Summary:

- Intel’s x86 CPU market share has been eroded by competition from AMD and their strategic mistakes in emerging growth areas like GPUs.

- Intel’s shift to TSMC’s 5nm process for their upcoming Meteor Lake processors shows their acknowledgment of lagging behind in technology.

- Intel missed out on the mobile market opportunity and is late to the AI GPU market, making it difficult to catch up with Nvidia.

JHVEPhoto/iStock Editorial via Getty Images

In recent years, Intel’s (NASDAQ:INTC) x86 CPU market share has gradually eroded due to competition from AMD (AMD) across desktop PCs, laptops, and servers. Furthermore, Intel has not sufficiently invested in emerging growth areas, such as GPUs, in the past. I don’t believe that Intel’s Gaudi and future roadmap will be able to catch up with Nvidia (NVDA) anytime soon. Therefore, I recommend initiating a “Sell” rating for Intel with a fair value of $37 per share.

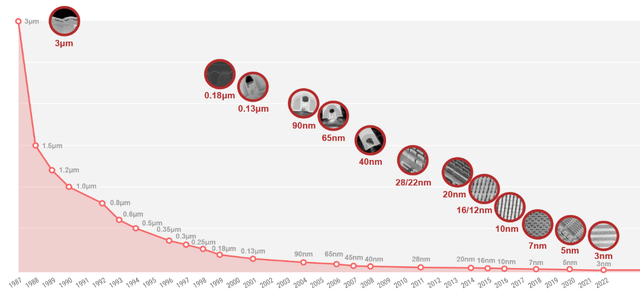

Strategic Mistake: Intel’s Vertical Integration and 14nm to 10nm Multi-Year Delay

Undoubtedly, Intel has long held a dominant position in the x86 CPU market for desktop PCs, laptops, and servers. Intel implemented a tick-tock pattern to introduce new products starting in 2007, successfully reducing its die size every other year. The 14nm products were launched in 2014, and Cannon Lake, intended to be the 10nm product, was initially slated for release in 2016. Unfortunately, Intel faced delays in the Cannon Lake and its 10nm silicon, finally introducing an expanded lineup of 10nm products, including the 11th Gen Intel Core processors and the Intel Atom P5900, in 2020.

In contrast, AMD revealed its first 7nm datacenter GPU products in 2018. Unlike Intel’s internal foundry model, AMD partnered with TSMC (TSM) for 7nm chip manufacturing, emphasizing dedication to chip design capabilities. AMD’s use of leading 7nm chip technology marked a significant leap over Intel for the first time, contributing to Intel’s loss of market share.

Several factors contributed to Intel’s challenges in transitioning from 14nm technology. Poor management within Intel and a bureaucratic culture, stemming from its longstanding dominant market position, played a role. Brian Krzanich, Intel’s CEO at the time, resigned in 2018 due to policy violations related to workplace relationships. Additionally, Intel operated its own fabrication plants, maintaining vertical integration. This meant Intel not only designed the chips but also manufactured them. The 10nm manufacturing process demanded advanced lithographic techniques, and, as a pure foundry player, TSMC invested heavily in R&D, achieving 10nm in 2016 and 7nm in 2018-outpacing Intel’s foundry technology. AMD’s success, in this context, can be attributed to standing on the shoulders of TSMC.

Intel’s Strategic Change: 5nm Processors Leveraging TSMC’s Process Nodes

Intel learned a hard lesson as their vertically integrated model proved challenging to compete in the evolving semiconductor landscape. To adapt, Intel initiated a partnership with TSMC for advanced 5nm technology. The upcoming Meteor Lake processors mark Intel’s shift, being the first desktop PC chips to utilize TSMC’s process nodes. During the Q3 FY23 earnings call, Intel’s management reported the commencement of initial shipments of Meteor Lake on Intel 4, with the official launch scheduled for December 14th, 2023. This strategic change underscores Intel’s acknowledgment of TSMC’s leadership in 5nm and 7nm process nodes, realizing catching up in a short timeframe is challenging.

