Summary:

- Intel reported what appeared to be a “kitchen sink” quarter.

- The stock fired up in response as investors said the worst was behind them.

- The larger semiconductor cycle looks to be peaking, and that portends poor things for the sector laggard.

yuriz/iStock Editorial via Getty Images

In our previous coverage of Intel Corporation (NASDAQ:INTC) we gave it a “Sell” rating. That was a consistent theme for our work over the last 3 articles.

Seeking Alpha

We appreciated the potential upside if everything went right, but there were just too many longer-term negatives to embrace buying the “blood in the streets”.

The stock is at $21.00 and there is strong support at $0.00, so that is the most you can lose. There could be plenty of upside in the next cycle. But as it stands, there is nothing that can change the course of this train wreck.

In two quarters, especially if a recession hits, we will see this move towards a junk rating. In 6, we might be discussing a bailout and existential risks. We continue to rate Intel Corporation stock a Sell and suggest investors use any rallies to exit.

Source: The Little AI Engine That Couldn’t

The company announced its Q3-2024 results and the stock soared in response. We tell you why this is a great exit point for those looking to book tax losses.

Q3-2024

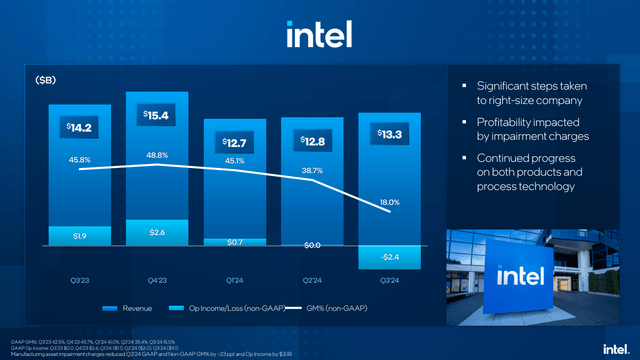

If you saw the price action and assumed that INTC reported a set of fantastic numbers, you were greatly mistaken. The earnings were in the deep red territory and way below the August guidance. The gross margins were so bad that you might think you stumbled upon another company’s finances. After all, this was the company that reported 50% gross margins regularly during its prime. The only solace was that revenues, which were down 6%, were still higher than the August outlook.

Wall Street took that revenue improvement and ran with it. Never mind the fact that INTC managed to lose more money on this revenue base than it had ever had.

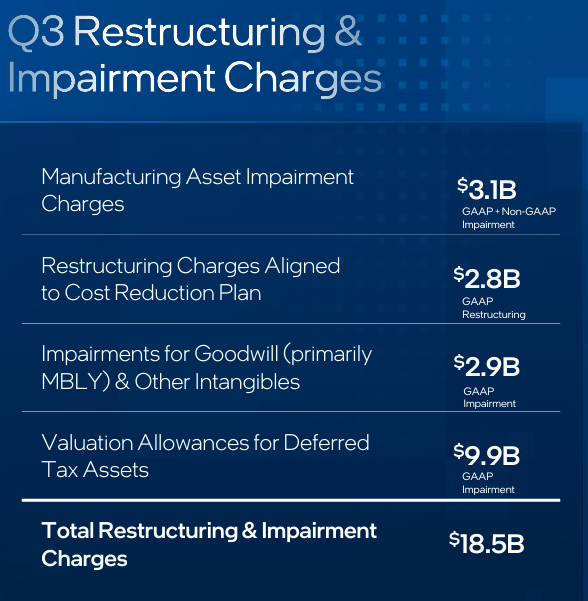

All of this would be enough to dump the “efficient market” philosophy but INTC’s numbers shown above were all heavily “adjusted”. Q3-2024 included the largest restructuring and impairment charges seen in its history. These amounted to over 20% of its market capitalization just prior to the results.

