Summary:

- Intel’s Foundry business reported a massive $7.0 billion loss and a negative 37% operating margin, raising concerns about the company’s pursuit of the foundry business.

- Intel’s external revenues from the foundry business are currently low, with a goal of only reaching $15 billion annually by 2030, far below TSMC levels.

- The stock is likely to retest the recent $32 lows after a typical Q1 beat followed by weak guidance for the next quarter.

Sundry Photography

As investors have been told for a long time, Intel (NASDAQ:INTC) isn’t a good investment until the company can turn the business around. One of the biggest concerns is the chip giant chasing the foundry business while lacking the technology to compete with the industry leader and prime chip customers unwilling to share designs with a competitor no matter the technology position. My investment thesis remains Bearish on the stock with signs the market wasn’t pleased with the guidance for the weak margins of the Foundry segment.

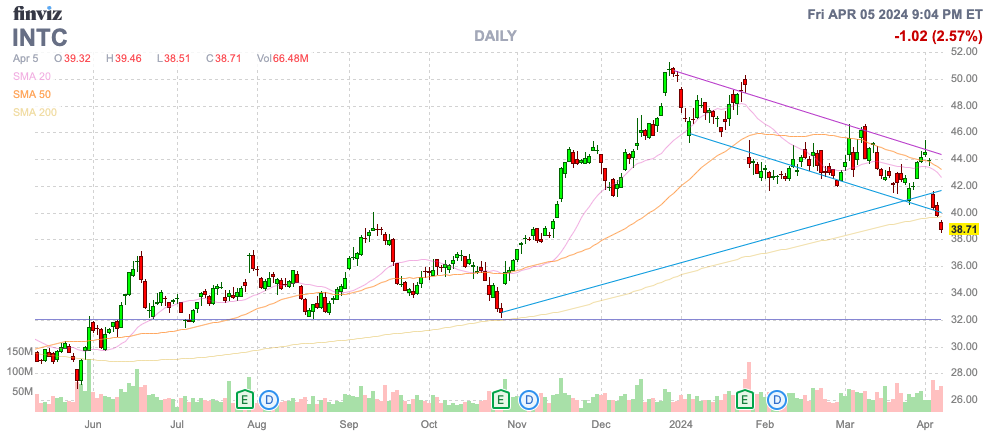

Source: Finviz

Foundry Event

Last week, Intel held a webinar to outline the new Foundry business and the related financials for the business. Previously, the chip company only listed external revenue under IFS.

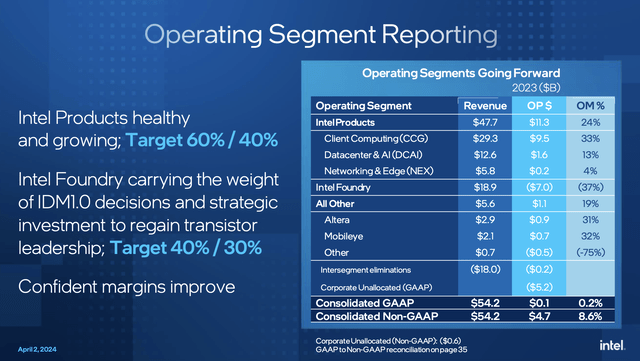

The market was caught off guard with the massive losses for the Foundry business based on charging the internal chip manufacturing at market prices. The business reported revenue of $18.9 billion with a massive $7.0 billion loss and an a negative 37% operating margin.

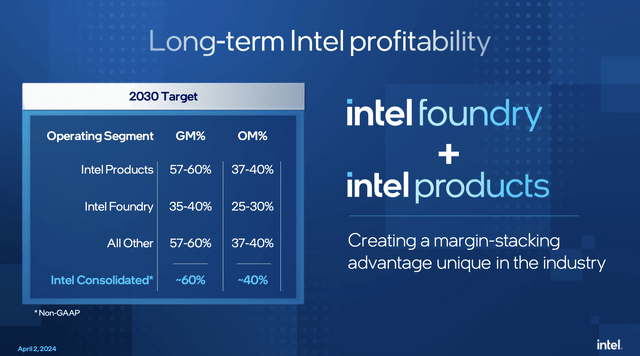

The numbers both question why CEO Pat Gelsinger pursued building the Foundry business and eliminates any possibility Intel is going to spin off the business any time soon. The company suggests the Foundry business will deliver 25% to 30% operating margins by 2030, but management didn’t provide any data on when the business will turn profitable.

