Summary:

- Intel reported mediocre quarterly results, but could beat analysts’ expectations leading to a little more optimism.

- But while the fundamental business of Intel is struggling, I still think the stock is a good investment at this point.

- INTC stock is trading for such a low valuation multiple that even low growth rates in the years to come make Intel a huge bargain.

- And investors should be cautious not to get caught in any hype and invest at the wrong time in the wrong companies.

da-kuk

In my last article in May 2023 I wrote that the bottom might be in for Intel Corporation (NASDAQ:INTC). And since the bottom below $25, the stock has increased 50% already (before correcting again) which is a great performance (of course, I did hit the bottom neither with my article which was published around $30 nor with my own investment in Intel around $27). Nevertheless, investor sentiment still seems rather negative about Intel and the company and stock certainly deserve another close look.

Technical Picture

We should not get too optimistic as Intel is still in a downtrend. In my opinion, the stock must climb at least above the resistance level between $40 and $42 (several lows in the last few years) before we can see Intel in an uptrend again. And although I am bullish on Intel from a fundamental point of view, I would still be cautious about the stock and not expect a rally in the next few quarters.

Intel Chart (TradingView)

Another decline to $25 seems also like a possibility – especially as Intel seems still like the hated and unloved company in the semiconductor space and sentiment is still negative. But the bottom around $25 seems like a good support level as we have several highs and lows here that were set between 2005 and 2015. Additionally, we see a declining trendline between the high of the Dotcom bubble and the breakout level in 2017. Of course, we might argue this trendline is arbitrarily, but I see Intel at a strong support level right now.

Quarterly Results

When looking at the last quarterly results, we can tell two different stories. The one story is the results itself – looking at the numbers and the year-over-year performance and this story has not much positive elements. The other story is about comparing Intel’s results to expectations – which are extremely negative as the sentiment surrounding Intel is negative. And Intel could beat revenue expectations by $760 million and non-GAAP earnings per share by $0.13.

However, when looking at the actual results we still see a business that is clearly struggling. Net revenue declined 15.5% year-over-year from $15,321 in Q2/22 to $12,949 million in Q2/23 and although the semiconductor industry is cyclical, this is a huge drop. And Intel already must report an operating loss in the same quarter last year (which was $700 million) and in this quarter the company reported an operating loss of $1,016 million. Finally, when looking at earnings per share, we see a switch from a loss of $0.11 in the same quarter last year to $0.35 in earnings per share this quarter. The main reason for the positive bottom line were $2,289 million in benefit from taxes for the second quarter of fiscal 2023.

Intel 10-Q Q2/23

Adjusted free cash flow is still negative, but at least we are seeing improvements here. Instead of a negative free cash flow of $6,381 million in the same quarter last year it was only $2,727 million this quarter.

Optimism Returning?

I wrote above that Intel is the unloved company in the semiconductor space with analysts and investors being rather bearish about the business. But it seems like analysts are getting a little more optimistic about Intel again – especially for fiscal 2023, analysts are expecting much higher earnings per share again, but for 2024 and 2025 estimates were also increased.

Intel Consensus EPS Revision Trend (Seeking Alpha)

In the next few years, analysts are expecting high growth rates for Intel – but we should keep in mind that we are starting at a very low basis as earnings per share completely collapsed in the recent past.

During the Investor Meeting 2022, management was quite optimistic about growth returning in the years to come and in a few years from now, Intel is expecting to grow in the double digits again. And to be honest, I don’t know what growth rates are realistic and possible for Intel. But my investment thesis about Intel is not so much based on huge growth rates in the years to come – valuation metrics play a much more important role and my investment thesis about Intel is mostly based on the cheap valuation metrics (and Intel being able to perform at least reasonably with rather low growth rates).

