Summary:

- Excessive capex spend and economic factors such as rising interest rates and inflation have contributed to the downturn in the semiconductor industry.

- The logic sector led by Intel Corporation continues to face a cyclical downturn, as the company predicts a decline in server CPU inventory in the near term.

- The Foundry and Memory chip sectors have begun to recover, but memory inventory continues to rise as chip supply continues to outpace demand, which has yet to increase appreciably.

- Days of inventory for the three sectors have increased from an average of 113 days a year ago to 134 days currently, as chip recovery will be slow.

FinkAvenue

Intel Corporation (NASDAQ:INTC) announces its Q3 2023 earnings post-market on October 26, 2023. In the last quarter, Intel exceeded expectations, despite a nearly 16% year-on-year drop in total revenue. Notably, the company managed to halt the quarter-over-quarter declines in two of its critical business segments, possibly indicating a potential stabilization for the chipmaker, which has faced challenges in recent years due to declining demand for PCs and notebooks.

In the second quarter, INTC reported revenue of $6.8 billion for its Client Computing segment, which encompasses semiconductors for PCs and notebooks. This figure marked a significant decrease from the previous year’s level of approximately $7.7 billion and was significantly lower than the unit’s average quarterly revenue of over $10 billion in 2021.

For Q3 guidance, Intel said during its Q2 call it expected to earn 20 cents per share and generate sales within a range between $12.9B and $13.9B for the third quarter, compared with total revenue during the Q2 quarter of $12.9B.

In this article, I take a deep dive into the possible semiconductor recovery of Intel with its logic chips and compare it to other semiconductor sectors and companies including Memory and Foundry.

Catalysts for Downturn

As a backdrop, more than two years ago, I first warned readers in my June 25, 2021, Seeking Alpha article, entitled “Applied Materials: Tracking A Likely Semiconductor Equipment Meltdown In 2023,” that a sharp downturn in semiconductors and semiconductor equipment would occur in 2023 due to excessive capex spend.

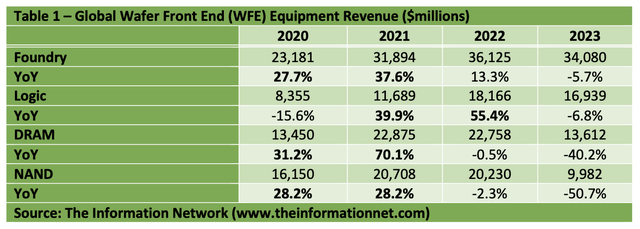

In Table 1, I show WFE (wafer front end) equipment spend for the three sectors analyzed in this article. Capex is comprised of equipment and construction in approximately a 50:50 ratio. Excess WFE means more chips are made, increasing supply and altering supply/demand dynamics. I highlighted in bold in Table 1 my estimate of excessive capex spend by year and sector.

Analyzing the Cyclical Recovery

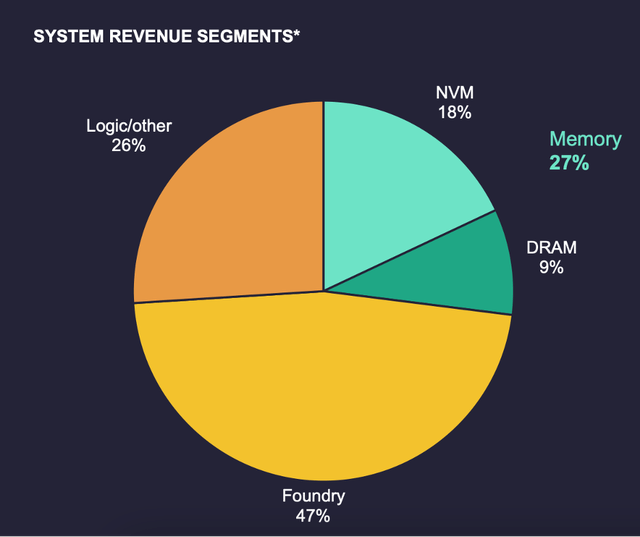

The semiconductor equipment suppliers generally segment their sales by semiconductor type. Lam Research, for example, in its recent quarter, segments its revenues as shown in Chart 1. These three sectors, Logic, Memory, and Foundry are analyzed in this article. The major focus is on Logic chips, exemplified by Intel, and its cyclical recovery compared to Memory and Foundry.

