Summary:

- iShares Semiconductor ETF has returned over 600% in the past decade, but Intel has lost 42% of its value in the same period.

- Investors need to look beyond the management pitch and question if Intel can come back from the current operational and strategic difficulties.

- Intel is currently staying afloat through solid performance in its PC division, while Data Center & AI isn’t delivering the growth one could expect in the current environment of demand.

- With all of the above and a pressured cash flow, I remain very concerned about Intel’s performance over the coming years.

Klaus Vedfelt/DigitalVision via Getty Images

Introduction

Investing in semiconductor exposure has been an exciting journey for most, as exemplified by the development of the iShares Semiconductor ETF (SOXX) which has returned more than 600% over the past decade or more than 220% in just the past five years. The five-year return of SOXX exceeds the ten-year return of the S&P 500, which comes in at 170%. However, once we dive into the individual companies, some exceed, and others disappoint. Such is the nature for there to be an average, and today I’m looking at Intel Corporation (NASDAQ:INTC) which belongs to the list of companies who don’t perform on par with its peers. Over the last decade, Intel has lost 42% of its value, with 57% lost if we zoom in on the past five years.

I have to admit, I’ve been a bit tempted by the prospect of investing in a beaten down Intel over the past years, as I’ve increased my semiconductor exposure. After all, it is one of the juggernauts of modern-day semiconductor manufacturing, or perhaps, used to be. In the summer of 2021 I published an article called “You Can’t Own Enough Semiconductor: Here Is Why And What”, where I, to no surprise, argued in favour of going heavy into the sector, which makes Intel a natural prospect given its status as a key player in the industry. I never did as I was concerned with the development, and having digested the latest quarterly report, I’m now firmly in the camp of those saying it’s on the decline in terms of its position in the industry and therefore also its ability to be a long-term compounder.

I often pick up beaten down blue chips as stock-related news tend to be over projected and immediately impact the stock more than its real impact over the mid- to long-term, but in this article, I’ll highlight why I don’t believe that to be the case with Intel. If I were a betting man, I would anticipate the stock to have fallen further in a year’s time rather than seeing it appreciate, but of course, it can go both ways. That might be crazy talk to some, but don’t forget that just because it’s down 50%, doesn’t mean it can’t fall another 50%.

Ultimately, I conclude the market has experienced a collapse in confidence with both Intel and its leadership team, led by Patrick Gelsinger as CEO. A collapse isn’t something that speaks in favour of an appreciating stock, and I conclude that Intel has had a lot of chances over the past years to change its trajectory, which it hasn’t and now, experiencing pressured cash flows and reduced R&D spending outlook will mean it can be concluded it has lost the battle with its stronger peers, led by Taiwan Semiconductor Manufacturing (TSM).

Intel has been consistent with disappointing shareholders in recent years, and the company is living in a period of free cash flow hemorrhaging that leaves investors even more nervous. There is simply too much risk in the case at this point for it to be attractive, and there are healthier alternatives in the market.

The Most Recent Development

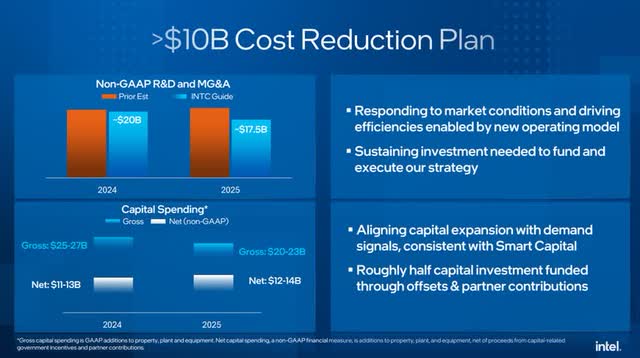

If you open the Q2-2024 presentation laying out the quarterly results, you are met by an executive summary where the headline theme is the initiation of a $10 billion cost reduction plan for 2025. This is supplemented by a plan of reducing headcount substantially, upwards of 15,000 or more out of a total close to 130,000.

