Summary:

- Intel Corporation faced a challenging quarter with a -6% top-line decline and significant impairments, but management is positioning for growth and profitability by eFY25.

- The restructuring plan includes a 15% workforce reduction, $1b non-product cost savings, and capital outlay reduction to $20-23b, aiming for positive free cash flow.

- New INTC product launches, including the Arrow Lake and Panther Lake, are expected to be margin accretive as they will not include embedded storage on the chip.

CaryllN/iStock via Getty Images

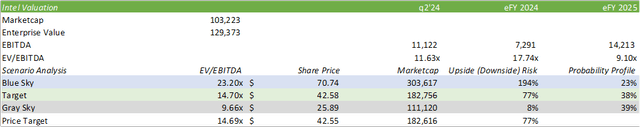

Intel Corporation (NASDAQ:INTC) experienced a challenging quarter with multiple impairments that pushed down margins on top of its -6% top-line decline. Despite the near-term headwinds, management is positioning the organization for modest growth and improved profitability. With an improved cost structure for 18A, I have reason to believe Intel may return to profitability in eFY25. I am upgrading my rating for INTC shares to a BUY with a price target of $42.55/share at 14.69x eFY25 EV/aEBITDA.

You can read my recent sum-of-the-parts analysis of Intel here:

Intel’s Breakup Can Generate Significantly More Value For Shareholders.

Intel Operations

Intel Corp. reported relatively lackluster Q3 ’24 earnings results with a -6% top-line decline and a deeper operating margin compression to -68% on a GAAP basis, and -18% on an adjusted basis. This positions Intel for 3 sequential quarters of GAAP operating losses.

Reconciling throughout the year-to-date results, Intel CEO Patrick Gelsinger noted in the Q1 ’24 results that the quarter would be the bottom in terms of revenue decline with sequential improvements going forward. This target has come to fruition with sequential growth in Q2 ’24 & Q3 ’24. Q1 ’24 was also the quarter Intel adjusted its reporting segments to break out Intel Foundries Services [IFS]. Management announced that another shift in reporting segments will occur in Q1 ’25 to simplify its reporting structure.

Q2 ’24 followed with worse than operating losses as Mr. Gelsinger laid out his planned restructuring roadmap in order to drive to turn Intel back into a profitable entity.

Q3 ’24 followed with an -18% adjusted operating margin paired with 3.5% sequential top-line growth, or -6% on a year-over-year basis. On a GAAP basis, the operating margin fell into a deeper loss at -68% as a result of the restructuring efforts as laid out in Q2 ’24. In the Q3 ’24 earnings call, Mr. Gelsinger noted that the firm had achieved key milestones across Intel Foundry and Intel Products despite the segments reporting an -8% decline and a -2% decline, respectively.

Management remains focused on managing costs & expenses, which has resulted in a 15%+ workforce reduction that is expected to conclude before the end of eFY24. This also includes a 20% reduction in the firm’s capital outlay as guided in Q1 ’24. This will ideally improve Intel’s cost structure by over $10b in eFY25. Management noted in Q3 ’24 that Intel 7 equipment was impaired, as the technology could not be transitioned to EUV processing.

The restructuring will target reducing non-product cost of sales by $1b and anticipates reducing operating expenses to $17.5b to drive margin expansion. Gross capital investments will also be reduced to the range of $20-23B with the goal of positive free cash flow in eFY25. This compares to a capital outlay of $25.75b in FY23.

The new vision for Intel is a leaner and more efficient operation with a simpler, streamlined product portfolio. This process will involve consolidating Intel’s Edge business into CCG and to refocus the NEX portfolio on networking and telco as well as consolidating the software business into its core business units.

As announced in the Q3 ’24 earnings call, Intel is in the process of selling or spinning off Altera in the coming years. More recently, Lattice Semiconductor (LSCC) announced that it is evaluating making a bid for the business unit. According to the report on Seeking Alpha, Intel values Altera at $17b, well above my estimated value in my sum-of-the-parts analysis on Intel a few months ago.

Intel Foundry Services [IFS]

Mr. Gelsinger noted in the Q3 ’24 earnings call that IFS is on track for its transition to EUV with the imminent launch of 18A. The acceleration of this transition was likely the result of Intel’s recently announced multi-year, multibillion dollar deal with Amazon (AMZN) AWS to manufacture Amazon’s custom silicon chips.

Management suggested on the Q3 ’24 earnings call that the Arizona foundry will be online in Q1 ’25, in time for the ramp-up of 18A. The site will be built out with EUV tools for 18A.

Intel was awarded an additional $3b in direct funding under the Secure Enclave program to produce chips for the US Government. In addition to this, funding through the CHIPS and Science Act was finalized, as reported on Seeking Alpha, with a reduced sum of $7.86b, down from the initial funding of $8.5b.