Intel’s CEO describes his company as:

“the sole American company designing and manufacturing logic semiconductors at the cutting edge of technology.”

Chart 1

The semiconductor industry is just beginning to recover from a year-long downturn that significantly impacted the memory market as revenues and profits plunged. But the recovery among different semiconductor types and companies has been uneven so far.

For example, Samsung Electronics (OTCPK:SSNLF), the world’s largest memory chip company, recently reported that its preliminary third-quarter profit dropped by 78%, based on demand for smartphone, PC, and server shipments and on cloud capex spend.

The Foundry Sector, led by Taiwan Semiconductor (TSM) aka TSMC, however, has started its recovery as global shipments of logic chips have started a recovery. TSMC reported earlier that monthly sales in September generated a 13.7% sequential increase in third-quarter revenue, above its own guidance, aided by artificial intelligence and the Android smartphone supply chain.

Intel is one of the largest logic companies. Intel CEO Pat Gelsinger noted during the company’s Q2 2023 earnings call:

“We see the server CPU inventory digestion persisting in the second half, additionally, impacted by the near-term wallet share focus on AI accelerators rather than general purpose compute in the cloud. We expect Q3 server CPUs to modestly decline sequentially before recovering in Q4.”

CFO David Zinsner added:

“Data center, network and edge markets continue to face mixed macro signals and elevated inventory levels in the third quarter.”

Importantly, Intel announces Q3 2023 earnings on October 26, 2023, and the information in this analysis is important to consider prior to the call, as it discusses the downturn and when an improvement in the company’s financials can be expected.

Intel and Logic Unit Shipments

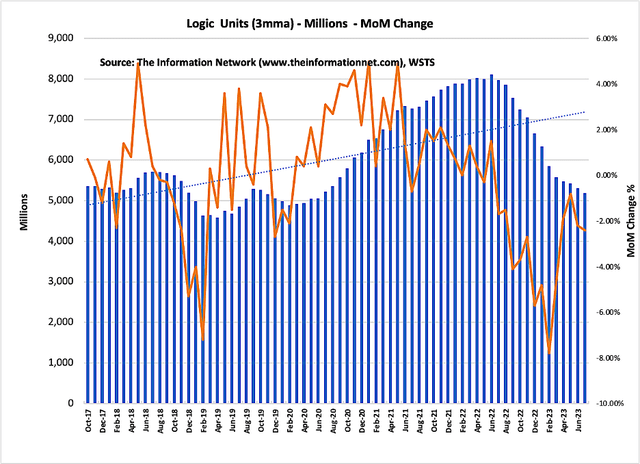

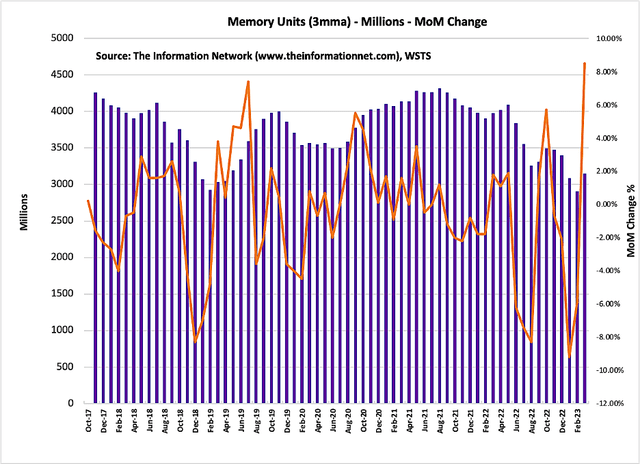

Logic shipments are shown in Chart 2 between October 2017 and July 2023. Here we can see that the increased WFE in 2021 and 2022 gave rise to a massive increase in the supply of chips which peaked in June 2022. Through July 2023, Chart 2 shows that unit shipments of logic chips were still dropping, although MoM change has been increasing for the past several months.