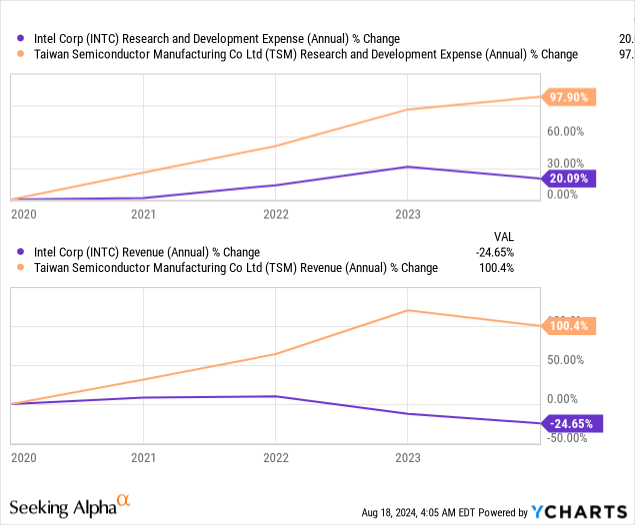

In recent times, investors have gotten used to seeing Intel disappoint, and yet, the company managed to surprise to the downside for this quarter, causing an 18% intraday downwards move. Intel’s peers, Nvidia (NVDA), Taiwan Semiconductor (TSM) and others experience explosive topline growth, while Intel experiences the exact opposite. As you will see in a minute, Intel has the R&D budget to be competitive, and its scale warrants it should be fighting for the throne, but it just doesn’t and hasn’t for quite a few years at this point.

Intel Cost Reduction Outlook (Intel Investor Relation Q2-2024)

This industry was always about three things. First, it’s about process knowledge. The only way to reach the next plateau is to master the one before it, so if you want to manufacture a 5nm chip, you need to be able to manufacture a 7nm chip. Process knowledge is king, and process knowledge requires people, machinery and software. Secondly, it’s about capital spending. This industry is capital intense like none other. Foundries come at a cost that easily exceeds $10 billion per foundry depending on its size, scale and purpose. As a company, you need a strong operating cash flow that will allow you to continue pouring money into running the machinery and stay at the edge of physics, which is basically what semiconductor manufacturing has become in this century. Thirdly, it’s about R&D spending as you need to constantly push the boundaries of what’s possible, and this again requires human capital and funds.

A $10 billion cost reduction plan might help alleviate cash flow challenges, but when you are already in the bottom of the pack, it doesn’t set you up for success long-term. As I tried to suggest, this is a marathon where it’s difficult to claw your way back once you are trailing.

If you look at the development in revenue and R&D spending over the past five years, then it’s very evident that they are moving in the wrong direction. Intel keeps plowing ever more cash into R&D, but to little avail in terms of turning that into top-line expansion. Yes, R&D is a long-term game same as Pharma, and yes, it’s not entirely fair to compare to TSM, but please keep in mind that this provides a high-level example of how the development is far from what it should be. You need your continuous R&D spend to turn into a positive top-line, especially when you are growing your R&D spend.

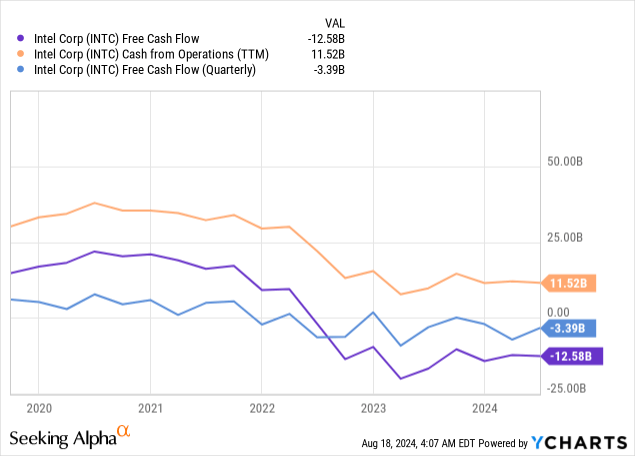

With no expansion in the top-line, and an increased capital expenditure, there is only one result – diminishing free cash flows. The picture above tells a clear story of a company in a challenging spot. Even if they did improve the situation, would they be able to allocate that into value-adding R&D that would elevate the business, so far, they have struggled with exactly that.

Before we shut down Intel outright in this piece, let me just point out that they have +$11 billion of cash on the balance sheet in combination with $18 billion in short-term investments, so the lights still come on in the morning, but this isn’t sustainable in my opinion. However, it doesn’t have to be sustainable for much longer either, if they just correct the situation, which is naturally what is being communicated as happening just around the next corner. Any management team believes in their own strategy, and there is of course a pitch to follow. Having seen such blatantly poor execution in recent years, however, it’s time to look beyond the pitch. There is, however, one positive story to be told, and that is related to Intel, of course, being a sum of business units, and not all are doing bad.

