Summary:

- Even with Intel’s 10nm fabrication, Intel’s client-side business is faring well.

- Intel’s planned 7nm launch will likely improve Intel’s competitiveness.

- Intel’s launch of Intel 4, 7nm fabrication, will likely instate confidence in investors, potentially allowing a higher valuation multiple.

RobsonPL

Introduction

In my previous articles, I argued that Intel (NASDAQ:INTC) is worth buying as the company’s success is closely tied to the United States and the EU’s national security. World’s most advanced semiconductor productions or fabrications heavily rely on TSMC (TSM) in Taiwan and Samsung (OTCPK:SSNLF) in South Korea. While these countries are currently Western Allies, Taiwan and South Korea are geographically close or under the influence of China and North Korea posing critical supply chain risks if any forms of conflict were to arise. Intel’s success is critical, hence government support such as the CHIPS Act is in place. Although, Intel has not proved any of its ambitious dreams yet, with Intel 4 on track to be released in 2023 and Intel 3, 20A, and 18A quickly following in 2024 and 2025, I strongly believe that 2023 could be a turnaround year for Intel as the company proves to investors that the company can meet its ambitious goals. Therefore, given the company’s low valuation, high-yielding dividend, and future potential all backed by strong government support, I believe Intel is a buy.

Intel’s 13th Gen Chip and Intel 4

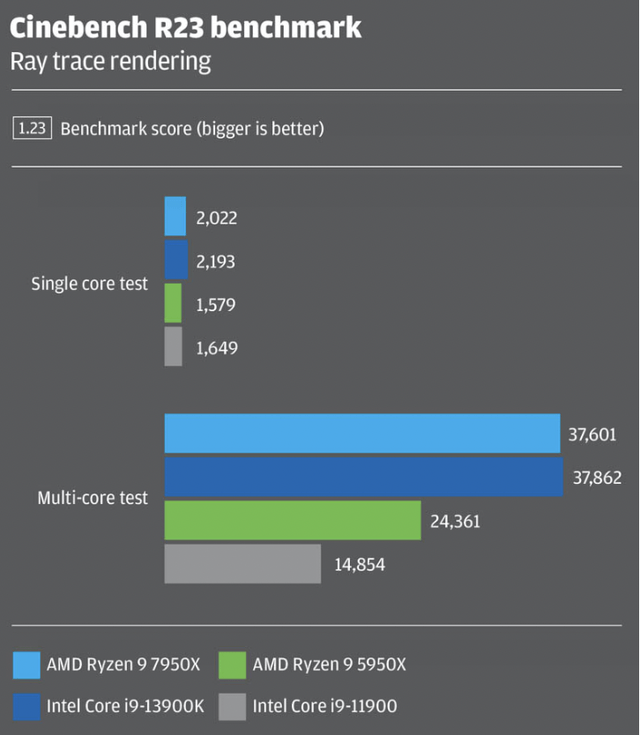

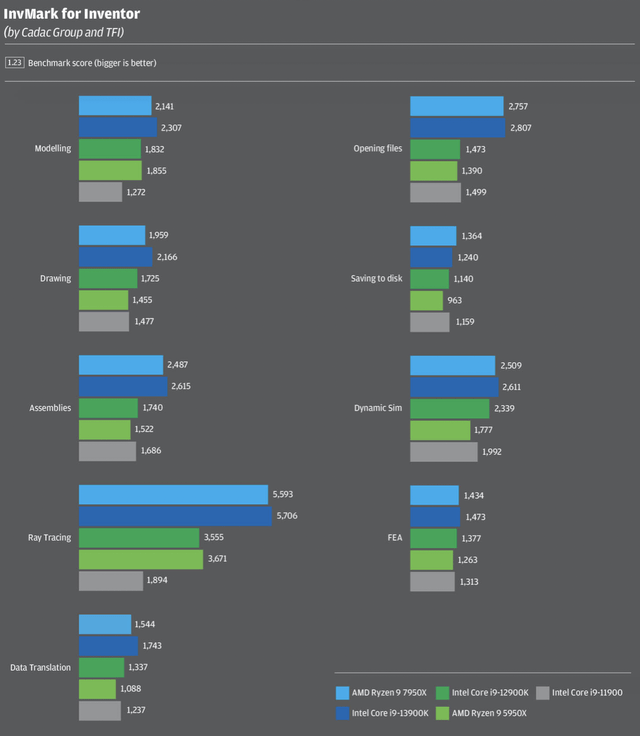

Intel’s 13th generation chips released in the second half of 2022 were competitive relative to AMD’s (AMD) Ryzen 7000 series, which was also released in the second half of 2022. Without considering the power efficiency, core, and thread counts, Intel’s performance, as the picture shows below, surpassed AMD’s performance in some metrics. This comes at a time when AMD is using TSMC’s latest 5nm fabrication technology while Intel is using its Intel 7 fabrication, previously known as Intel’s 10nm fabrication technology. Nanometer comparison is often not the most accurate way to gauge the fabrication technology superiority, but considering that Intel’s 10nm fabrication was started in the second half of 2018 compared to TSMC’s 5nm that started in 2020, the competitiveness of Intel’s 10nm product should be seen as a potential for significant product improvement given a more advanced fabrication comes online, which is expected in 2023.

