Summary:

- Intel financials continue to be awful.

- Heavy capex spending is necessary but likely won’t yield financial benefits for the company for some years.

- Despite poor financials, high trading volume suggests potential institutional accumulation, anticipating positive developments at Intel.

- We rate the stock at Accumulate with an eye to replicating what we believe to be large-investor accumulation.

JHVEPhoto/iStock Editorial via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

If Boeing Is Still Solvent So Too Is Intel

By Alex King, CEO, Cestrian Capital Research, Inc.

The reason to want to own Intel Corporation (NASDAQ:INTC) long term is simple – it’s a national champion just like The Boeing Company (BA). And the stock is a bet on whether the US can in fact decouple its semiconductor device demand from a supply chain dominated by Taiwan Semiconductor Manufacturing Company Limited (TSM). Success in doing so is a strategic imperative for the US; it’s as important today as nuclear missile stockpiling was in the 1960s. The US can get there one of two ways. One, it can hope that TSM’s Arizona and other US fabs can (1) produce in volume at high yield, and (2) remain somehow independent of the Taiwanese ownership of those fabs in the event that China decides to implement the notion that Taiwan isn’t really a country at all but more a kind of island neighborhood of the mainland. Or, it can hope that Intel gets its act together and is able to produce advanced devices with modern feature sizes at volume… you get the idea.

I, personally, doubt Option One is a viable strategy. The TSM Arizona fab is reporting compelling yields now, which is good. But if the parent company is sequestered… then what? Occupy the Arizona plant and wrest it from parent control? Not pretty. So I think it’s all eyes on Intel. Also, not pretty. But the US appears to be in a “Run What Ya Brung” kind of race, so I think we can expect a river of federal money and other forms of assistance to flow from DC all the way into the Santa Clara Valley.

I own Intel personally and I don’t mind holding it for a long time. I don’t suppose it will be an easy one to own, but then my allocation to it is modest and if the stock halved along the way, it wouldn’t keep me awake at night. I think Intel is a must-win for the US, and generally speaking, betting against US semiconductor technology has been a losing bet for, oh, about 80 years now. So I’ll be sitting tight with my INTC stock.

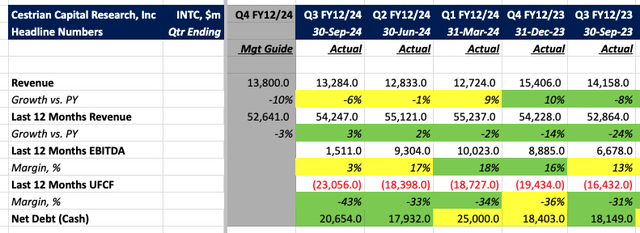

Here’s the Q3 headlines, which are a mess.

Intel – Headline Financials

Intel Financial Summary (Company SEC Filings, YCharts, Cestrian Analysis)

The story doesn’t get any better if we dig into the details. Revenue growth is getting more negative, cash flows have yet to bottom out if we look at the slower-burn trailing twelve month unlevered pretax FCF measure, and the only reason that the balance sheet can support 20x TTM EBITDA leverage is because the company is called Intel. (It would be fine if it was called Boeing too by the way).

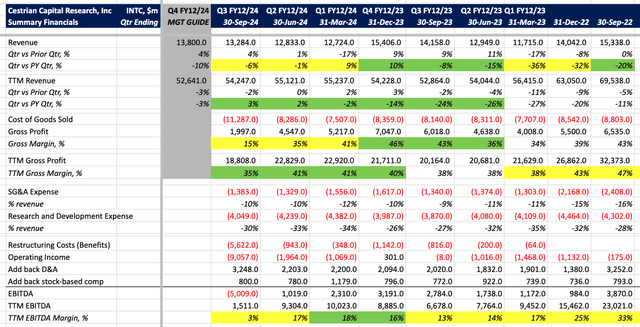

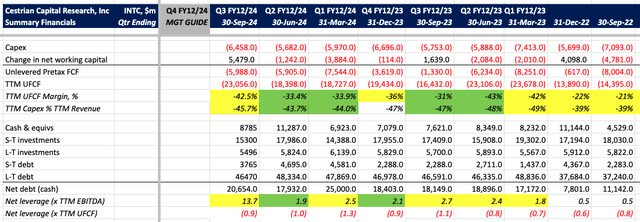

Intel – Detailed Fundamental Analysis

INTC Fundamentals I (Company SEC Filings, YCharts, Cestrian Analysis) INTC Fundamentals II (Company SEC Filings, YCharts, Cestrian Analysis)

Currently, the fundamental problem at Intel is that the company has to spend a huge amount of capex – some $25bn in the last 12 months – in order to grow revenue and earnings. It obviously takes some time for money being put into factories and machines and such to actually drive revenue and earnings. Years, in the case of semiconductor companies. So for a long time now, Intel has been a show-me story on the capex front. But the fact is that the company cannot, even in the best possible circumstances, generate a return on this huge capex for another couple of years yet. The most likely in my view is that the stock starts to turn up whenever leading indicators of success start pointing up. Fabs switched on, certain yield targets hit, new process geometries testing well, etc.

