Summary:

- Failure to stay ahead of the competition, especially when you are the leader of the pack, could lead to irrevocable market share losses.

- Intel’s Client Computing segment is grappling with competitive pressures and macroeconomic headwinds, which are well-documented by fellow Seeking Alpha authors.

- The data center business – the second-largest contributor to revenue – is at risk too, as evident from recent market share and performance data.

Justin Sullivan

When Intel Corporation (NASDAQ:INTC) replaced Bob Swan with Pat Gelsinger in early 2021, I was convinced the company was headed in the right direction as I strongly believe – with due respect to financiers – that tech companies should be run by technologists, not financial experts. Innovation is key for a tech company to survive and thrive in the long run. Historical events surrounding once-dominant tech companies such as Nokia Corporation (NOK), BlackBerry Limited (BB), and International Business Machines Corporation (IBM) show that innovation goes hand in hand with the long-term prospects for a tech company. Failure to stay ahead of the competition, especially when you are the leader of the pack, could lead to irrevocable market share losses. Intel stock, unfortunately, has found itself in a tough spot with repeated failure to keep up with the competition.

In this analysis, I will not dive deep to discuss the dividend cut. I welcome this decision, as I believe slashing the dividend – or even scrapping it for that matter – will improve the capital allocation efficiency of the company at a time when substantial investments are required to get its manufacturing process in sync with its rivals. The objective of this analysis is to look at the technical aspects of Intel’s data center business to determine where the company is headed.

The Red Flags

A few Seeking Alpha authors have established the fact that the demand for Intel’s Client Computing segment, which accounts for PC chips, will decline this year amid unfavorable macroeconomic developments. The Client Computing segment was the largest contributor to Intel’s revenue in 2022 (49.87%), and any weakness in this sector will have a material impact on the company’s financial performance. Intel guided for lackluster revenue, earnings, and gross profit margins for the first quarter of 2023 amid these struggles and claimed there is not enough “visibility” to project full-year numbers at this time given macro uncertainties.

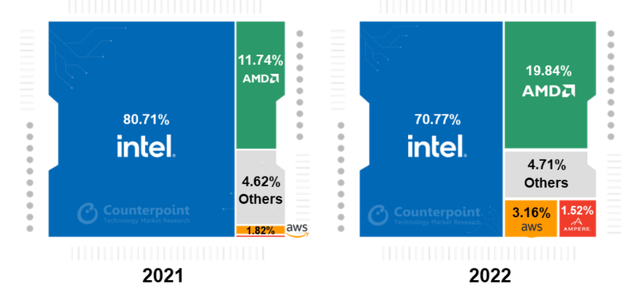

The data center business (Data Center and AI segment) accounted for just over 30% of revenue in 2022, making it the second-largest contributor to the topline. This segment has historically shown impressive gross margins, which makes the data center business an important one in the context of profitability. In 2022, Intel’s data center segment revenue declined by 15.4%, operating income from this segment slumped by 73%, and operating margins plummeted to 12% from 37% in 2021. It was a challenging year for the global data center CPU market, with revenue declining 4.4% YoY. Still, Advanced Micro Devices, Inc. (AMD), Intel’s arch-rival, reported an impressive 42% YoY increase in data center segment revenue, a 20% increase in operating income from this segment, and just a 500 basis points decrease in operating margins. As illustrated below, AMD gained market share in the data center segment at Intel’s loss in 2022.

Exhibit 1: Global data center CPU revenue share

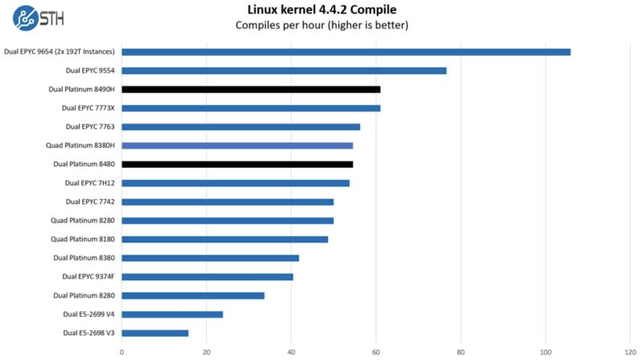

Intel, after prolonged delays, launched Xeon Sapphire Rapids processors on January 10, but these next-generation chips are still comparable to AMD’s Milan generation which was launched in 2021 according to many industry experts. This generational gap between Intel and AMD is not going to help Intel’s cause in the coming years. Linux Kernel compilation tests conducted to compare the performance of Intel’s latest Sapphire Rapids processors with AMD’s Milan (released in March 2021) and Genoa (November 2022) processors show that AMD is still leading the charge despite Intel’s notable improvements. A study conducted by ServeTheHome shows that Intel’s fastest processor, Xeon Platinum 8490H, has a similar performance profile to AMD EPYC 7773X, a Milan family processor released more than a year ago. AMD’s latest product, Dual EPYC 9654, is miles ahead of any of Intel’s processors.

Exhibit 2: Linux Kernel compilation test results

Intel’s manufacturing inferiority compared to the likes of Taiwan Semiconductor Manufacturing Company (TSM) has a lot to do with competitors such as AMD gaining an edge over Intel from performance metrics. Since Pat Gelsinger’s appointment a couple of years ago, the company has moved in the right direction, with a renewed focus on improving its manufacturing capabilities to regain some lost momentum. Despite this, Intel is likely to see a further deterioration of data center market share in the next couple of years, as the company still has a lot of ground to cover.

Takeaway

With global PC shipments declining, Intel’s Client Computing segment is likely to perform poorly this year. The data center business, on the other hand, is at risk because of continued market share losses triggered by the superior performance capabilities of competitors such as AMD. UK-based ARM, a chipmaker who is eyeing a U.S.-listing, is also proving to be a threat to Intel with its chips now being used by big tech companies such as Amazon.com, Inc. (AMZN) in their data centers. Despite the positive developments since Mr. Gelsinger took over, Intel’s long-term success is not a guarantee today, and I do not believe that any company is too big to fail. I will continue to sit on the sidelines as the risk-reward profile of investing in Intel does not appear to be attractive.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The unexpected moment is always sweeter

At Leads From Gurus, we strive to achieve sweet returns by predicting which companies would report unexpected earnings. Join us to discover the power of earnings surprises.

Your subscription includes access to:

- Weekly actionable ideas that would help you beat the market.

- In-depth research reports on stocks that are well-positioned to beat earnings estimates.

- Three model portfolios designed to help you beat the market.

- Educational articles discussing the strategies followed by gurus.

- An active community of like-minded investors to share your findings.

Act now to secure the launch discount!