Business Is Not The Same As Investment

And without any doubt, Advanced Micro Devices, Inc. (AMD) or NVIDIA Corporation (NVDA) are performing much better than Intel – while those two competitors are reporting impressive growth rates, Intel would be happy if it could grow at all. But it seems once again that many investors – or at least commentators here on Seeking Alpha – don’t get the difference between a business and an investment. Yes, Intel as a business is the worst performing of the three right now and when being able to just pick a business I could own, my choice would most likely be NVIDIA at this point.

However, we can’t just pick any business and own it – we must pay a price for the business (or a fraction of a business). And like we are (sometimes) comparing prices when buying items in a store, we should also compare prices when investing in companies. And huge differences for the buying price should go along with huge differences in quality. And while it makes a difference when buying a car if one car is ten times more expensive than the other, it should also make a difference when buying stocks. A car must be qualitative better to justify such a high price – and a business has as well to justify a much higher stock price.

Sadly, the problem might be the same for buying cars as for investing in stocks: The expensive alternative is often picked for the completely wrong reasons. These reasons might be greed, reputation, luxury or just a good feeling to participate in something huge (which might be a hype). But this is often a mistake and especially in investing you might lose a lot of money. And while it is not so easy to quantify if one car is actually 10 times “better” and should deserve a 10 times higher price, in investing the answer is quite simple: The stock that is ten times more expensive should generate a ten times higher return on investment – measured for example by an (expected) ten times higher free cash flow over the lifetime of a business.

Artificial Intelligence and Hype

And at this point we return to semiconductors. When NVIDIA is able to generate a 10 times higher free cash flow per share, it deserves a 10 times higher stock price than Intel. And of course, the higher stock price is also justified when NVIDIA is able to generate 10x the free cash flow per share in the years to come due to higher growth rates.

When comparing Intel as well as NVIDIA and AMD we see huge discrepancies between the three companies that have a similar business model. Starting with the stock price performance, we see Intel declining about 30% in the last five years while AMD increased 405% in value and NVIDIA could gain even 595% during these five years.

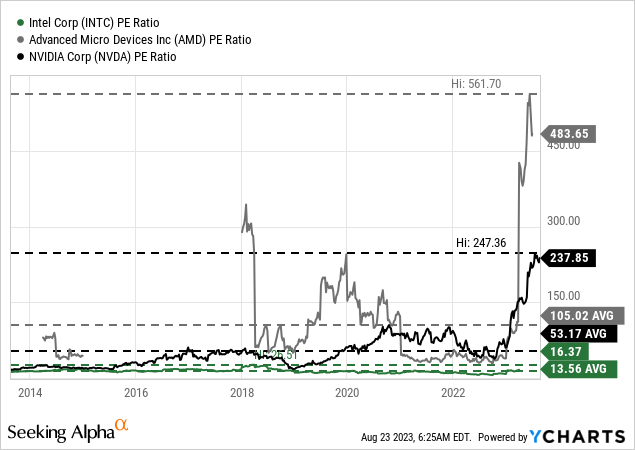

A potential reason could be that Intel was extremely overvalued five years ago and the stock price declined to correct that extreme valuation multiple. But that is not the case: In the last ten years, Intel was trading for an average P/E ratio of 13.56 and we can’t really argue that the stock was immensely overvalued at any point. In comparison, AMD and NVIDIA were trading for much higher multiples on average and especially in the last few quarters, valuation multiples exploded for these two stocks.

