Summary:

- Despite the recent disappointment in earnings, the management indicated a trough in all revenue segments in 2H FY2024, reflecting a potential growth inflection point in FY2025.

- INTC is expected to complete its “5 Nodes In 4 Years” plan by FY2025, ramp up Intel 20A production later this year and begin producing Intel 18A in mid FY2025.

- The company’s margins are expected to improve over time as it nears the end of its transition plan, optimizing its cost structure.

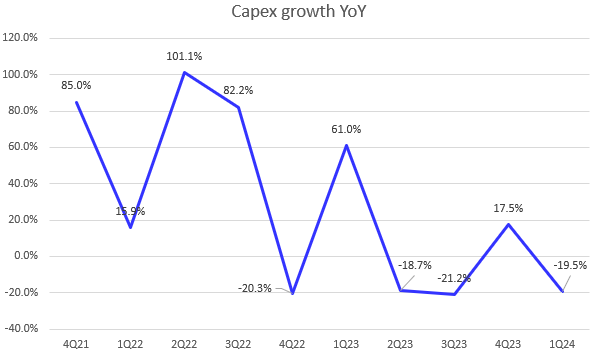

- INTC’s capex growth will continue to slow down as management indicates that FY2024 reaches the peak for the “5 Nodes In 4 Years” plan, driven by factory start-up costs, thereby improving FCF.

- The stock is currently trading at 17.6x non-GAAP P/E for FY2025 and 1.36x P/B fwd, which is 37% below its 10-year average, indicating an attractive buying opportunity.

JasonDoiy

Investment Thesis

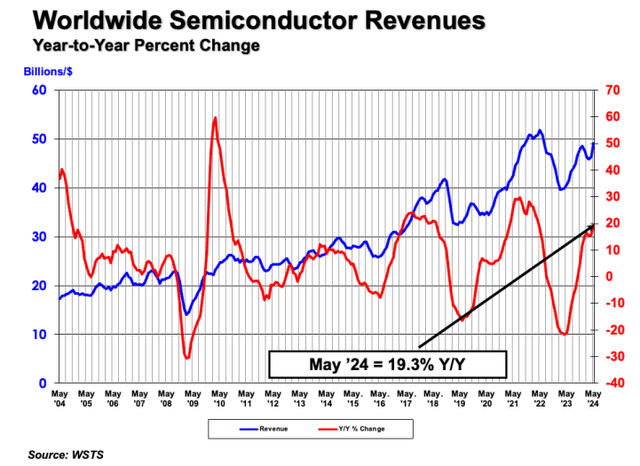

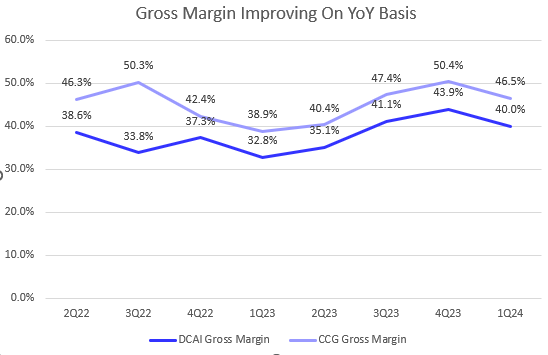

Intel (NASDAQ:INTC)’s stock recently popped more than 10% in a week, driven by strong SIA monthly data that indicated better-than expected semi sales. Investors might scope up semi laggers after the iShares Semiconductor ETF (SOXX) has rallied 43% YTD, as INTC has significantly underperformed the benchmark, remaining down 27% YTD. Despite continued growth headwind in the Data Center and Artificial Intelligence (DCAI) segment, there are early signs of recovery, with the Client Computing Group (CCG) showing a strong growth rebound. I believe INTC will benefit from the current AI boom, even though it may not be as competitive as other semi peers.

Investors should recognize that INTC is a long-term turnaround play, as the company attempts to close the technology gap created by a decade of underinvestment. This can limit the potential for multiple expansion in the near term. Nevertheless, I believe the “5 Nodes In 4 Years” goal remains achievable. Given its current attractive valuation, I have initiated a buy rating due to the limited downside amidst a secular AI tailwind and gradual improvement in its fundamentals in FY2025, which justify a higher multiple.

Looking Past FY2024 and Expecting a Prolonged Recovery

The company model

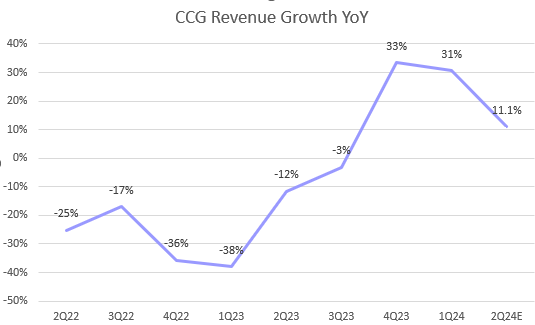

The demand outlook for INTC’s core ultra-based AI PCs remains strong. I believe the company can navigate near-term wafer-level supply constraints and improve its revenue growth in FY2025. In its recent earnings report, INTC not only failed to surpass revenue consensus but also provided weak guidance for the coming quarter, implying a 15.6% YoY decline in total revenue. Let’s talk about CCG segment first. Despite achieving 31% YoY growth in the last quarter, the company indicated flat QoQ growth in 2Q FY2024, reflecting a 11.1% YoY in PC growth.

