Summary:

- Intel outperformed the market year-to-date, and now it’s even more of an obvious sell to me.

- The company recently reported the weakest quarterly earnings in its history. Intel’s turnaround plan requires massive CAPEX, so free cash flows are likely to be weak in the near future.

- My valuation analysis suggests there is no upside potential for the stock, and the dividend yield is very small to be called attractive.

Leon Neal

Investment thesis

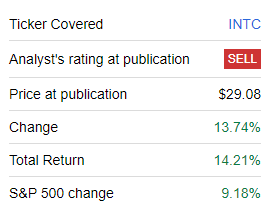

My initial bearish thesis about the Intel (NASDAQ:INTC) stock did not age well. The stock notably outperformed the broad market since late March, when my first article about INTC was published.

Seeking Alpha

On the other hand, INTC stock underperformed the industry benchmark, which is the iShares Semiconductor ETF (SOXX). This ETF delivered about a 17% price increase since March 27. This suggests Intel’s fundamental weakness compared to semiconductor peers. The company recently recorded one of the weakest quarters in its history, and my valuation analysis suggests the stock is slightly overvalued. The company remains fundamentally weak, and its turnaround plan is risky, demanding massive CAPEX. Therefore, I reiterate my “Sell” rating.

Recent developments

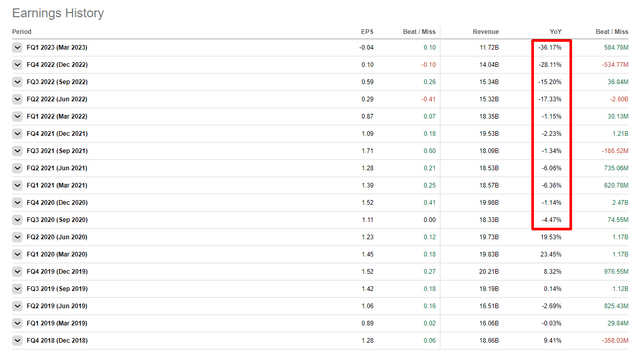

Intel reported its Q1 FY 2023 financials on April 27 and delivered above-consensus figures. There was a solid beat in revenue, though sales declined 36% YoY. By the way, it was the eleventh straight revenue decline YoY.

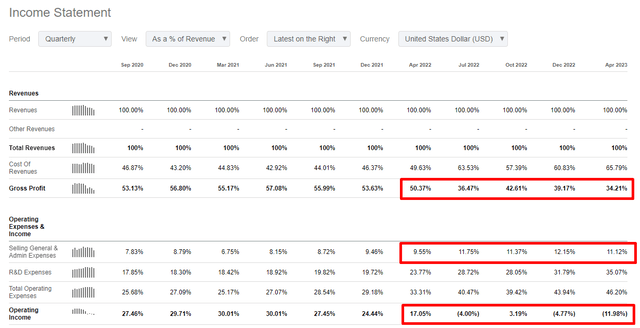

Due to decreasing revenue, the company’s profitability suffered inevitably. Intel’s gross margin was more than 50% in Q1 FY 2022, and its operating margin was 17% during the same quarter. In Q1 of FY 2023, the gross margin softened to 34%, and the operating income went negative with a -12% margin. The primary reason operating income became negative is the increased investment in R&D, which is suitable for the long term. But, the SG&A to revenue ratio also increased, and I take this as management putting little effort in to address the weakening revenue.

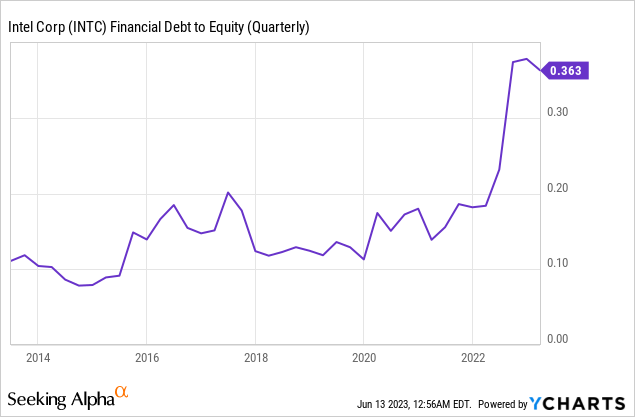

The company’s balance sheet looks sound, with solid liquidity metrics and a moderate debt-to-equity ratio. On the other hand, the net debt position is massive at above $20 billion. I also do not like the trend of rapidly increasing leverage. I realize that the company needs financing for the turnaround plan execution, but the exposure is very high.

I consider increasing debt a problem, especially under tough macro conditions. The company’s revenue has declined for several straight quarters, and margins are under big pressure. Last quarter, the company generated a massively negative levered free cash flow [FCF] of about $5.6 billion. As the company’s sales are declining and margins are under pressure, several more quarters are ahead with a negative FCF. It means that the balance sheet metrics will continue to deteriorate.

The upcoming quarter’s earnings consensus estimates suggest little positive since the topline is expected to grow about 3% sequentially. But, on a YoY basis, revenue is expected to decline double digits again with a 21% drop. Adjusted EPS is expected to be negative again, meaning another weak quarter is likely from the FCF perspective.