As a result, Intel has gained market share in consumer computing (PC and Laptops) in the fourth quarter of 2022, maintaining a dominant position in the market.

However, some investors point out that Intel chips are competitive against AMD chips due to Intel chips having higher power consumption resulting from more CPU Core counts than AMD chips. While it is true that Intel’s 13900k has 24 cores and AMD’s Ryzen 7950X has 16 cores with 13900k’s peak power consumption about 23 watts higher than 7950X at 253 watts, I do not see this as a sign of significant weakness. 13900K has more core counts because Intel has separate cores called P and E to capture both the power efficiency and performance. E cores handle lighter workloads while the P cores handle heavier workloads. Further, it is likely that with the efficiency problem could be solved over time as Intel brings more advanced semiconductor fabrication methods.

(Smaller nanometer chips mean that transistors within a chip are smaller and more tightly packed allowing energy transfer to be more efficient. Because AMD uses TSMC’s 5nm fabrication, it is only natural that AMD chips are more power efficient.)

Since Pat Gelsinger promised a turnaround in 2020, Intel is showing meaningful progress. Even with relatively older fabrication methods, Intel is showing substantial progress in client-side computing, so with a fabrication upgrade to Intel 4, which is on track to deliver in 2023, Intel’s performance lead is likely to continue for the foreseeable future.

Intel 4 and Enterprise Chips

While Intel is faring well in client-side computing, AMD has been consistently taking server chip market share from Intel. It is estimated that AMD holds about 17.3% market share, up for the 14th consecutive quarter and a 7.3-point gain from the prior year. Lost enterprise customers will be hard to win back. Still, as Intel starts the Intel 4 production and foundry business while the overall semiconductor market grows, the growth potential of Intel will likely not be bound by market share competition with AMD.

So, why is Intel 4 so important?

Intel 4, a 7nm fabrication, will be Intel’s first fabrication using EUV technology, an advanced machinery that uses lasers to precisely fabricate semiconductors. Before Pat Gelsinger, Intel insisted on holding back EUV investment while TSMC and Samsung took advantage of the advanced equipment. Now, given that Intel will be using the same advanced equipment, Intel will be finally competing on the level playing field. This has immense implications. With more precise fabrication, Intel 4 is expected to deliver two times more density than Intel 7 allowing about 40% power reduction at the same performance or 21.5% performance gain at the same power usage, signaling Intel’s start to close its technological gap between Samsung and TSMC.

I believe the expected launch of Intel 4 has 3 major potential upsides for Intel. One, Intel’s client-side leadership can continue to be strengthened with more advanced fabrication possibilities. Two, Intel 4’s launch will almost confirm Intel 3’s launch in 2024, only a year after Intel 4, as they are designed to be compatible (Intel 3 aims to be higher density/efficiency while Intel 4 aims to focus on performance). Third, Intel 4 will likely signal the start of Intel’s comeback, building much-needed confidence in investors and Intel Foundry Service’s potential.

Risk

All investments and ideas come with their respective risks, which is the case for Intel. First, the biggest risk to my bullish thesis on Intel is a potential delay to the launching date or mass production schedule of Intel 4. The delay will not only challenge Intel products’ competitiveness in the market, but investors will also quickly lose the trust and hope that has been slowly building since Mr. Gelsinger became the CEO. Further, a recession of a significant magnitude may pressure the entire semiconductor industry’s growth as only a mild market contraction is expected to happen in 2023 before turning back to growth in 2024. Overall, I believe that Intel’s future success heavily relies on the on-time delivery of Intel’s 2025 roadmap, an investment in Intel can be risky.

Valuation

I believe Intel’s valuation is cheap today with limited downside risks as significant negativity has already been priced in. Investors are already aware that the entire semiconductor industry will see a contraction in 2023 before continuing on its growth trajectory in 2024. Investors are also aware of high inflation, potential recessionary risk, or even an upcoming mild recession. As such, unless the macroeconomic conditions deteriorate substantially or Intel postpones Intel 4, I believe the downside risk is limited while the valuation remains attractive for investors. Intel currently has a market capitalization of about $121 billion with a forward price-to-earnings ratio of 15, which is in line with the company’s historical valuation multiples. Further, about a 5% dividend is a bonus for investors while the company attempts to take back semiconductor market leadership.

Upon Intel’s launching of Intel 4, I believe the progress will start to instate confidence into investors allowing Intel to gradually expand its valuation multiples closer to AMD’s valuation multiple at about 20 today. Further, as the semiconductor industry hits a contractionary bottom sometime in 2023, investors will likely start to look beyond 2023 and into 2024, which can bring higher average selling prices along with the market expansion. Therefore, I believe current Intel’s valuation is attractive.

Summary

There are many moving parts in Intel’s stock today as Intel aims to turn around its company to better compete against companies such as AMD, TSMC, and Samsung. So far, the company has been showing promising results. The company’s client-side products remain strong with foundry and enterprise solutions also having a promising road map with solid progress. As such, I believe that Intel’s launch of Intel 4, a 7nm fabrication, in 2023 will allow investors to be more confident in Intel potentially expanding the company’s valuation multiples. Therefore, I believe Intel stock is a buy ahead of an expected Intel 4 launch.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of AMD, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.