Summary:

- INTC’s failure to execute its turnaround story has triggered the drastic pullback by -30%, or the equivalent -$39B in market capitalization.

- This is worsened by the underwhelming FQ2’24 financial performance, dividend suspension, and drastic layoffs through 2025, with its reversal hanging in balance.

- Combined with the uncertain monetization of its foundry ambitions and deteriorating balance sheet, INTC’s investment thesis remains underwhelming at these bottom levels.

- Moving forward, the management needs to miraculously “pull a rabbit out of the hat” to not only survive the highly competitive industry, but to eventually thrive and regain the market’s/ shareholders’ trust.

- Only time may tell.

robynmac

We previously covered Intel (NASDAQ:INTC) in April 2024, discussing its underwhelming Foundry prospects after the release of its new segment reporting, as the IDM 2.0 brought forth the uncertain cash burn and drag on its overall profitability.

This was on top of its delayed node roadmap compared to its foundry peer, signaling Intel Foundry’s uncertain prospects due to its nascency.

While we were optimistic about the stock’s US-made sentiments, it remained to be seen when its foundry segment would be able to deliver the critical combination of node advancement, volume manufacturing, and profitability, resulting in our reiterated Hold rating.

Since then, INTC has already pulled back tremendously by -44.4%, well underperforming the wider market at +2.5%, triggered by the underwhelming FQ2’24 financial performance, dividend suspension, and drastic layoffs.

Combined with the ongoing market rotation from high growth semiconductor stocks and the intensifying market pessimism surrounding generative AI, we believe that there may be more pain during its uncertain turnaround, resulting in our reiterated Hold rating.

We shall discuss further.

INTC’s Investment Thesis Has Turned Out Poorly Indeed

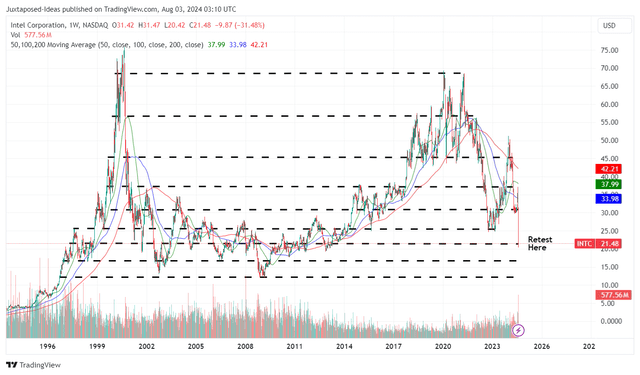

INTC 30Y Stock Price

Unless one had been living under a rock, it went without saying that INTC, as a legacy semiconductor company, had failed to capitalize on its previous x86 market leadership and the ongoing AI boom.

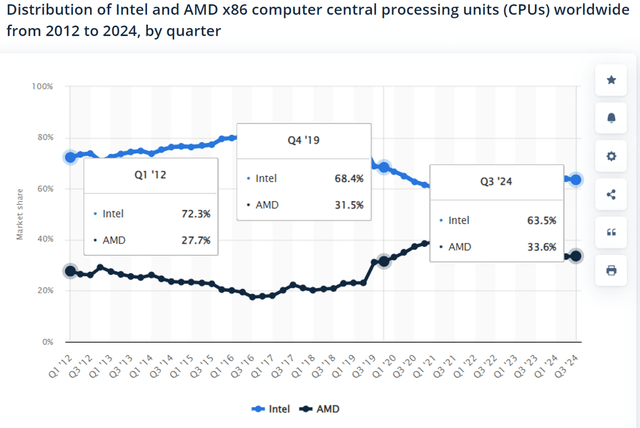

x86 Computer Central Processing Units Share

For example, INTC has reported moderating x86 CPU market share of 63.5% by Q3’24 (-0.4 points QoQ/ +0.9 YoY/ -13.4 from FQ2’19 levels of 76.9%), as its direct competitor, Advanced Micro Devices (AMD) continues to grow to 33.6% (+0.2 points QoQ/ -1.5 YoY/ +10.5 from F2’19 levels of 23.1%).

At the same time, in an attempt to grow x86 market shares and Client Computing Group revenues to $7.41B in FQ2’24 (-1.5% QoQ/ +9.2% YoY), the management has went on drastic price cuts, naturally impacting the segment’s operating margins to 33.6% (-1.4 points QoQ/ +4.4 YoY/ -7.3 from FY2019 levels of 40.9%).

Furthermore, it goes without saying that during the ongoing generative AI boom, Nvidia (NVDA) has already emerged as the clear leader.

This is thanks to Jensen Huang’s visionary gift of a DGX-1 supercomputer to OpenAI back in 2016 and the subsequent nurturing of a “large community of AI programmers who consistently invent using the company’s technology.”

This development has triggered NVDA’s robust data center revenue growth to $22.6B (+23% QoQ/ +427% YoY) in the latest quarter and the leading share of up to 90% in the AI GPU chip market/ 80% of the entire data center AI chip market.

How about INTC?