Valuation update

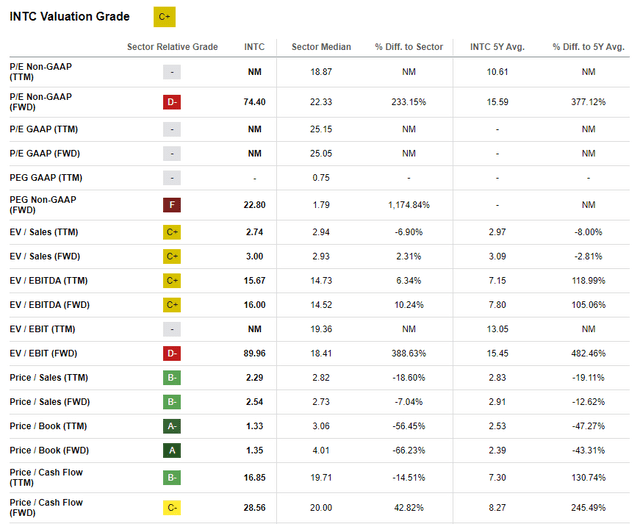

Intel rallied more than 20% year-to-day and substantially outperformed the S&P500 index. Seeking Alpha Quant assigns the stock a “C+” valuation grade, suggesting the stock is fairly valued. If we look at the multiples, we can see that discrepancies between current ratios, sector median, and 5-year averages are mixed. This is mainly due to the company’s heavy reinvestments in business as part of a turnaround strategy where profitability metrics are suffering.

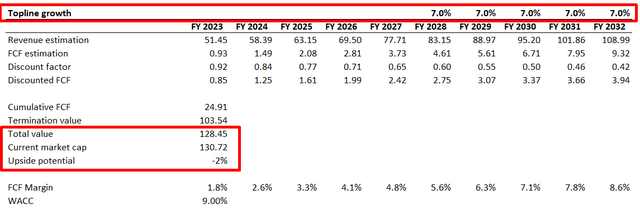

I use discounted cash flow [DCF] approach to value INTC stock. Valueinvesting.io suggests the company’s WACC is about 9%, which I use. I have revenue consensus estimates available up to FY 2027. For the years beyond FY 2027, I project a modest 7% revenue CAGR. In FY 2022, the company delivered a 1.8% levered FCF margin ex-SBC, which I used for FY 2023. I expect the FCF margin to expand by 75 basis points yearly.

As you can see, the DCF model suggests the stock is slightly overvalued under given conservative assumptions.

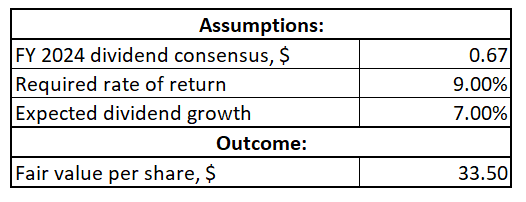

From the dividend discount model [DDM], the stock does not look attractive either. Consensus estimates project FY 2024 dividend to be at $0.67. Even if I use a 7% dividend growth rate and the same WACC as I used for the DCF, the stock has no upside.

Author’s calculations

Risks update

In the current reality, the cyclicality of business is a major risk for Intel. The Eurozone fell into recession recently, and this geographic area represents a significant part of the company’s sales. The economy of the U.S. is not there yet, and Goldman Sachs even shared their opinion that a recession became less likely. On the other hand, Manufacturing PMI is still weak and below 50, indicating a weak manufacturing activity. Therefore, I expect the weak demand for Intel’s end markets to last for the next quarters, and the rebound timing and pace are also very foggy.

Intel operates in a highly competitive semiconductor industry and has been losing its market share to Advanced Micro Devices (AMD) over the long term. The company’s revenue grew slower than the semiconductor industry over the last decade. Intel’s revenue grew at a 1.8% CAGR between FY 2013 and FY 2022. At the same time, the semiconductor industry grew at about 6.6% CAGR. That said, it is highly likely that competitors are offering more advanced chips to the market.

To keep up with the evolving environment, Intel started the execution of its turnaround plan. Under this, the company plans to invest about $20 billion in new fabs in order to be able to keep up with the evolving industry. The management expects this plan to be executed within two years. I consider this project a high risk because it requires massive CAPEX, and the payoff period will be long. The rapidly advancing technology might mean that new fabs can become obsolete before this massive CAPEX pays off. Apart from risks that the investment may not ultimately pay off, there are various other potential risks. For example, there is a high risk that the project will run out of either budget or the time schedule, meaning delays in new product launches. Delays in launches will mean the company will continue to lose market share to its fabless competitors like AMD.

Bottom line

Overall, I still consider Intel stock as a “Sell”. The year-to-date rally looks more thanks to AI mania than fundamentally strong reasons. Intel bulls are betting heavily on the company’s turnaround plan. Still, I believe it is a fifty-fifty game with massive CAPEX and substantial investment in R&D. There is little certainty about whether these investments will pay off. The company is losing its market share to more innovative AMD, and it is a secular trend, not temporary. A forward dividend yield of 1.6% also suggests the stock is not a good buy for dividend investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.