Summary:

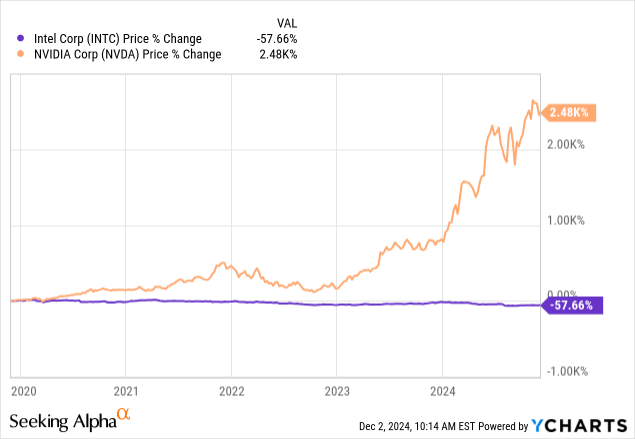

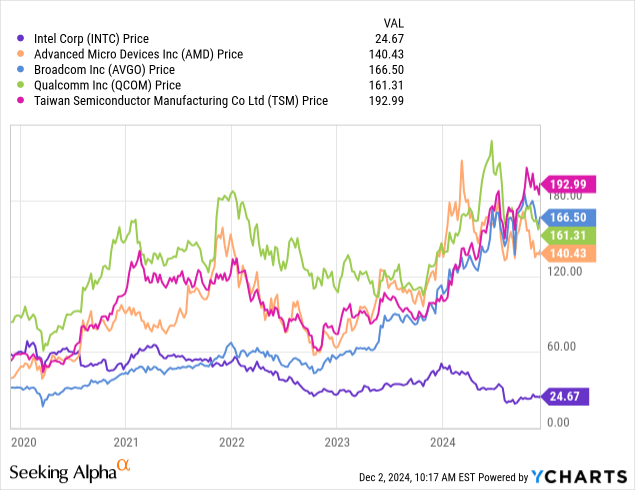

- Intel Corporation has been removed from the Dow Jones 30, replaced by NVIDIA Corp, reflecting their poor performance over the past five years.

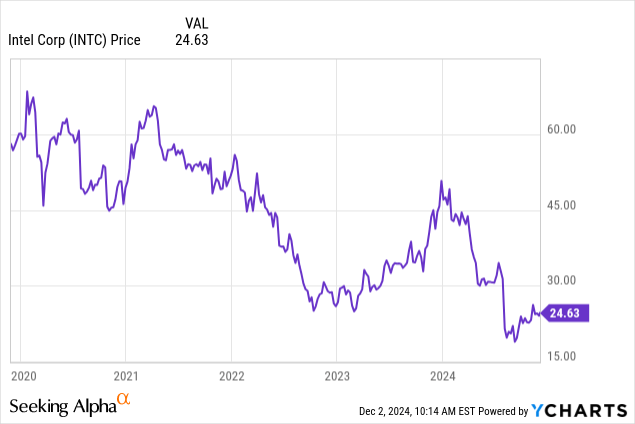

- Intel’s stock is down 57% from five years ago, underperforming compared to other large semiconductor companies.

- Intel was once dominant in CPU hardware, but the shift to GPU hardware has left them struggling to compete.

- The transition in the semiconductor industry from CPU to GPU dominance has significantly impacted Intel’s market position and stock performance.

- However, Intel has changed, and the future is looking rosier by the day, especially now with CEO Pat Gelsinger stepping down.

JHVEPhoto/iStock Editorial via Getty Images

Introduction

Intel Corporation (NASDAQ:INTC) is an American semiconductor giant that was just recently removed from the Dow Jones 30, a prestigious “best of the best” list, where they were dethroned by NVIDIA Corp (NVDA). Based on how these two have performed over the last five years, you can see why Intel lost their crown.

It got so bad that Qualcomm asked if Intel would consider a buyout.

Zoom in on just Intel, now down 57% from five years ago, and we see a rollercoaster for investors.

Compare it to other large semiconductor businesses besides NVIDIA, and it doesn’t get any better. This stock has been an absolute dog.

What Happened?

Intel’s story is really long, going back to when they were actually very dominant in the chipmaking field a decade ago. I recommend this NYT write-up on INTC’s decline if you’re interested in the history.