INTC Q3-2024 Presentation

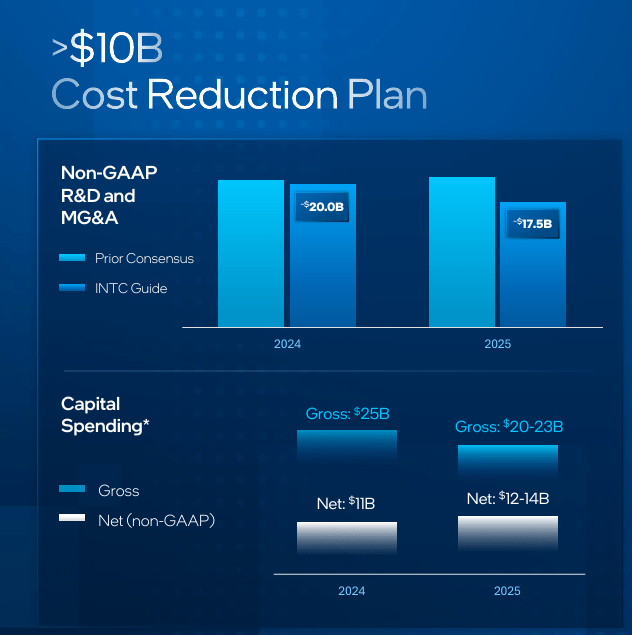

The one real bright spot was that there was a huge cost reduction plan put in place.

INTC Q3-2024 Presentation

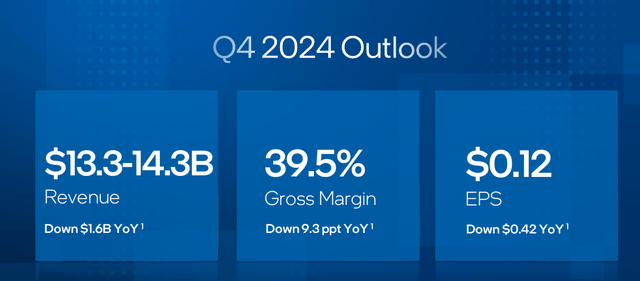

The other lollipop for Wall Street was the guidance for the next quarter. This was a bit ahead of the consensus. This once again set the stage for investors to believe that they have indeed caught the bottom.

Our Outlook

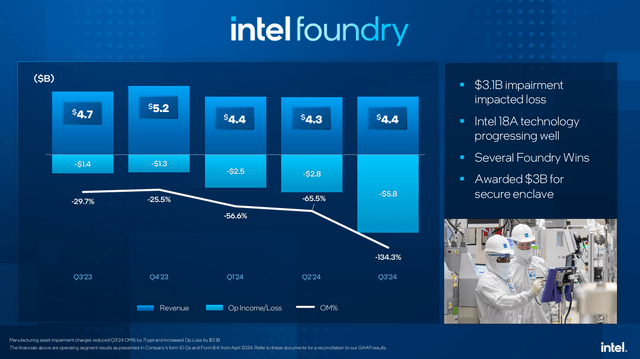

We would love to cheer for this underdog and nothing would please us more than to see INTC become the comeback kid. But the results look so awful that we don’t see things changing. Yes, we are all pining for the INTC foundry magic. That same foundry which lost $5.8 billion on $4.4 billion of revenue.

