Summary:

- Intel has big and ambitious plans for the future.

- And the markets in which they want to operate offer great opportunities for the future.

- But the question remains whether the competition is much further ahead in terms of technology and knowledge.

4kodiak

The Intel Investment Thesis

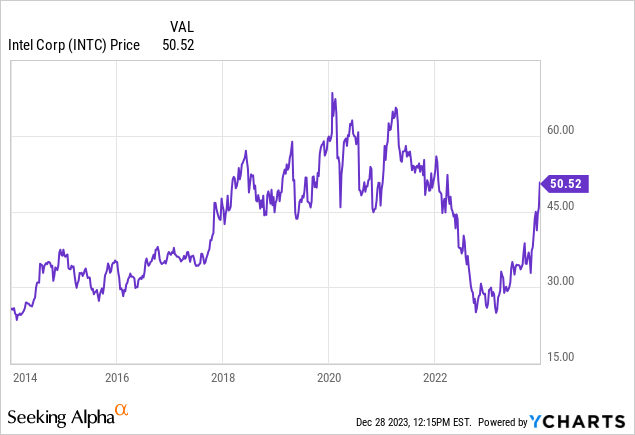

Year to date, Intel Corporation (NASDAQ:INTC) has rewarded shareholders handsomely, but over the past 5 years, the story has been different as Intel has yet to return to its 2020 highs. But a huge TAM, positive comments from the management about future opportunities, and big promises have lifted the stock this year.

But after all the big announcements, Intel needs to walk the walk and deliver the results. The goals are certainly ambitious, as they are trying to compete with some of the best companies today. And they are trying to compete with them on several fronts at once.

And that, in my opinion, may be a goal that is set too high. But let’s look at Intel’s competition and the market situation.

Intel Vs. AMD In The CPU Market

It is a neck-and-neck race between Intel and AMD (AMD), who are clearly in control of the CPU market. AMD’s Ryzen 9 7950X3D is currently the best gaming processor available, and AMD’s Ryzen 9 7950x is the number one choice for multi-core processors. Intel, on the other hand, has the upper hand in single-core processors with the Intel Core i9 14900k.

AMD’s current competitive advantage is that it has focused on Chiplet while Intel has focused on Monolithic technology. But that has changed as Intel has seen the benefits of Chiplet, which is why Meteor Lake will be a Chiplet. Still, they have to catch up to AMD’s lead and all the knowledge and economies of scale that AMD has built up in this area over the last few years. But Intel’s cash flows from this business will likely be used to fund IFS and the battle against AMD and NVIDIA (NVDA) in generative AI and deep learning, where Intel is sending Gaudi 3 into the race.

For a more detailed description of this ongoing battle and a lot of interesting comments, check out my article on AMD here.

IFS Vs. TSMC

This is one of the interesting parts of Intel, because this could be one of the driving forces going forward. The U.S. and Europe do not want to be so dependent on TSMC and the risk associated with Taiwan, so the U.S. government wanted to give money to any company that would make chips in the U.S. through their Chips Act. Unfortunately, the payouts have been very slow, and as of today, only $35 million of the promised $52 billion has been paid out.

But it looks like Intel will get the biggest piece of the pie, because the U.S. needs American companies that can guarantee other American companies quick access to high-performance chips. And Intel seems to be the right company for the job. Samsung’s and TSMC’s U.S. plants would be a relatively small part of their overall business, and the chips would likely not be the most advanced in their portfolios. So it makes sense to give Intel or Micron (MU), Qualcomm (QCOM) and GlobalFoundries (GFS) a larger share of the subsidies.

However, TSMC currently has significant competitive advantages because it has knowledge and experience that is years ahead of the competition. And this may be one of those cases where that knowledge cannot be bought. And the fact that Intel itself outsources some parts to TSMC is interesting. It could be due to lower production costs, not enough manufacturing capacity, but it could also be because they know that TSMC’s manufacturing is top notch.

Intel has said that their 18A node will be better than TSMC’s N2, but I will have to see the first independent benchmarks to believe it. At the moment I cannot imagine it. However, as ASML has delivered its first next-generation EUV to Intel, this could help them as they are expected to play an essential part in manufacturing nodes beyond 3nm. And the $3.25 billion grant from the Israeli government could also help Intel advance in the EUV market. But the fab won’t be online until 2028.

In summary, TSMC has built strong relationships, very specific knowledge, and a high level of credibility with its customers like Apple (AAPL), who trust TSMC for a reason. That is a hell of a competitive advantage.

Gaudi 3

Gaudi 3 is Intel’s answer to AMD’s MI300X and NVIDIA’s H100, and their attempt to gain market share in the generative AI and deep learning space. Gaudi 3 is made by Habana Labs, an Israeli chip startup that was acquired in 2019 for $2 billion. The Gaudi2 and 4th Gen Xeon results were also decent, but still far from the H100 in the MLPerf 3.1 benchmark. But I will stay tuned for the first independent Gaudi3 results sometime next year. But for now I think AMD and NVIDIA are still ahead of Intel and I am not sure if they can close the gap.

