Summary:

- It appears that INTC may have taken a leaf out of Elon Musk’s playbook, by opting to drastically cut prices for its CPU and GPU offerings.

- This strategy has directly contributed to the semi chip company’s recovering top and bottom lines, further boosted by its exemplary forward guidance.

- INTC’s foundry ambition seems to be accelerating as well, with three firm commitments and six more in “active negotiations,” up from one customer previously reported in early September.

- These promising developments may have directly boosted its stock prices and valuations, with great optimism embedded within.

- However, due to the increased chance of a hard landing, investors may want to wait for a moderate pullback to INTC’s previous support level of $32 for an improved upside potential.

AlexSecret

We previously covered Intel (NASDAQ:INTC) in September 2023, discussing its mixed prospects, since it offered neither high growth potential nor excellent dividend incomes, worsened by its impacted top and bottom lines at that time.

The stock’s investment thesis had been speculative then, mostly tied to its uncertain foundry success, recovery of PC demand, and mid-tier AI chips.

In this article, we will be discussing INTC’s excellent results from the drastic price cuts for its GPU offerings, with the management likely targeting price conscious gamers at a strategic time of PC refresh and high inflationary environment.

While we finally rate the stock as a Buy, investors may want to wait for a moderate retracement before adding at its support levels of $32 for an improved margin of safety.

The INTC Investment Thesis Remains Robust, With The Price Cuts Bringing Forth Great Results

This is why we believe that INTC has taken on a similar path as that of Tesla’s (TSLA) Elon Musk, with the semi-chip company engaging at drastic price cuts to boost consumer demand, building upon the aggressive pricing strategies for its CPUs, as discussed in our previous article here.

For example, Intel® Arc™ Alchemist Graphics series was released in October 2022, as a direct competitor to Nvidia’s (NVDA) GeForce and Advanced Micro Devices’ (AMD) Radeon discrete GPU series.

At that time, INTC’s flagship Arc A770 8GB was priced competitively at $329, the mid-tier Arc A750 at $289, and the entry-level Arc A380 at $139. For context, the competitor’s equivalent for the A770 was NVDA’s RTX 3060 12GB with an original list price of $329 and AMD’s Radeon 6600 XT 8GB at $379.

By February 2023, INTC/ retailers had opted to slash prices, with A770 8GB heavily discounted by -18.2% to $269, A750 by -17.3% to $239, and A380 by -14.3% to $119. The same occurred again for the A750 by -31.1% to $199 in May 2023 and the A770 16GB version with prices also slashed by -28.1% to $318 in China in mid-2023.

Combined with the cleverly bundled game offerings and multiple application subscriptions, it is unsurprising that the core gaming consumers realize the massive value they are getting from INTC’s continuous price cuts across CPUs and discrete GPUs. This is especially given the rising inflationary pressures and elevated interest rate environment.

It appears that Pat Gelsinger has delivered on its promise for affordable GPUs after all, with “Moore’s Law being alive and well,” as a direct response to NVDA’s statement that falling GPU prices are “a story of the past” and that “Moore’s Law is dead.”

And it is due to this strategic approach, that INTC has been able to generate robust revenues of $7.86B (+15.9% QoQ/ -3.2% YoY) in the Client Computing Group in FQ3’23:

CCG delivered another strong quarter, exceeding expectations for the third consecutive quarter, driven by strength in commercial and consumer gaming SKUs where we are delivering leadership performance.

As we expected, customers completed their inventory burn in the first-half of the year, driving solid sequential growth, which we expect will continue into Q4. (Seeking Alpha)

INTC’s uptrend in the CPU/ gaming segment builds upon its recovery in FQ2’23 at $6.78B (+17.7% QoQ/ -11.6% YoY) and FQ1’23 at $5.76B (-12.9% QoQ/ -38.1% YoY).

This is compared to AMD’s slower client/ gaming revenue recovery of $2.95B in FQ3’23 (+14.7% QoQ/ +11.3% YoY), $2.57B in FQ2’23 (+3.6% QoQ/ -32.3% YoY), and $2.48B in FQ1’23 (inline QoQ/ -37.8% YoY).

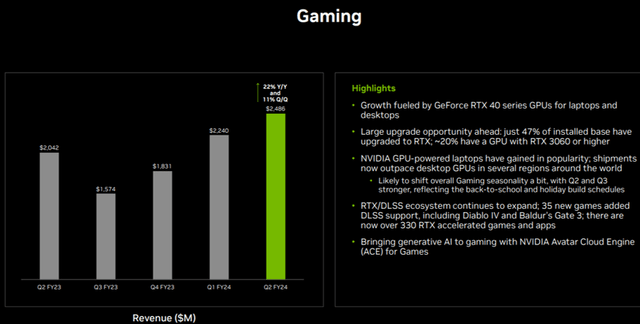

NVDA Gaming Segment

AMD’s numbers are underwhelming indeed, since it implies that NVDA continues to lead the premium segment of the gaming GPU market, as observed in the latter’s sustained QoQ expansion over the past four quarters.

With NVDA and AMD highly focused on profit generation, with the former yet to report earnings and the latter recording gross margins of 51% (+1.5 points QoQ/ +1.3 YoY) in the latest quarter, it appears that INTC may emerge as the unexpected winner amongst the price conscious gaming consumer group, with impacted gross margins of 42.5% (+6.7 points QoQ/ -0.1 YoY/ -16.1 points from 58.6% in FY2019).

