Summary:

- Intel plans to establish Intel Foundry as an independent subsidiary, aiming to compete with TSMC and secure external customers with strong U.S. government support.

- Intel’s 5N4Y target focuses on launching 18A CPUs by late 2025, with key products Panther Lake and Clearwater Forest being crucial to success.

- Next-gen Arrow Lake CPUs are expected soon, boasting strong specs and significant multi-core performance improvements, essential for Intel’s competitive edge.

- Despite financial struggles and job cuts, Intel’s future looks promising with subsidies, 18A launch, and potential revenue growth from internal and external customers.

FinkAvenue

Intel (NASDAQ:INTC), a company we last discussed in early-August as not a value trap, saw >6% returns today and similar returns after-hours. The company made a flurry of announcements, including a multi-billion dollar deal with Amazon AWS, and billions in government support for Secure Enclave. As we’ll see throughout this article, Intel is just getting started.

Intel Foundry

The biggest source of Intel’s issues over the last several years have been the company’s foundry business. Similarly, it has been among the largest source of the company’s focus to improve its business. The company’s announced plan is to:

To build on our progress, we plan to establish Intel Foundry as an independent subsidiary inside of Intel. This governance structure will complete the process we initiated earlier this year when we separated the P&L and financial reporting for Intel Foundry and Intel Products.

Essentially, the company is planning to separate its business into a separate foundry business that competes with TSMC. Intel has spent roughly $25 billion on the foundry business in each of the last two years, and the company, as the only U.S. based fab company, is receiving strong government support to remain competitive.

The company has received a number of U.S. government grants, including a recently announced $3 billion Secure Enclave. Additionally, the U.S. government through the Chips Act will be providing Intel with $8.5 billion in subsidies and $11 billion in loans. This support will make it much easier for Intel to once again become competitive.

More importantly, making Intel Foundry an independent business will enable the business to competitively gain external customers. It’ll enable the company to gain customers who want to focus on the United States. Intel Foundry with an 18A node will be competitive again with TSMC, and it’ll be able to generate revenue.

On top of all of this, fabs are a relatively concentrated business. TSMC, Intel, and Samsung are the only companies offering it. An example of the new strength of Intel foundry is the company’s recent deal with AWS. As part of this multi-billion deal, Intel will produce an 18A AI custom chip for AWS, and produce a custom AWS chip for Xeon on Intel 3.

This combination shows the strength of Intel Foundry and how the worst is over.

Intel 5N4Y

Intel is focused on its 5N4Y target, which is primarily focused on launching its 18A CPUs in the next year.

Intel Investor Presentation

The essential products for the company are both Panther Lake and Clearwater Forest. These are products that have powered on and booted into operating systems. This was announced in August 2024, which, with our experience, means a late-2025 launch for the product. It’s key for the company to manage to hit this launch date.

The company is effectively skipping ramping 20A entirely with this move which makes 18A even more make-or-break for the company. Microsoft and the U.S. Department of Defense are part of the 18A node as well, which is essential to the company’s success.

Intel Next Generation

The planned next generation of Intel CPUs, Arrow Lake, has had its specs leaked, with a planned launched (with iGPUs) in the next month or two.

Tech Power Up

The specs are strong with P-cores being able to boost clock to 5.7 GHz and 16 E-cores with 24 total cores. The TDP is expected to be able to reach 250W. These are strong multi-core processors that are expected to be able to achieve double-digit multi-core performance improvements. Most important, they’re only manufactured with partner TSMC.

Intel, in its separation of the foundry business, now requires the foundry to win over itself. The company has announced products on the 18A node, which require the foundry to operate for Amazon as well. That’s essential for the next generation.

Intel Financial Performance

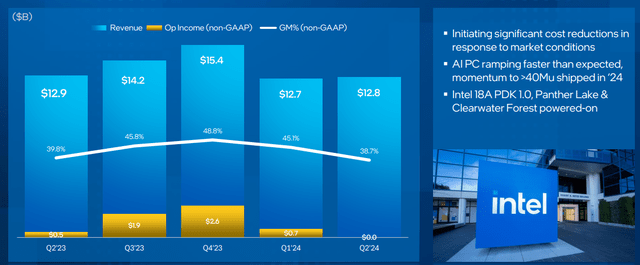

Intel is eking out financial viability as the company continues to struggle through these expensive ramps.

Intel Investor Presentation

The company recently announced its latest set of cost-cutting measures which is tough for morale. The company needs to find a way to cut 15k jobs at the same time as the company is asking and leaning on its employees more than ever to get 18A out the door. It’s an incredibly tough spot for the company to be in.

The company is at more than $10 billion in annual losses from Intel Foundry despite the almost $20 billion in revenue the company is pulling in. Operating income from its overall business is roughly flat. The company is managing to survive, but there’s no secret that the company has dropped almost 60% YTD as its financial picture remains weak.

However, our view is that this is the weakest time for the company. The company is receiving subsidies and 18A should start next year. With Intel as a customer as well that could help revenue grow and losses come that substantially. That could also combine with the company’s external customers and next generation CPUs along with cost savings.

All of that shows Intel’s strength.

Thesis Risk

The largest risk to our thesis is whether Intel can remain competitive in a market with wealthy customers. Gone are the days where Intel was larger than all of its customers who happily bought its CPUs. Apple realized years ago it was cheaper to move that division in-house. Large customers like Amazon demand lower margins. That’s a consistent risk for the company.

Conclusion

At the end of the day, when you bet on a company, you’re betting on management. In a capital intensive and risky business where most competitors no longer exist, that’s even doubly true. Intel’s management made a bad call and had some bad luck with the company’s 10 nm node, and they’ve been paying ever since.

Pat inherited Intel in the same way John Flannery inherited General Electric in 2017. The company’s 5N4Y plan was tough and it’s had its hiccups. However, the company is still working to achieve 18A in 2025, and we expect it to be able to achieve that. That will enable foundry losses to decline and future shareholder returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated, and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.