Intel Products

Intel announced its partnership with Advanced Micro Devices (AMD) to create the x86 Ecosystem Advisory Group to ensure an interoperable platform. I believe the intent of this group is to maintain the x86’s dominance as the go-to server chip. What makes this interesting is that Alphabet (GOOG) and Oracle (ORCL) are both a part of this advisory group and are using ARM architecture for CPUs.

In CCG, Intel launched its Intel Core Ultra 200V series processor, formerly known as Lunar Lake, in September 2024. The processor was designed for AI PCs and is said to provide significantly improved performance and battery life. Management anticipates Intel will ship more than 100mm AI PCs by the end of 2025 on a cumulative basis. Lunar Lake will likely narrow gross margins as a result of memory being built into the packaged chip. Management also noted that iterations beyond Lunar Lake will not include embedded memory, allowing for gross margins to improve going forward.

Intel also recently launched Arrow Lake, the desktop form factor of Lunar Lake. Accordingly, Arrow Lake’s initial launch may have run into some optimization issues that led to a degradation in gaming. These issues are currently being addressed and are expected to be resolved by the end of November or early December.

The next iteration to follow will be Panther Lake, Intel’s first client CPU on Intel 18A, which is set to be released in 2h25. Unlike the transition to Intel 4 & Intel 3, where management leveraged its Ireland facility that led to higher wafer costs and significant margin compression, Panther Lake is set to bring more than 70% of the wafers in-house to improve profitability.

Xeon 6 was launched in q3’24. This product doubled the performance of its predecessor with increased core counts, memory bandwidth, and embedded AI acceleration. Intel also launched Gaudi 3 AI Accelerator in the quarter, improving the networking bandwidth by 2x when compared to the previous model. As part of its release, Intel is partnering with IBM (IBM) to deploy Gaudi 3 as a service on IBM Cloud. Despite the product improvements, management noted that adoption of Gaudi 3 is slower than anticipated.

Intel Financial Position

Intel reported a $3b non-cash impairment and accelerated depreciation charge as a result of retiring Intel 7 from production as a result of the transition to EUV. This charge impacted IFS, resulting in an operating loss of $5.8b in Q3 ’24; it also drove the adjusted gross margin down by 18% to 15%, significantly below management’s target of 38%. In addition to this charge, management impaired Intel’s deferred tax asset balance by nearly $10b, impaired $2.6b in goodwill related to Mobileye, and realized a $2.2b severance charge related to the workforce reduction. Management is anticipating the principal cash cost related to restructuring charges to be realized in Q4 ’24.

Management is guiding similar losses in Q4 ’24 as experienced in Q3 ’24. Looking out to eFY25, management does not anticipate its three major foundry deals to materially impact the income statement, as the ramp-up period will occur later in the fiscal year.

Management is targeting a capital outlay of $20-23b with the goal of achieving positive free cash flow for eFY25. Excess capital will be deployed to improve the balance sheet by reducing Intel’s debt position.

Intel currently holds $24b in cash & equivalent and $50b in total debt, for a net debt/aEBITDA of 2.32x. Intel paid down $2.8b in debt in Q3 ’24 and will continue its deleveraging efforts in eFY25.

I’m forecasting Intel to report at the lower end of the guidance range at $13.38b in net revenue and an adjusted EPS of $0.08/share for Q4 ’24 in January. For eFY25, I’m forecasting 3% top-line growth to $54b and adjusted EPS of $0.70/share.

Risks Related To Intel

Overall, I believe Intel’s recovery to be a bumpy road as the firm accelerates development and production to meet current market demands. Compared to consensus estimates, I’m forecasting Intel to be at the lower end of the range as the firm accelerates into the post-EUV technology. Despite my lower forecast, I do believe a significant proportion of the headwinds are in the past, putting Intel in a good position to realize a strong recovery.

Bull Case

Intel signed 3 significant contracts for external foundry utilization, with AWS being named directly for the hyperscaler’s custom silicon. Intel made a major push in q2’24 to capture AI PC market share with Lunar Lake, despite pushing down gross margins. Going forward, Intel is well-positioned to realize tailwinds as it releases higher margin chips as well as begins the manufacturing of external chips.

Bear Case

Intel has a long road ahead of itself to regain its dominance across its foundry and design businesses, pushing the firm to accelerate the 20A at the risk of pushing down margins. This may not be a one-time occurrence for the 18A and 14A as timing will be in focus. Foundry remains highly unprofitable as an independent segment and may not achieve profitability until the firm brings in more external customers.

Valuation & Shareholder Value

Intel shares trade at a significant discount to its industry peers, at 13.20x EV/EBITDA on an unadjusted basis. If Intel’s operations realize improved profitability as forecast, I believe INTC shares may reflect the improved operating model with a higher trading multiple to more closely match its peers.

Looking out to eFY25, I believe INTC shares hold significant value as management takes aim at reducing costs and streamlining operations. As a result of this outlook, I am upgrading my rating for INTC shares to a BUY with a price target of $42.55/share at 14.69x eFY25 EV/aEBITDA.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, AMD, ORCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.