Summary:

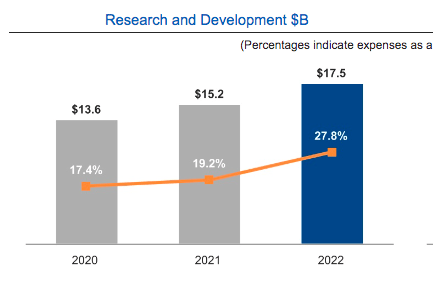

- Intel’s R&D budget had increased to $17.5 billion in 2022 which is 27.8% of its revenue.

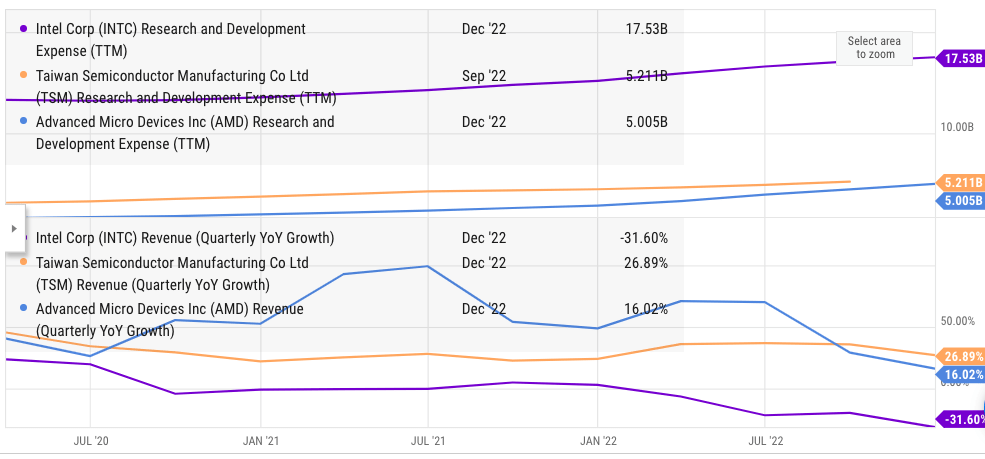

- Both AMD and TSMC are also increasing their R&D expenses to launch new products and these two rivals cumulatively spent over $10 billion on R&D in 2022.

- Due to the higher revenue growth rate in AMD and TSMC, we should see a faster increase in their R&D budget.

- It is highly likely that the cumulative R&D budget of AMD and TSMC will outpace Intel in 2024 which will cause further erosion of the competitive edge for Intel.

- Intel is already lagging behind AMD in the product cycle due to past delays and any loss in the R&D race will end up hurting the long-term growth trajectory for the company.

4kodiak

Intel (NASDAQ:INTC) has been one of the biggest R&D spenders in its industry over the past few years. However, rapid revenue growth in Advanced Micro Devices (AMD) and Taiwan Semiconductor (TSM) has allowed these two rivals to ramp up their R&D budget and increase the pace of product launches.

In a previous article in July 2022, it was mentioned that R&D trend would hurt Intel. Since then the stock has declined by another 25% as the margins get eroded by R&D increase. This trend will increase in the next few quarters as Intel’s revenue base declines while competition ramps up its R&D budget and increases the product cycle.

In 2022, Intel’s R&D budget of $17.5 billion easily outpaced the close to $10 billion cumulative R&D budget of AMD and TSMC. But we will be seeing a massive change in this trend in the next few quarters. Intel is facing a revenue decline and its R&D to revenue is already at a staggering 27.8% which could lead to cost-cutting in this department. On the other hand, higher revenue growth of AMD and TSMC will give them the flexibility to increase their R&D expense. It is highly likely that the cumulative R&D budget of AMD and TSMC will exceed Intel’s in 2024.

Intel has been plagued by product delays. The new management had promised to solve this issue. Even in the best-case scenario, the current product launch timeline of Intel is behind AMD which will certainly cost the company significant market share. Intel’s management will now face a dual issue. One is to improve the product launch timeline and reduce delays and at the same time, it will need to deliver better bang for the buck in R&D due to higher resources available with AMD. Intel’s stock has seen a significant correction in the last year but it is still a value trap as the management tries to resolve product-related issues while facing much stronger rivals.

Change in R&D hierarchy

Intel’s leadership position in R&D will likely change in the next few quarters as AMD and TSMC ramp up their budget. Both AMD and TSMC have shown faster revenue growth in the past and have given forecasts for more positive growth in the next few quarters compared to Intel.

Ycharts

Figure 1: R&D expense and quarterly revenue growth of Intel, AMD and TSMC.