WFE spend in Table 1 above shows that logic companies increased spend in 2021 and 2022 compared to 2020 and 2021 for foundry and memory. I based the continuing downturn in logic shipments on the later ramp in equipment spending for this sector. This time gap has helped reduce days of inventory, which is discussed later in this article.

Chart 2

Microprocessor Unit Shipments

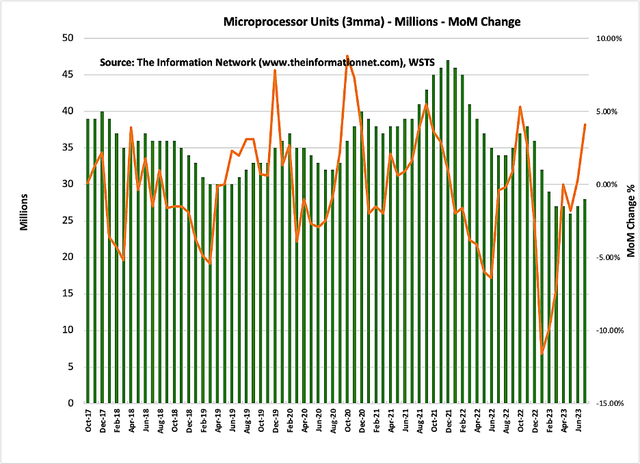

Microprocessor shipments are shown in Chart 3 between October 2017 and July 2023. Here we can see that the increased WFE in 2020 and 2021 gave rise to a massive increase in the supply of chips which peaked in December 2021. Through July 2023, Chart 3 shows that unit shipments of microprocessor chips started increasing in June 2023. This ramp in microprocessors is partially due to a ramp in shipments of AI and smartphone chips.

Again, excessive WFE spend for foundries started in 2020, earlier than logic, and recovery has started earlier than logic.

Chart 3

Memory Unit Shipments

Memory shipments are shown in Chart 4 between October 2017 and July 2023. Here we can see that the increased WFE in 2020 and 2021 gave rise to a massive increase in the supply of chips which peaked in August 2021 for both DRAM and NAND. Through July 2023, Chart 4 shows that unit shipments of memory chips started increasing in March 2023.

Chart 4

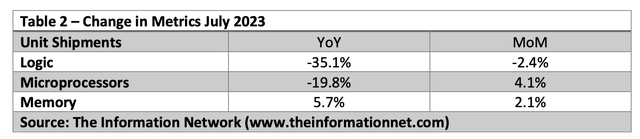

Table 2 summarizes the change in metrics for Units for the three segments.

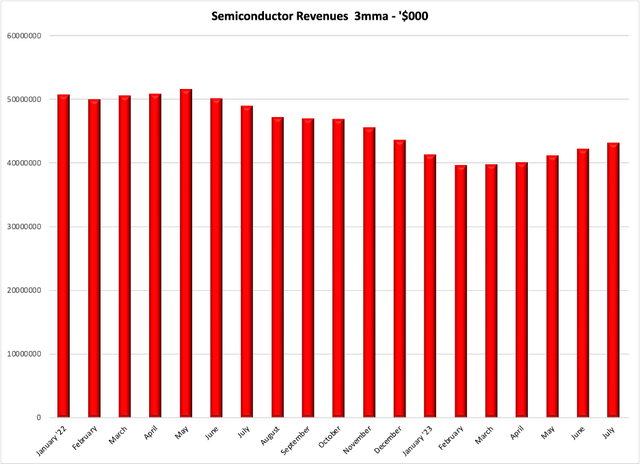

Revenue for the Overall semiconductor industry, which includes other sectors besides the three analyzed in this article, started recovering in April 2023, as shown in Chart 5.