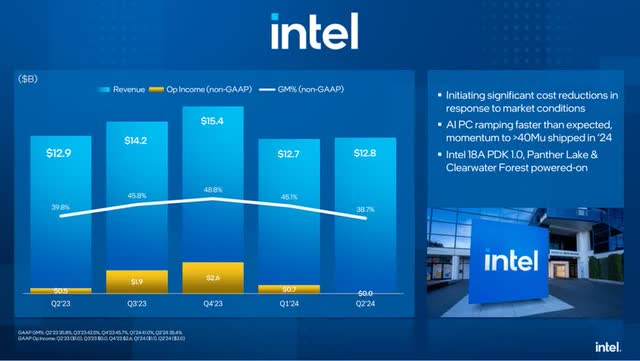

Intel Total Financial Performance (Intel Investor Relations Q2-2024)

The picture above, provides the helicopter perspective of Intel, and that doesn’t look appetizing with declining top-line and drastically reduced gross margins meaning that Intel come out with more or less nothing on the bottom line. In addition, the gross margin is quite a bit lower than what the company guided just recently in the prior quarter. We have to look a bit deeper, however, as some of the business units are actually doing okay.

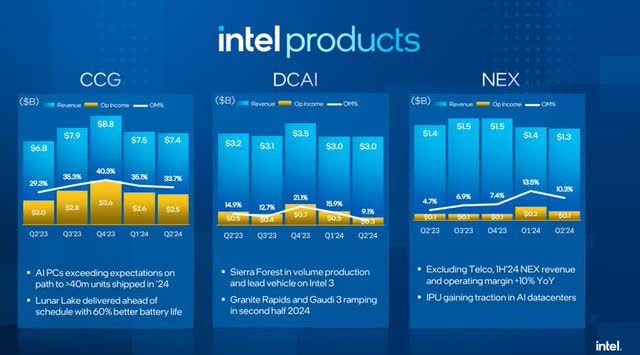

Intel operates in a number of business units, the major ones being the following, which are those that can turn the needle for the company.

- Client Computing Group (CCG)

- Data Center & AI (DCAI)

- Network & Edge (NEX)

- Foundry

Intel Business Unit Overview (Intel Investor Relations Q2-2024)

As can be observed, Intel has a strong PC-related business that is supporting especially the negative development in foundry, as can be seen below. What can also be observed, is that its data center business isn’t reporting anywhere near the same development as its peers. Intel’s product line-up appears to be lacking in competitiveness, despite the very strong demand for anything data center and AI related. That is concerning, as it’s here growth should come from.

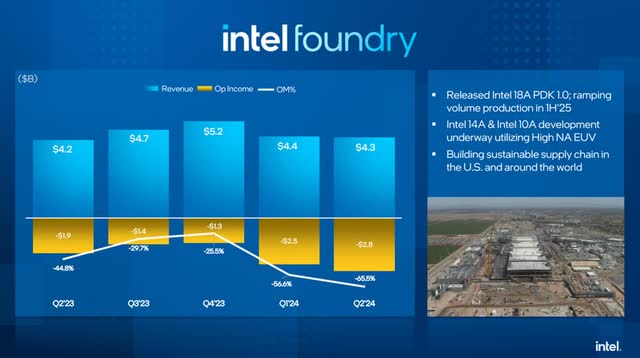

Intel Foundry Performance (Intel Investor Relations Q2-2024)

Here is what Pat Gelsinger, the CEO, had to say during the earnings call in relation to the foundry business.

“Our investments in a global footprint of leading-edge capacity continues to weigh on near-term profitability, but long term, they position us to profitably participate in the largest and fastest-growing parts of the semiconductor market. We continue to expect the investments we’re driving through this year to put us on a course for meaningful financial traction with operating profits for Intel Foundry troughing in 2024 and then driving to breakeven.”

This isn’t unusual in the sense that as a semiconductor company, you have to go through cycles of investing in capacity upfront in order to harvest returns down the road. Texas Instruments (TXN) is doing the exact same thing at this point in time, but their business is performing better on a relative level. In the quote above, Pat Gelsinger concludes that the business will be much better off in 2025, and while that might be true, it might not as well. I’ll come back to this in the next part of the article, as the company hasn’t managed to deliver on its previously communicated strategy.