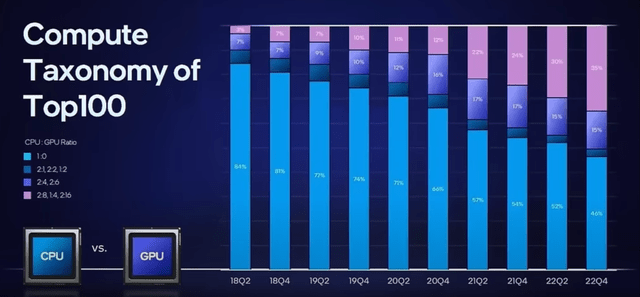

The time when INTC was dominant in the chip space was a time when CPU hardware was king for most major applications. Today, it’s GPU hardware that is the big moneymaker for chips, and Intel hasn’t been producing the right hardware. AI hardware is almost entirely reliant on GPUs, with 3-4 GPUs per CPU in newer AI datacenters.

It’s fallen behind in a space that has become increasingly more and more relevant since 2018, even according to Intel themselves.

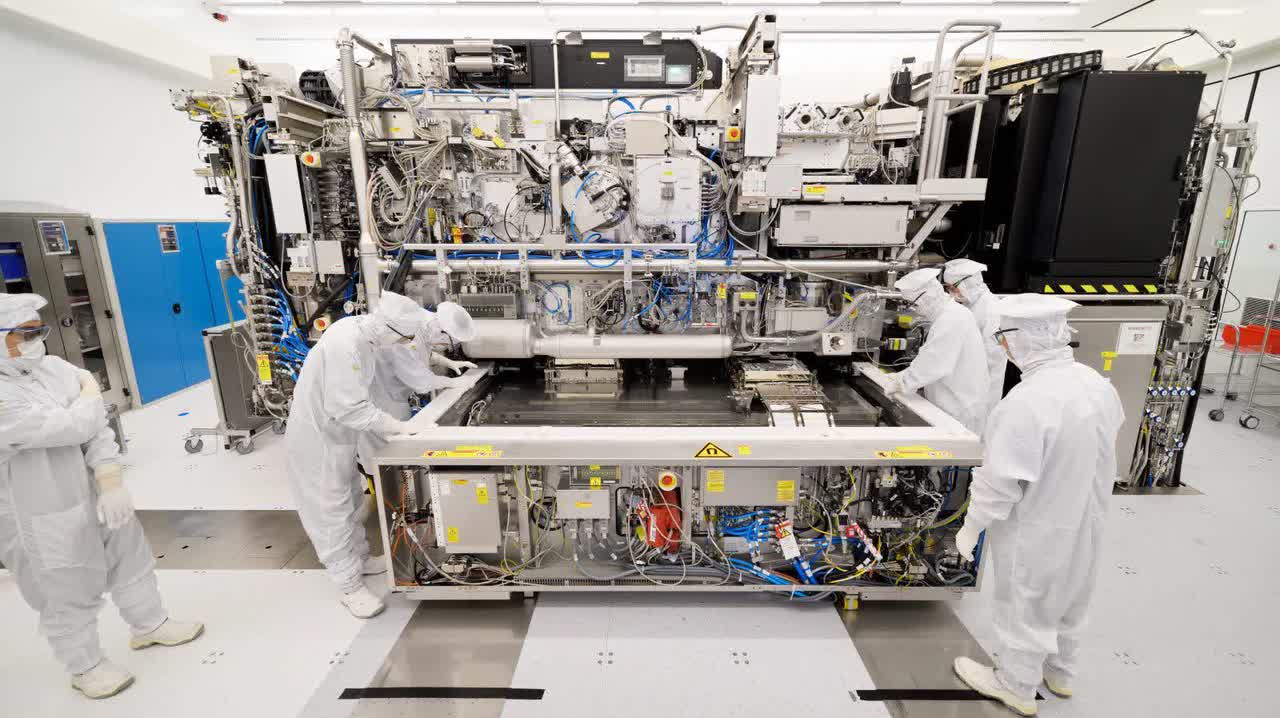

It’s become obvious to everyone in the room that the AI boom and complex computing tasks going forward will require heavier and heavier GPU power, as well as thinner and thinner CPUs. Without High-NA EUV Lithography, a tech that Intel recently bought into, Intel hasn’t been able to keep up in the CPU space much either.

That will change when their Ohio facility, funded in part by the CHIPS Act, spins up in the next few years, but that’s still years out. What’s going on right now?