The introduction of Intel’s Meteor Lake processors, leveraging TSMC’s 5nm node, positions them competitively against AMD’s RX 7000 series. Notably, AMD launched their Ryzen 7000 series in August 2022, placing Intel approximately 16 months behind. AMD’s plans for 3nm and 4nm Zen 5 chips in 2024 further intensify the competition. While it’s early to make definitive assessments, Zen 5 is expected to deliver enhanced performance, with AMD focusing on front-end and wide issue re-pipelining, making it more suitable for integrated AI and machine learning optimization.

Considering these developments, I maintain the view that Intel’s technology lags behind AMD by at least 12 months. Stabilizing their market share in the x86 CPU market appears challenging for Intel in the near term.

Strategic Mistake #2: Lost the Mobile Booming Opportunity

Intel acquired Infineon’s (OTCQX:IFNNY) wireless division for $1.4 billion in 2011 to enhance their portfolio in the high-volume smartphone market where Intel had minimal presence back then. Intel announced its low-power Atom chips in 2010 for high-end smartphones and tablets. Since then, Intel’s mobile business has struggled to compete against Qualcomm (QCOM), finding it difficult to convince mobile device manufacturers to use their chips. It is challenging to pinpoint why Intel faced difficulties in the mobile business, but it could be attributed to Intel being primarily an x86 architecture company with a corporate culture focused on the PC and services market. They encountered structural issues when trying to shift internal resources from PC and server markets to the mobile sector.

In 2019, Apple (AAPL) acquired the majority of Intel’s smartphone modem business, essentially marking the end of Intel’s mobile roadmap. Intel missed a significant opportunity in the massive mobile market. I believe the primary reason is not the technology itself but rather their corporate culture and a lack of focus on new growth areas, as they were too comfortable with their decade-long dominant leadership in the traditional PC and server markets.

Strategic Mistake #3: Late to AI GPU: Intel’s Gaudi 3 in 2024 and Falcon Shores in 2025

During the Q3 FY23 earnings call, Intel’s management expressed their anticipation of capturing a growing share of the accelerator market in 2024 with their suite of AI accelerators led by Gaudi. Gaudi 2, their current AI accelerator, is already on the market, and they have plans to launch Gaudi 3 GPU in 2024, followed by Falcon Shores GPU in 2025. While Gaudi 2 has contributed modestly to Intel’s revenue, it is experiencing rapid growth. However, during the call, they acknowledged that Intel is currently facing supply constraints on Gaudi and is working aggressively to address the global supply shortage.

Intel’s acquisition of Habana Labs for $2 billion in 2019 led to the launch of the Gaudi 2 accelerator in 2022, specifically designed for AI deep learning applications using 7-nanometer technology. According to media reports, Intel’s upcoming Gaudi 3 will be manufactured using the 5nm process, featuring increased memory, compute, and networking capabilities compared to Gaudi 2. Additionally, Intel plans to introduce Falcon Shores in 2025, followed by Falcon Shores 2 in 2026.

I am encouraged by their AI GPU roadmap, and they are making a notable investment in the fast-growing GPU market. However, Intel is late to the GPU market. Nvidia’s GeForce RTX 40-series GPU products are based on the 5nm node and were launched in September 2022. The GeForce RTX 40-series is the most popular GPU in the current market, and Intel’s similar product, Gaudi 3, is still planning to launch in 2024. As such, Intel is lagging behind Nvidia by at least one and a half years. Nvidia is currently working on their GeForce RTX 50-series graphics card, and the market anticipates it will use TSMC’s 3nm processor node and be introduced around the end of 2024. I think Intel has a long way to go in order to catch up with Nvidia, or it may be a mission impossible.

In my view, Intel has been struggling for growth, and their primary focus in the past was on their core x86 CPU market, thus they totally missed the GPU market growth opportunity. They had to acquire Habana Labs in 2019 to enter this market. Compared to Nvidia, Habana Labs was a relatively small player in the GPU market at that time. In the semiconductor industry, a first-move advantage is especially important. I don’t think Intel can compete against Nvidia in the GPU market anytime soon.