On the one hand, we believe that INTC remains overly optimistic, especially since the management still expects to achieve a full year global PC shipment of 270M units (-5.6% YoY), inline with its FQ1’23 guidance.

For now, we are less certain about this ambitious projection, since it requires FQ4’23 to bring forth an immense shipment volume of at least 88.43M (+34.9% QoQ/ +35.2% YoY).

This is based on the global volume of 53.97M in Q1’23 (-17.4% QoQ/ -32.5% YoY), 62.06M in Q2’23 (+14.9% QoQ/ -11.5% YoY), and 65.54M in Q3’23 (+5.6% QoQ/ -6.7% YoY).

Thanks to the US government’s strict export regulation for AI chips, it appears there may more intermediate-term headwinds for multiple AI chip designers, INTC included, depending on how the ongoing negotiations develop.

With the management expecting to generate $2B in near-term sales from the Gaudi AI chips, it appears that the semi chip company may still lag behind the market leader, NVDA, whose revenues jumped by a drastic +$6.31B in the previous quarter to $13.5B, thanks to the robust demand for Generative AI.

On the other hand, we believe that the price cuts have worked extremely well, with INTC’s CCG segment reporting an impressive recovery in operating margins to 26.3% (+11.2 points QoQ/ +6.1 YoY).

While the segment’s margin has yet to recover to FY2019 levels of 40.9% (+2.5 points YoY), we are not overly concerned for now, since we believe that the management’s strategic pricing cuts across GPUs and CPUs may yield improved market share in the Q3’23.

For context, INTC recorded a 3% share (-1 points QoQ/ -2 YoY) in the discrete GPU market and 68.4% (+3 points QoQ/ -0.2 YoY) in the overall x86 market in Q2’23.

INTC’s near-term tailwinds are also significantly aided by the timely PC and server refresh cycles since the pandemic boom, with an estimated PC refresh cycle of every three to four years and data centers at every three to five years.

This trend is also validated by Dr. C. C. Wei’s, the CEO of TSM, promising commentary in the latest earnings call:

As I said, we do observe some early signs of demand stabilization in PC and smartphone end markets. Those two segments are the biggest segment for TSMC’s business. We want to say that 2024 will be a very healthy growth. But right now, did we see the bottom very close. (Seeking Alpha)

Combined with the INTC management’s promising FQ4’23 revenue guidance of $15.1B at the midpoint (+6.6% QoQ/ +7.5% YoY) and adj EPS of $0.44 (+7.3% QoQ/ +375% YoY), it appears the demand destruction may very well be behind us.

So, Is INTC Stock A Buy, Sell, or Hold?

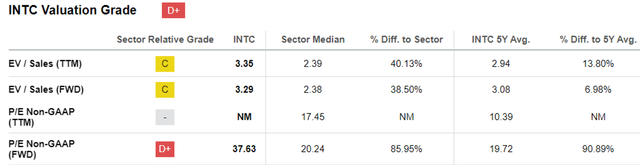

INTC Valuations

As a result of the promising factors discussed above, we are not surprised by the optimism embedded in the INTC stock’s FWD valuations, with its FWD P/E valuation of 37.63x well exceeding its 3Y pre-pandemic mean of 12.23x and sector median of 20.24x.

Perhaps part of the premium is attributed to its ramping-up foundry segment, with three customers already making financial commitments by October 2023, with six more in “active negotiations,” up from one customer that was previously reported in early September 2023.

Combined with TSM’s vote of confidence in INTC’s IMS business, it appears that there is more clarity in its foundry ambitions, further cementing its position as the US government-backed “Western foundry” with a geopolitically secure supply chain.

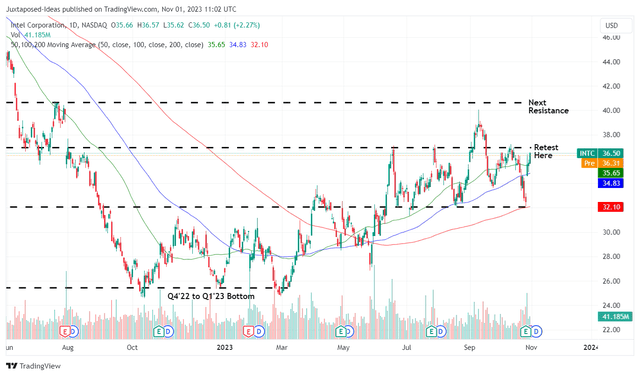

INTC 1Y Stock Price

With great tailwinds over the next few quarters, it is unsurprising that the INTC stock has also rallied dramatically since the recent earnings call, further contributing to the recovery of its stock prices since the February 2023 bottom.

However, with the stock trading near to its fair value of $35.37, based on the management’s FQ4’23 adj EPS guidance of $0.44, its first three quarters adj EPS of $0.50, and its FWD P/E valuation of 37.63x, we believe that there is a minimal margin of safety at current levels.

It also remains to be seen if the stock is able to sustain its premium P/E valuations, with Larry Summers, the former US Treasury Secretary, already predicting an increased chance of a hard landing, thanks to the overly sticky inflationary pressure.

Therefore, while we may finally rate the INTC stock as a Buy, investors may want to wait for a moderate pullback to its previous support level of $32 for an improved upside potential.

There is no need to chase this rally.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, TSLA, NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.