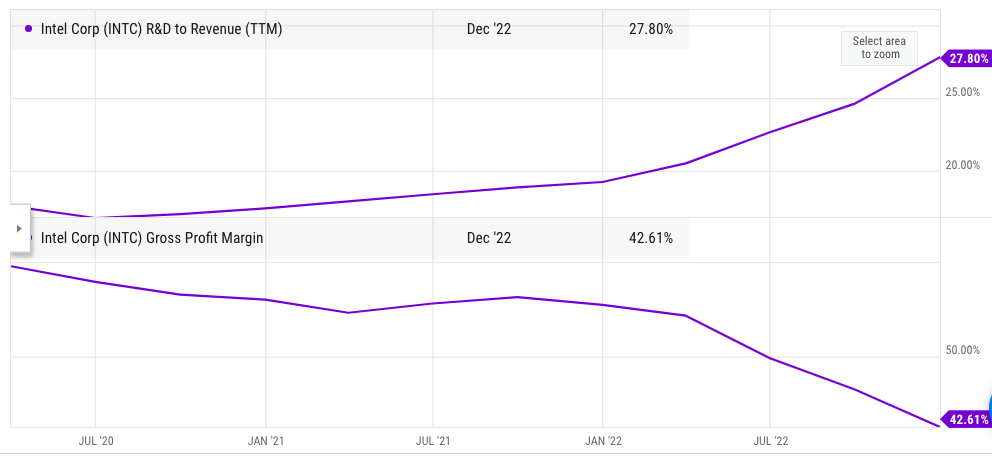

Already, Intel’s R&D expense compared to its revenue is the highest it has ever been. An increase in R&D budget during declining revenue quarters is one of the major reasons behind the gross margin decline of Intel. Wall Street usually views R&D expense positively as it helps a company build long-term product runway but Intel has shown massive delays and there would be more focus on meeting the timeline for the products announced.

Company Filings

Figure 2: More than 10 percentage point increase in R&D expense as a percentage of revenue in two years led to margin decline.

More bang for the buck

There is simply no room for further increase in R&D budget without causing a massive decline in margins and profitability. Intel has already announced some cost-cutting measures to save cash and has also ended up cutting the dividend which will save close to $4 billion annually. The company will now have to deliver better products with a more limited R&D budget. AMD under CEO Lisa Su has shown that it is possible to build a competitive product pipeline in niche segments with lower resources. It remains to be seen if Intel’s management can successfully deliver products that will allow the company to regain some of the lost market share.

Ycharts

Figure 3: Most of the gross margin decline in Intel has been due to the increase in R&D expense as a percentage of revenue.

Even with a lower budget, AMD has launched products that are more competitive than Intel and have allowed AMD to expand its market share. As mentioned above, Intel is highly likely to lose the R&D leadership in 2024 against a cumulative budget of AMD and TSMC. This will be a major headwind for the management which is trying to not only improve the product pipeline but also build a capital-intensive foundry business.

Deep value or a value trap

It is likely that the semiconductor industry is at a cyclical bottom due to macroeconomic factors. As these headwinds subside, the entire industry will start reporting better numbers. However, Intel’s problems are bigger than the cyclical ups and downs in this industry.

If the company continues to see product delays and falls further behind AMD, it will be very difficult to stop a complete rout. The decline in revenue growth has a cascading effect which leads the company to make massive cost cuts. These cost cuts eventually lead to a lower R&D budget putting more challenges to sticking with the product launch timeline. This makes it a vicious circle. The foundry business is also likely to be a huge diversion which takes up enormous capex while the company is struggling with its basic product timeline.

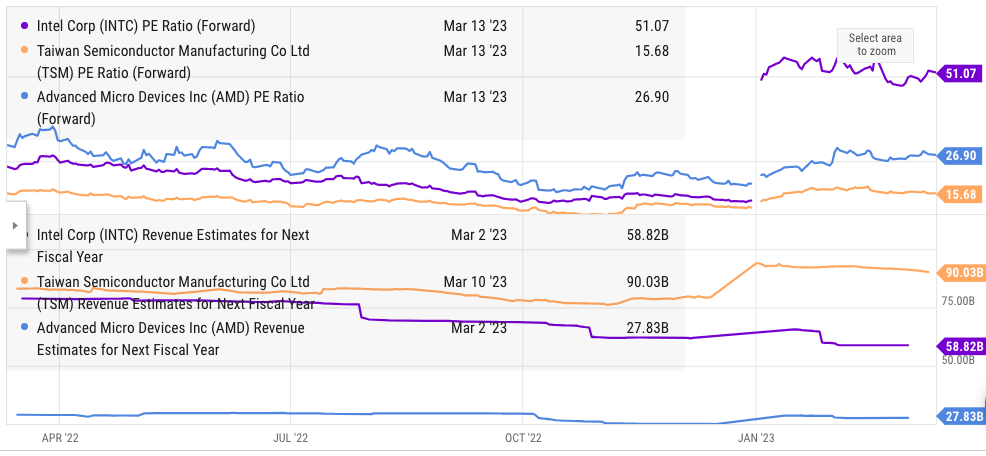

Ycharts

Figure 4: Forward PE ratio and revenue estimate for next year for Intel, TSM, and AMD.

The forward revenue estimate of Intel has seen a big decline in the past few quarters as the company reported poor numbers. The forward PE ratio of Intel is also quite high due to lower margins and profitability outlook. Investors betting on Intel would need to see better product launch timeline and a sustainable growth trajectory for the foundry business. In the current environment, Intel remains a value trap as it faces a growing challenge from rivals while also facing product delays.

Investor takeaway

Intel has had a massive R&D budget lead over rivals in the past. It is likely that Intel will lose its R&D expense leadership to the cumulative budget of AMD and TSMC in R&D by 2024. Intel spent $17.5 billion in R&D in 2022 which was equal to 27.8% of the revenue. This spending rate was the main reason behind the rapid decline in margins. We should see cost-cutting by the company as it tries to bring expense in line with revenue projections. On other hand, AMD and TSMC will likely increase their R&D budget to match their revenue growth. Cumulatively, both these companies spent $10 billion on R&D in 2022.

This will be a big headwind for Intel as it already faces product launch delays and is falling behind AMD in process technology. There is no easy way that Intel can change these dynamics and the company will need to do more with less showing better bang for the buck spent in R&D. The capital-intensive foundry business will also lead to lower resources available for R&D causing a big decline in this vital expense item. Intel stock is a value trap under these situations and the long term growth runway does not seem positive.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.