amount of debt, especially for a company that is facing challenges and limited earnings power for now.

Intel’s decision to suspend the dividend is another potential downside risk because it could prompt income investors and funds that are focused on dividend paying stocks to sell Intel shares since it is no longer a dividend stock.

Here Are The Positives I See For Intel

There is a chance that this latest plan to turnaround the company through major lay-offs and expense reductions might be what is truly needed in order to create a final capitulation in the stock and allow the company to be leaner and therefore more profitable.

Unlike some top semiconductor companies, Intel actually manufactures chips and is, of course, developing its foundry business, which allows it to make chips for other companies. The foundry business is losing money and is not expected to be profitable in the foreseeable future. However, the trend for “onshoring” whereby products are sourced and made locally or within the United States is likely to remain strong. Taiwan is producing about 90% of the world’s most advanced chips and that is a major risk for the global economy. Taiwan is prone to earthquakes and there are other potential supply shocks that could impact many of the top chip companies that rely on Taiwan Semiconductor (TSM) as their manufacturer. One growing concern is the potential for China to take action on its goals to unify Taiwan. This is where Intel’s foundry business could get interesting, and it could be very important for companies to hedge their production risks by having Intel produce at least some of their chips. This factor alone could help make Intel’s foundry business successful in the future.

Earnings Estimates And The Balance Sheet

According to the consensus earnings estimates below, which are provided by Seeking Alpha, Intel is not trading at an undervalued price to earnings ratio unless you go out a couple of years or more and that is only if these estimates turn out to be accurate. The earnings estimate of $1.94 per share for 2026, could imply a PE ratio of about 10 times, but 2026 is far off and a lot can go right or wrong by then.

Earnings Estimates

|

FY |

EPS |

YoY |

PE |

Sales |

YoY |

|---|---|---|---|---|---|

| 2024 |

0.32 |

-69.65% |

62.24 |

$52.47B |

-3.24% |

| 2025 |

1.26 |

+295.61% |

15.73 |

$57.16B |

+8.92% |

| 2026 |

1.94 |

+54.10% |

10.21 |

$61.81B |

+8.14% |

I believe investors have to consider Intel’s balance sheet as a potential downside risk factor. The company has about $53 billion in debt and around $29.27 billion in cash. That’s a lot of cash, but it has a lot more debt and investors and credit analysts might become more wary, especially if the U.S. and global economy heads into a recession.

My Strategy And Final Thoughts

I have not added to my very small position in Intel, even though I do like buying major pullbacks. I feel there are too many issues and uncertainties surrounding this company. I also feel that I can no longer trust management guidance or that goals will be executed successfully. In addition to all this, I am increasingly concerned that the Fed has waited too long to cut rates and that there are many signs we are heading for a recession. I wrote about the signs I see of an impending recession in this article, and this concern is keeping me from buying stocks at this time unless I see a very exceptional opportunity. I also see Intel shares as being potentially hard-hit by tax-loss selling pressure later this year, and based on this, I would not be surprised to see it drift lower. My strategy is to see how Intel shares perform over the next couple of months and also to see how Q3 results are before buying any shares. For now, I am going to hold my very small existing position in Intel, but I am mostly viewing Intel as a potential buying opportunity for late this year when it might be even cheaper due to tax-loss selling.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.