But even if Intel can compete on the hardware side, NVIDIA still has a big software moat with CUDA, and AMD is trying to break it with its open source ROCm software. How will Intel try to compete?

Nevertheless, I believe that the Intel Core Ultra and the 5. Generation Xeon will drive increased sales for Intel. I think the $400 billion AI accelerator market is big enough for multiple companies, but that AMD and NVIDIA will still get the biggest piece of the pie. But even a small piece of such a large market can benefit shareholders.

Intel’s Metrics and Balance Sheet

Long-term debt is $46 billion, a little less than twice the total of cash and ST investments, which is $25 billion. And normalized net income should be back in the $10 billion to $15 billion range soon. So Intel has a solid balance sheet, given the cash position, the earnings that are about to normalize, and all the subsidies that they get from various governments.

TTM’s FCF leaves something to be desired as it stands at -$4 billion. However, these should turn positive again in the future, as Intel typically produces a good amount of FCF, and the $12 billion they achieved in 2020 and 2019 would really help drive the stock price if they get back to that. Intel definitely has a chance to get back to that level if they follow the roadmap and deliver what they promise.

Intel’s Capital Allocation And ROIC

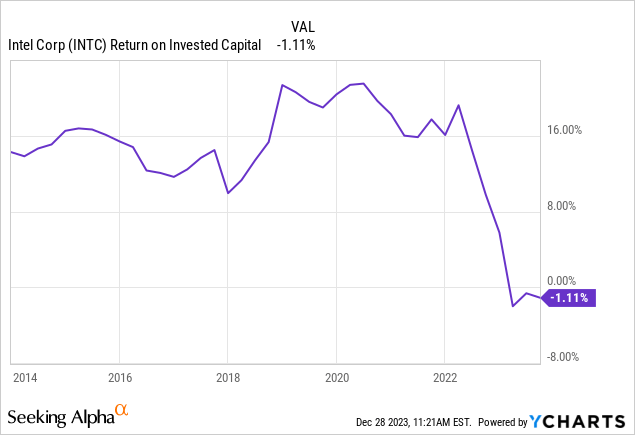

Intel, like AMD, is in a period where they are making a lot of investments and therefore ROIC and EPS suffer temporarily. Historically, ROIC has been between 10% and 14% for most of the past 10 years, and WACC has been between 6% and 8% for the same period. Therefore, Intel has historically had a positive ROIC-WACC spread of approximately 4% to 8%, which is a good spread. Not world class, but good enough to create above average value from their investments. And I think in 2024 or 2025, ROIC will be back to the old numbers.

Intel’s Reverse DCF

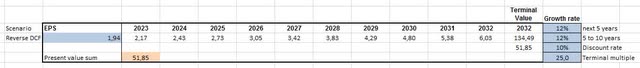

Intel’s TTM diluted EPS is $-0.39, so we need to normalize it to get a more realistic picture. Once the investments start to bear fruit, EPS should shoot up. So, I think it is better to use the TTM diluted EPS of $1.94 from December 2022 to see what is priced into the stock.

And in this case, an EPS CAGR of 12% is priced in over the next 10 years. With all the growth opportunities and government support, this is very likely achievable. So from a quantitative investment perspective, the stock looks undervalued.

What could EPS look like in 5 years?

Since I like to be conservative in my assumptions, I think EPS of about $4 to $5 is achievable. And if the multiple stays about the same, that would put the stock above $100. But the upside could be much higher, as the growth rate for all the players in the hyped industries could be exorbitantly higher than projected. But to achieve that, Intel needs to get its costs under control so that its bottom line looks better again.

Conclusion

Intel’s goals are ambitious because it is going after several industries and strong competitors at once. At present, Intel is inferior to some of these competitors in terms of quality, knowledge, and economies of scale. However, things can change, and since Intel’s success could be very important to the Western world, we should expect to see a lot of capital flowing into Intel from various governments.

Time will tell if this is enough to make Intel the number one choice for chip manufacturing. But even if Intel never becomes the best, they are still good enough to make a lot of money in all the growth markets they participate in. In particular, government subsidies should help them compete on price. But of course Intel has to deliver, which has caused them some problems in the past, such as Intel losing the lead they had over AMD a few years ago.

But the new CEO, Pat Gelsinger, has closed and sold some businesses to focus on opportunities with the best growth potential and where Intel sees the most value. And if the ambitious goal of competing with TSMC and Samsung is successful, Intel shareholders would benefit greatly. But the question remains whether Intel is spinning too many plates trying to compete in several tough markets at once. In the worst case, IFS and Gaudi do not achieve sufficient market share while Intel focuses on them, and because of this shift in focus they lose market share to AMD in the CPU market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.