Chart 5

Consumer Electronic Product Recovery

Many analysts are touting an uptick in consumer-related items, particularly PCs and Smartphones, in 2H 2023. I agree, but with an important proviso – 2022 was bad but 2023 will be worse as recovery won’t happen until 2024.

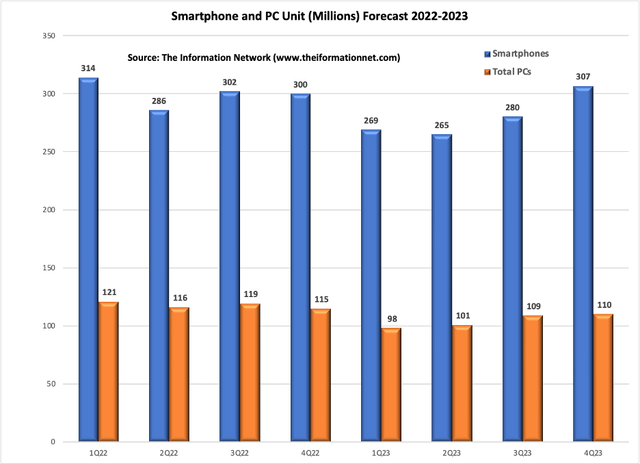

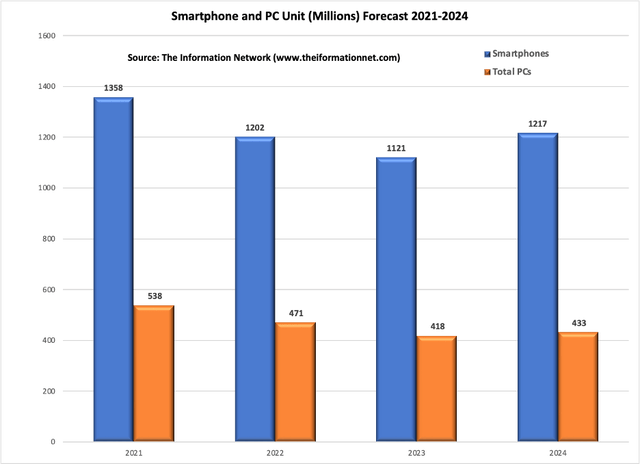

Chart 6 shows quarterly unit shipments for Smartphones (blue bar) and PCs (orange bar) from Q1 2022 to Q4 2024. Here we can see that shipments will reach a low in Q1/2 2023 and begin showing positive QoQ growth in Q3 2023.

Chart 6

However, Chart 7 shows that demand for these consumer products was so bad in 2022, extending into 2023, that a YoY recovery won’t happen until 2024 according to my analysis.

PC shipments dropped 12.4% YoY in 2022 and I expect another 11.2% drop in 2023 before increasing 3.4% in 2024. While unit shipments of PCs will be lackluster, the cheap prices of DRAMs and NAND due to chip oversupply will be a catalyst for smartphone vendors to add more memory to smartphones.

Smartphone shipments dropped 11.5% YoY in 2022, and I expect another 6.7% drop in 2023 before increasing 8.6% in 2024. While unit shipments of smartphones will be lackluster, the cheap prices of DRAMs and NAND due to chip oversupply will be a catalyst for smartphone vendors to add more memory to the smartphones.

