Summary:

- Intel Corporation provided a positive update on Data Center and AI chips.

- The chip giant will likely continue to donate market share to peers, even if it gets new chips like Emerald Rapids, Sierra Forest, and Granite Rapids to market on time.

- Intel Corporation stock remains expensive at 17x ’24 EPS targets that are shrouded by risk of more chip delays crushing these forecasts.

David Becker/Getty Images News

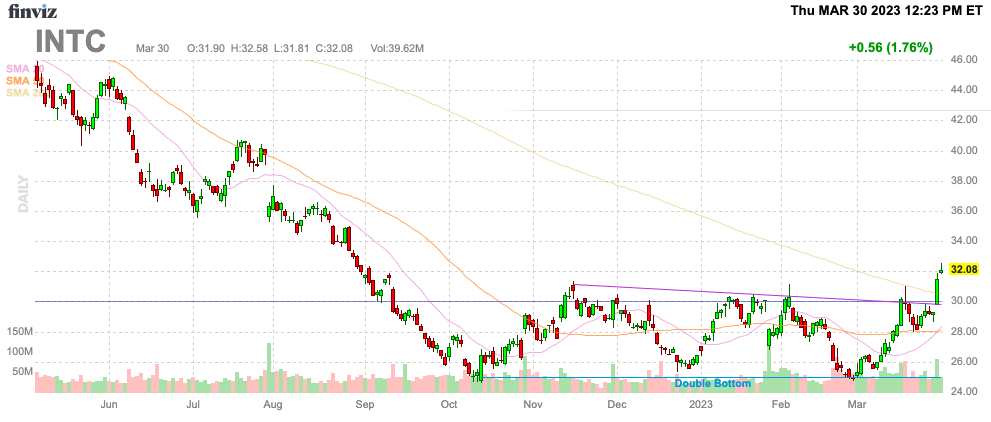

Intel Corporation (NASDAQ:INTC) has amazingly broken key support around $30 on a somewhat upbeat Data Center update. The chip giant has potentially swung back towards hitting chip release targets, but catching peers is a different story. My investment thesis remains Bearish on the chip stock, though INTC stock is technically trading better now.

Source: Finviz

Positive Update

Intel presented a Data Center and AI investor webinar on March 29. Charlie Demerjian of SemiAccurate provided the following view regarding the presentation.

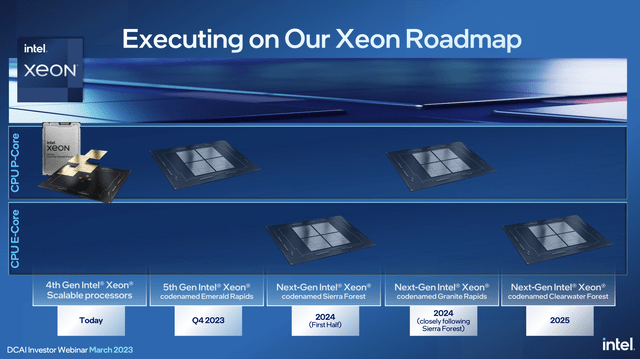

The most important update is that Intel generally remains on schedule to deliver multiple updates to data center CPUs in the next year. The company has the 5th generation Xeon CPU hitting the market in Q4’23 with a couple of updates in 2024.

Source: Intel Data Center webinar

The big question is whether Intel is going to hit this compressed timeline after years of pushing out new chip launches. From Q4’23 to mid-2024, the chip giant is forecasting the release of Emerald Rapids, Sierra Forest and Granite Rapids.

As a reminder, Advanced Micro Devices, Inc. (AMD) has already released Genoa and Bergamo server chip variations of the Zen-4 based Epyc chips. AMD will release Turin derivative Zen 5 chips in 2024 by the time Intel launches the next-gen version of Xeon chips in mid-2024.

The problem for Intel now is that chip launches are required to just remain a few steps behind AMD. Any more delays by Intel will just widen the gap with chips manufactured at Taiwan Semiconductor Manufacturing Company Limited (TSM).

Intel promised 1 million Sapphire Rapids chips shipped by the middle of 2023, and this amounts to a very small fraction of the market. The NextPlatform estimates up to 31 million server chips will be shipped this year with the chip giant not having a chance of catching up to TSMC process technology until the Intel 20A (2 nm process) comes to market in 2025.