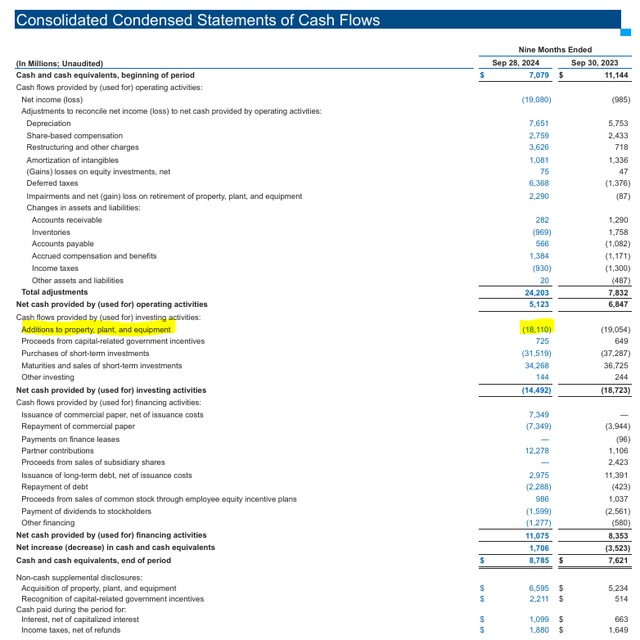

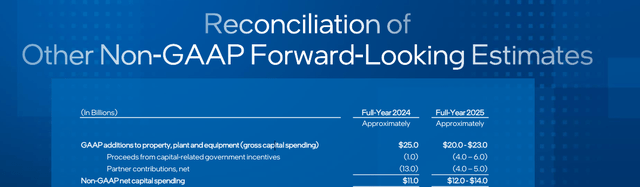

The cash burn right now is epic. The company generated $5.1 billion from operating cash flow and spent $18.1 billion during the first 9 months of this year.

That spend is going primarily towards the foundry, which itself is burning cash at an exponential rate. Inventory write-downs, something we have been warning about for the last 12 months, finally took place.

Operating income was negatively impacted by a $300 million write-down of accelerator inventory due to reduced revenue expectations. Intel Foundry delivered revenue of $4.4 billion up slightly sequentially, driven by increased wafer mix of Intel 4, 3. Foundry operating loss of $5.8 billion was down sequentially materially driven by the $3 billion impairment charges I discussed earlier.

Source: INTC Q3-2024 Conference Call Transcript

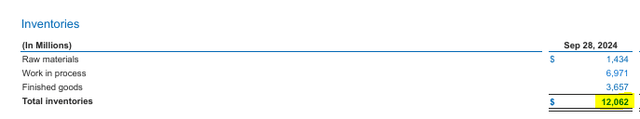

You would think with all the write-offs and inventory impairments that inventories would move lower sequentially. You would be wrong. Inventories actually rose to $12.06 billion, up from the $11.2 billion seen last quarter.

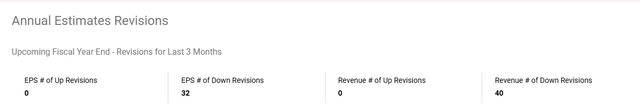

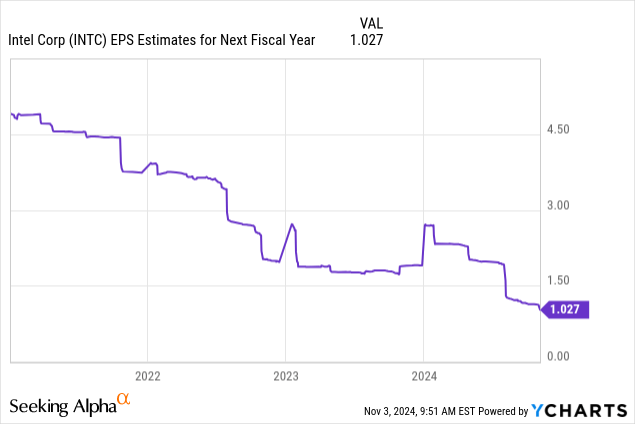

INTC’s hopes lie now on a rapid turnaround cycle in their profits. We will add here that while the quarterly revenue number beat, the EPS estimates for next year, were revised lower. You can see that in the last little drop in the next chart.

You can also see the same in the earnings revision chart from Seeking Alpha where “consensus” reached a whole different level.

In essence things were slightly better on the revenue front from Q3-2024 and worse on every other front for the next 12-24 months. From an existential perspective, investors have to be cognizant that 2025 will see $4-$5 billion of operating cash flow and perhaps $20-$23 billion of capex. Yes, its partners will “chip” in and those government grants will ease the pain, but the net cash outflow will still be fairly huge.

