Summary:

- Intel’s Q1 guidance led to a stock price drop of over 10%, indicating concerns about their investment plan and lack of significant free cash flow.

- The company faces challenges in Mobileye and PSG segments due to inventory corrections, impacting their performance in the first half of FY24.

- Intel’s core CPU advantage is eroding from competition with AMD and the trend towards GPU over CPU in the data center market.

Leon Neal

Intel (NASDAQ:INTC) reported its Q4 FY23 results on January 25, accompanied by a poor Q1 guidance that led to a stock price drop of more than 10%. I presented my ‘Sell’ thesis last November, emphasizing that their investment plan is unlikely to keep pace with their rivals. It appears that Intel is not expected to generate any significant free cash flow in the near future. I reiterate a ‘Sell’ rating, assigning a fair value of $35 per share.

Q4 Review and FY24 Outlook

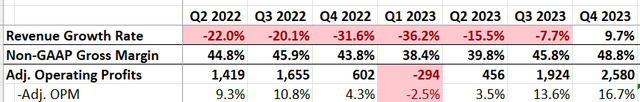

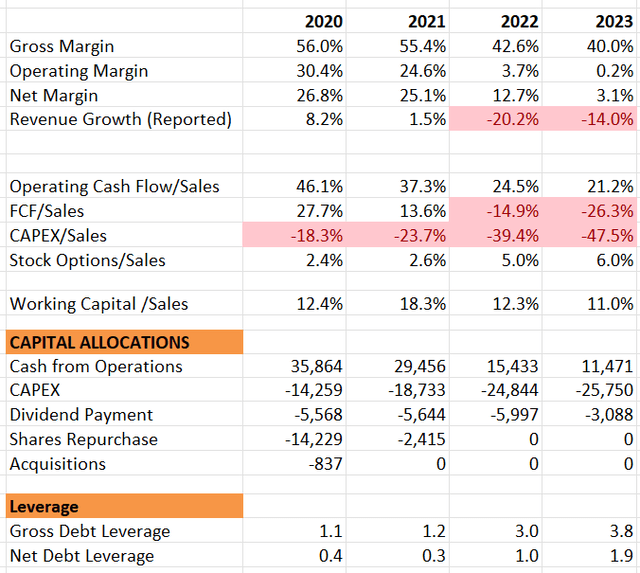

In Q4 FY23, Intel achieved a 9.7% revenue growth and reported $2.58 billion in adjusted operating profits. For the entire FY23, the company generated $11.47 billion in cash from operations, but incurred capital expenditures exceeding $25 billion. Notably, Intel distributed $3 billion in dividends, representing a significant decline from the $5-6 billion range observed in the preceding years.

For Q1 FY24, Intel is forecasting an 8% increase in revenue with a gross margin of 44.5% and an EPS of $0.13. The management anticipates strong performance in client server and edge products, while acknowledging weaker growth in discrete, Mobileye, PSG, and some existing businesses. The company is grappling with significant headwinds, particularly in Mobileye and PSG segments, due to inventory corrections.

Management has acknowledged increased spending on R&D and capacity expansion, which is expected to pose challenges for margin expansion in the near term. During Mobileye’s earnings call, Mobileye reported an excess inventory of 6-7 million units of EyeQ chips at their customers, with the majority expected to be cleared by mid-2024. This situation is likely to impact Intel’s Mobileye business in the first half of FY24.

Intel’s decision to spin off their programmable solutions group (PSG) into a standalone business is accompanied by expectations of substantial inventory corrections in the FPGA business, leading to headwinds lasting at least through the first half of FY24.

Overall, Intel faces the prospect of muted growth in the first half of FY24, primarily due to inventory corrections. Margin expansion seems unlikely in the near future due to increased spending. The company’s financial metrics over the past four years indicate margin compression, slowing growth, high capital expenditure, and negative free cash flow. The following table examines Intel’s annual financial metrics over the mentioned period.