Still Donating Market Share

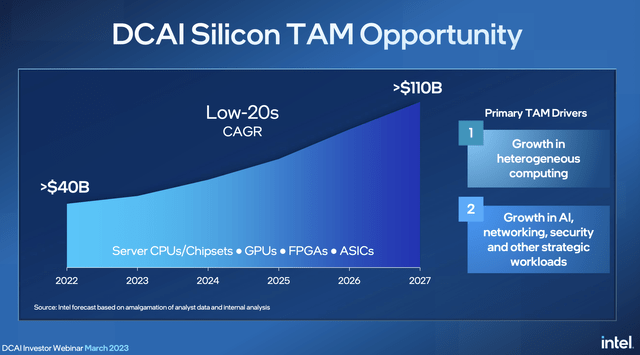

Similar to AMD forecasts, Intel predicts dramatic revenue growth for the data center segment. The chip giant forecasts the market growing from $40 billion in 2022 to over $110 billion in 2027.

Source: Intel Data Center webinar

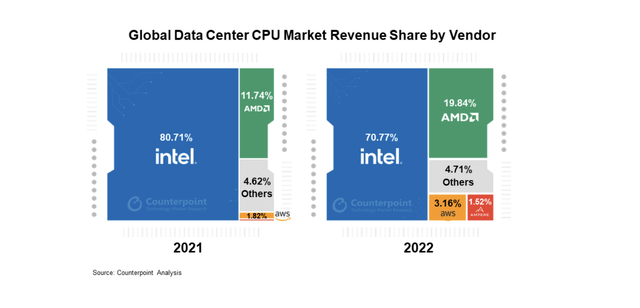

While the market shows dramatic growth, one should expect AMD to eventually catch up to the market share of Intel and possibly pass the chip giant. By a lot of estimates, AMD only has ~20% of the server CPU chip market.

Intel has the potential to lose data center market share and still grow, but a lot of the market growth will be donated to AMD and ARM-based chips. Using a rough estimate, Intel had ~$19.2 billion in data center revenue during 2022, while AMD ended the year on an annualized run rate of $6.8 billion, with the majority of that revenue focused on CPU server revenues.

The big question is whether Intel loses more revenue in the near term or AMD just gains the growing total addressable market (“TAM”) for the segment. Either way, the smaller chip company needs over $10 billion in annualized revenue to gain in order to match Intel.

Investors turning bullish on Intel don’t fully grasp that these new chips hitting the market only stem the downside risk of AMD eventually grabbing 70% to 90% of the server CPU market. These new Intel chips won’t prevent AMD from reaching market share parity with the chip giant.

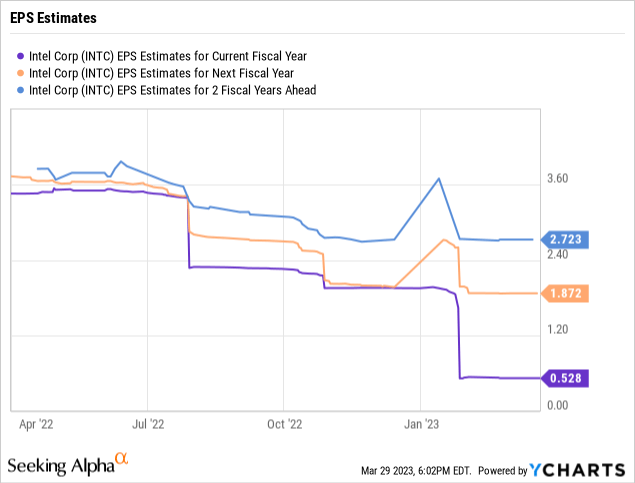

Intel faces a somewhat dire financial picture the next couple of years. Analysts now forecast the company barely remaining profitable this year, with only a $0.53 EPS target.

Intel will burn a lot of cash this year with plans to still build up new chip fab capacity. The big question is whether the EPS can rebound in 2024 to hit the current $1.87 target. The company should be helped by a rebound in PC chip demand, even if data center market share is donated to AMD.

INTC stock is definitely attempting a breakout here. The reason for being so bullish doesn’t appear to exist, with Intel now trading at 17x 2024 EPS targets.

The company could still burn cash under this scenario while still paying a hefty dividend payout of $2 billion despite the big cut to the annual dividend to only $0.50. Remember, the problem here is that Intel still isn’t viewed from a financial picture where the company is eventually equal in size to AMD.

The company plans to spend ~35% of revenues on capex over the next couple of years, with capital offsets of up to 20% to 30%. The gross capex will be close to $20 billion for a chip company not making much in the way of profits.

Takeaway

The key investor takeaway is that Intel Corporation is progressing back towards meeting product launch schedules after years of disastrous delays. The chip giant needs far more than just more timely product launches to prevent market share donation to AMD.

Intel stock has definitely discounted a lot of the weakness when recently trading below $30, but the upside remains questionable considering the cash flow predicament for a couple of years. Not to mention, the risk to the story is that Intel Corporation fails to get these new server CPU chips to market on time and the company falls further behind AMD.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.