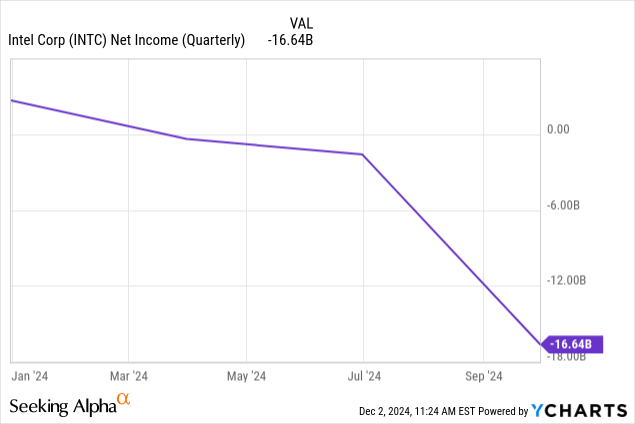

Losses and Losses

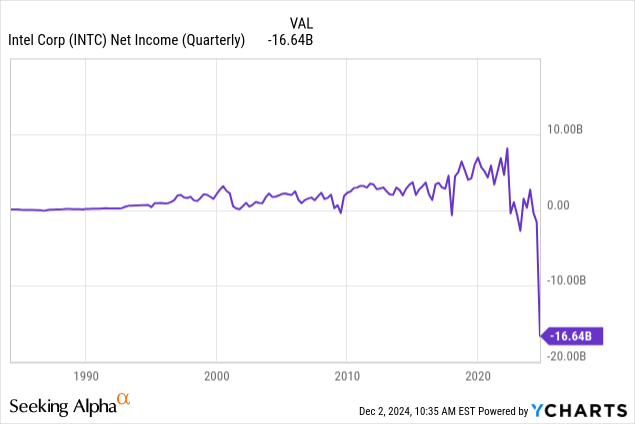

On Oct 31st, the last earnings call, Intel posted their largest loss ever as they’ve begun the switch to producing GPUs and next-gen CPUs.

Notice how far back that chart goes. It goes back 56 years.

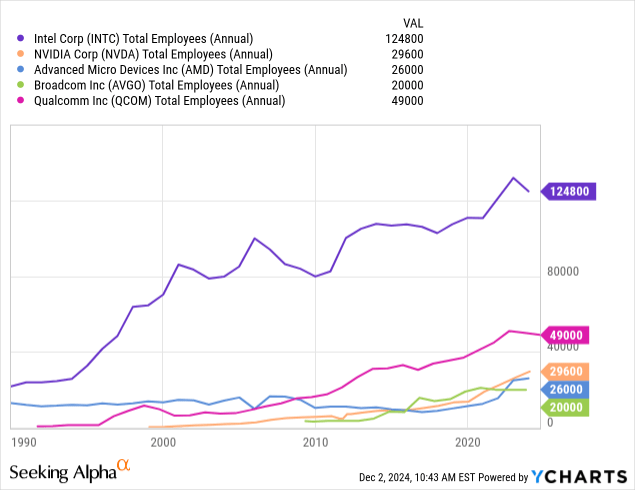

They also announced mass layoffs, which may actually be justified. It turns out that Intel is one of the largest employers of all of these competing firms, even if they aren’t performing well.

The Changes Will Right the Ship

I’m not always one for declarative statements because they get me in trouble in the comments section, but I really do believe that Intel is changing for the better in ways that it hasn’t before. It’s catching up to a landscape that’s already changed, but the fixes they’ve introduced have me interested and listening.

The largest change came today (12/2/24) when the CEO, Pat Gelsinger, announced his departure. With the other changes that I am going to get into, this is the cherry on top because it means that Intel’s board sees the need for fresh eyes and new leadership. Pat has been in charge since 2021, and Intel absolutely failed to position themselves for anything AI-related, it seems.

That may change moving forward, especially with Intel’s push into the GPU space. New, fresh leadership will help that. I am not worried about the “co-CEO” bit they are running in the interim, as that is likely temporary.

Arc Battlemage Will Disrupt Consumer GPU Market

Launching on December 12th, the new desktop GPU series from Intel is a long-time coming product that Intel hasn’t competed in seriously in at least a decade or more. This is a push in the right direction, to recapture some consumer market from NVDA and AMD, especially since their current market share is virtually 0%.

VideoCardz

These cards should be competitive for modern desktops, especially in the gaming niche that commands a significant portion of consumer desktop demand, especially higher-end cards.