Intel Foundry Model

In FY22, Intel’s Foundry business accounted for only 1.4% of the group’s revenue. In 2023, Intel outlined its internal strategy for the Foundry business, expressing ambitions to become the second-largest external foundry by 2030. To achieve this objective, Intel aims to reduce redundant costs and invest in manufacturing capacity. The newly appointed CEO, Patrick Gelsinger, announced a $20 billion investment plan for two new chip factories in Arizona. According to the Tom’s Hardware, as of Q1 2022, Samsung (OTCPK:SSNLF) controlled 16.3% of the global foundry market share, while TSMC owned 53.6%. Intel faces the challenge of surpassing Samsung Foundry to attain its goal.

In 2023, Samsung Foundry filed documents with authorities in Arizona, New York, and Texas to build a semiconductor manufacturing facility in the U.S., investing $17 billion in a new manufacturing facility in Texas.

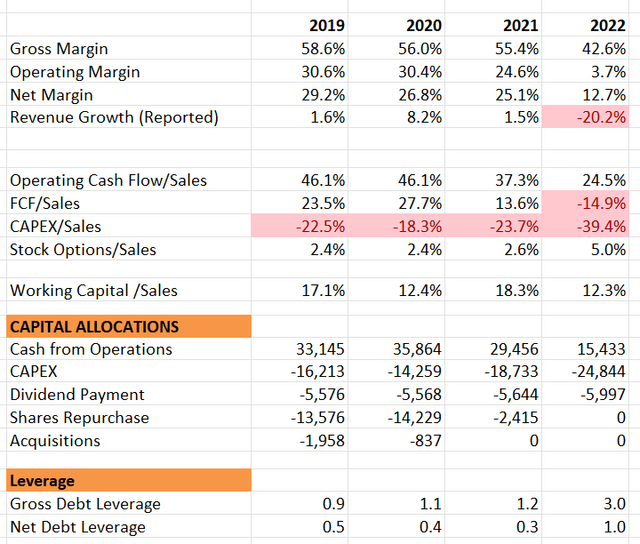

It’s evident that Intel’s rivals currently dominate the market share. To achieve success in the Foundry business, Intel must make substantial capital expenditures in the coming years. In FY21, Intel spent $18 billion on capital expenditure, followed by another $24 billion in FY22. According to their FY22 annual report, Intel has committed $22.7 billion in capital investment for FY23. This represents a significant investment, accounting for approximately 40% of their total revenue. While these investments are crucial for their foundry success, they pose a substantial burden on Intel’s financials and notably impact their free cash flow generation.

Historical Financial Analysis

In FY22, Intel experienced a 20.2% drop in revenue, primarily attributed to lower notebook and desktop volumes in the consumer and education market segments. This decline was further exacerbated by the ongoing ramp-down resulting from the exit of their 5G smartphone modem business and reduced demand for their wireless and connectivity products. Over the past few years, Intel has struggled to generate notable growth due to market share losses and insufficient investment in key growth areas such as AI and Foundry.

Under new leadership, Intel is undergoing a significant transformation, marked by substantial investments in AI accelerators and foundry businesses, accompanied by aggressive cost-cutting initiatives. During the earnings call, the management outlined plans to achieve $3 billion in cost savings in FY23 and projected savings of $8-10 billion over the long term. I agree with their strategic focus on cost-cutting; without these savings, it would be challenging for Intel to allocate internal capital for substantial investments in emerging growth areas.

On the balance sheet, Intel currently maintains a healthy net debt leverage of around 1x. However, due to their substantial capital expenditure, their free cash flow conversion has been experiencing a recent deterioration. Furthermore, they opted to suspend their share repurchase program in FY22. Looking ahead, I anticipate that their capital allocation will remain constrained in the future, primarily due to the ongoing heavy investments they are making.

Recent Financials and Outlook

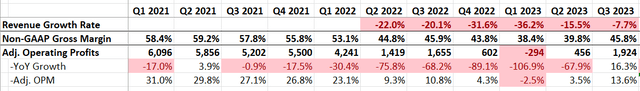

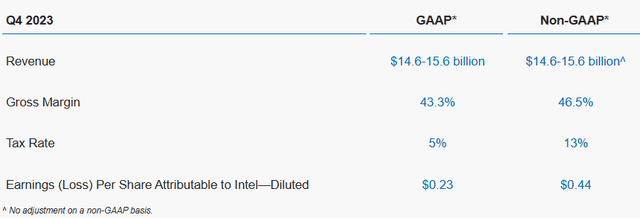

In Q3 FY23, Intel reported a -7.7% decline in revenue growth and a 16.3% increase in adjusted operating profit growth. Notably, both revenue and gross margin exceeded their prior guidance.