The company model

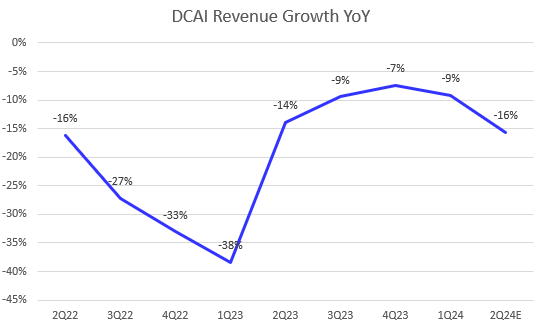

While the DCAI segment has shown some improvements, revenue continued to decline by 9% YoY in 1Q FY2024, compared to a 38% YoY decline in 1Q FY2023. The company also guided flat YoY growth in 2Q, implying a 16% YoY decline, compared to a 14% YoY decline in 2Q FY2023.

However, the company is expected to see a growth decline trough in all segments in 2H FY2024. According to the 1Q FY2024 earnings call, this is due to strong demand for general-purpose servers from both cloud and enterprise customers, as well as increased core ultra-assembly capacity to support a growing PC TAM driven by enterprise upgrades and AI PC demand. Although the company’s growth trajectory has significantly lagged behind its peers, I believe we can expect higher YoY growth for CCG and DCAI segment in FY2025.

Gradually Improving Margins Over Time

The company model

In addition, I believe INTC will gradually expand its gross margin over time due to a more optimized cost structure as they approach the end of the “5 Nodes In 4 Years” plan. With the company’s top-line growth expected to rebound in FY2025, management anticipates a better gross margin next year compared to FY2024. They also mentioned a long-term goal of reaching 60% by FY2030. The transition from pre-EUV wafers to post-EUV wafers is a significant tailwind for INTC, as blended average wafer pricing is expected to grow three times faster than costs over the decade. However, investors should be patient, as the company may still face near-term margin headwinds. Management indicated a gross margin contraction QoQ in 2Q FY2024 due to the benefit of gross margin improvement in 2Q being pulled into 1Q.

Intel 20A Begins Production Ramp in 2H FY2024

The CEO Gelsinger initiated a long-term roadmap of “5 Nodes In 4 Years” in July 2021. The goal is to complete the node of Intel 7, Intel 4, Intel 3, 20A, and 18A. The company is expected to ramp up Intel 20A production later this year in Arrow Lake and begin producing Intel 18A in mid-FY2025. During this process, significant upfront costs associated with this roadmap will likely impact margins. However, as manufacturing volume increases, we should see a gradual expansion in margins and improved earnings growth.

Slowdown in Capex Improves FCF in FY2025

The company model

As we can see from the chart, INTC’s capex have shown a YoY decline in recent quarters after a significant increase in FY2022. I believe the worst for INTC is behind us, as the management indicates that FY2024 is the peak for the “5 Nodes In 4 Years” driven by factory start-up costs. I believe the company is expected to capitalize its previous investments in FY2025. This will create a tailwind for its FCF as earnings growth rebounds, thereby improving its OCF.

Valuation

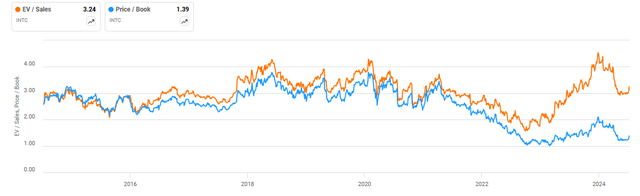

Due to the previously elevated cost structure under INTC’s transition roadmap, the company has suffered from multi-year growth decline and inefficient operating efficiency. Investors need to carefully consider valuation multiples on a TTM basis to evaluate its valuation profile, as it may lead to incorrect conclusions. For example, INTC appears to be trading at an expensive valuation with a non-GAAP forward P/E of 31.5x, which is 37% above its 5-year average. However, looking past FY2024 and expecting a strong recovery in FY2025, we should rely on its FY2025 earnings estimate. The stock’s non-GAAP P/E for FY2025 is 17.6x, which is very attractive as a semi-AI play.

Additionally, as shown in the chart, its EV/Sales TTM is almost in line with its 10-year average despite a revenue decline over the past 12 months, which is another positive signal given the current lofty valuation in the semi sector.

Lastly, while it is uncommon to focus on P/B metrics to evaluate a semi stock, we should remember that INTC is a value play with distressed fundamentals. The stock is trading at 1.4x P/B TTM, which is 37% below its 10-year average. Therefore, I believe the current stock’s valuation is very appealing given its potential growth inflection in FY2025.

Conclusion

Despite the recent rally, INTC still lags behind its benchmark, down 29% YTD. Despite ongoing challenges in revenue growth and margin expansion, we still can see some early recovery signs, particularly within CCG segment. It will be a bumpy path for closing the decade long technology gap with its “5 Nodes In 4 Years” plan. However, the stock’s current valuation presents an attractive investment opportunity. While the company continues facing near-term growth and margin pressures in 2Q FY2024, I anticipate a gradual improvement in revenue and margin by FY2025, driven by the end of “5 Nodes In 4 Years” plan, which can improve its earnings and OCF. Capex is also expected to decline, add further tailwind on FCF profile. Therefore, I rated a buy rating on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.