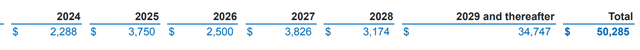

Their gross debt leverage stands at 3.8x at the end of FY23, indicating a relatively high level. They hold $49 billion in total debts and $25 billion in cash and equivalents. In 2023, they issued a total of $11.0 billion in aggregate principal amount of senior notes. I am uneasy about their elevated debt level, particularly given their current phase of high capital expenditure and negative free cash flow. The positive aspect is that the majority of their debt maturity is due in 2029 and thereafter, as illustrated in the table below.

Strong Accelerator Pipeline & Diminishing CPU Advantages

They disclosed that their accelerator pipeline delivered double-digit growth in the quarter, now exceeding $2 billion and continuing to grow. To meet rising demand, they increased the supply of Gaudi 2 and Gaudi 3 and are set to launch Gaudi 3 this year, promising 4x the processing power and double the networking bandwidth. While they have a robust accelerator pipeline, its current size, representing less than 5% of total revenues, is comparatively small at the group level and unlikely to have a significant impact in the near term.

Intel’s data center business remains heavily reliant on CPU products. They anticipate a double-digit percentage decline sequentially in Q1 FY24, experiencing a mix shift from CPU to accelerator in the data center market. In a recent conference, Nvidia (NVDA) highlighted accelerated computing as the primary growth driver for the data center market, suggesting that the trend toward GPU over CPU may persist as more enterprises shift workloads to the cloud and invest in AI capabilities, posing a continued threat to Intel’s core CPU growth.

Furthermore, Intel’s core CPU advantage faces erosion from AMD (AMD). AMD plans to launch their Turin Gen 5 server CPU in 2024, featuring Zen 5 cores, likely based on a 4nm node and a 3nm version. AMD emphasized their competitive edge in architecture, 3D packaging, collaboration with foundry partners, and chip design during a recent conference. This advantage extends beyond process technology, and it appears Intel may require significant time to catch up with its peers.

PSG Spin-off is Near-term Catalyst

Intel has decided to spin off its Programmable Solutions Group (PSG), a move that could potentially unlock shareholder value and be used to reduce the company’s debt level. Standalone operations for PSG began on January 1, 2024, and Intel plans to attract private investors initially, followed by an IPO in the coming years. PSG, with a revenue of about $2 billion, constitutes less than 4% of Intel’s total revenue. Using a revenue multiple of 4x for valuation, the market cap is estimated to be around $8 billion at the time of the IPO. This strategic decision has the potential to act as a catalyst for Intel’s stock price in the future.

Valuations

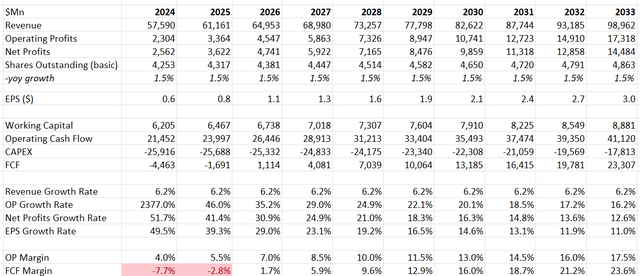

I am still using the global semiconductor market growth rate as a reference for Intel’s normalized revenue growth projections. Allied Market Research predicts the global semiconductor market to grow at a compound annual growth rate of 6.21% from 2022 to 2031. Therefore, I assume Intel can deliver around 6.2% topline growth in the model.

After Intel completes its heavy investment period, there should be room for margin expansion, especially considering the relatively low base. Amortization and depreciation costs are expected to moderate over time. According to my calculations, Intel is projected to reach a 17.5% operating margin by FY33. This level seems reasonable for a semiconductor company with its own foundry capacities.

Intel DCF – Author’s Calculation

The model employs a 10% discount rate, consistent with the level used in all of my models. Additionally, the terminal growth rate is assumed to be 4%. Taking these factors into account, the fair value is estimated to be $35 per share.

Conclusion

Intel is more likely to experience muted growth in the first half of FY24 due to inventory corrections in the Mobileye and FPGA markets. I am concerned about their high debt leverage and the technological lag compared to Nvidia and AMD. Consequently, I reiterate a ‘Sell’ rating with a fair value of $35 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.