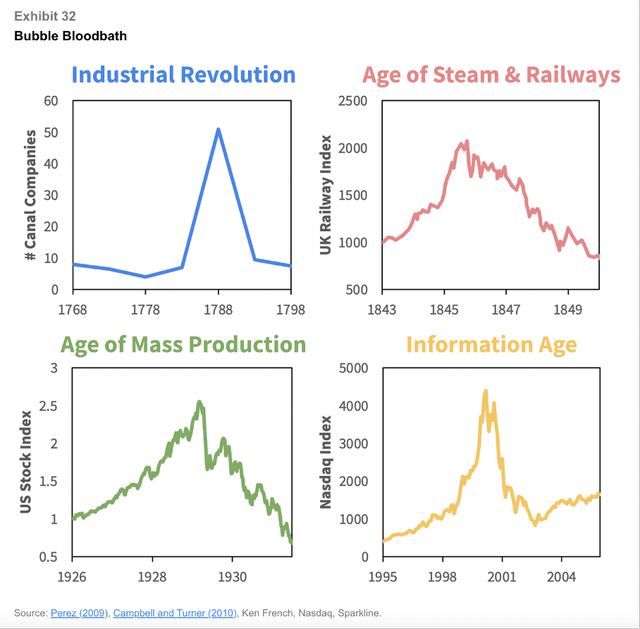

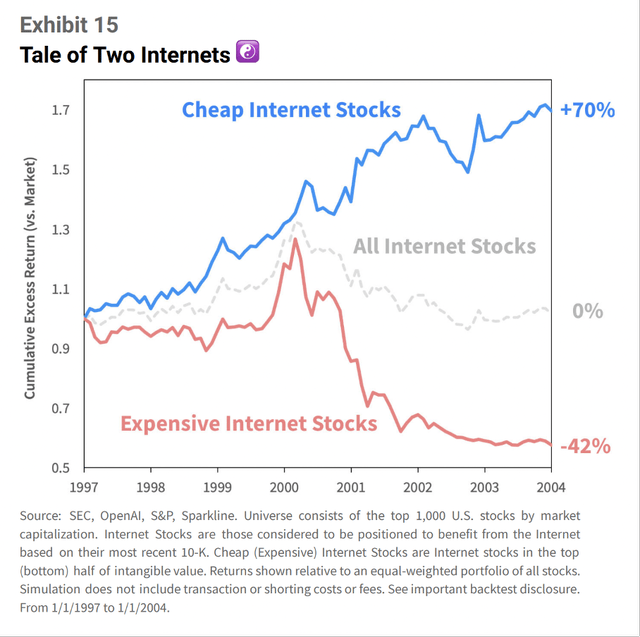

When looking at historic data, it is not uncommon that new innovations – including the industrial revolution, the invention of steam/railway or the beginning of the information age/internet – go along with huge bubbles and often an extreme hype in asset prices.

Sparkline Capital

And following this extreme hype is often a huge crash and investors losing a lot of money. While we don’t know what the future will bring, we see similar patterns with AI stocks – especially NVIDIA is standing out as investors’ darling.

