Summary:

- Intel’s AI revenue and focus on cost-saving business applications in the AI market position it well for long-term growth.

- Intel’s investment in its foundry service and the introduction of its 5th Gen Intel Xeon Scalable processors enhance its capabilities in the AI and data center markets.

- However, Intel’s financials and relative weakness compared to its peers raise concerns about its future growth and make it a risky investment in the AI market in my view.

- Due to a formidable selection of more probable above-alpha returns from other semiconductor investments over the long term, my analyst rating for Intel is a Sell.

Justin Sullivan

I think Intel (NASDAQ:INTC) is significantly overvalued at the moment. Also, while the shares have potential due to the rising AI market and the firm’s strong positioning in this, I have concerns about the company’s financials, particularly its future growth. I wonder if Intel is the best investment, even though I admire the company, its history, and its continued effects on the technology industry today.

Intel & AI

While the firm is driven largely by client computing revenue, I want to look more specifically at AI, data center, and foundry service revenue for this analysis, as I believe these are going to be significant areas of opportunity for the firm moving forward and may create higher long term upside in the stock.

Intel’s AI revenue is growing, especially in relation to its B2B segments. Intel is competitively positioned against Nvidia (NVDA) and Advanced Micro Devices (AMD), focusing strategically on cost-saving business applications integrating AI rather than advanced training. As such, it has a unique and large customer base for a niche in the AI market.

In addition to these cost-saving AI operations, Intel Foundry Services, IFS, is improving industries like automotive, with a strong outlook for EVs by 2030 and beyond. IFS is solving the computing needs of next-gen vehicles through technology nodes, algorithms, software, and applications.

The firm also has a hand in advanced AI, introducing 5th Gen Intel Xeon Scalable processors, currently unique as a mainstream data center processor with built-in AI accelerators. This powerful technology enhances AI, analytics, networking, security, storage, and high-performance computation.

Intel is also making a $25 billion investment in a new foundry in Israel, including a $3.2 billion grant from Israeli governance. It should start operations in 2028 as an extension of the Kiryat Gat manufacturing facility and is an effort to strengthen the global supply chain.

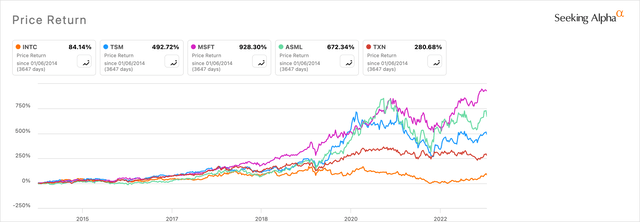

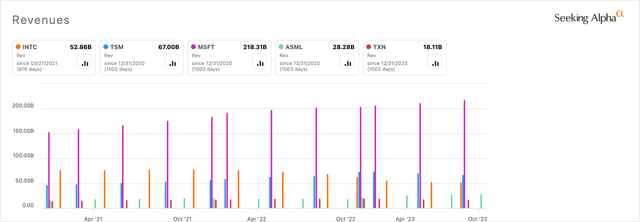

I think Intel has a vital part to play in the AI market, but I don’t think it will be the dominant player nor the best investment to have made in a decade if bought at this time. There are simply too many better investments for exposure to AI, like TSMC (TSM), Microsoft (MSFT), ASML Holding (ASML) and Texas Instruments (TXN).

For this analysis, I am comparing Intel to indirect peers because I am analyzing the firm based on portfolio allocation measures, intending to find the best companies for stock returns through exposure to AI, not the best company in chip design per se.

Risk From Relative Financial Weakness

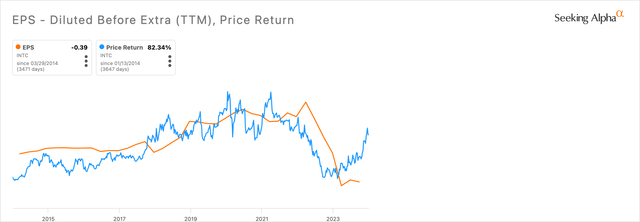

Intel has particularly struggled with growth relative to its indirect peers; Microsoft wins by far:

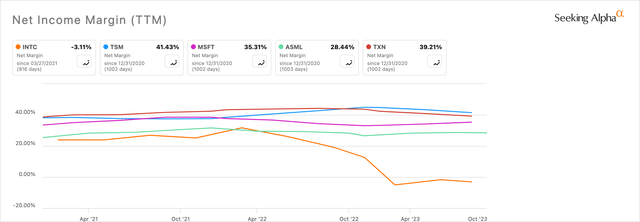

In addition, comparing the firms on net income margin presents a situation where Intel has fallen way below the pack:

Intel’s negative net margins recently have been caused by a global decline in PC demand but also heightened competition from chip manufacturers. The firm’s need to invest heavily in advanced technologies has caused a significant challenge as it attempts to keep up with the various industries associated with its segments.

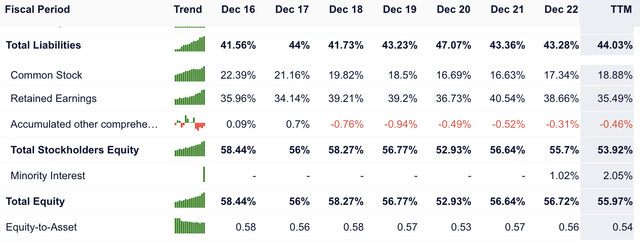

Looking deeper, the balance sheet for the firm is moderately stable, but it ranks worse than 63% of 969 companies in the semiconductors industry on its equity-to-asset ratio. It’s not a major red flag, but remains a point of relative weakness to consider when allocating capital.