David Zinsner, the CFO, elaborated

“Foundry operating loss of $2.8 billion was worse sequentially. We expect operating losses to continue at approximately the same rate in Q3 with more than 85% of wafer volumes still coming from pre-EUV nodes with an uncompetitive cost structure and power performance and area deficits reflected in market-based pricing. The continued ramp of our Intel 4 and Intel 3 Ireland facility and elevated R&D and start-up costs to support the rapid progression of our leading-edge technology development will also weigh on profitability.”

In the world of banking, you say that debt is solid as rock, and assets are soft as butter, meaning that you must be careful in terms of what value you assign to an asset. Similarly, R&D spending is a fact, but future revenue is an unknown, and if you are a business that continuously delivers, then investors will ask few questions, but if the opposite is the case, then that calls for caution.

What the two executives state here is not in any way illogical, but it is of course a question of whether we take it as facts or not. Facts are, that the business is struggling and has been for a number of years, and they now need to take a deep cut into their capital investment program, which is the one thing fueling Intel’s future. I remain a skeptic at this point.

Naturally, the questions came pouring in during the earnings call, with the word foundry being mentioned a total of 43 times.

One thing is apparent, however, Pat Gelsinger keeps believing in Intel’s outlook, as he picked up shares following the negative market reaction, something he has done sometimes over the past years. It is often considered a strong indicator if a CEO picks up shares, and it might as well be here. However, Pat Gelsinger has a reported net worth somewhere between double and triple digit million dollars, so adding a couple of hundred thousand dollars, is perhaps not a substantial amount, lessening the strength of that indicator.

Observing Intel’s Development Over The Years

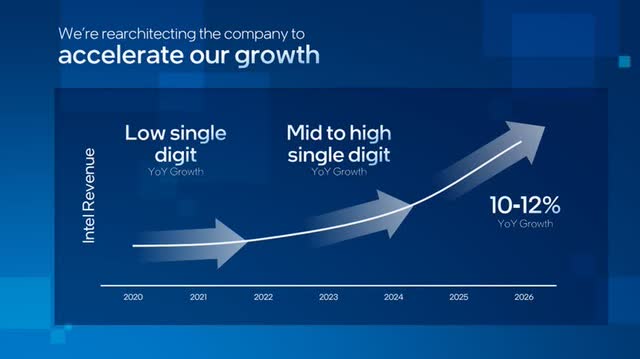

I previously mentioned that Pat Gelsinger and his team expect Intel to see its lowest performance in 2024, with an improved situation in 2025. Let’s have a look at the strategy laid out just a couple of years ago.

Below is the opening headline of Intel’s investor conference 2022. Hindsight is 20/20, and it’s easy to come off in a bad position when looking backwards at a failing strategy. At that investor conference, Intel pointed towards the company

- being the next great growth story

- delivering technological leadership in product offerings

- being the steward of Moore’s law

- being confident in regaining process leadership

- As well as other positive developments to come

Intel Strategy 2022 (Intel Investor Presentation 2022)

All those expectations came together in form of an anticipated growth story unfolding, as can be observed below.

Intel 2022 Growth Outlook (Intel Investor Presentation 2022)

Evidently, Intel is yet to deliver on the strategy laid out back in 2022. There is a difference between missing the target by an inch, and by a mile, while this situation is closer to the second. The stock has reacted, as could be expected, by continuously trending downwards, as the market has gotten to a point where trust in Intel and its management team is very low.

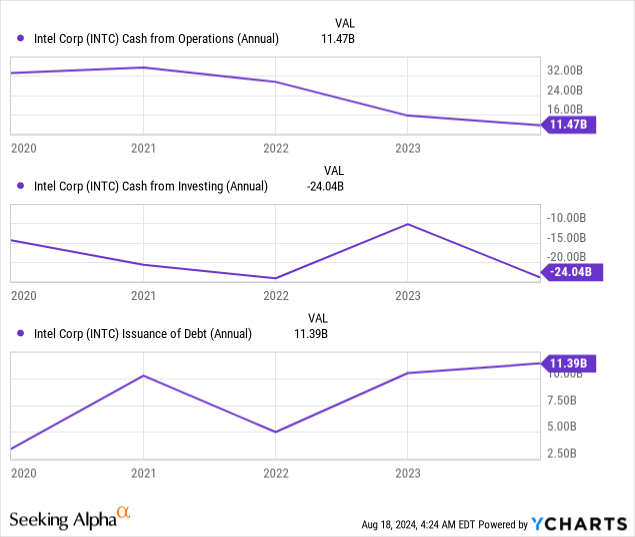

The way the situation has unfolded, a very stressed cash flow can be observed.