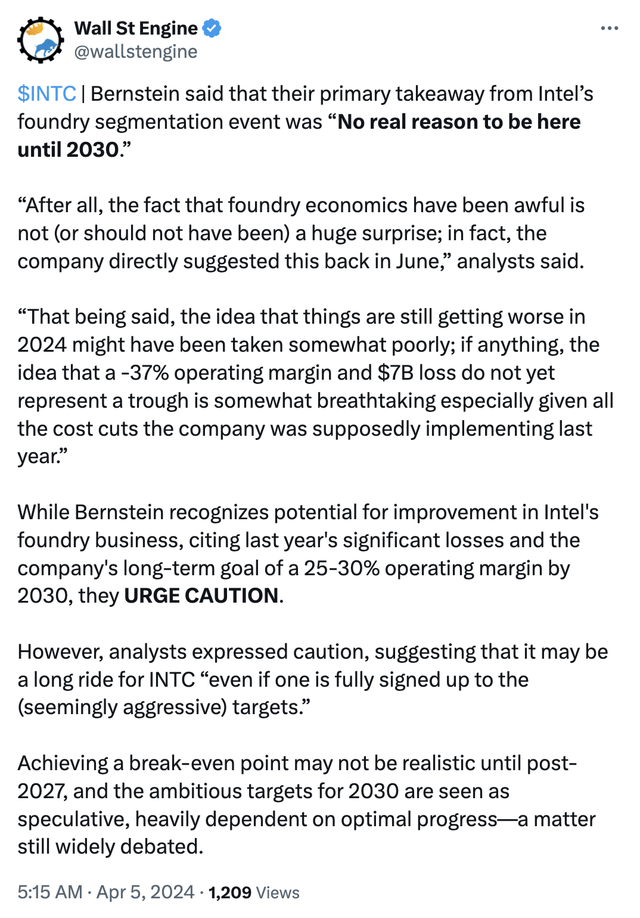

Bernstein analyst Stacy Rasgon was so frustrated with the numbers provided for the Foundry business that he proclaimed “No real reason to be here until 2030” while questioning the 2030 operating margin guidance considering the massive losses and questions on the 18a node progress requiring a massive shift in margins in what amounts to a short time period.

A main part of having a foundry business is catering to external customers, something Intel really doesn’t have now. The chip company only reported $953 billion in IFS revenues in 2023 with a projection that existing deal values amount to $15 billion worth of lifetime value with an ultimate goal of getting to external revenues of $15 billion annually by 2030.

Taiwan Semiconductor Manufacturing Company Limited (TSM) forecast 20% revenue growth in 2024 leading to consensus revenues targets of $83 billion. Analysts have TSMC topping $100 billion in revenues by 2026 really questioning how Intel will have process technology leadership in the next few years, yet external revenues will be paltry compared to the market leader.

Weak Q1 Ahead

Intel spent the last couple of weeks getting AI and Foundry business webinars out of the way prior to Q1’24 earnings. The chip giant probably should’ve kept one of the webinars for after the quarter.

The company reports after the close on April 25 and guided to the following numbers back when reporting Q4’23 results:

-

Revenue to be between $12.2 and $13.2 billion, well below the $14.25 billion analysts were anticipating.

-

Adjusted EPS of $0.13 cents, far below consensus estimates of $0.42.

-

Adjusted gross margins of 44.5% and a tax rate of 13%.

As highlighted above, the Client Computing business is the strongest with 33% operating margins and the development of AI PCs could provide some upside potential for the Intel business. Though, investors need to keep in mind the management team likes to guide ultra weak numbers and beat the consensus estimates while guiding down again for the next quarter.

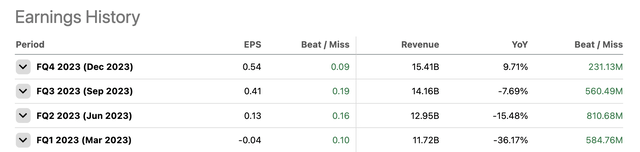

Intel beat quarterly results all throughout 2023 by ~$500 million per quarter with regular $0.10 EPS beats. Remember though, the Q4’23 EPS beat still left the company producing an EPS $0.05 below the 2022 level and guiding down substantially for the upcoming Q1.

Investors really need to hear some stronger guidance with the estimate for higher PC demand from AI chips. The consensus estimates have a Q2 EPS of only $0.26 with revenues below $14 billion. While sales are expected to rebound 5% from the Q2’23 levels, the company produced Q2’19 revenues up at $16.5 billion.

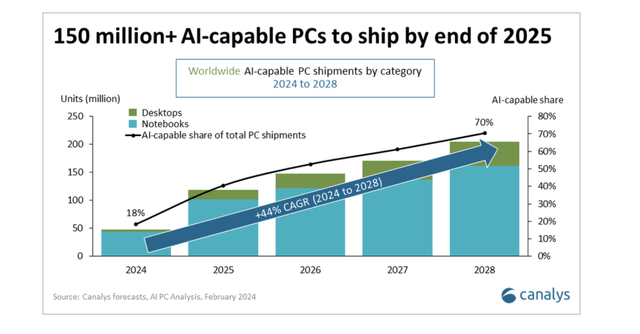

Canalys predicts the PC demand jumps to 267 million units in 2024, up 8% YoY. Qualcomm (QCOM) has a competitive AI chip hitting the market and AMD (AMD) continues pushing to take market share, so a lot of questions will exist on whether Intel is losing market share, if guidance is weak. AI-capable PCs are projected to hit 48 million in 2024 and jumping over 100 million in 2025.

The stock had rebounded to $50 in a clear indication the market got too excited by AI promises. Intel slumped on the news of the very weak Foundry margins, but the stock still appears expensive with all of the questions about the business.

Intel is forecast to only generate a $1.36 EPS this year. The stock needs the EPS to jump 70% in 2025 to a $2.32 EPS in order to justify the current price, but investors should be weary of the chip giant driving higher sales in a market shifting to AI data center sales where Intel is weak.

Takeaway

The key investor takeaway is that Intel continues to frustrate the market with a push back into Foundry services floundering again. The stock is likely headed back to the prior lows of $32 and investors should watch from the sidelines with more weak results ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.