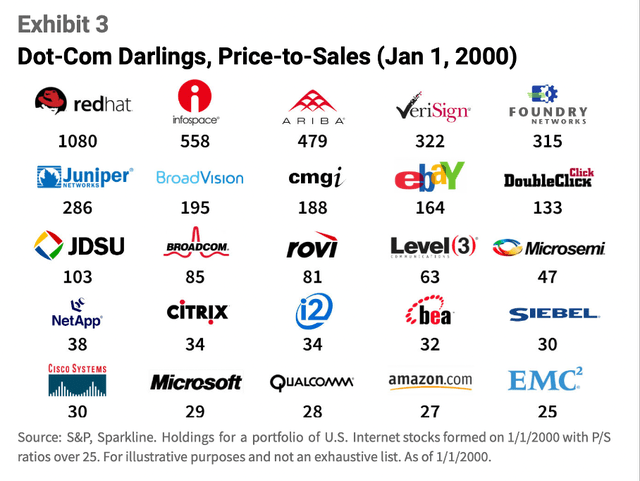

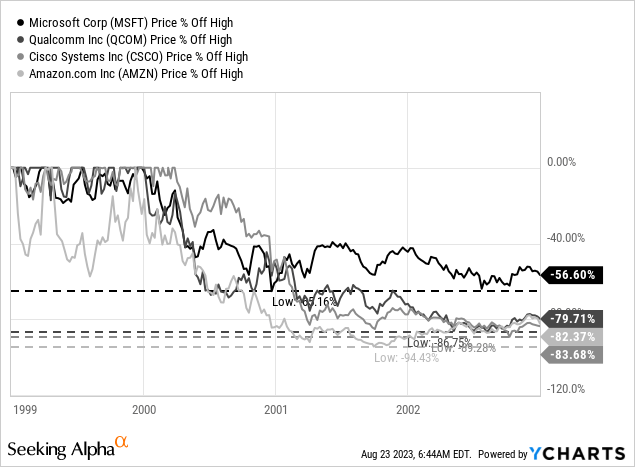

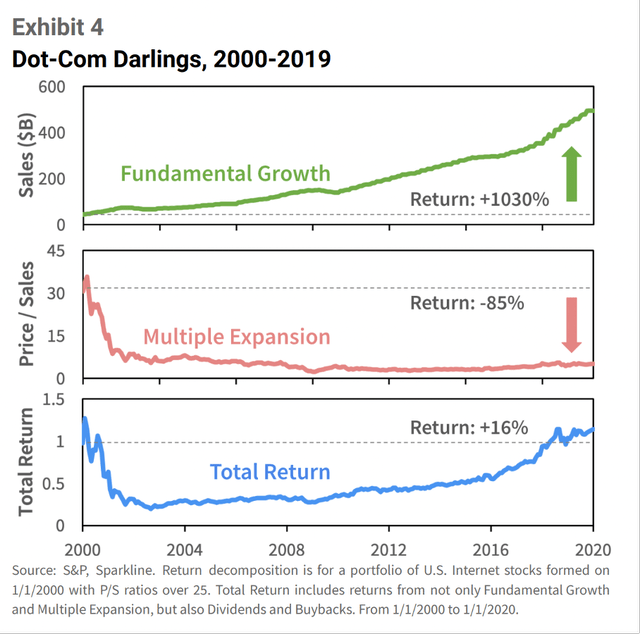

When looking at the last huge bubble – the Dotcom area – we certainly see similarities. Sparkline Capital released a report “Investing in AI: Navigating the Hype” a few weeks ago and when looking at some of the Dot-com darlings in this report trading we see double-digit or even triple digit P/S ratio back in 2000. When looking at the companies that survived and are still around today, eBay Inc. (EBAY) had a P/S ratio of 164 at the peak, Cisco Systems, Inc. (CSCO) traded for a peak P/S ratio of 30, Microsoft Corporation (MSFT) for 29 times sales, Qualcomm Incorporated (QCOM) for 28 times sales and Amazon.com, Inc. (AMZN) traded for a P/S ratio of 27.

Sparkline Capital

NVIDIA is trading for a P/S ratio of 44 right now and several of these companies that were trading for lower P/S ratios during the Dotcom bubble declined extremely steep in the following years.

And of course, one can argue that NVIDIA might have higher margins than some of these companies and therefore a comparison is not perfect. But I think we can state that stocks trading for almost 50 times sales face a high risk for a sell-off or correction.

Artificial Intelligence certainly has the potential to be a huge trend and also having a huge impact on the GDP of many countries. But such a major innovation also has the potential to generate a huge bubble and lead to immense losses for investors. And all semiconductor companies might profit from that trend – however, NVIDIA might fall into the camp of companies that perform great, but investors will not profit (as the stock price is declining or struggling).

Sparkline Capital

When looking at the Dotcom darlings, we see a fundamental growth of 1,030% (which is impressive) but due to a massive multiple contraction, the total return was only 16% for these stocks. And a similar scenario is possible for NVIDIA – a business that will perform great in the coming years (or the next decade) but investors not really profiting from that fundamental growth as the multiple contraction (that will happen at some point) will off-set the increases.

Intrinsic Value Calculation

But at this point, I don’t want to compare Intel to NVIDIA or AMD to determine which is the best investment. I just want to look at Intel and determine if Intel is a good investment or not. It would also be possible that all three semiconductor stocks are terrible investments at this point.