ASML Machines Will Create Opportunity in AI Chips

One of the curious moments to me when I was writing my first coverage of ASML back in May, was that while Intel was buying their newest generation of fabricators, High-NA EUV Lithography machines, TSMC wasn’t. While Intel received their machines in March and has been building the fabs in Ohio and Arizona to house and operate them, it took TSMC until November this year to receive their first shipment. This kind of getting ahead is important for Intel, as every month in their R&D process matters now that they have left the tick-tock cycle that pushed them so far behind.

These machines will be capable of taking logic nodes all the way to the 2nm level, which is very, very small, and currently beyond what both TSMC and Intel produce. This is a massive game-changer in chips in general and continues to push forward Moore’s Law.

Kurzweil

Keep in mind that the chart above is missing some things, but they fall in line with the projection, as does what ASML projects these new machines can do.

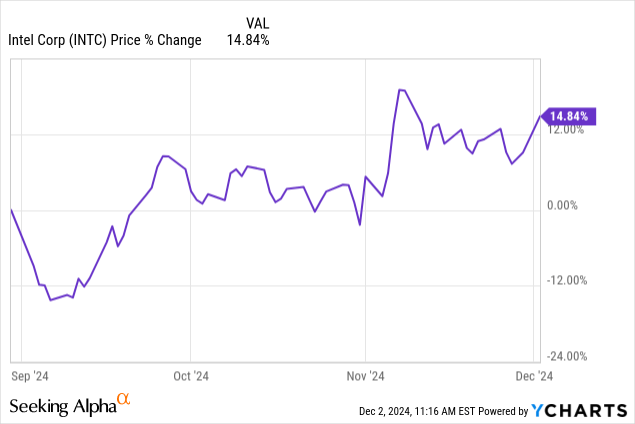

The Market Agrees

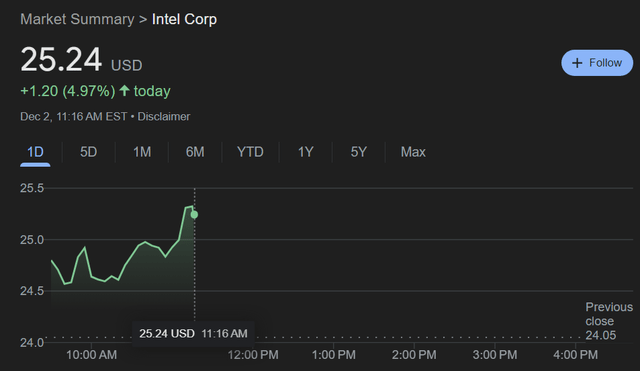

One of the interesting things following the announcement of the downsizing of employees and operations, alongside the record loss, was that the stock went up since then.

Even today, just an hour after the announcement of Gelsinger’s stepping down, INTC is up 5%. The market sees that Intel has a bright future, but needs to change and adapt right now.

Gelsinger promises that his tenure would bring change, and it has, but mostly in showing off how badly behind Intel had become. It was a giant from years past, not a giant today. That will change as Intel produces these new products like Battlemage and the newer line of chips possible thanks to ASML’s machines.

Risks

Instead of being a takeover target, I see an underdog just recovered from its lowest, and ready to grow into the new AI chip market that has brought NVDA so much success or the consumer market that has brought AMD so much success. Intel still has a good foothold in its corporate data business, especially those that are not as demanding on computing power and can leverage that business (and its massive employee count, even still) to regain footholds in those areas that it lost over the last ten years. The last ten won’t be like the next ten.

Unless they are, which is the largest risk. We’ve heard the “this time, things will be different” from Intel before. Pat himself said that before Intel fell 50%.

The difference that I see this time is that the parts are actually moving, not just saying they’ll move. The CHIPS Act brought a lot of hope to Intel with these new foundries, and the market seems to agree that in the last few months, Intel has gotten better and is moving out of its old ways for good.

Pat leaving is the confirmation of that change.

Another risk is continued losses, which could further harm Intel’s ability to spin up these two new American fabs or build a new GPU architecture for the next generation after this current launch.

Conclusion

Ultimately, I am highly considering Intel as a place in my equities portfolio. My only other semiconductor holding is ASML, as I believe the market has overvalued most companies like NVDA. To this end, I recommend investors consider no more than a 3% allocation to Intel, with conservative investors recommending no more than a 1% allocation to any individual company stock.

I am likely going to initiate a small position to start, but I am bullish on Intel and its future.

Thanks for reading.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ASML either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may initiate a long position in shares or derivatives of INTC in the next 72 hours.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.