Summary:

- A potential spinoff of Intel’s foundry business raises new doubts about management’s strategy.

- Intel’s cash flow issues and competitive pressures from TSMC complicate its foundry ambitions.

- Before buying INTC, investors deserve Q3 results or other updates for more clarity on Intel’s strategic direction.

- By that same token, they need a price with a better risk-reward balance.

RyersonClark/E+ via Getty Images

A month ago, I wrote that Intel (NASDAQ:INTC) was a hold, citing the confused nature of its capital allocation since Pat Gelsinger’s return to the company as CEO. His tenure has been marked by rising capex, reduced revenues, increased debt, and layoffs of 15% of their workforce. I rated the stock a Hold until a better price is offered or until operating results show improvement, instead of setbacks that Gelsinger himself described as “painful.”

Recently, reports have come out the company is considering spinning off its foundry business, the very thing that Gelsinger’s return was supposed to reinvent. While these have not been officially confirmed by Intel yet, Citigroup (C) seems to take it seriously, with their analysts suggesting Intel do just that.

I am also in the camp that takes it seriously and think it’s worth a follow-up to my previous thesis. I maintain my Hold rating, but I will discuss what I believe to be the key points this time.

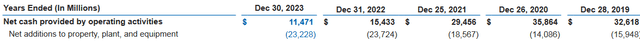

Intel’s Cash Flow Sitaution

Seen above, Gellsinger’s return as new CEO in early 2021 marked a trend of decreasing operating cash flows (as R&D expense ticked up), along with increased capex, mostly to expand its foundry business. The result is OCF is exceeded by capex, and Gellsinger’s plan seems increasingly untenable.

This has continued to be a problem for the first two quarters of 2024 as well.

Competitive Pressures

The fruits of these efforts have yet to be realized, so some might question why they’d exit the foundry business. It owes to the competitive landscape of the semiconductor industry. In an interview with Bloomberg, Ian King spoke to this, noting that their foundry customers would also be their competitors from other segments, namely Nvidia (NVDA) and AMD (AMD), both of whom run a fabless model and would rely on such a service. He questioned why they’d write Intel a check that will be invested in developing rival products, while a separate foundry business wouldn’t raise such a concern.

In 2022 (earlier in Intel’s capital projects), Nvidia CEO Jensen Huang expressed an openness to using Intel’s foundry service going forward. The US government recently urged Nvidia and AMD to use Intel’s foundry services, hoping to reduce their reliance on TSMC (TSM). Intel’s main selling point, from a public policy perspective, is that America depends on production that occurs in Taiwan (near a hostile China), so domestic production is advantageous.

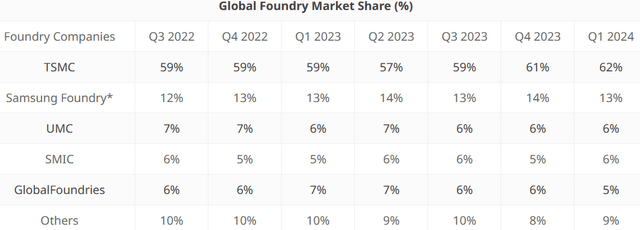

Foundry Market Share (www.counterpointresearch.com)

Seen above, TSMC leads the global foundry market, usually boasting share of around 60% and with no close seconds. According to their own financial report (2023 Form 20F, pg. F-10), TSMC has enjoyed positive OCF the last three years, in excess of capex.

TSMC’s Arizona Plant (tsmc.com)

TSMC has been prescient to preempt Taiwan-specific risks and perceptions by outsiders. A few weeks ago, the announced breaking ground on a European site through a joint venture. Since 2020, they have announced plans to develop three fab sites in Arizona. These counter the domestic preference Intel might have had over time. The first site is slated to begin production in the first half of 2025.

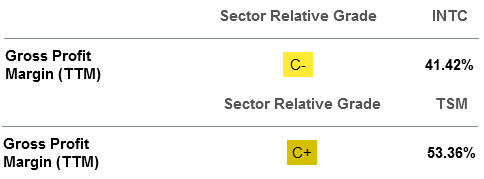

Gross Margin Comparison (Seeking Alpha)

For Intel to compete with TSMC, it would likely have to price competitively and sacrifice margin. Currently, however, Intel’s gross margins are already worse than TSMC’s. With the struggles in its cash flow situation, a problem that TSMC lacks, one has to wonder how much Intel can afford to give up. I don’t see how Intel can practically choke out the market leader from a place of financial weakness.

Telling on Itself

I might well have raised many of these points in my initial thesis on Intel. Yet, these become more pertinent when sources like Bloomberg report that Intel is beginning to consider spinning off the foundry business.

As I mentioned in my last article, Gelsinger’s return was a big deal. The buybacks disappeared, and the dividend was not yet eliminated but heavily slashed.

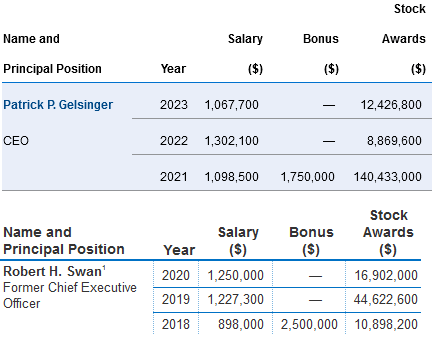

Executive Compensation (2020 and 2023 Definitive Proxy Statements)

He was also generously compensated on his arrival, with $140M in stock-based compensation at the time, dwarfing what his predecessor, Bob Swan, was receiving. Intel didn’t simply invest in a foundry business; it invested heavily in the person that was spearheading it.

My point? Intel doesn’t have to say anything, but actions do speak. They’ve officially declined to comment on Bloomberg’s reports about the spinoff idea. They could say, “We will not spin off,” but they haven’t, and I doubt Bloomberg reported what was simply idle gossip. What I consider more likely is that it’s a genuine question among management, and it’s too early in the discussion for Intel to give an official answer yet.

Investors eyeballing INTC need to weigh the importance of this. Where there was so much certainty three years ago, Intel seems to be having doubts. Even if this does not lead to a spinoff, that it’s even being asked speaks volumes about the difficulty of running a profitable foundry business. It’s kind of telling on itself.

Valuation and Potential Moves

As far as valuation is concerned, very little has changed about the business, and the most recent results we have are still those of Q2. With no free cash flow, I said last time that the best gauge of value for INTC is book value per share. Currently, that is reported as $26.95.

6M Price/Book History (Seeking Alpha)

With cash going out and debt piling on, I noted that a discount is warranted, as book value per share is likely to decrease, and so I only believe INTC is fairly valued at the current moment, hardly giving an attractive entry price, given these hurdles.

Discussion around a potential spinoff only increases the demand for a margin of safety, in my view, perhaps a deeper one. Moreover, the nature of the spinoff, and how certain liabilities would be distributed, raises more questions. A foundry spin-off could prove to be a better or worse investment than Intel proper.

As there is demand for more clarity investors should probably also wait for management to address these when Q3 results are announced.

Conclusion

Intel was going to rise again upon the hiring of Gelsinger as CEO in 2021 and the launch of his ambitious plans for a foundry business. Now things seem more up in the air, with a spin-off of the much-touted foundry vision plausibly on the table. This calls into question the wisdom of both the management and even the board. This subtle development raise a big question: Can investors have confidence in them going forward?

There are two ways to mitigate risks: We can clarify that they don’t exist and/or price them as if they do. The value on the table is therefore not much different, but our demand as investors for better price and information is higher. For that reason, I maintain my Hold rating until Intel the risk-reward picture improves.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.