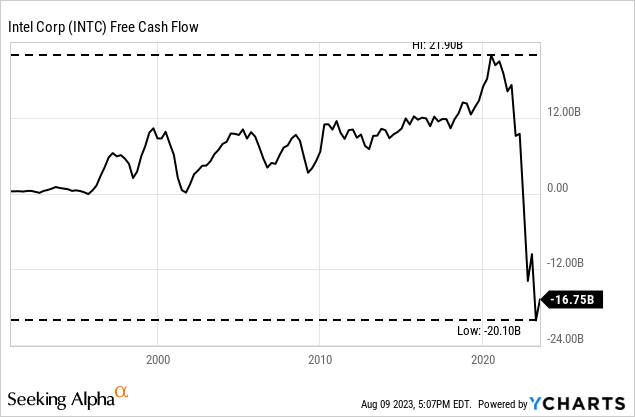

Usually, I am taking the free cash flow of the last four quarters (or the guidance) as basis for our calculation. However, in case of Intel it gets a little more difficult and due to the extreme volatility, it is a challenge to make reasonable assumptions. When looking at free cash flow since the early 1990s, we always saw fluctuations for Intel – but in the last few quarters free cash flow fell off a cliff.

And although we see first signs for improvement again, Intel still generated a negative free cash flow of $16.75 billion in the last four quarters. We could be very optimistic and assume Intel returning quickly to previous free cash flow levels of $22 billion (however, I don’t think that is likely). On the other hand, part of the reason for the negative free cash flow are the extremely high capital expenditures ($26.5 billion in the last four quarters) and we can assume those expenditures to be lower again in the next few years (maybe between $15 billion and $20 billion).

Additionally, we can also look at the long-term targets Intel provided during its 2022 Investor Meeting (although I don’t know if management is seeing these Targets as still realistic). When asking during the last earnings call, CFO David Zinser was a bit optimistic about free cash flow:

Our expectation is still by the end of the year to get to breakeven free cash flow. There’s no reason why we shouldn’t achieve that. Obviously, the net CapEx might be a little different this year than we thought coming into the year. But as we talked about, there’s just a focus on free cash flow, the improved outlook in terms of the business. We think we can get to breakeven by the end of the year.

So, let’s be optimistic as well and assume $0 free cash flow for fiscal 2023 (a huge improvement compared to the negative amount right now). But let’s be rather cautious for the following years and assume $5 billion in free cash flow in 2024, $10 billion in 2025 until Intel will reach about $20 billion again in 2027 (a rather cautious path back to previous results). For the years following 2027 we assume 5% annual growth till perpetuity. When calculating with these assumptions we get an intrinsic value of $70.33 for Intel and are looking at a huge bargain.

The huge problem for Intel are the extreme fluctuations we are seeing right now making it difficult to come up with reasonable assumptions for the future. In such a case I rather tend to be “pessimistic” and not get carried away by too optimistic assumptions (but when reading about Intel right now, it is certainly difficult to get carried away). However, I can also calculate with more optimistic numbers and will come up with intrinsic values as high as $125 for Intel (here we are in line with management’s expectations during the 2022 Annual Meeting and assume $20 billion already in 2025 followed by 10% growth till 2032 followed by 6% growth till perpetuity).

Conclusion

I don’t have a crystal ball and don’t know the future. But in my opinion, Intel is a much better investment than NVIDIA (or AMD) although the fundamental business is struggling. NVIDIA must perform close to perfection in the years to come to be fairly valued as the extreme valuation multiples pose a huge risk for investors. And at the slightest disappointment the stock price will collapse.

Intel on the other hand has no expectations to fulfill. At the current stock price, nobody seems to expect any growth or good results from Intel. And if Intel should disappoint and still perform terrible, we still have a solid investment as this negativity is priced in already. However, if Intel should be able to profit from the huge trend that AI probably is, we are looking at an extreme bargain (and Intel doesn’t even have to grow in the double digits).

Sparkline Capital

And like we had a “tale of two internets” we might also have a “tale of two AIs”. Like there were cheap internet stocks in 2000s, there will also be cheap AI stocks today that profit immensely from the trend but are unloved and undervalued right now. Our task is to identify these stocks and invest in them.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.