For Q4 guidance, Intel anticipates revenue in the range of $14.6 billion to $15.6 billion, with a gross margin of 46.5%. In terms of capital allocation, they underscored that there is no deviation from their earlier projection of mid-30% net capital intensity throughout FY23 and FY24. As previously analyzed, Intel’s substantial investments in U.S. manufacturing facilities necessitate high capital expenditure spending.

The most significant observation from Q3 FY23 lies in the robust growth of Intel’s Gaudi accelerator portfolios, with nearly a doubling of their pipeline in the last 90 days. I am confident that these Gaudi accelerator portfolios will experience rapid growth in FY24, especially considering the current scenario where demands are surpassing supplies. This challenge is not exclusive to Intel but extends to major players such as Nvidia and AMD. It’s worth noting, however, that despite the strong performance in the accelerator segment, it constitutes a relatively small portion of Intel’s group revenue. Consequently, while the trajectory is promising, it may take a considerable amount of time for this segment to significantly impact overall financials. In the near term, Intel’s growth continues to be driven by the core x86 CPU segment.

Key Risks

Elevated inventories in network and telecom markets: In Q3 FY23, Intel’s Network and Edge business experienced a 32% year-over-year decline, following a 38.3% drop in Q2 FY23 and a 30.4% decrease in Q1 FY23. This decline is attributed to elevated inventory levels in the network and telecom end-markets. The Network and Edge business accounts for approximately 14% of group revenue and 8.8% of operating profits. In the Q3 FY23 earnings call, Intel’s management noted that the weakness in the network and telecom end-markets is expected to persist throughout the fiscal year.

China Export Restriction: The existing export restrictions imposed by China primarily target machine learning chips and accelerators. In the Q3 FY23 earnings call, it was mentioned that the company is currently within the 60-day comment period with the Bureau of Industry and Security. The outcome remains uncertain at this point, but it has been factored into their full-year guidance.

Valuation

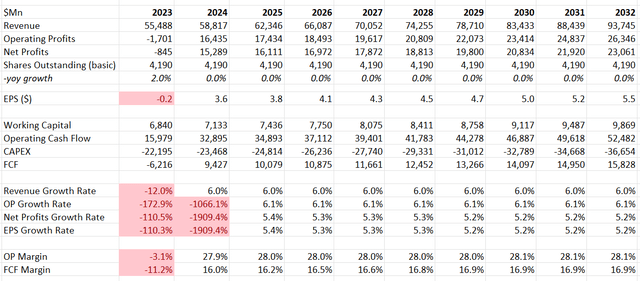

The assumptions for FY23 align with the company’s guidance, projecting a 12% decline in revenue year-over-year. According to Allied Market Research, the global semiconductor market is anticipated to grow at a compound annual growth rate of 6.21% from 2022 to 2031. Assuming a normalized growth rate, it is presumed that Intel’s revenue growth aligns with the overall market growth. This takes into account potential losses in market share in their core CPU market offset by gains in AI accelerators and foundry segments.

Intel DCF – Author’s Calculation

The valuation model does not anticipate substantial margin expansion, considering the significant investments in capital expenditures, which are expected to result in elevated depreciation costs in the upcoming years. The model employs a 10% discount rate, a 4% terminal growth rate, and a 13% tax rate. As per the model, the estimated fair value of the stock price is $37 per share.

Conclusion

In the core x86 CPU market, I believe Intel’s technology is trailing behind AMD by at least 12 months, and their GPU technology lags significantly behind Nvidia. Despite Intel’s substantial investments in manufacturing capabilities, the impact of past strategic mistakes has resulted in a technology gap that may take several years to bridge with their competitors. Given my estimate, I perceive the stock as overvalued, prompting me to initiate a “Sell” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.