Well, the Pat Gelsinger led company reported only $3.04B of Data Center/ AI related revenues in FQ2’24 (inline QoQ/ -3.4% YoY), while only guiding FQ3’24 revenues of $3B (inline QoQ/ -3% YoY), exemplifying its inability to capitalize on the ongoing AI boom.

This is despite the Intel® Gaudi® 3 AI accelerator on track to launch in FQ3’24, with “roughly two-times the performance per dollar on both inference and training versus the leading competitor,” implying that NVDA’s GPU/ AI accelerator offerings remain inherently more attractive to hyperscalers despite the hefty price tag.

While NVDA’s Blackwell launch may be moderately delayed, it is apparent that multiple hyperscalers have placed further trust in its superior AI accelerator offerings, based on GOOG’s (GOOG) order worth $10B, Meta (META) at $10B, and Microsoft (MSFT) at $1.62B.

These developments are also why INTC has reported underwhelming FQ2’24 revenues of $12.8B (+0.7% QoQ/ -0.7% YoY) and adj EPS of $0.02 (-88.8% QoQ/ -84.6% YoY).

Combined with the hefty FY2024 capital expenditure guidance of $26B (+1% YoY/ +60.3% from FY2019 levels) and FY2025 at $21.5B (-17.3% YoY), attributed to its Foundry dreams, it is unsurprising that the company has reported negative Free Cash Flow of -$12.58B over the last twelve months (+24.8% sequentially/ -174.3% from FY2019 levels of $16.93B).

This is why we believe that the management’s decision to suspend dividends from Q4’24 onwards has been prudent, building upon the previous cut announced in early 2023 – one that we believe should have happened earlier, with the management “seemingly financing its dividend payouts with debt.”

This is especially since INTC’s balance sheet has been consistently deteriorating, with growing (current and long-term) debts of $53.02B (+1.1% QoQ/ +7.6% YoY/ +82.8% from FY2019 levels of $28.99B).

Moving forward, with most of the bad news already baked in and the peak capex intensity behind us, we believe that the management may be better positioned to slowly turn the legacy ship around.

This is partly aided by the projected reduction of -$1.6B in Operating Expenses in 2024 and -$4.1B by 2025, down from the $21.6B reported in FY2023, and the capex reduction – resulting in the supposed $10B in cost savings.

Even so, if we may be painfully honest, it is uncertain how successful their eventual turnaround may be, since INTC’s legacy businesses have failed to innovate and stay ahead of the rapidly changing semiconductor landscape.

With other players already gaining massive headways in the x86, data center, and CPU/ GPU end markets, amongst others, the management needs to miraculously “pull a rabbit out of the hat” to not only survive the highly competitive industry, but to eventually thrive and regain the market’s/ shareholders’ trust.

For now, only time may tell.

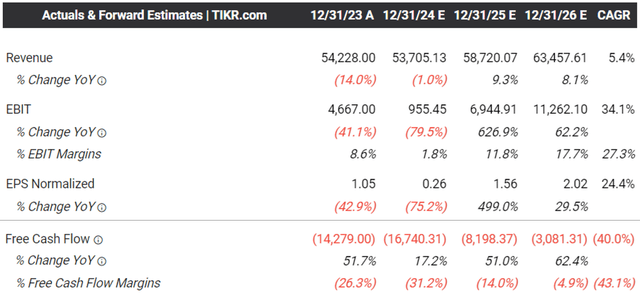

The Consensus Forward Estimates

For now, a quiet optimism is already observed in the promising consensus forward estimates, with INTC expected to report trough FY2024/ FY2025 years and FY2026 likely to bring forth drastically improved numbers.

Even so, with bloated balance sheet and negative Free Cash Flows, we believe the management is unlikely to reinstate dividends in the intermediate term, effectively putting an end to the 31 years of consecutive dividend payouts.

So, Is INTC Stock A Buy, Sell, or Hold?

INTC 30Y Stock Price

As a result of these pessimistic developments, it is unsurprising that the market has opted to punish INTC first, as observed in the drastic two day pullback by -30.1%, or the equivalent -$39B in market capitalization.

For context, we had offered a fair value estimate of $30.10 in our last article, based on the annualized FQ4’23 adj EPS of $1.36 (after adjusting for the $1.2B litigation benefit for improved accuracy, as opposed to the reported sum of $2.52) and the 5Y P/E mean valuations of 22.15x.

While INTC is finally cheaper, we are uncertain if it is wise to recommend a Buy rating here, since there may be six more quarters of uncertainty until its headcount reductions are completed.

At the same time, while the management has highlighted a robust overall AI PC market share growth from less than 10% in 2024 to over 50% by 2026, it remains to be seen how much gains the legacy semiconductor company may report, with the CPU market increasingly competitive as QUALCOMM (QCOM) enters the picture with ARM-based processor.

Combined with the uncertain monetization of its foundry ambitions, as discussed in our previous article here, and other more experienced foundry leaders establishing geopolitically secure operations in Japan/ the US, we believe that it may be more prudent to maintain our previous Hold rating here.

Lastly, with Pat Gelsinger failing to deliver (in hindsight) the overly ambitious turnaround story, we believe that there may be more uncertainty ahead, especially since INTC no longer pays out dividends while boasting minimal near-term growth prospects.

Patience may be more prudent here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.