There has been a considerable amount more debt issued recently, too:

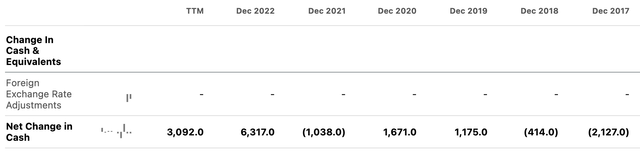

Additionally, while the company has reported a net income of -$1.644 billion TTM, it had a $3.092 billion net change in cash TTM, which is relatively strong in comparison to historical records:

I would not say the firm’s financials overall are bad, just that they are moderate and not in excellent condition. Something I think is important to consider when putting Intel in a competitive perspective with other PC & AI peers who have more room financially to invest and expand at a potentially faster rate.

Valuation Risk

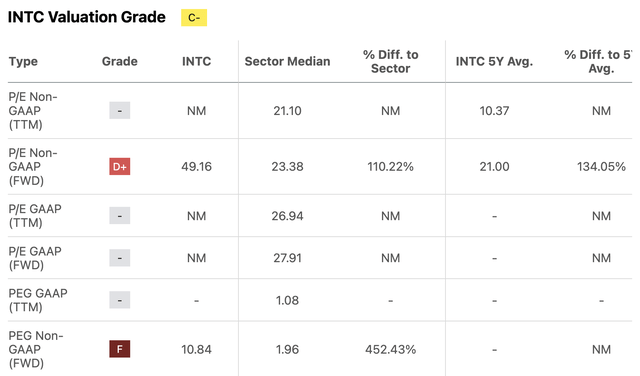

I think Intel is overvalued at the moment, especially when considering the current stock price in relation to its poor growth rates.

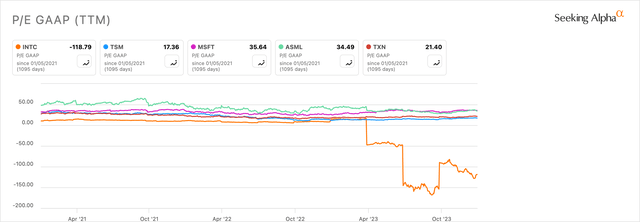

The firm’s current P/E ratio of -118 is considered ‘not meaningful’, primarily due to earnings declines recently relative to market growth:

Seeking Alpha Author, Using Seeking Alpha

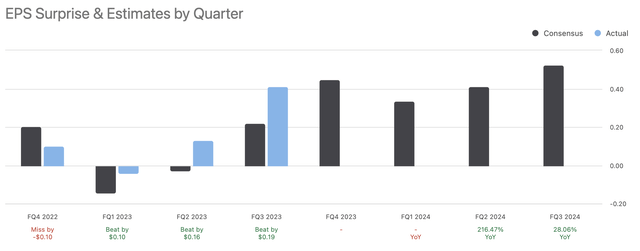

The firm’s forward P/E ratio of around 50 is also not strong when compared to peers TSMC (around 20), TXN (around 24), and ASML (around 34). Consensus earnings for Intel are promising, but such a high stock price in relation to the earnings estimates doesn’t also mean earnings growth is guaranteed to continue, nor is the stock priced fairly at 50x future earnings.

I think investors have speculated that Intel is a long-term value play, and in fact, I’m not sure that it can justifiably be supported as such. Instead, I think most of the profits that have been made in 2023 from investing in the stock in 2022 are the result of shorter-term value investments that may have already paid off. The current price now suggests that the firm is oppositely overvalued with that forward P/E ratio of 50. Intel does not live up to long-term value investing standards at the current price, in my opinion.

Optimistic Outcome

Intel’s 5th Generation Xeon Scalable processors, launched in December 2023, are significant for success in edge computing and AI with small and large-scale capabilities, providing a distinct advantage against the advanced focus of firms like Nvidia. This niche could play out positively for Intel stock.

The firm also reported revenue at the higher end of its guidance in Q3 2023, which is a promising sign. Yet, it was an 8% Y/Y decrease for revenues of $14.2 billion. Q4 2023 is expected to see revenue of between $14.6 billion and $15.6 billion. The firm is also making operational changes, including integrating the Accelerated Computing Systems and Graphics Group into its Client Computing Group, Data Center, and AI Group. This effort to reduce costs is a positive indicator of strategic shifts to lift stock returns over the long term.

New R&D and manufacturing facilities in the EU, including Fab 34 in Ireland and new plans in Germany and Poland, as well as the Israel deal mentioned above, also present a favorable profile for Intel as a Western semiconductor foundry to balance power in the industry away from Taiwan. This crucial political perspective provides some balance in placing Intel strategically in a portfolio.

Taking into account the above fundamentals and operations, an optimistic outcome for Intel could see it advance over some of its direct peers like AMD in CPUs, for example, and lead in unexpected ways in niche markets strengthened by its supply chain operations. Such advancements could introduce the company as a favorable investment, but I think this is relatively speculative, and the evidence suggests less probability of outsized success than a firm like AMD, for example, which is also one of the higher-risk, higher-return assets to invest in advanced technology with at the moment, in my opinion.

Conclusion

Intel is a vital company in the semiconductor supply chain, and my analysis in no way is meant to detract from the crucial significance of the firm in semiconductor operations. However, its current financials and uncertain operational future mean that above alpha returns from Intel are not as probable as other more statistically favorable firms like Nvidia, TSMC, and ASML Holding. For that reason, my analyst rating for Intel is a Sell.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM, NVDA, TXN, ASML either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.