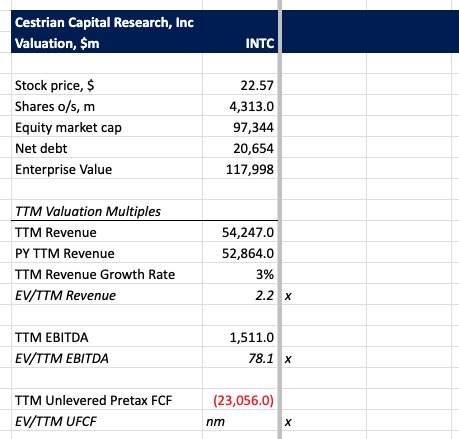

The valuation more or less doesn’t matter right now. The stock is expensive on fundamentals whichever way you cut it. If the company succeeds in its mission, the present price will turn out to be cheap: 2x TTM revenue at what may be near a trough level of revenue isn’t so bad if in fact it’s near trough level and not still in free fall.

Intel – Valuation Multiples

INTC Valuation Analysis (Company SEC Filings, YCharts, Cestrian Analysis)

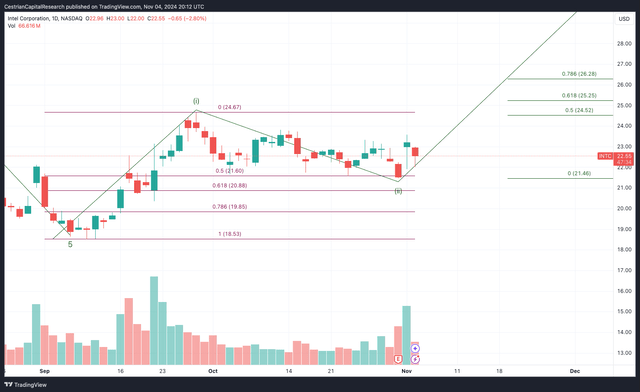

Intel – Stock Chart And Rating

Since Intel stock properly fell off a cliff and started crawling along the beach, volume has been rather high, as you can see from the volume x price analysis – the gray bars on the right-hand side of the chart. This could be institutional selling, but I don’t think it is. I think this is institutional accumulation anticipating something going right at Intel. Major cost cut, improving yields at those small process nodes, successful fab lights-on, something. Because most likely as such things hit the news, the stock has a chance to move up, and folks buying now are doing so anticipating this, I believe.

We rate Intel at Accumulate as a result – not because of the numbers but because of that volume of probably buying by large account investors.

You can open a full page version of this chart, here.

Intel Stock Chart (TrendSpider, Cestrian Analysis)

By the way, if you were looking for confirmation of this, you might care to zoom in a little. Not definitely but probably, INTC stock is starting to put in a move up in the smaller degree. You can open a full page version of this chart, here.

Intel Stock Chart II (TradingView, Cestrian Analysis)

The reason to think the stock may be in an up-move is that, having bottomed out at $18.53, that low was tested over three days and held firm. The move up to $25 or so was then “retraced” to the 50% level – which is to say that in normal speak the stock gave up half the gains it achieved between $18.53 and $24.67, and has tested that support level on two days so far. If $21.60 holds as support – actually even if only $19.85 holds as support – then we may be in a Wave iii up over the timeframe shown in the second chart. All of this is just pattern-recognition possibilities, of course.

So, Accumulate rating, patience needed if you choose to put your capital or your clients’ capital to work here, I think.

Cestrian Capital Research, Inc – 4 November 2024.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives.

Business relationship disclosure: See disclaimer text at the top of this article. Cestrian Capital Research, Inc is an affiliate partner of TrendSpider.

Cestrian Capital Research, Inc staff personal accounts hold long positions in INTC; no positions in TSM directly but these accounts hold long positions in ETFs linked to the Philadelphia SOX index.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Our Investor Community.

Our Growth Investor Pro service is one of the most highly-respected and most popular services on all of Seeking Alpha. And right now you can take a one-month trial for just $99 before deciding if you want to take an annual subscription. You can learn all about it here including the wall of 5-star reviews we’ve received in bear and bull markets alike.