Summary:

- Intel’s ambitious 2026 targets have not been met, leading to significant investor angst and the sharpest decline in its stock price seen since 1975.

- Management is actively working to restore investor confidence through cost-cutting measures, potential asset sales, and streamlining the business portfolio.

- The company’s stock is undervalued, trading below its book value, despite the company’s strategic importance and ongoing cost reduction initiatives.

- I recommend buying Intel at current levels, expecting a reversal in stock price due to management’s efforts and the company’s strategic importance.

TonyFalconenyc/iStock via Getty Images

Investment Thesis

Intel (NASDAQ:INTC) (NEOE:INTC:CA) is not just enduring a difficult few weeks this year. The company has been caught in the crosswinds of chip warfare for over a decade now, but the pace has intensified in the last 5 years.

The company brought in Pat Gelsinger as CEO in 2021 to lead Intel through a new transitory phase for the company and position Intel back onto the right path to product and process leadership. The new management laid out an ambitious plan in 2022 that was supposed to return Intel to its former glory.

But with a couple years remaining from their 2026 goals, Intel finds itself further behind, as revealed on its recent Q2 earnings report.

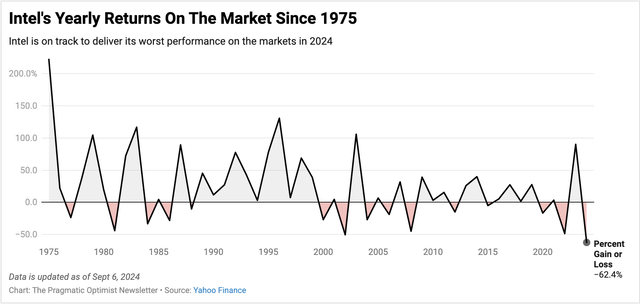

This led investors to bail out Intel’s stock in spades, putting the company at one of the worst yearly returns since 1975.

Exhibit A: Intel’s stock is on track to deliver one of the worst annual performances on the stock market since 1975 (Market Data)

Such an animalistic reaction by investors to the company has forced management to throw everything at the overarching problem—restoring investors’ confidence and reshoring its business transition trajectory.

I believe Intel rests at valuation levels that have priced in the worst trading far below its book value. I recommend buying Intel at current levels.

The Financial Burden Of Intel’s Turnaround & The Stopgap

There is no easy way to look at Intel’s revenues below in Exhibit B and relive the optimism in Gelsinger’s bold turnaround plan that was announced in 2022.

Exhibit B: Intel’s revenues by segment (Company filings)

Intel promised mid-high single-digit revenue growth by 2023 and boldly stated revenue would eventually grow to an ambitious target in excess of $110 billion by 2026. Along the way, gross margins were expected to hover at ~52% by 2024, eventually growing to 56% by 2026, while operating expenses would account for just under 30% of revenues in 2024 before heading lower to ~26% of revenues by 2026.

All this was expected to be done with a disciplined & focused investment to execute on their DCAI (Data Centre & AI) roadmap, while the CCG (Client Computing Group) would continue to deliver value for its leadership in PC processors and related components. Most importantly, Intel’s foundry business was expected to expand its manufacturing capacity in a profitable way while sourcing external clients for its business.

What only transpired since then is akin to the company getting its feet trapped in quicksand. Revenue growth kept falling, margins contracted even faster, and Intel is now left with a huge financial burden on its hands due to the expensive foundry investments it has made into its capital-intensive business, with costs exceeding at least $30 billion. This puts Intel in a precarious position, as its margins are the worst in a decade, as noted in Exhibit C.

Exhibit C: Intel’s margins are the worst in a decade (Company filings)

This forced management to suspend its dividend, cut its workforce by 15%, and save ~$10 billion in costs for the company. With management projecting total revenues worth $13 billion in Q3 and analyst estimates expecting the company to report ~$13.7 billion in revenues, that implies a revenue contraction of ~3% to $52-53 billion. The $10 billion in savings indicates an inflection in the company’s margin profile from the current levels where investors have priced the worst for Intel and the next few quarters.

At a recent conference, Gelsinger acknowledged the drubbing his company’s stock got and the wake-up call that came along with it:

We understand that, and we’re taking seriously what the market’s telling us, and hearing that clearly. But we’re also staying very focused on delivering and executing on the large number of the things that we laid out. We described a set of cost reductions. I can tell you today, most of those are well underway already like everybody in the industry, we realize we have to operate efficiently with nimbleness, with urgency.

Based on reports, Intel is throwing everything it has got to restore investor confidence. Management is already considering unlocking value from some of its assets by either selling a stake or the whole portion of its PLD manufacturing business, Altera, that it acquired for ~$17 billion about a decade ago. Then there is also the option for Intel to separate its capital-intensive foundry business away from its design business, which should also add shareholder value, at least in the near term.

Despite what reports suggest, management has made it clear, as recently as last week, that they are reviewing Intel’s portfolio of businesses and investments actively and will mostly be done streamlining its business portfolio “by the time we [they] announce earnings in the third quarter.”

Markets Have Priced Intel Fearing The Worst

I will note that my bullish thesis is based on management’s actions, which should financially boost the company’s standing at least in the near term. And markets appear to be mispricing this aspect of the company when valuing Intel.

Intel is priced at 0.7x its book value, which implies some level of a floor to the bearish sentiment that Intel currently has. Moreover, these levels have not been seen in Intel’s book value pricing per data as far back as I can go.

Exhibit D: Markets are pricing Intel at its lowest level relative to its book value (YCharts)

Intel has ~206 billion in assets, most of which are due to its foundry assets, including land, as well as ~$29.3 billion in cash, equivalents, and investments. Intel’s $10 billion cost reduction initiatives should help in unlocking value from their assets, which can be used to reduce the ~$53 billion debt load it currently carries.

Despite its woes, Intel is still one of the most strategically important companies for the U.S., and the current mispricing also ignores that fact.

Risks & Other Factors To Know

As noted earlier, part of Intel’s cost reduction plan is to spin out assets or completely divest parts of their business. Their foundry business in particular does have some considerations that the company will be factoring in because it has been a beneficiary of the CHIPS Act, receiving federal funding and tax credits in return for its investments on U.S. soil. This means any sale of the foundry business will be scrutinized by the U.S. government due to the sensitive nature of the business if Intel decides to sell the business.

Intel may also decide to keep the foundry business if it can attract more clients. Currently, Microsoft and Broadcom are some clients Intel has secured for its future 18A node, although reports suggest Broadcom is already working with Intel to iron out deficiencies through its QA process. However, the decision to keep its foundry business will impact margins since Intel might be undercutting competitors to sell exclusive capacity contracts, which are hard to come by nowadays in the fab world.

My thesis does not correspond to my long-term view of the company, where I believe there are fundamental issues the company still needs to work through on its products. Right now, management is focused on righting the ship with its investors. I believe investors are not pricing that in the near term over the next year.

Takeaways

Investors’ sentiment against Intel appears to be at its lowest levels, as the company has failed to track its 2026 targets. However, that raging sentiment against Intel has driven the stock down to some eye-raising discount levels, with Intel’s market capitalization trading at a value far under its book value. This is ignoring the margin inflection that is already visible on a TTM basis or the additional $10 billion in cost savings that is due to come in from its cost reduction strategies.

Intel’s management is doing everything to restore investor confidence, and I expect a reversal in Intel’s stock price over the coming weeks.

I am cautiously recommending a Buy on Intel.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in INTC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.