The cash flow development leaves me very concerned. In fact, the development in operating cash flow and capital expenditure, means that Intel is burning cash at an alarming rate. It has gotten to the point where all these capital expenditures need to pay off. Intel’s profitability is struggling, causing a lot of pressure on the cash flow.

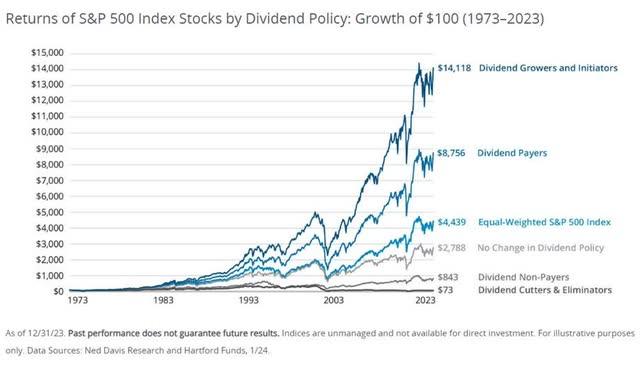

If you made it so far, we didn’t even discuss the suspended dividend. I’m not going to speak at lengths about it, I’ll let the graph below speak of the typical consequences. Historically and in general, cutting your dividend isn’t something that speaks in favour of future performance. Back in 2023, Intel reduced its dividend by 65% and during the Q2-2024 reporting, it was suspended going forward. This just underlines the cash flow bleed the company is going through in the years to come.

Hartford Funds – The Power Of Dividends (Hartford Funds)

Valuation & Closing Remarks

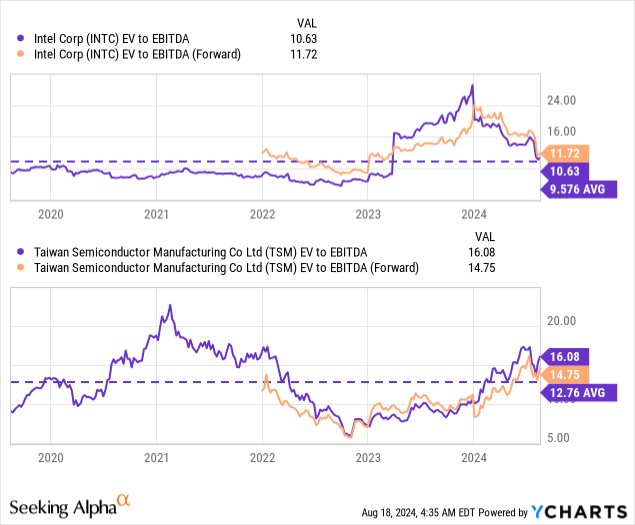

Normally I find it meaningful to debate the valuation of a given company. The problem, here, is that so many other themes cloud the validity of any valuation perspective. The management team has struggled with transparency in terms of just how poor the development has been. Just two years ago, the management team committed Intel to its dividend, which has been both severely reduced and now suspended since then. The strategy from 2022 hasn’t been executed as communicated. The list goes on with points of concern.

As investors, we need to look beyond the pitch from top management and ask ourselves if we still have credibility in their ability to deliver on their vision. At this point, I have lost trust in Intel to deliver. The probability of Intel catching up on the technology curve diminishes for every single quarter of weak execution and even more so, when the company is forced to cut into its R&D and capex programs.

Valuation wise, Intel has been beaten so much, that it may very well deliver strong returns at some point down the road. One theme I haven’t discussed here, is the fact that Intel’s foundry footprint is primarily located in the US, and we all know today, that semiconductor manufacturing has become a national security topic, as such I wouldn’t be surprised if there will be continued access to grants that can bolster even a struggling Intel. I believe, however, that uncertainty and risk of continued weak performance, will mean the stock, at best, trades sideways in the coming years.

However, cheap Intel might be, I believe it’s a stock to best stay away from at this point in time. Even so, for investors who have a keen interest in turnaround situations, this could be the classic situation of trying to catch a falling knife.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.