So there are lots of hills to climb before we get to the promised foundry fruit.

Verdict

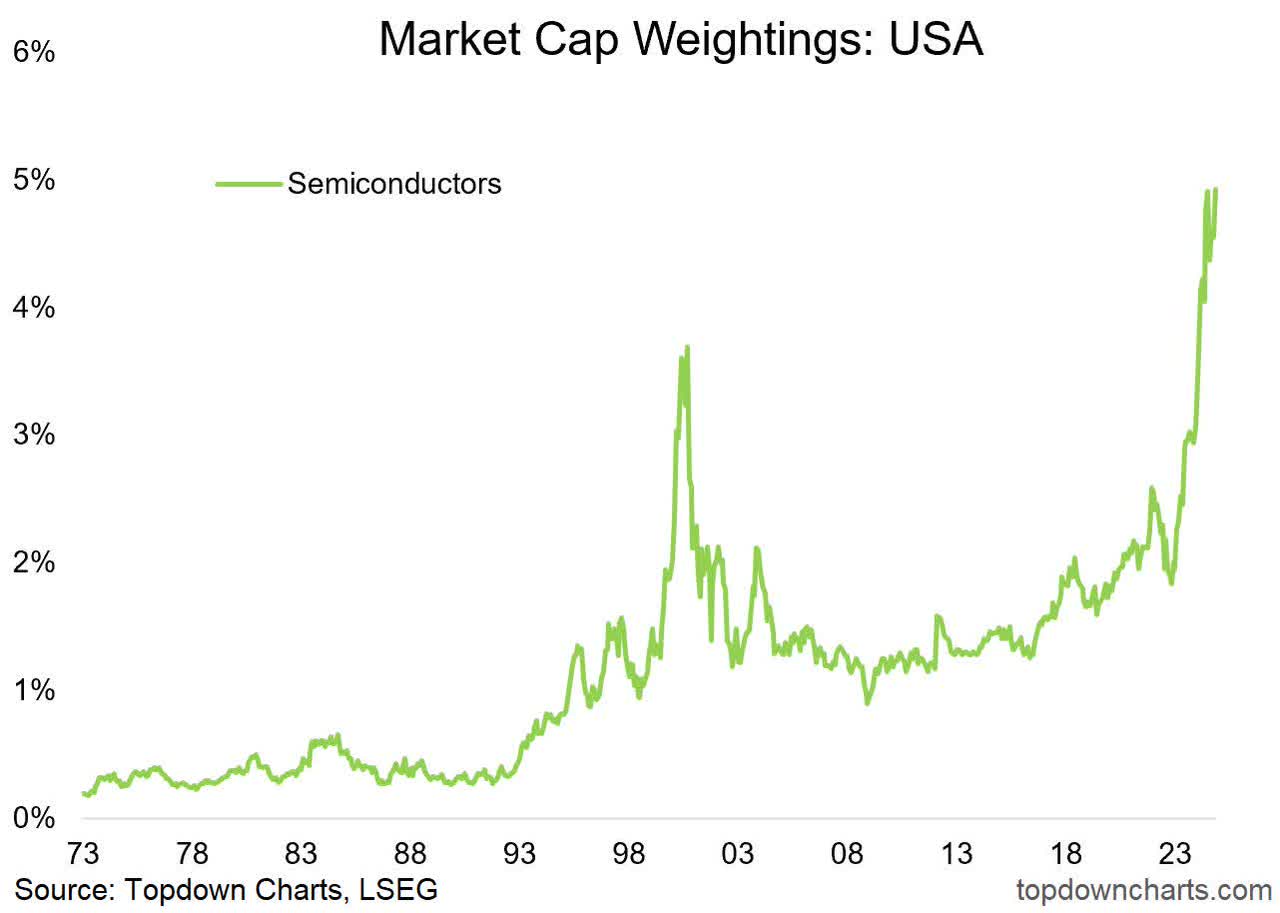

Semiconductors are cyclical. Anyone thinking that this is a secular sector, regularly gets carted out to the woodshed every few years. INTC’s performance here in the face of peak profits for other semiconductors, is speaking volumes. Does the chart below make you think “nascent bull market” or “epic bubble”?