Chart 7

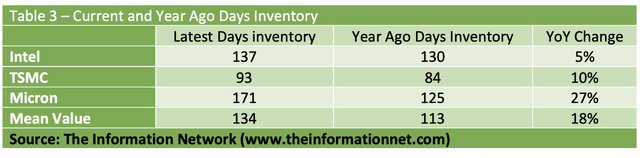

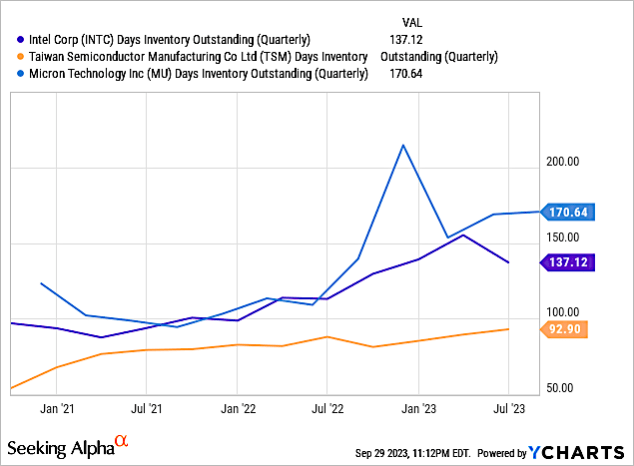

Chip Manufacturer Days of Inventory

Chart 8 shows days of inventory for Intel (Logic), TSMC (Foundry), and Micron (MU) (Memory) for the past 1-year period. Average days of inventory for all companies have increased over the past year as chip supply continues to outpace demand, which has yet to increase appreciably.

Chart 8

YCharts

Table 3 shows that days of inventory have increased 18% over the past 1-year period on average, based on higher inventory levels at MU.

Investor Takeaway

Driven by a mix of skyrocketing consumer demand followed by pandemic supply constraints, the traditionally cyclical semiconductor industry moved along a new cycle that started in August 2020 and ended in August 2022. The downturn was amplified by a 40-year high inflation rate and recessionary fears that dampened demand primarily for consumer electronic products.

A recovery in the overall semiconductor market has now started in March 2023, albeit unevenly based on various sectors. The key issue is WFE spend, which must be adjusted judiciously to prevent another market/sector downturn.

Logic chips have yet to recover. As noted above, with Intel being defined by its CEO as “the sole American company both designing and manufacturing logic semiconductors at the leading edge of technology,” the company is a cornerstone of the logic chip sector.

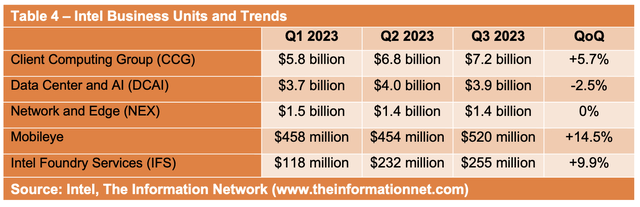

Table 4 below shows Intel’s business unit revenues for the recent Q2 2023 quarter and my estimates for Q3 2023.

Intel, The Information Network

Intel exceeded expectations in its second-quarter revenue, despite a nearly 16% year-on-year drop in total revenue. Notably, the company managed to halt the quarter-over-quarter declines in two of its critical business segments, possibly indicating a potential stabilization for the chipmaker, which has faced challenges in recent years due to declining demand for PCs and notebooks.

In the second quarter, Intel reported revenue of $6.8 billion for its Client Computing segment, which encompasses semiconductors for PCs and notebooks. This figure marked a significant decrease from the previous year’s level of approximately $7.7 billion and was significantly lower than the unit’s average quarterly revenue of over $10 billion in 2021. But as I show in Chart 6 above, that sector is recovering.

Data Center is a problem, as I estimate revenue growth of -2.5% in Q3. More important is the introduction cadence of new chips. For example, Intel’s next Data Center CPU, Emerald Rapids, won’t be launched until 4Q 2023.

Intel’s next Data Center accelerator Habana Gaudi3 launch has most likely been pushed back from 4Q 2023 to 2024.

I expect 1-2 more quarters of diminishing growth in the Data Center unit.

I rate Intel Corporation stock a Hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.