Top Down Charts

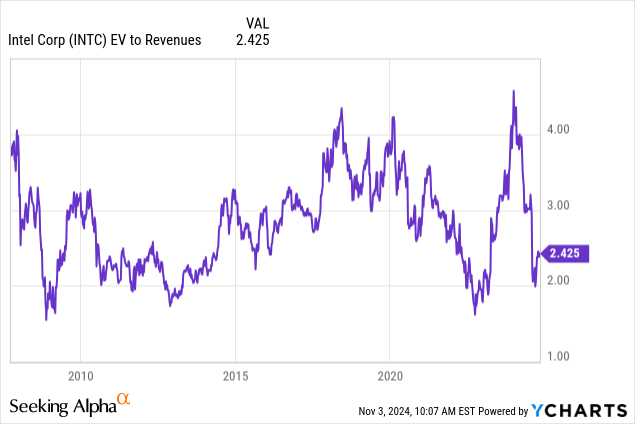

INTC like all semiconductor stocks, receives investments today via ETFs. Once that bubble above bursts, you will see the full consequences for the company running dead last in this race. The stock looks modestly attractive on an EV-to-sales basis. But if you simply use the 2009 and 2022 lows seen on this ratio and adjust for the cash burn (debt increase) over the next two years, we can see INTC drop another 40% from here.

We maintain a “Sell” rating.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

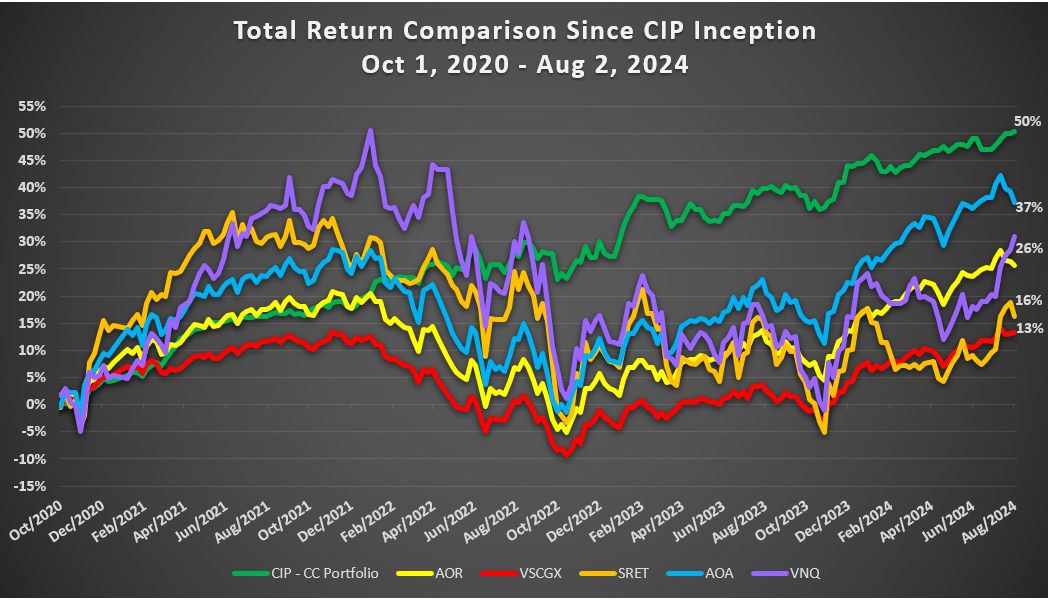

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.